This week, BTC experienced a wave of adjustment, retreating over 8,300 points from a high of nearly $99,000, and at one point approaching the strong support zone of $90,000 to $90,500. During the decline, many altcoins followed suit, and the total market capitalization of cryptocurrencies evaporated by over $300 billion. As of the time of writing, BTC is reported at $96,655.

According to analysis by AICoin (aicoin.com), the main reasons for the BTC pullback include:

1. Market Overheating: The Fear and Greed Index shows the market is in a state of "extreme greed," with investor sentiment high, leading to FOMO (Fear of Missing Out).

2. Excessive Leverage Trading: Due to the previous rise in BTC, a large number of short positions in the market were liquidated, resulting in downward pressure at this stage.

3. Surge in Arbitrage Demand: Stimulated by a one-sided upward trend and positive news, funding rates have risen, while the price difference between spot and futures contracts has widened. More and more funds are flowing into arbitrage, leading to a surge in demand, but a divergence with supply has increased market adjustment pressure.

4. Technical Pullback: On the 8-hour cycle, BTC has shown divergence resonance, with indicators such as MACD and RSI forming divergence signals.

Currently, the long-to-short ratio of BTC positions on OKX has dropped below 1.0, while Coinbase maintains a positive premium, and market bullish expectations remain unchanged. According to AICoin PRO data, the main players are still firmly betting on the $100,000 mark.

In the current bull market, a pullback is an opportunity! In addition to technical analysis, we can also use AICoin tools to seize potential trading opportunities. Here are several practical methods:

Method 1: Lock in AICoin Exclusive News

(1) Volume Anomaly Alerts

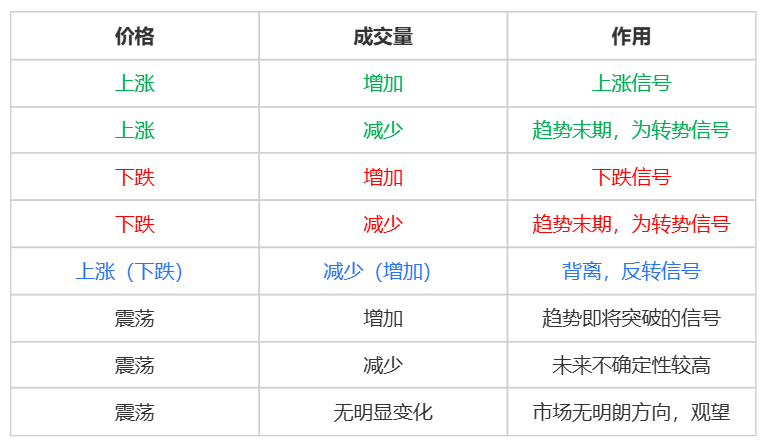

Pay attention to changes in trading volume. If the price rises and trading volume increases, it is a bullish signal; conversely, it is a bearish signal.

Common volume-price analysis patterns are shown in the image below:

