Original authors: Nathan Frankovitz, Matthew Sigel

Original translation: Wu Says Blockchain

Driven by the regulatory benefits brought about by Trump's election, Bitcoin has successfully broken through its historical high. As market attention continues to rise, various key indicators suggest that the strong momentum of this bull market is expected to persist.

As we predicted in September, the price of Bitcoin (BTC) experienced high volatility and an upward trend after the election. Now, Bitcoin has entered an unknown territory without technical price resistance, and we believe that the next phase of the bull market has just begun. This pattern is similar to the post-election period in 2020, when Bitcoin's price doubled by the end of the year and further increased by about 137% in 2021. With a significant shift in government support for Bitcoin, investor interest is rapidly increasing. Recently, we have seen a surge in investment inquiries, with many investors realizing that their allocation in this asset class is significantly insufficient. While we closely monitor the market for signs of overheating, we reiterate our price target of $180,000/BTC for this cycle, as the tracked key indicators show sustained bullish signals.

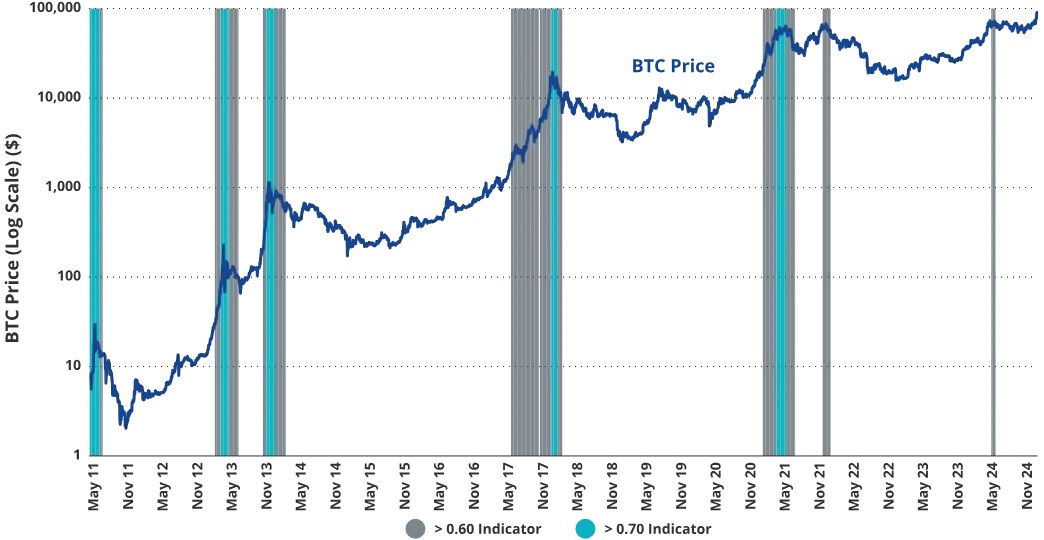

Bitcoin Price Trends

Market Sentiment

The 7-day moving average (7 DMA) of Bitcoin reached $89,444, setting a new historical high. On election night, Tuesday, November 5, Bitcoin surged about 9%, reaching a historical high of $75,000. This aligns with our previous observation: as the likelihood of Trump's victory increased, Bitcoin's price rose accordingly. Trump explicitly promised during his campaign to end the SEC's "enforcement regulation" strategy and to make the U.S. the "world capital of crypto and Bitcoin."

After Trump's election as president, regulatory resistance turned into a driving force for the first time. Trump has begun appointing pro-crypto officials in the executive branch, and with the Republican Party controlling the joint government, the likelihood of passing related supportive legislation has increased. Key proposals include plans to establish a national Bitcoin reserve and to rewrite legislation related to crypto market structure and stablecoins, with expectations that FIT21 will be rewritten with market and privacy-friendly terms, while the new stablecoin draft will allow state-chartered banks to issue stablecoins without Federal Reserve approval.

As countries like those in BRICS explore alternatives like Bitcoin to bypass dollar sanctions and currency manipulation, stablecoins provide a strategic opportunity for the dollar's global outreach. By eliminating regulatory barriers and allowing state-chartered banks to issue stablecoins, the U.S. can maintain the global influence of the dollar and leverage the faster adoption of cryptocurrencies in emerging markets. These markets have a strong demand for financial services, hedging against local currency inflation, and decentralized finance (DeFi).

