Original Source: BitMEX

Key Highlights

This week marks the Thanksgiving holiday in the United States, with mainstream cryptocurrencies showing a sideways trend overall. Although market volatility is low, sector rotation is evident.

While meme coins continue to consolidate, traditional tech altcoins lead the gains. Following last week's increases in XRP and ADA, this week $TIA has become the best-performing altcoin.

In the trading strategy section, we will analyze the ongoing influence of Trump's trading on Bitcoin.

Data Overview

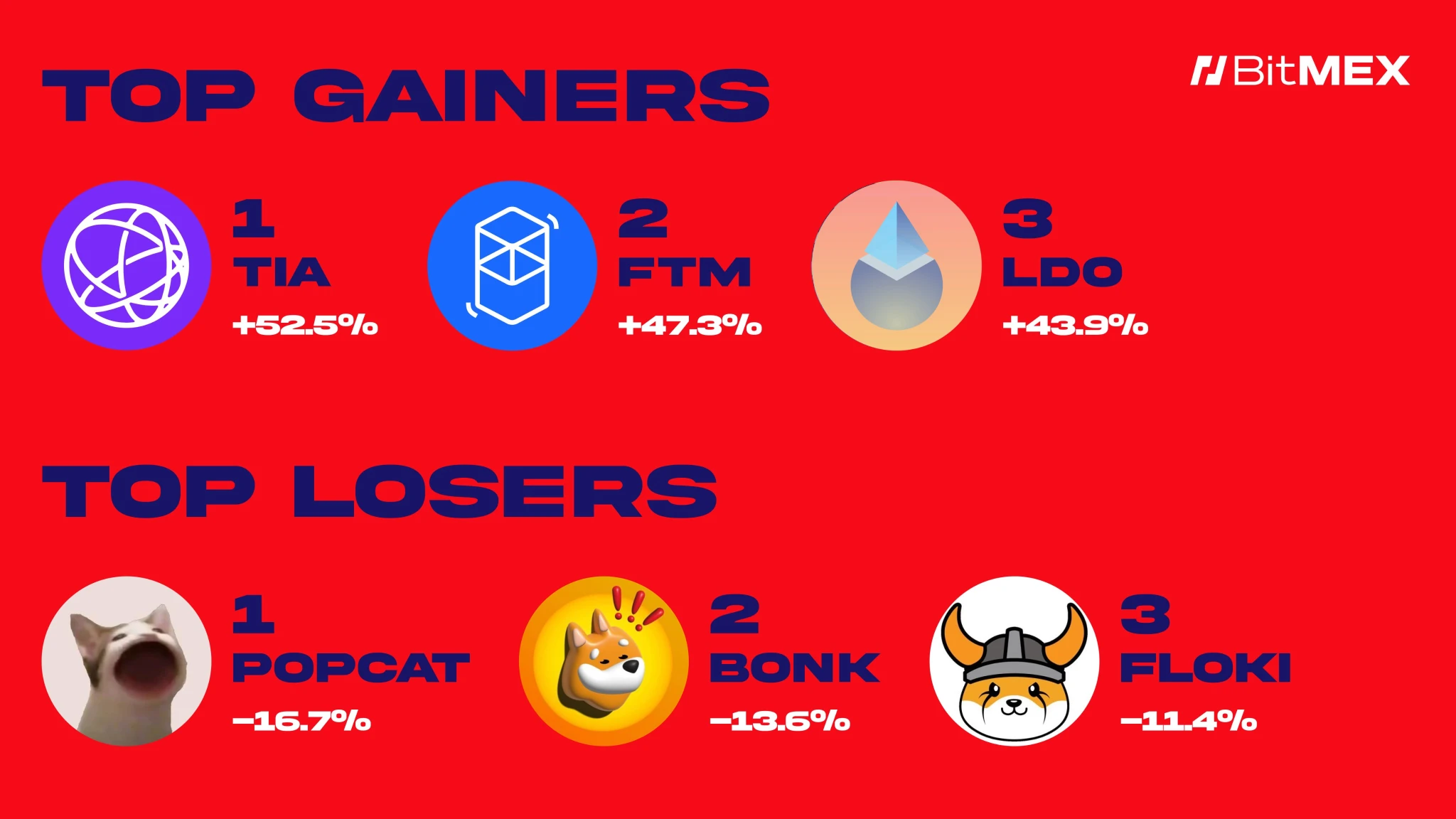

Best Performers This Week

$TIA (+52.5%): Despite facing significant selling pressure in previous weeks, it showed strong resilience this week, leading the market.

$FTM (+47.3%): Driven by brand revitalization and expectations of a mainnet upgrade, it continues to strengthen.

$LDO (+43.9%): The voting on the Lido DAO 2025 target proposal brings new momentum.

Poor Performers This Week

$POPCAT (-16.7%): This week, the meme coin sector on the BitMEX platform led the decline.

$BONK (-13.6%): Experienced a pullback following the trend of Popcat.

$FLOKI (-11.4%): Declined in sync with other meme coins.

Market News

Macroeconomic

ETH ETF saw an inflow of $133 million this week (source).

BTC ETF experienced an outflow of $451 million this week (source).

The U.S. core PCE in October increased by 2.8% year-on-year, up from the previous value of 2.7% (source).

The Vancouver city government is advancing a "Bitcoin-friendly city" initiative, which will provide policy support for the crypto industry (source).

The number of initial jobless claims in the U.S. last week was 213,000, lower than the expected 216,000 (source).