Path: Exclusive section in the News column on PC or APP

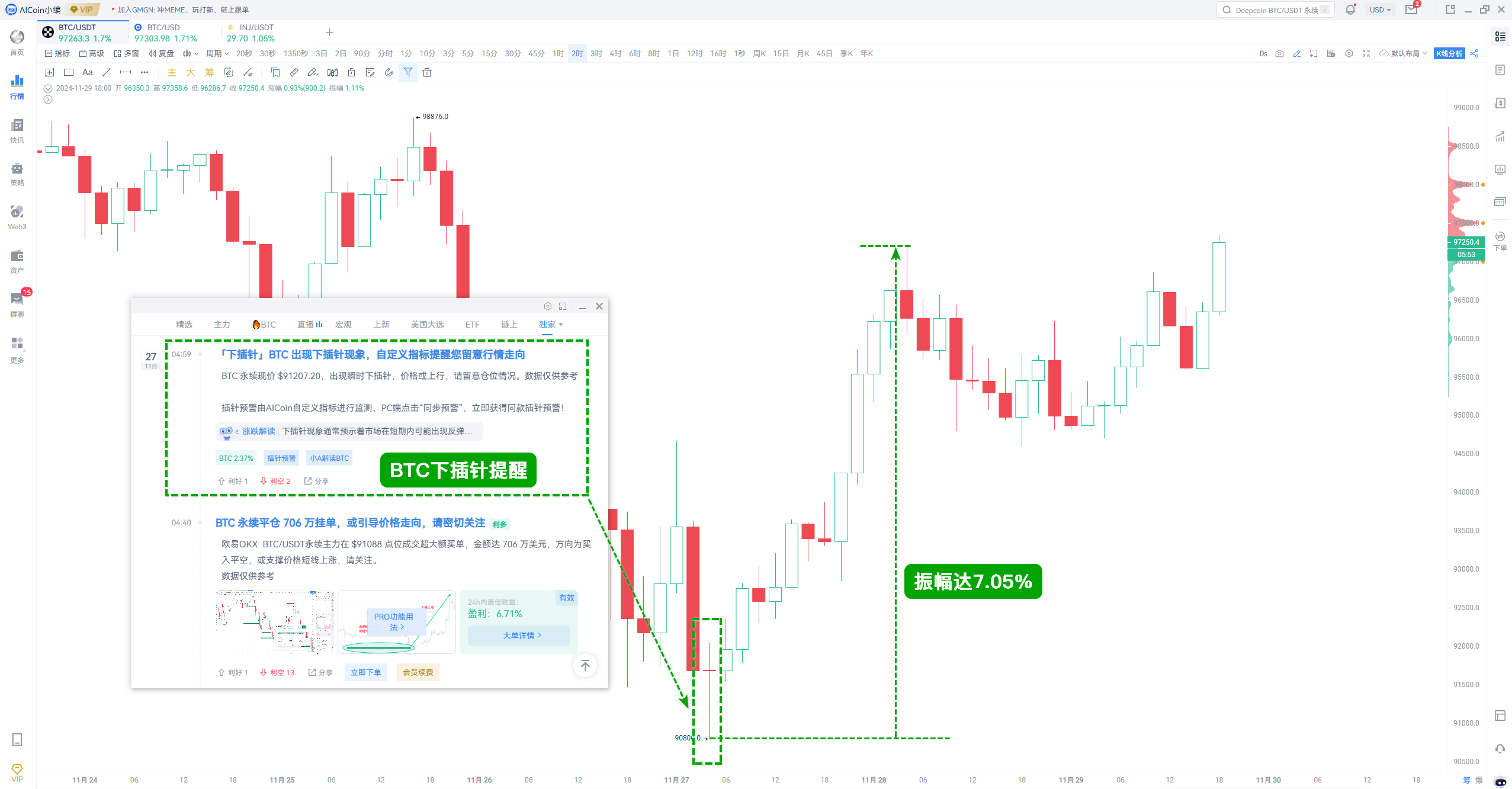

(2) BTC Spike Alerts

Spike patterns can be seen as reversal signals. An upward spike indicates resistance to rising, while a downward spike suggests weakening downward pressure.

If a spike is accompanied by a surge in trading volume, it is a very good signal for escaping peaks and bottom fishing:

• Escape Peak: A clear upward spike appears, along with an increase in trading volume, especially if accompanied by main players offloading, the effect is more pronounced;**

• Bottom Fishing: A clear downward spike appears, along with an increase in trading volume, especially if accompanied by main players entering the spot market, the effect is even better.**

Based on this, a custom indicator can also be developed, such as the 【Spike Volume Method】 strategy released by AICoin editors, which monitors top and bottom signals in real-time based on spikes and trading volume changes: https://www.aicoin.com/link/script-share/details?shareHash=NvxkOWbAqQPvVb5J