We expect that SAB will be repealed in the first quarter after Trump takes office, either by the SEC or by Congress, which will prompt banks to announce cryptocurrency custody solutions. If Gary Gensler has not resigned, Trump may fulfill his promise to replace the SEC chairman with a more crypto-friendly candidate and end the agency's notorious "regulation by enforcement" era. Additionally, by 2025, the U.S. Ethereum (ETH) ETF will be revised to support staking, the SEC will approve the 19b-4 proposal for the Solana (SOL) ETF, and the creation and redemption of ETFs in physical form will make these products more tax-efficient and liquid. Given that Trump has previously acknowledged the commonality between Bitcoin mining and artificial intelligence (AI) in terms of energy intensity, energy regulation is expected to ease, leading to cheaper and more abundant baseload energy (such as nuclear power), thereby enhancing the U.S.'s global leadership in energy, AI, and Bitcoin.

This election marks a bullish turning point, reversing the capital and job outflows caused by previous hardline policies. By stimulating entrepreneurial vitality, the U.S. is poised to become a global leader in crypto innovation and employment, transforming cryptocurrency into a key industry for domestic growth and an important export product for emerging markets.

Bitcoin Dominance

The 7-day moving average of Bitcoin dominance (a measure of Bitcoin's market cap relative to the total market cap of all cryptocurrencies) rose 2 percentage points this month to 59%, reaching its highest level since March 2021. Although this upward trend, which began at 40% in November 2022, may continue in the short term, it may soon peak. In September, we noted that Harris's victory could enhance Bitcoin's dominance due to a clearer regulatory status for Bitcoin as a commodity. In contrast, Trump's pro-crypto stance and his expanded cabinet team may drive broader investment in the crypto market. As Bitcoin reaches new highs in an innovation-friendly regulatory environment, the wealth effect and reduced regulatory risks are expected to attract native capital and new institutional investors into DeFi, thereby enhancing returns for smaller projects within the asset class.

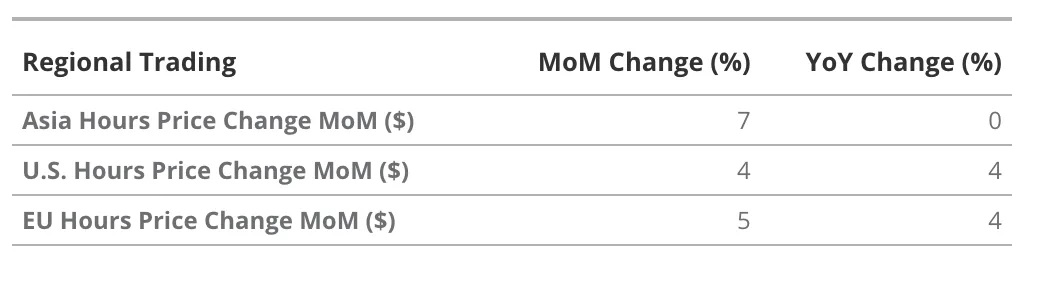

Regional Trading Dynamics

At first glance, traders in the Asian market trading session seem to have significantly increased their Bitcoin holdings this month, contrary to the trend in recent years where Asian traders typically net sold while European and American traders net bought. However, the surge in Bitcoin's price on election night occurred during the Asian trading session, likely due to a large number of U.S. investors trading around the election. This unique event makes it difficult to attribute such price fluctuations solely to regional dynamics. Consistent with historical behavior, traders in the U.S. and European trading sessions continue to increase their Bitcoin holdings, maintaining the price performance trend observed in October.

Source: Glassnode, 11/18/24 (Past performance is not indicative of future results.)