A Brazilian congressman proposed establishing a national Bitcoin reserve to address economic fluctuations (source).

Trump's team may nominate former SEC commissioner Paul Atkins for the chair position (source).

XT exchange was hacked, suspending all withdrawal operations (source).

Chinese concept stock SOS announced a $50 million Bitcoin purchase plan, causing its stock price to surge by 47% (source).

Project Updates

The sanctions against Tornado Cash were overturned by a U.S. appeals court, causing TORN to surge over 500% (source).

The DeFi project WLFI, supported by Trump, proposed deploying the Aave V3 protocol on Ethereum (source).

Animoca Brands made a strategic investment in the Pudgy Penguins NFT project, enhancing its Web3 gaming layout (source).

The emerging DEX pump.fun surpassed Ethereum in daily revenue, attracting market attention (source).

Phantom wallet added support for the Base network, expanding its multi-chain ecosystem (source).

The Movement Network Foundation announced the MoveDrop plan, which will airdrop 10% of tokens to the community (source).

Line plans to launch mini Dapps in 2024, drawing on the successful experience of Telegram's gaming ecosystem (source).

The Aave community proposed establishing a strategic partnership with Instadapp, intending to invest in INST tokens (source).

Trading Insights

Note: The following content does not constitute investment advice. This is merely a summary of market news, and we always recommend conducting your own research before executing any trades. The following content does not guarantee any returns, and BitMEX is not responsible if your trades do not meet your expectations.

How Long Can Trump's Influence on Bitcoin Last?

