Author: Poopman, IOSG Researcher

Compiled by: 0xjs, Golden Finance

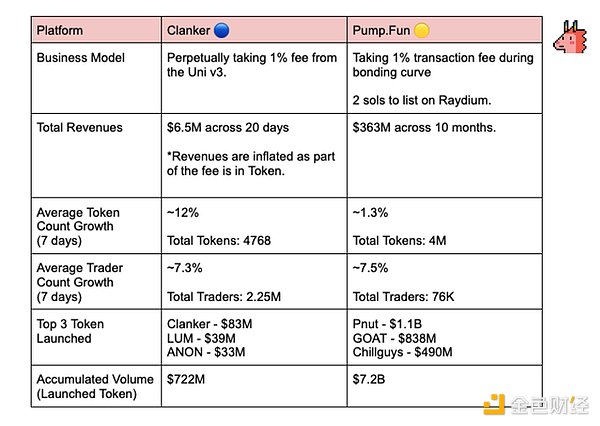

1. Business Model

PumpFun: Charges a 1% transaction fee during the joint curve + 2 sols to be listed on Raydium.

Clanker: Charges a permanent 1% fee from Uni v3 due to the absence of a joint curve, using the #LpFeesCut feature.

New Upgrade: 0.4% of the fees will be returned to the issuer, providing more incentives for issuing tokens.

2. Total Revenue

PumpFun: Generated $363 million in revenue over 10 months. Currently 55 times that of Clanker.

Clanker: Generated $6-7 million in revenue over 20 days. Some of the fees are in tokens, which exaggerates the revenue.

3. Token Quantity Growth (7 Days)

PumpFun: 4 million tokens, with a daily growth of about 1.3%.

Clanker: Currently has 4,768 tokens, with a daily growth of about 12%.

4. Top 3 Market Cap Tokens

PumpFun:

- Pnut - $1.1 billion

- GOAT - $838 million

- Chillguys - $490 million

Clanker:

- Clanker - $83 million

- LUM - $39 million

- ANON - $33 million

Some Key Points:

Although Clanker has successfully directed a large volume of transactions on Base, it has not sent any positive signals to Farcaster.

Early BOT sniping seems to be an issue, but there is no clear/accurate data showing its toxicity.

The user base of Farcaster is limited, which may hinder the growth of token quantity. However, this design can provide strategic value for both Base and Farcaster.

The increasingly diversified assets on Base are key to unlocking the "real" base Base Season.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。