Key Indicators

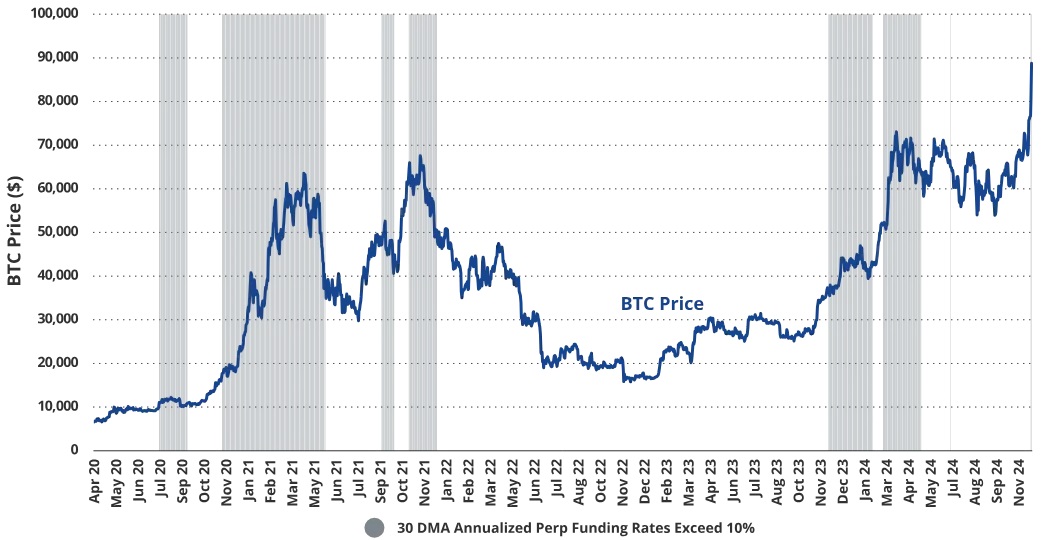

To assess the potential upside and duration of this bull market, we analyzed several key indicators to evaluate market risk levels and possible price tops. This month, our analysis began with perpetual contracts (perps), where the performance of funding rates provides insights into market sentiment and helps gauge the likelihood of market overheating.

Bitcoin's price typically shows signs of overheating when the 30-day moving average funding rate (30 DMA Perp Funding Rates) exceeds 10% and persists for 1 to 3 months.

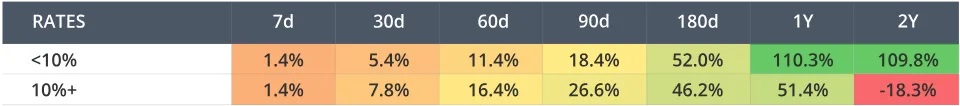

BTC average return rate compared to perpetual funding rates (January 4, 2020 — November 11, 2024)

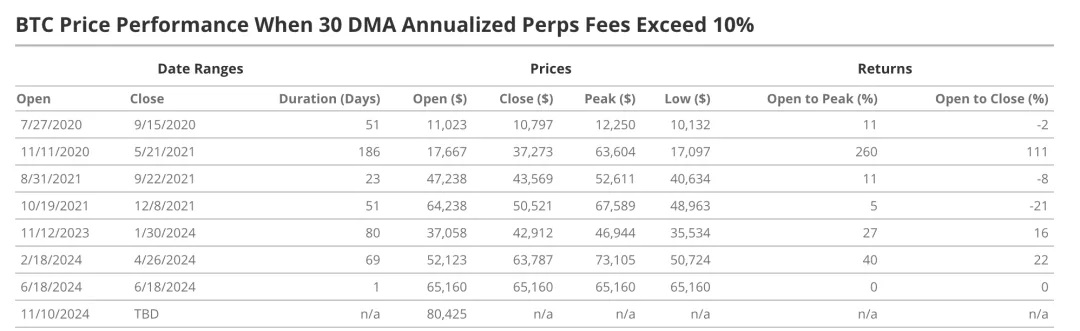

When the 30 DMA annualized Perps fees exceed 10%, BTC price performance

Source: Glassnode, as of November 12, 2024

Since April 2020, we have analyzed periods when the 30-day moving average perpetual contract funding rates exceeded 10%. The average duration of these periods is about 66 days, with an average return of 17% from opening to closing, although the duration varies significantly across different periods. The only exception was a single-day spike on June 18, 2024, reflecting short-term market sentiment. Other instances lasted for several weeks, highlighting structural bullish sentiment, which typically leads to significant short- to medium-term gains.

