Author: hyphin, On Chain Times Author

Translation: xiaozou, Golden Finance

1. Introduction

Since our last article on meme coins (in March this year), the total market size and market share of the industry have continued to grow, showing no significant signs of stagnation. Undoubtedly, it is the fastest horse in the race.

This phenomenon can be attributed to the viral spread of social media (its inherent characteristics), extremely low entry barriers, and the continuous emergence of fresh narratives that attract speculators, even though many (if not most) fail to maintain meaningful attention in the long term. Nevertheless, market participants have become accustomed to this, frequently entering and exiting profitable short-term trends, leveraging momentum for gains while maintaining loyalty to high-conviction bets, making them more enduring. Although some may be reluctant to admit it, in the current market environment, meme coins that have been thoroughly tested by the market have a lower likelihood of extinction compared to those that rely solely on impression-driven value without providing any substantive value (limited to capital transfer).

While Solana may not be the only contributor to the total market capitalization of these massive tokens, most of the activity in the space indeed occurs within its chain ecosystem trenches. For this reason, this article will continue to focus on this chain, attempting to provide a global picture.

2. Tribute to Pump

With the birth of pump.fun (a Solana-native token incubation platform), significant changes have occurred in the local market dynamics. Interacting with speculative tokens has become simpler, cheaper, and safer (from a security perspective). Through a user-friendly interface, standardized token deployment can be conducted in a controlled environment, allowing anyone to create new tokens based on common configurations, thereby eliminating the risk of potential malicious actors hidden within smart contracts. This essentially only requires the deployer to provide some creative input, without any technical knowledge. By abstracting away all complexities, the focus is placed on what truly matters—mass speculation.

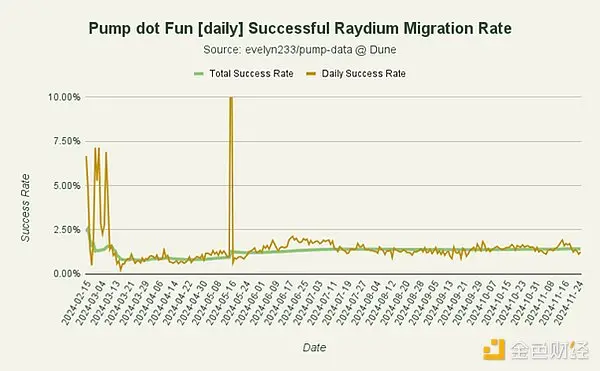

Once a tokenized meme is created, it can be traded directly in the platform's internal market, and once its market capitalization reaches approximately $69,000, it will be automatically deployed to Raydium. However, most creations fail to reach this threshold and are never launched into the market.

About one in every 100 tokens "graduates" from pump.fun, due to significant saturation, limited liquidity, and other reasons beyond the scope of this article. Those who step into the ring must showcase something interesting and shockingly unique to capture the attention of the warriors in the trenches. Despite these challenges, the protocol quickly established itself as a genuine gateway for trading micro-cap tokens and launching new tokens, rapidly surpassing all other competitors in the field.

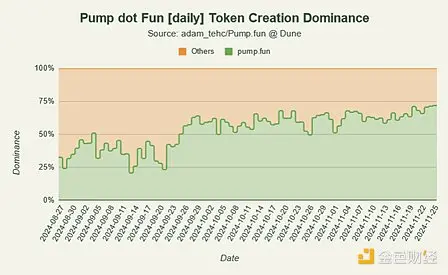

So far, the deployment dominance compared to other alternatives has reached an astonishing 71.9%, demonstrating the widespread popularity and far-reaching impact of this application. Recent momentum has quickly made it mainstream, with many new users from TikTok joining in, ambitiously wanting to scale it up and fan the flames even more.

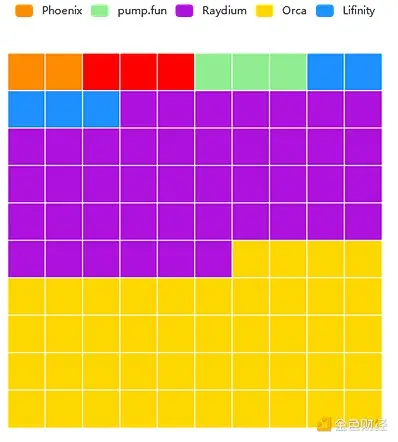

3. All Roads Lead to Raydium

Whether through secret launches, pump.fun releases, or presale tokens, the vast majority of meme coin liquidity pools come from Raydium. The influx of numerous memes into the market has increased its market share, with decentralized exchanges accounting for a significant portion of Solana's current on-chain trading volume.