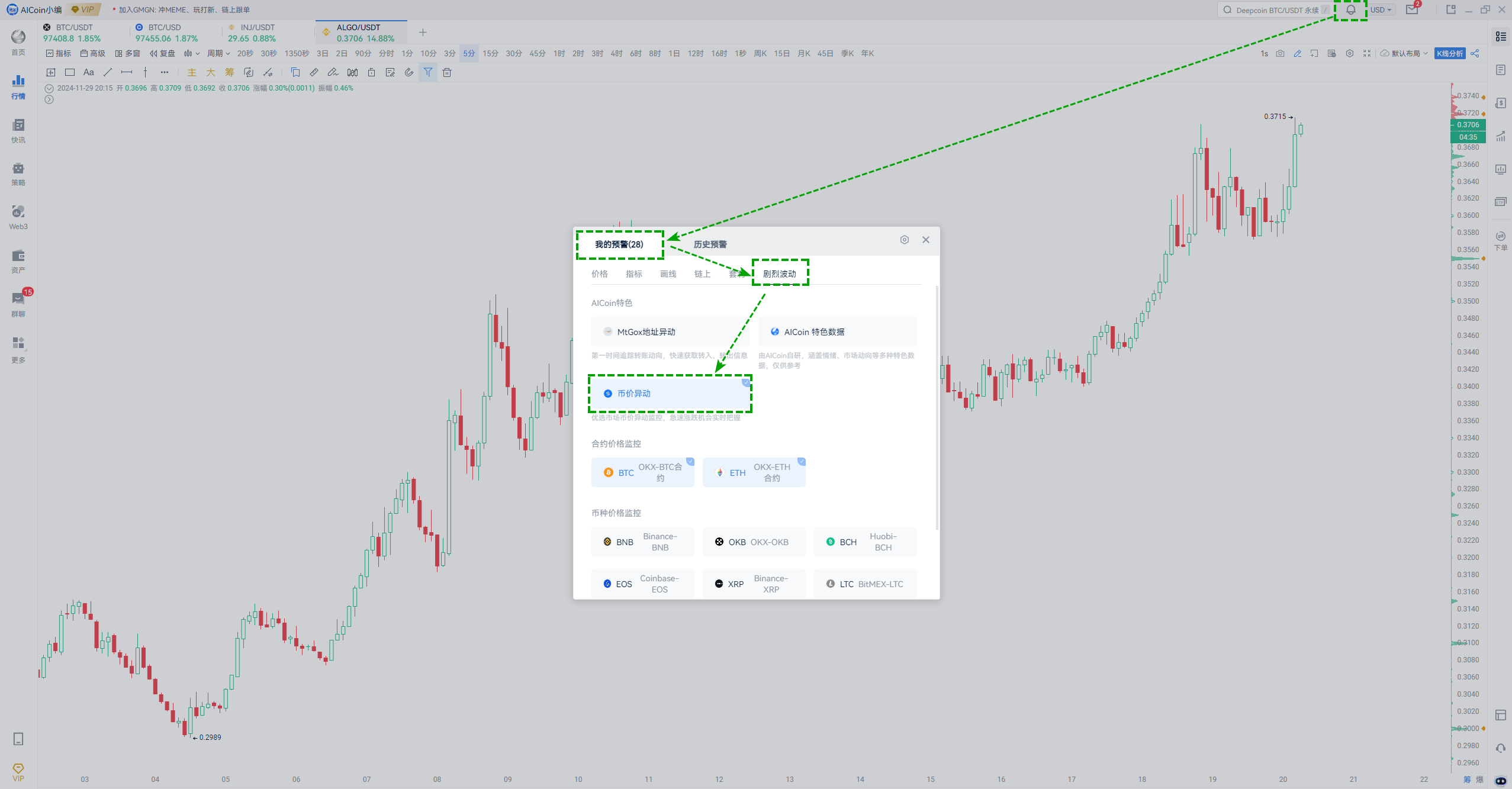

Method 2: Severe Volatility Alerts

Pay attention to BTC severe volatility alerts. If BTC shows a downward alert, lock in the 5-minute gain leaderboard and focus on coins that did not follow the drop or can quickly recover their losses.

Because when BTC drops significantly, it usually leads to a drop in altcoins. If a coin does not drop or follows BTC's drop but can quickly recover its losses, it can be considered a strong coin.