For example, the high funding rate phase that began on August 31, 2021, lasted for 23 days, followed by a 28-day cooling period, and then resumed for 51 days on October 19. Including this brief interval, the total duration of high funding rates in 2021 reached 99 days. Similarly, the current high funding rate phase that began on November 12, 2024, has lasted for 80 days, followed by a 19-day interval, and then restarted for another 69 days of high funding rates, totaling 168 days, comparable to the 186 days from November 11, 2020, to May 21, 2021. Notably, purchasing Bitcoin on days when funding rates exceed 10% has resulted in average returns higher than on days with lower funding rates across 30-day, 60-day, and 90-day time frames.

However, the data shows a pattern of underperformance over longer time frames. On average, Bitcoin purchased on days when funding rates exceed 10% begins to underperform the market from 180 days onward, with this trend becoming more pronounced over 1-year and 2-year time frames. Given that market cycles typically last about 4 years, this pattern suggests that sustained high funding rates are often associated with cycle tops and may serve as early signals of market overheating, indicating a greater susceptibility to long-term downside risks.

Source: Glassnode, as of November 13, 2024

As of November 11, Bitcoin has entered a new phase, with funding rates exceeding 10% again. This shift indicates stronger short- to medium-term momentum, as historically, higher funding rates have been associated with higher 30-day, 60-day, and 90-day returns, reflecting greater bullish sentiment and demand. However, as funding rates remain elevated, we may move away from a long-term (1–2 years) favorable return phase. Given the current supportive regulatory environment for Bitcoin, we expect another high-performance period, similar to the post-2020 election period, when sustained funding rates above 10% drove a 260% increase over 186 days. With Bitcoin currently trading close to $90,000, our target price of $180,000 remains feasible, reflecting a potential cycle return of about 1,000% from the cycle trough to peak.