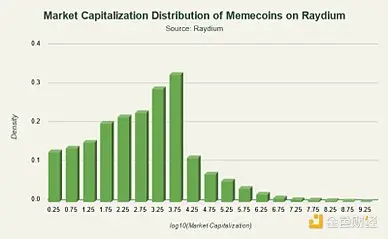

In a gold rush, those selling shovels to speculators often reap the most rewards. This analogy also applies to the current situation. Regardless of how well meme coins perform, the platforms facilitating trading activities will benefit immensely from the trading volume generated by increasing speculative activities. Many things and common sense indicate that only a few tokens garner attention, while the rest are destined to gradually fade from view. This perspective can be confirmed or refuted simply by observing the market capitalization distribution of all existing trading pairs.

Due to the lack of effective tagging methods from data providers, distinguishing between meme and non-meme tokens on a larger scale is quite challenging. After careful consideration, the method used to curate the comprehensive dataset is to collect information on all Raydium liquidity pools with non-zero liquidity (as of November 25, 2024), excluding official token listings and legitimate projects in CoinGecko. The remaining 493,203 pools contain 474,161 unique address tokens, which will serve as the basis for analysis in this section.

Most tokens, at any point during their lifespan, even with very minimal activity, often fall within the range of $100,000 to $1 million, forming noticeable peaks in the early and mid-stages. It is evident that the chart forms a gradually smoothing tail—highlighting a few tokens with high valuations, which is expected, as maintaining a moderate market cap in such an attention-driven environment is challenging. While this example encompasses the entire dataset, it is also worth exploring the potential structural distribution differences between tokens originating from pump.fun and those directly deployed to Raydium.

Separating the two can provide important insights into the overall distribution's distinct patterns, as well as their respective performances, showcasing unique characteristics.

(1) pump.fun

Note that pump.fun tokens need to exceed a certain market cap threshold to gain liquidity pools, and due to the greater liquidity provided at issuance, their values are generally higher, often ranging from $5,000 to $15,000. This indicates that most released tokens cannot maintain or exceed their market cap before migrating to Raydium. Many of these tokens also fall within the mid-range (hundreds of thousands to a few million), as the deployment pipeline somewhat filters out unappealing memes and allows the community to leverage the reputation or traction gained during this process as a growth catalyst.

(2) Direct Deployment

In the lower market cap bands, there remains a significant density, indicating that many smaller, less desirable tokens struggle to gain significant traction. Part of the reason may be due to saturation, poor timing of these tokens' introduction to the market, or a clear lack of narrative, originality, and proper promotion. Although not obvious, the extremely high market cap meme density listed on multiple centralized exchanges is more concentrated, as these memes emerged long before pump.fun appeared.

In our dataset, the aggregation around lower market cap tokens confirms the above viewpoint. While trend exhaustion and the inevitable bursting of speculative bubbles pose significant obstacles for any token, inconsistent incentives largely lead to the momentary collapse and subsequent demise of many memes. Anonymous scammers mislead their users, while those with ulterior motives, the so-called "developers," normalize outright fraud in the space, causing many seemingly promising concepts to be stillborn after their inception. Upon closer inspection, it is found that a large portion of tokens are deliberately set up for failure, aiming to extract maximum value from unsuspecting speculators, posing a continuous threat to those brave enough to take risks at the table.

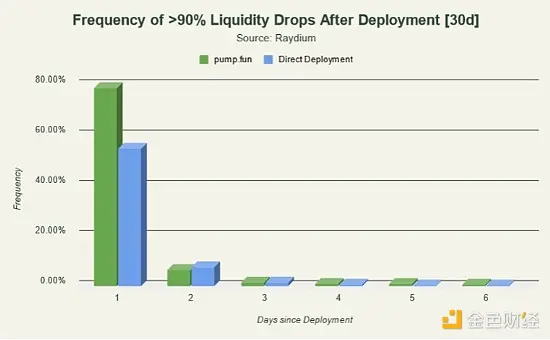

In just the past 30 days, nearly two-thirds of tokens were slaughtered within the initial 24 hours, with over 90% of available liquidity evaporating. Recovering from such catastrophic events during the birth phase is often impossible, but occasionally, disgruntled token holders attempt community takeovers by creating new social media accounts, trying to regain lost momentum, and in some cases, stubbornly or resentfully restarting. The outcomes of such actions are predictable, but if done well, they may provide supporters with a decent exit.

4. Conclusion

The meme coin landscape on Solana is both unpredictable and vibrant, characterized by boundless creativity, rampant speculation, and ever-present risks. Platforms like pump.fun and Raydium have become the epicenter of this thriving ecosystem, offering opportunities and challenges to participants. While some standout tokens rapidly rise, igniting dreams of overnight fame, the sobering reality is that most meme coins fail to sustain their initial momentum, leaving behind a series of shattered hopes. As this speculative frenzy continues to evolve, one thing has remained clear: in a world where viral spread often outweighs facts, a cautious approach and thorough investigation are crucial. Whether you are a curious bystander or an active participant, navigating the niche market requires both a keen eye for trend judgment and a steadfast skepticism towards promises of easy wealth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。