The bull market is in hand, and 2024 is an exciting year for Layer 1 (L1) blockchains, with token prices skyrocketing over 7000% since January. In the rapidly evolving crypto space, some unexpected tokens have become the top performers this year. Let's take a look at the biggest L1 winners and losers of 2024.

Author: Prem Reginald

Translation: Blockchain in Plain Language

Inspired by Donald Trump's victory in the presidential election, the cryptocurrency market in 2024 is showing a vertical growth trend. **As platforms for decentralized applications (dApps) and **smart contracts, the demand for L1 solutions has surged, leading to fierce competition among major L1 blockchains for top positions. However, they face strong challenges from Layer 2 (L2) solutions, which are dedicated to enhancing transaction speeds at very low costs, thus competing with established blockchains like Ethereum.

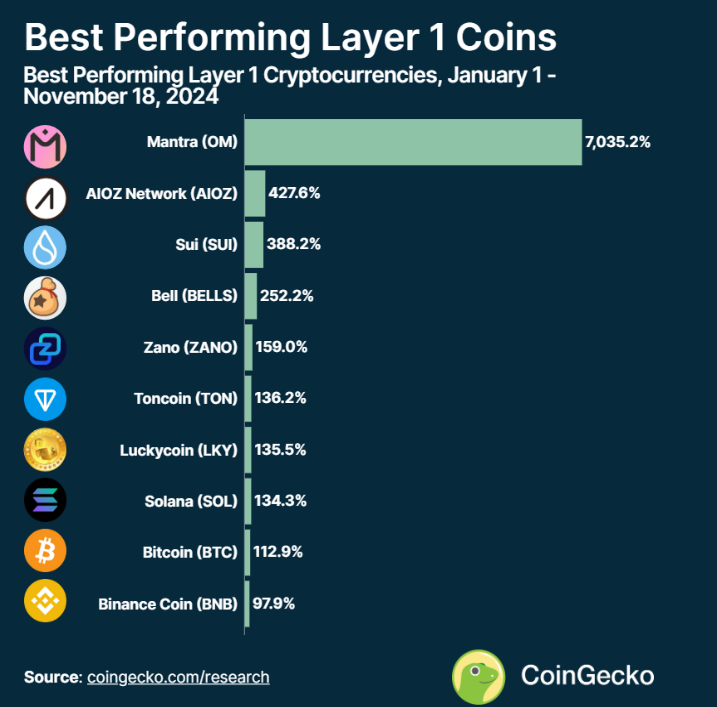

1. Which Layer 1 Tokens Performed Best?

Among the best-performing tokens, Mantra (OM) has achieved unprecedented growth, with its value soaring by 7,035.2%. This surge is partly due to Mantra's collaboration with the UAE-based digital bank Zand. Zand has tokenized real-world assets (RWA) by complying with the regulations of the Dubai Virtual Assets Regulatory Authority (VARA). Additionally, the demand for RWA products continues to grow, with traditional financial institutions increasingly bringing money market funds and bonds onto the blockchain.

2. Other Outstanding Tokens

AIOZ Network (AIOZ) is another standout performer, growing by 427.6% year-to-date (YTD). The platform's decentralized content distribution network has seen increasing adoption driven by ongoing ecosystem optimizations. Also in the top three is Sui (SUI), which has grown by 388.2% YTD, benefiting from rapid developments within its ecosystem, including the launch of innovative dApps leveraging its high scalability and developer-friendly features.

Other notable performers include:

Bellscoin (BELLS): Growth of 252.2%

Zano (ZANO): Growth of 159%

Toncoin (TON): Growth of 136.2%, successfully hosting dApps and launching "click-to-earn" games through integration with Telegram.