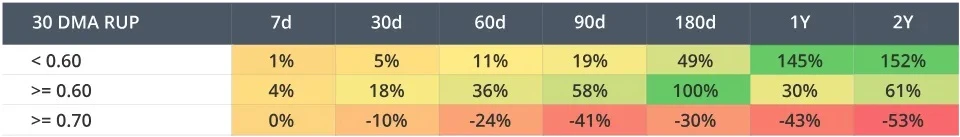

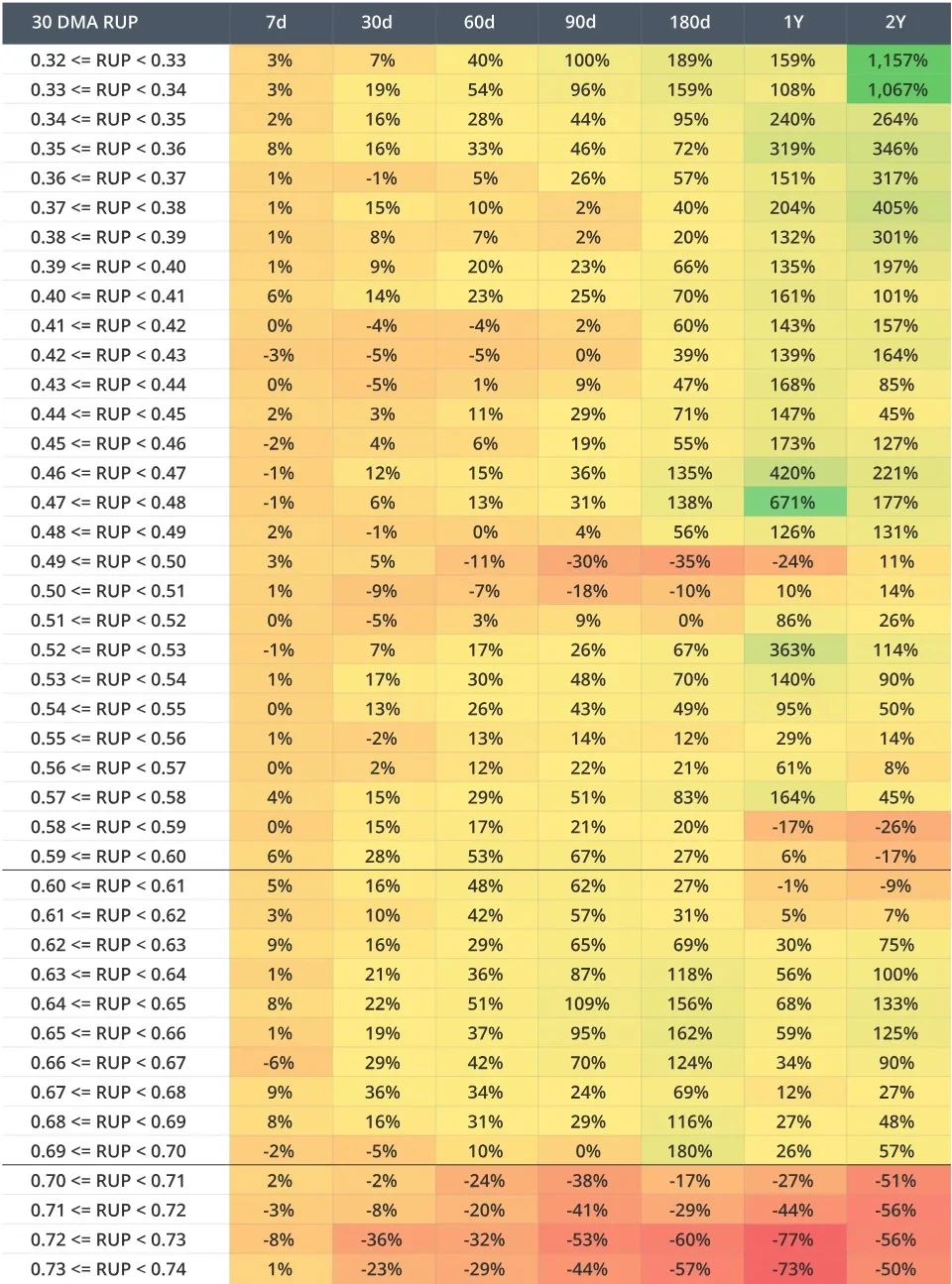

A higher 30-day moving average (DMA) relative to unrealized profit levels (>0.60 and 0.70) has historically indicated a top in Bitcoin prices.

BTC average returns compared to 30-day moving average relative unrealized profit (RUP) (November 13, 2016 — November 13, 2024)

Source: Glassnode, as of November 13, 2024

BTC average returns compared to 30-day moving average relative unrealized profit (RUP) (November 13, 2016 — November 13, 2024)

Source: Glassnode, as of November 13, 2024

Next, we focus on relative unrealized profit (RUP), which is another important indicator for measuring whether the Bitcoin market is overheated. RUP measures the proportion of unrealized gains (i.e., paper profits that have not yet been realized through sale) in Bitcoin's total market capitalization. When Bitcoin's price exceeds the last purchase price for most holders, this indicator rises, reflecting more of the market entering a profitable state, thereby embodying market optimism.

Historically, high levels of 30-day moving average (DMA) RUP (especially above 0.60 and 0.70) typically indicate strong market sentiment and potential overheating. As shown in the red intervals in the chart, when RUP 30 DMA exceeds 0.70, it often coincides with market tops, as a higher proportion of unrealized profits triggers more profit-taking. Conversely, when RUP levels fall below 0.60, it indicates more favorable market conditions for long-term buying, with historical data showing higher 1-year and 2-year returns for purchases made below this threshold.

Analysis of the past two market cycles indicates that levels of 30 DMA RUP between 0.60 and 0.70 typically yield the highest short- to medium-term returns (7 days to 180 days). This range usually reflects the mid-stage of a bull market, where market optimism is rising but has not yet reached excessive levels. In contrast, when RUP exceeds 0.70, returns across all time frames consistently show a negative correlation, reinforcing its role as a strong sell signal.

As of November 13, Bitcoin's 30 DMA RUP is approximately 0.54, but daily values have exceeded 0.60 since November 11. According to our detailed data table, the risk gradually increases as RUP approaches 0.70, emphasizing the importance of short-term trading within the 0.60 to 0.70 range. However, if the 30 DMA of RUP rises close to 0.70, it may signal market overheating, warranting caution for long-term positions.