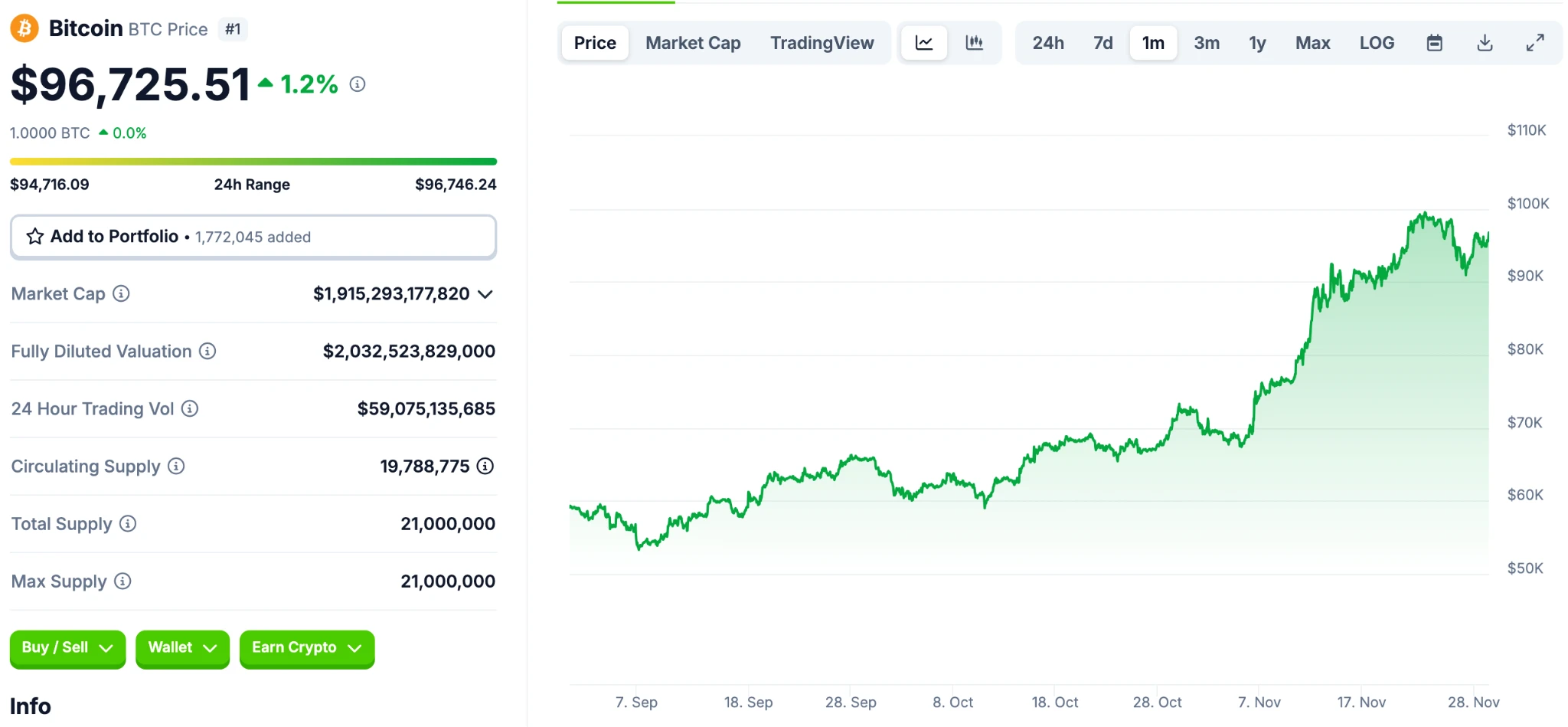

Since Trump won the election on November 7, Bitcoin has risen over 40%, reaching an all-time high. While some traders attribute this surge to the so-called "Trump effect," a deeper analysis of the Trump administration's cryptocurrency policy framework and the composition of its execution team suggests that this could be one of the most significant institutional breakthroughs in the history of the cryptocurrency market.

Analyzing Trump's Administration's Cryptocurrency Policy Commitments

1. U.S. Bitcoin Strategic Reserve

The most groundbreaking policy commitment is the proposal to include Bitcoin in the national strategic reserve system. Currently, the U.S. holds approximately 207,000 Bitcoins, and the Bitcoin bill proposed by Senator Lummis requires that all Bitcoins held by federal agencies be transferred to the Treasury as a strategic reserve. The bill also stipulates that the Treasury will purchase no more than 200,000 Bitcoins annually over five years, totaling 1 million Bitcoins, and hold them for at least 20 years. If the bill passes, the U.S. will not only refrain from selling its existing 207,000 Bitcoins but will also create approximately $80 billion in buying pressure over the next five years.