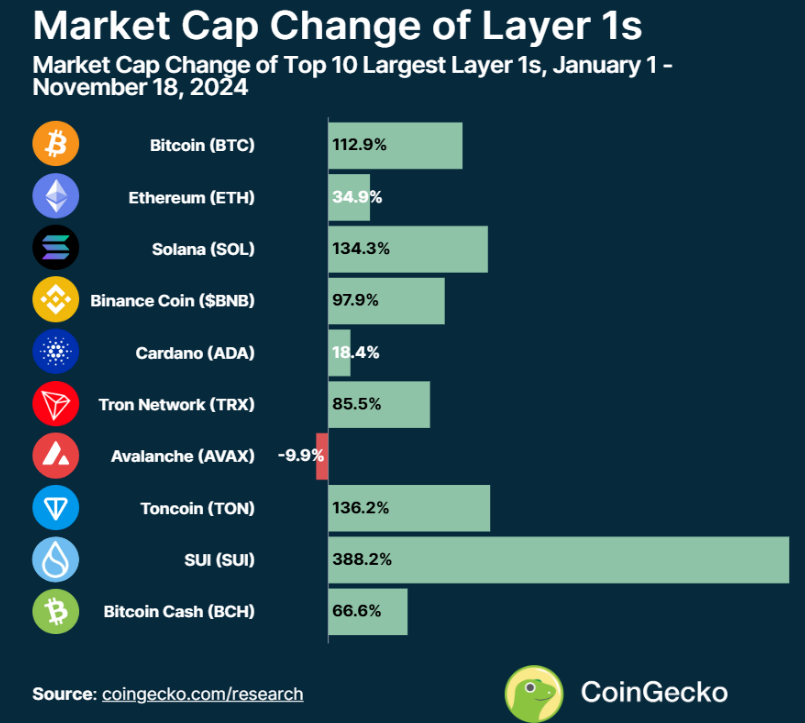

3. Moderate Growth Among Top Ten Layer 1 Tokens

Despite the impressive performance of small and mid-cap Layer 1 tokens, larger market cap tokens like Bitcoin, Ethereum, and Solana remain solid investment choices.

Bitcoin (BTC) achieved an annual growth of 112.9%.

Ethereum (ETH) grew by 34.9%, but underperformed compared to similar tokens. With the rise of new Layer 2 and other blockchains, Ethereum's dominance has been declining year by year, despite the launch of a spot Ethereum ETF in the U.S. However, Ethereum still outperformed the S&P 500 index, which rose by 24.8% in 2024.

Solana (SOL): Rising from the Ashes

Solana (SOL) has risen from the shadow of the 2022 FTX bankruptcy, growing by 134.3% year-to-date. Most of its gains occurred in 2023, driven by the memecoin frenzy, with prices soaring from $15 to $120. This trend has also extended to other blockchains, such as Tron Network (TRX), which has grown by 85.5% this year.

Meanwhile, Toncoin (TON) recorded an impressive growth of 136.2%, primarily due to its ability to host dApps on the popular messaging app Telegram. The "click-to-earn" game model has become extremely popular on Telegram, further driving its growth.

Sui: The Most Eye-Catching Performance

Sui has had the most remarkable performance this year, growing by 338.2%. This increase is mainly attributed to rising investor interest, increased on-chain activity, and enhanced utility through significant dApp expansion. Additionally, Circle's USDC has been integrated into the network, and there has been a trend of funds moving from Ethereum to Sui.