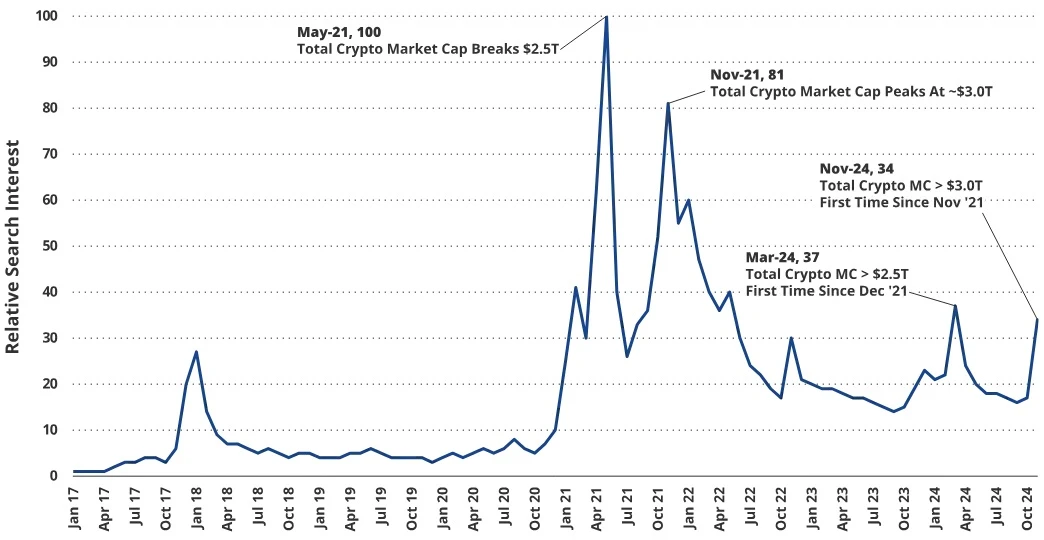

U.S. Regional "Cryptocurrency" Search Trends

Source: Google Trends, as of November 18, 2024

The search popularity of "cryptocurrency" as a Google search term is an important indicator of retail investor interest and market momentum. Historical data shows that peaks in search popularity are often closely related to peaks in the total market capitalization of cryptocurrencies. For example, after reaching historical highs in search popularity in May and November 2021, significant market declines followed: a roughly 55% correction occurred within about two months after the May peak, while a bear market lasting about 12 months followed the November peak, with a total decline of approximately 75%.

Currently, search popularity is only 34% of the May 2021 peak, slightly below the 37% local peak observed in March 2024 (when Bitcoin reached its highest price of this cycle). This relatively low search popularity indicates that Bitcoin and the broader crypto market have not yet entered a speculative frenzy stage, leaving room for further growth and not yet reaching the mainstream attention levels typically associated with market tops.