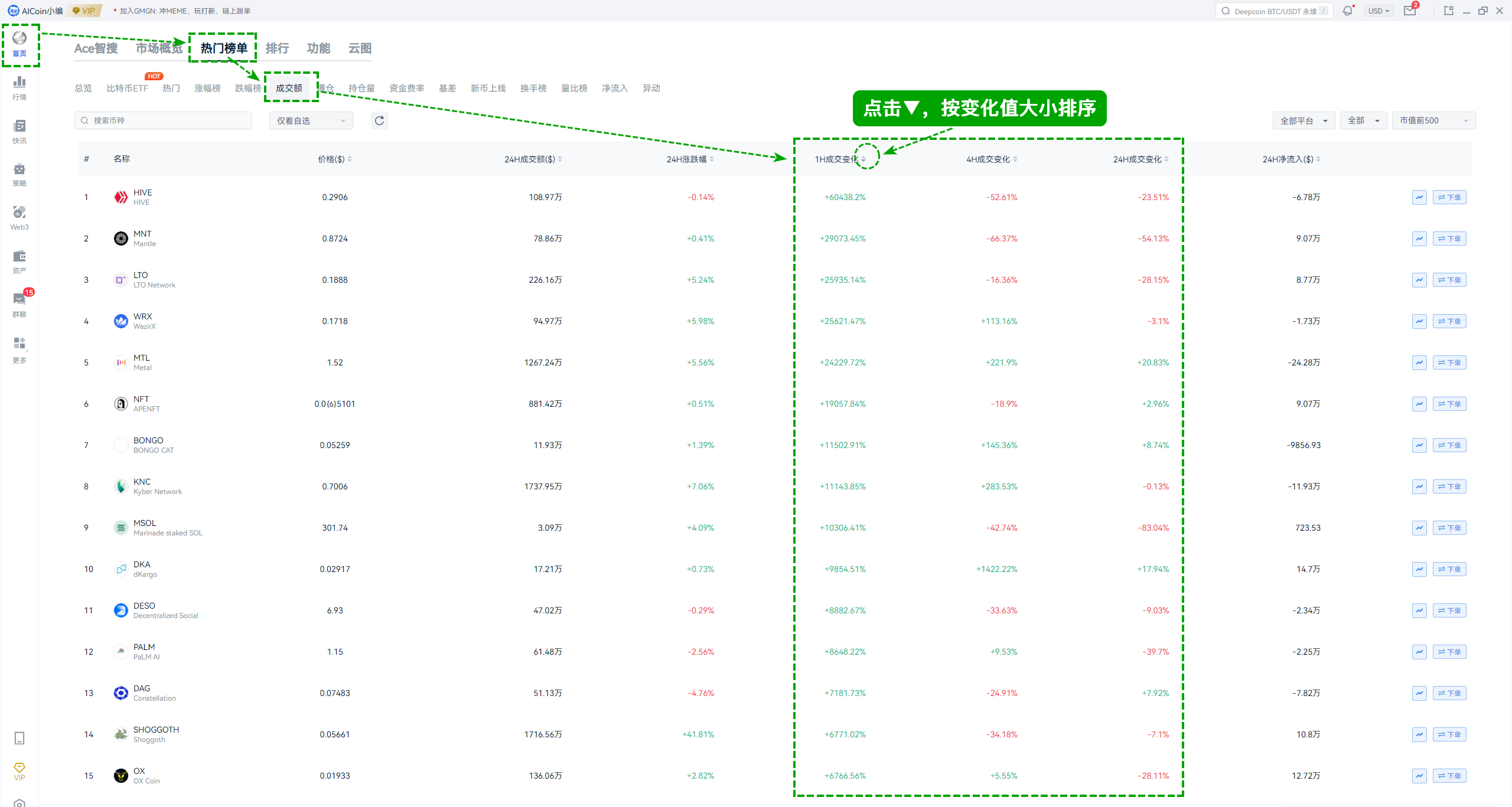

Method 3: Leaderboard Data

(1) Trading Volume Leaderboard

Condition 1: Changes in trading volume for 1H, 4H, and 24H are all ranked at the top;

Condition 2: Price increase ≤10% (if not, relax a bit, aim for a smaller increase);

Condition 3: 24H trading volume ≥$5 million;

Condition 4: The higher the turnover rate, the better.

