Author: Frank, PANews

After much anticipation, it has finally arrived. On November 29, the decentralized derivatives exchange Hyperliquid announced the genesis event for its native token HYPE. After the token went live, the price of HYPE soared, starting at $2 on November 29 and reaching a peak of $9.8 on December 1, nearly a fivefold increase in less than three days.

Compared to other major airdrop projects this year, HYPE's market performance has been truly impressive. In this airdrop, Hyperliquid distributed a total of 310 million tokens, which, even at the opening price of $2, amounts to a scale of $620 million. It can undoubtedly be considered one of the largest airdrop projects of the year.

However, it is strange that in the lead-up to Hyperliquid's airdrop announcement, there was little discussion among Chinese KOLs on social media, and there were not many Chinese bloggers sharing their gains afterward. It seems that those KOLs focused on quick profits collectively missed out on this significant opportunity.

Airdrop Sent to 94,000 Addresses, with a Maximum Airdrop Value of Nearly $10 Million

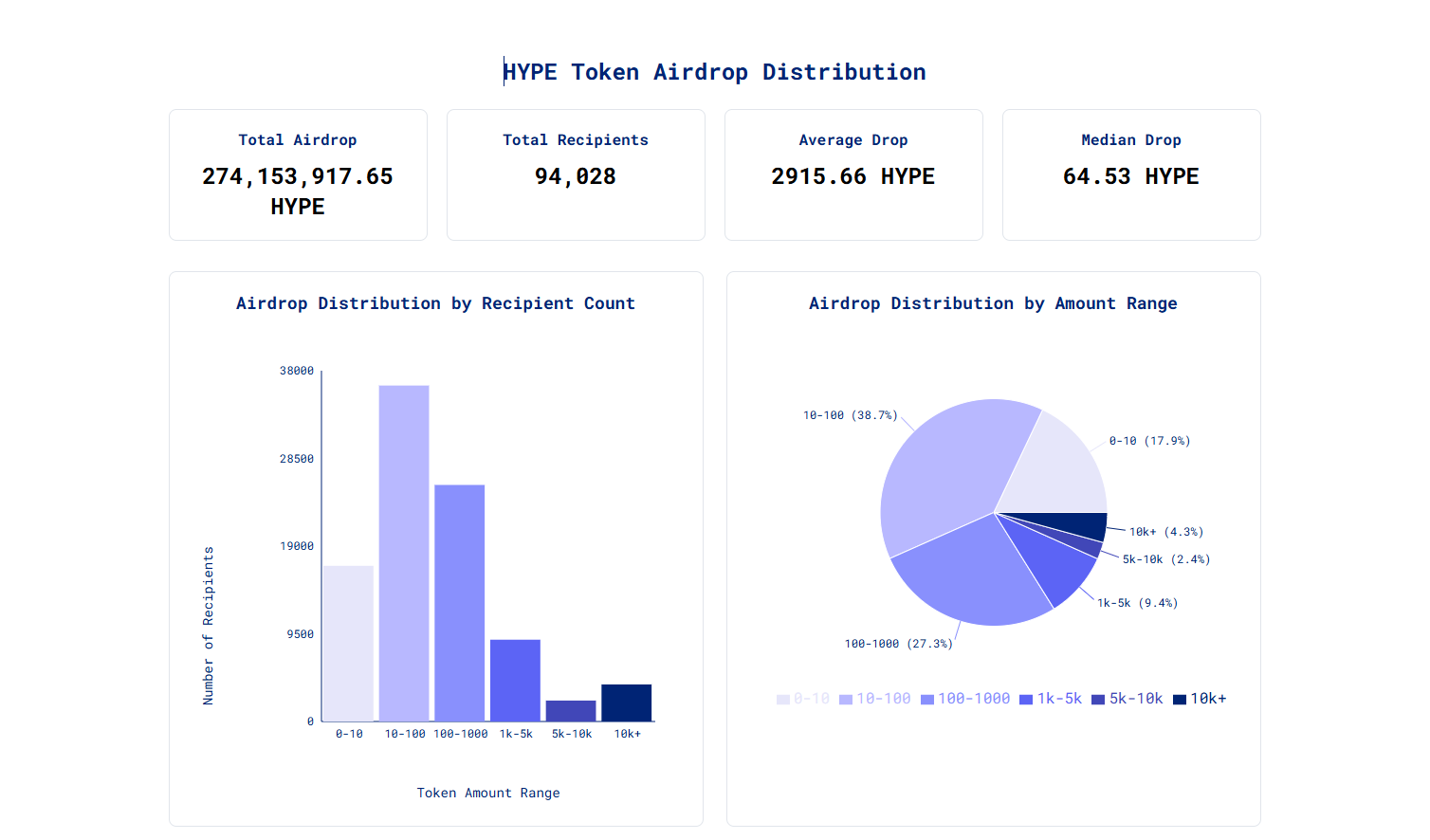

According to ASXN Data, the actual number of tokens airdropped by Hyperliquid was approximately 274 million (some users missed the opportunity to claim due to not signing the Genesis Event terms). A total of 94,000 addresses received the airdrop, with an average of 2,915 HYPE tokens per address, which, at the price of $9.8 on December 1, is equivalent to $28,500. From this perspective, Hyperliquid is indeed one of the largest airdrops of the year.

However, behind the average of 2,915 tokens lies the Pareto principle, as the average is skewed by large airdrop recipients; the median airdrop amount was only 64.53 tokens. In terms of overall distribution, about 38.7% of users received between 10 and 100 tokens, and 17.9% received fewer than 10 tokens. Therefore, approximately 56.6% of users received no more than 100 tokens. Additionally, accounts receiving fewer than 1,000 tokens accounted for 83.9%. This indicates that most people did not reach the average of 2,915 tokens, but even a few hundred dollars could buy an iPhone from Hyperliquid's airdrop.