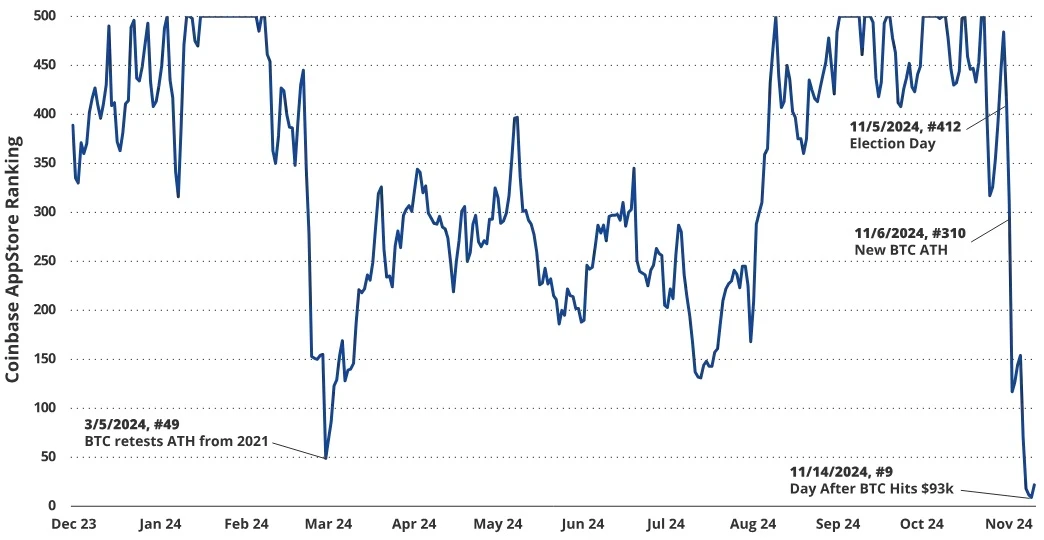

Coinbase App Store Ranking

Source: openbb.co, as of November 15, 2024

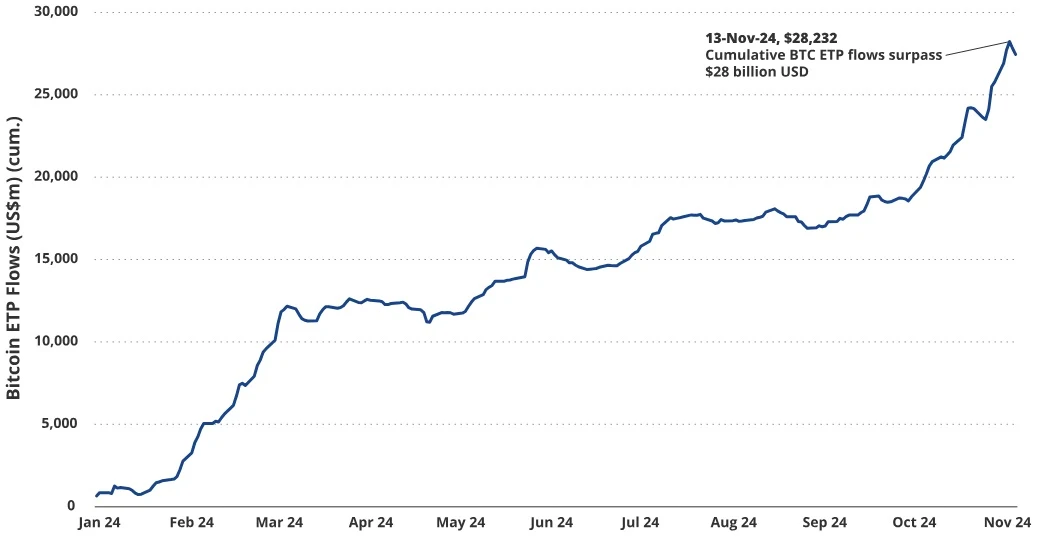

Similar to Google search popularity for "cryptocurrency," Coinbase's ranking in the app store is also an important indicator of retail investor interest. On March 5 of this year, after Bitcoin's price surged about 34% in 9 days and retested the historical high of about $69,000 from 2021, Coinbase re-entered the top 50 in the app store rankings. Although Bitcoin reached a new high of about $74,000 later in the month, retail interest waned as price volatility decreased to summer lows and public attention shifted to the presidential election. However, the breakthrough on election night reignited retail interest, with Coinbase's app store ranking jumping from 412th on November 5 to 9th on November 14. The surge in participation drove further price increases while setting a new record for Bitcoin ETF inflows.