View the trading volume leaderboard: AICoin PC homepage

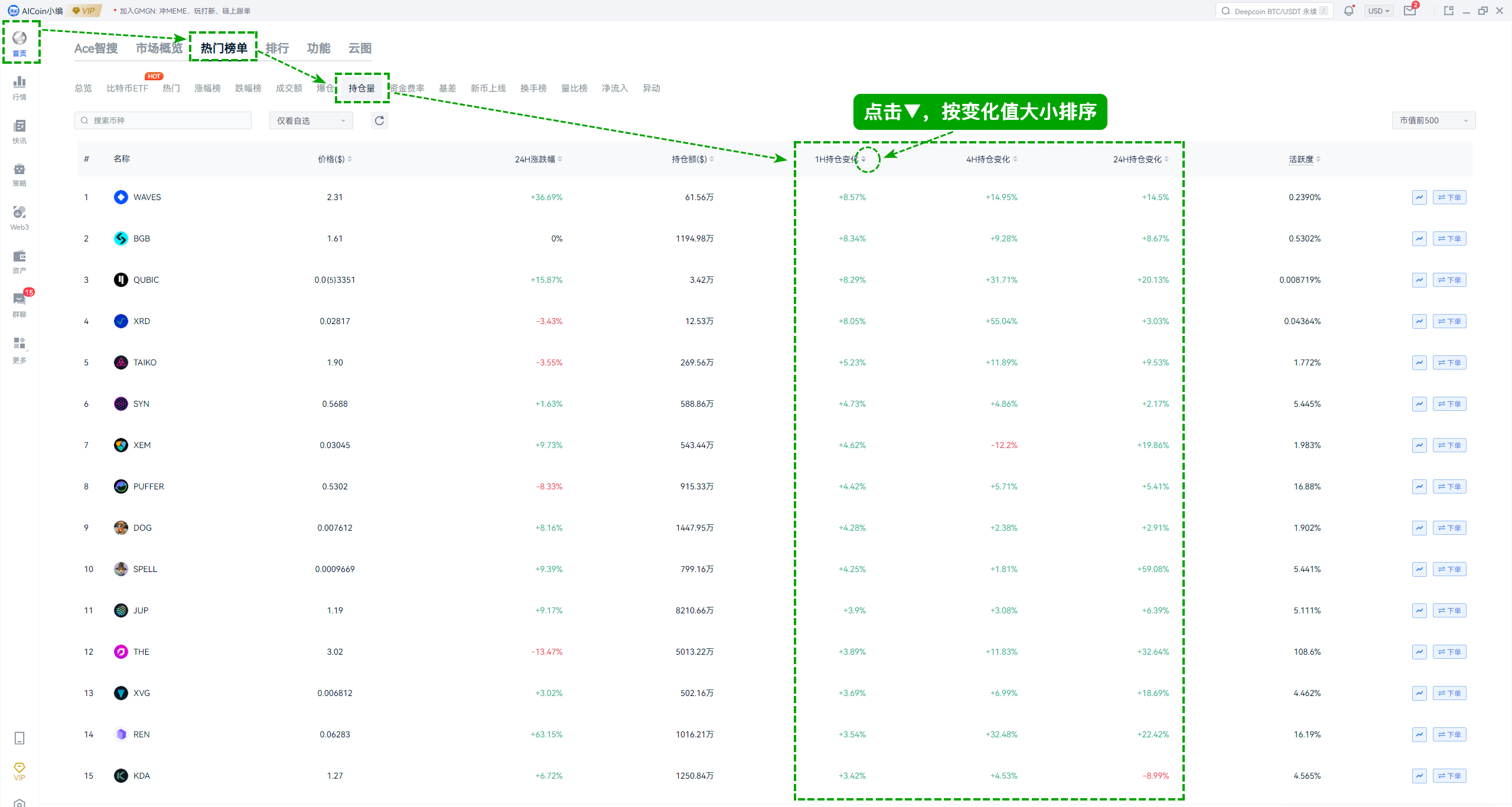

(2) Open Interest Leaderboard

Condition 1: Changes in open interest for 1H, 4H, and 24H are all in the top 10;

Condition 2: Open interest ≥$10 million;

Condition 3: Price increase ≤10%;

Condition 4: The higher the activity level, the better.

If you filter the open interest leaderboard and find those that do not meet confirmation conditions 2 and 3, exclude them, and prioritize the 24-hour open interest leaderboard.

View Path: AICoin PC, [Homepage - Popular Leaderboard - Open Interest]

Method 4: Price Anomalies

Pay attention to 5-minute price anomaly alerts, suitable for short-term traders. If there are multiple consecutive bullish candles with large K-line bodies, the likelihood of a sustained trend is high.

Set Path: Alerts - Severe Volatility - Price Anomalies

Download AICoin PC: https://www.aicoin.com/download

For more trading strategies and methods sharing, feel free to join the 【PRO CLUB】 group to discuss with us!

The above content is for reference only and does not constitute any investment advice!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。