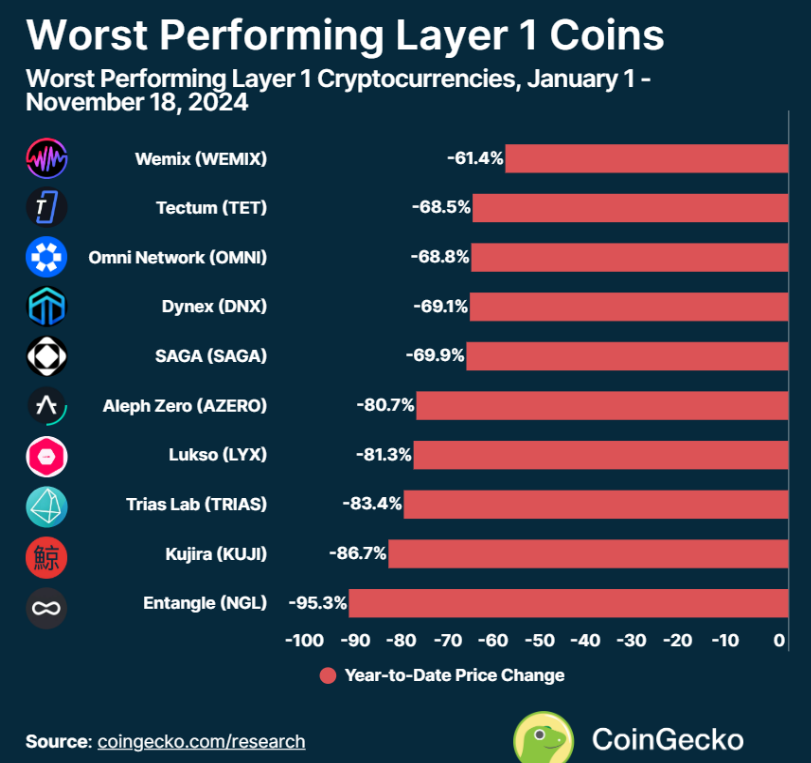

4. Largest Declines

On the other hand, some tokens have seen declines of up to -96% year-to-date.

Entangle (NGL) performed the worst, down -95.3% YTD.

Following closely are Kujira (KUJI) and Trias Lab (TRIAS), down -86.7% and -83.4%, respectively.

NGL was launched in March 2024 at a high valuation, and its price has continued to decline since then. Kujira's performance has been affected by the team's high-risk leveraged liquidity positions, which backfired during market volatility.

5. Performance of Layer 1 Tokens Launched in 2024

The performance of various Layer 1 cryptocurrencies launched in 2024 has been mixed, reflecting the challenges of breaking through in a competitive market.

Aleo (ALEO) launched in September and has declined by -58.1% since its release.

Saga (SAGA) launched in April and faces a similar predicament, down -69.9% YTD.

Omni Network (OMNI), also launched in April, is down -68.8%.

Zeta Chain (ZETA) launched in February and has declined by -57.3% so far.

Performance of Router Protocol (ROUTE) and Other New Projects

Router Protocol (ROUTE) launched in July and has seen a price drop of 24.8%, while Ice Open Network (ICE) has experienced a relatively smaller decline of 34.5% since becoming active in January. Meanwhile, Kaia (KAIA), which entered the market by the end of October, achieved a slight positive growth of 5.2%. These performances reflect the volatility of new Layer 1 projects and the importance of ongoing innovation and user adoption for gaining market recognition.

6. Top Ten Layer 1 Projects Ranked by Price Performance

Note: YTD is an abbreviation for Year-to-Date, meaning "year to date." It is commonly used to describe the performance of a metric (such as returns, price changes, or performance) over the period from the beginning of the year (usually January 1) to the current date.

7. Conclusion

In 2024, the Layer 1 blockchain space has shown diverse performances. Mantra leads with a staggering year-to-date (YTD) increase of 7035%, thanks to its strategic partnerships and cutting-edge blockchain use cases. Meanwhile, established players like Bitcoin, Solana, and Toncoin have shown steady performance, proving their resilience in a changing market. At the same time, newly issued tokens face significant challenges, often struggling due to high starting valuations.

As competition between Layer 1 and Layer 2 solutions intensifies, the focus on scalability, utility, and compliance will determine the emergence of the next wave of winners, which is particularly important in this rapidly changing crypto market.

Note: This study analyzed the price returns of the top 100 cryptocurrencies sorted by market cap in the Layer 1 category on CoinGecko. The YTD growth data covers performance from January 1, 2024, to November 18, 2024. These data reflect a snapshot of the market, showcasing the performance differences of various tokens in a broader market environment.

Article link: https://www.hellobtc.com/kp/du/11/5563.html

Source: https://www.coingecko.com/research/publications/layer-1-blockchains-price-returns?utmcampaign=Data%20Visualization&utmsource=x&utm_medium=social

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。