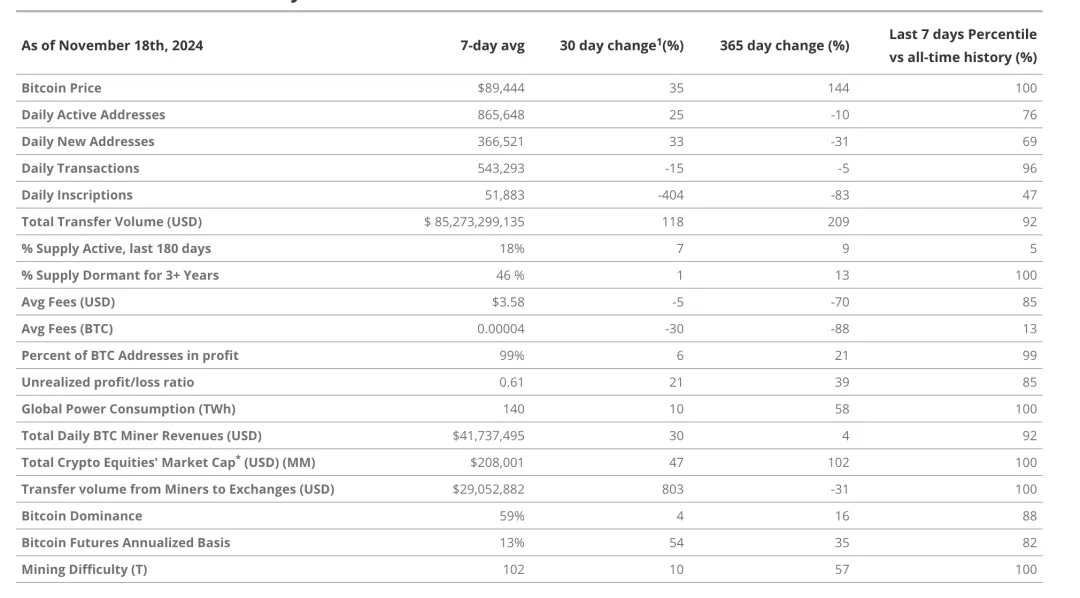

Bitcoin's Network Activity, Adoption, and Fees

Daily Transaction Volume: The 7-day moving average of daily transaction volume is approximately 543,000 transactions, down 15% week-over-week. Despite the decline, activity remains strong, at the 96th percentile of Bitcoin's history. Although the number of transactions has decreased, larger transaction loads have offset this impact, as evidenced by the increase in transfer amounts.

Ordinals Inscription: Daily inscriptions (NFTs and meme coins on the Bitcoin blockchain) saw a week-over-week increase of 404%, reflecting a resurgence of speculative enthusiasm driven by rising prices and favorable regulations.

Total Transfer Volume: Bitcoin transfer volume increased by 118% week-over-week, with a 7-day moving average of approximately $85 billion.

Average Transaction Fees: Bitcoin transaction fees decreased by 5% week-over-week, with an average fee of $3.58 and an average transaction load of approximately $157,000, resulting in a corresponding transaction fee rate of about 0.0023%.

Bitcoin Market Health and Profitability

Profitable Address Ratio: As Bitcoin prices reach historical highs, approximately 99% of Bitcoin addresses are currently in profit.

Unrealized Net Profit/Loss: This ratio has increased by 21% over the past month, reaching 0.61, indicating a significant rise in the ratio of relative unrealized profits to unrealized losses. As an indicator of market sentiment, this ratio is currently in the "Belief-Denial" range, corresponding to a phase of rapid expansion and contraction between peaks and troughs in the market cycle.

Bitcoin On-Chain Monthly Dashboard

Source: Glassnode, VanEck Research, as of October 15, 2024

Bitcoin Miners and Total Market Capitalization of Crypto

Mining Difficulty (T):

Bitcoin's block difficulty has risen from 92 T to 102 T, reflecting that miners are expanding and upgrading their equipment fleets. The Bitcoin network automatically adjusts difficulty every 2,016 blocks (approximately every two weeks) to ensure that each block is mined in about 10 minutes. The increase in difficulty indicates heightened competition among miners and represents a strong and secure network.

Total Daily Revenue for Miners:

Miners' daily revenue increased by 30% week-over-week, benefiting from the rise in Bitcoin prices, although BTC-denominated transaction fees decreased by 30%, impacting total revenue.

Volume of Miners Transferring to Exchanges:

On November 18, miners transferred approximately $181 million worth of Bitcoin to exchanges, equivalent to 50 times the previous 30-day average, driving a 7-day moving average increase of 803% week-over-week. This extreme fluctuation is the highest level since March, and similar levels were observed before Bitcoin's last halving. Although the sustained high transfer volume from miners to exchanges may indicate market overheating, this peak occurred after lower summer miner sell-offs, suggesting that this is profit-taking for operational and growth purposes rather than a signal of a market top.

Total Market Capitalization of Crypto Stocks:

The 30-day moving average of the MarketVector Digital Assets Equity Index (MVDAPP) increased by 47% week-over-week, outperforming Bitcoin. Major index constituents like MicroStrategy and Bitcoin mining companies directly benefit from the rise in Bitcoin prices through their holdings or mining operations. Meanwhile, companies like Coinbase leverage broader crypto market gains, as rising prices drive expectations for increased trading fees and other revenue sources.

Source: farside.co.uk, as of November 18, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。