For individual addresses, the highest single address received 970,000 tokens, which, at the price of $9.8, would amount to airdrop value of $9.56 million. This should become the highest claimed value for a single address in airdrop projects in 2024 (the largest single address for Starknet was $360,000, and for Jupiter, it was $130,000).

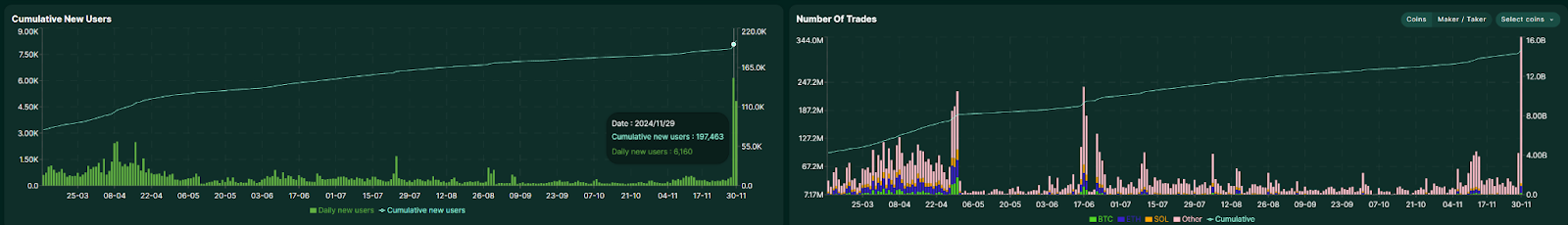

Airdrop Brings 10,000 New Users in 2 Days

Although there was not much promotion on social media, the luxurious airdrop results still brought a significant number of new users to Hyperliquid. Historical data shows that before the airdrop announcement, Hyperliquid's daily new users were generally below 500, often around 150 new users. However, on November 29 and 30, the two days saw 10,993 new users, even surpassing the total new users in the past month. On November 30, the total number of transactions exceeded 3.44 million, a tenfold increase compared to before the airdrop.

However, the surge in user activity does not seem to have significantly impacted trading volume, with total trading volumes of approximately $1.8 billion and $1.9 billion on November 29 and 30, respectively, showing no obvious growth. Nevertheless, compared to other projects where user numbers plummet after an airdrop, Hyperliquid's performance is indeed somewhat unique.

The growth trend for Hyperliquid has already formed. According to defillama data, Hyperliquid Perp ranks second among all derivatives protocols, slightly below Jupiter Perpetual. On November 17, Hyperliquid briefly led Jupiter to become number one. In July of this year, Hyperliquid was ranked fourth, behind GMX and DYDX. As a rising star among decentralized derivatives exchanges, Hyperliquid's rise has already begun.

Hyperliquid Ecosystem Tokens Surge Collectively

As of December 1, HYPE's market capitalization exceeded $3.3 billion at its peak, ranking around 44th among all tokens, comparable to OKB. The market capitalization of ARB is currently about $4 billion, and if HYPE's price continues to rise, it may directly surpass ARB.

For those who received the airdrop, the significant increase in HYPE is undoubtedly the best booster. On social media, many KOLs have stated that Hyperliquid, compared to those projects that have raised a lot of money but have complex rules and user games, is simply a model of integrity for the year. Some users have also noted that HYPE is currently just a standalone token, only tradable on Hyperliquid.

With the popularity of HYPE, Hyperliquid seems to have become a new gold mine. Besides HYPE, other tokens on Hyperliquid have also surged rapidly during this wave. From November 29 to December 1, native trading tokens on Hyperliquid such as PURR, JEFF, and HFUN saw significant increases. In particular, JEFF (a MEME token themed around Hyperliquid's founder Jeff) saw a peak increase of nearly tenfold within three days. OMNIX has also experienced exponential growth in recent days.

However, how long this strong upward trend can be sustained remains uncertain.

So far, Hyperliquid's on-chain deposits and withdrawals still need to be bridged through Arbitrum. Over 60% of USDC tokens on the Arbitrum chain are held by Hyperliquid addresses. This seems to be a mutually beneficial process, with Hyperliquid bringing ample active addresses and funds to Arbitrum, while Arbitrum provides Hyperliquid with stable and inexpensive infrastructure before its mainnet launch.

As of now, Hyperliquid has not accepted any investments. The Hyperliquid Foundation stated in the announcement of the genesis event that in the token distribution: "There is no allocation for private investors, centralized exchanges, or market makers." Previously, PANews conducted in-depth research on Hyperliquid's development philosophy and other content. (Related reading: Top MEME Tokens with Market Capitalization Over $100 Million, Will the L1 Public Chain Hyperliquid Focused on Derivatives Trading Become the New MEME Gold Mine?)

According to Hyperliquid's official information, the Hyperliquid EVM is currently online on the testnet, but integration with other L1 states has not yet been completed. In the short term, it seems that asset transfers via cross-chain bridges like other L1s cannot be used. Additionally, as an L1, Hyperliquid's ecosystem is not yet well-established, with everything from the browser to the DEX being self-operated by Hyperliquid. This approach has its pros and cons; the advantage is that all technological innovations and development focuses on enhancing the performance of the decentralized derivatives exchange, aiming to create a decentralized Binance. The downside is that it may be challenging to expand brand influence through ecosystem development.

From Hyperliquid's official social media management, aside from announcements, there is almost no other content being released. This is a form of persistent simplicity, but in the crypto field, which is keen on hype and promotion, it is indeed quite unique.

However, the recent popularity of Hyperliquid once again confirms the principle that any marketing gimmick pales in comparison to price increases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。