2. White House Cryptocurrency Advisor Position

According to Bloomberg, the Trump administration plans to establish the first White House cryptocurrency advisor position. This position will:

Manage inter-agency relations: Coordinate cryptocurrency policy between Congress, the White House, and other government agencies.

Oversee regulatory frameworks: Responsible for jurisdiction and policy matters related to cryptocurrencies.

Directly connect with the industry: Following Trump's meeting with Coinbase CEO Brian Armstrong, this position will serve as an important link to the cryptocurrency industry.

The establishment of this position marks a significant shift in how cryptocurrencies are handled at the federal level.

3. SEC Chair Replacement

With Gary Gensler officially announcing his resignation next year, the appointment of a new chair for the Securities and Exchange Commission (SEC) indicates a more inclusive regulatory direction:

Accelerate cryptocurrency ETF approvals: Lower the barriers for institutional investment.

Clarify regulatory guidelines: Shift from an enforcement-oriented approach to a more transparent regulatory framework.

Enhance market stability: Reduce market volatility caused by regulatory uncertainty through clear policies.

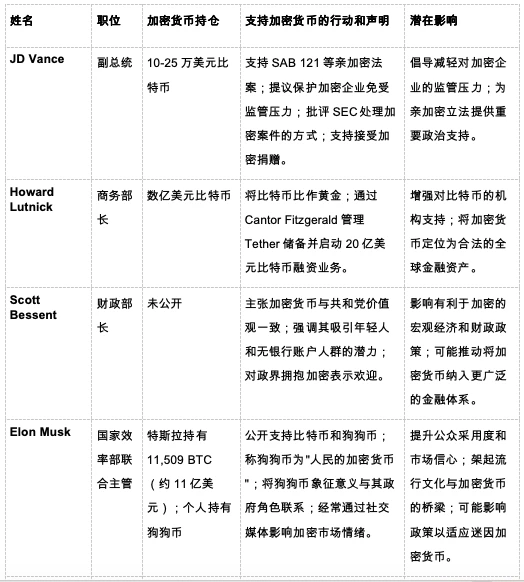

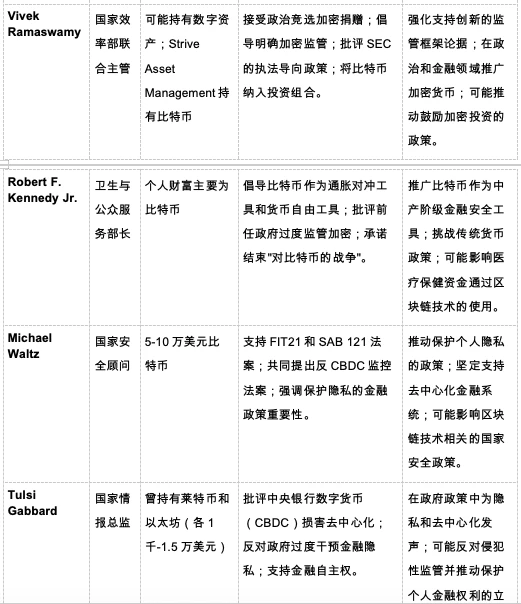

New Government's Position on Crypto Assets

An unprecedented number of senior officials in the new government hold significant amounts of cryptocurrency and possess deep industry experience. This alignment of interests may significantly influence the strength and direction of policy implementation.

Key Cabinet Members and Their Cryptocurrency Involvement

Halfway Through the Cycle

The integration of policy support, institutional recognition, and market confidence suggests that the cryptocurrency market may have entered a new sustainable upward cycle. Unlike previous surges primarily driven by retail speculation, this growth is built on structural changes in regulation and institutional adoption.

Notably, Bitcoin's price has risen over 40% in less than a month since Trump won the election. This rapid increase reflects the market's optimistic expectations regarding the new government's pro-crypto stance and the anticipation of significant policy shifts favorable to the cryptocurrency industry.

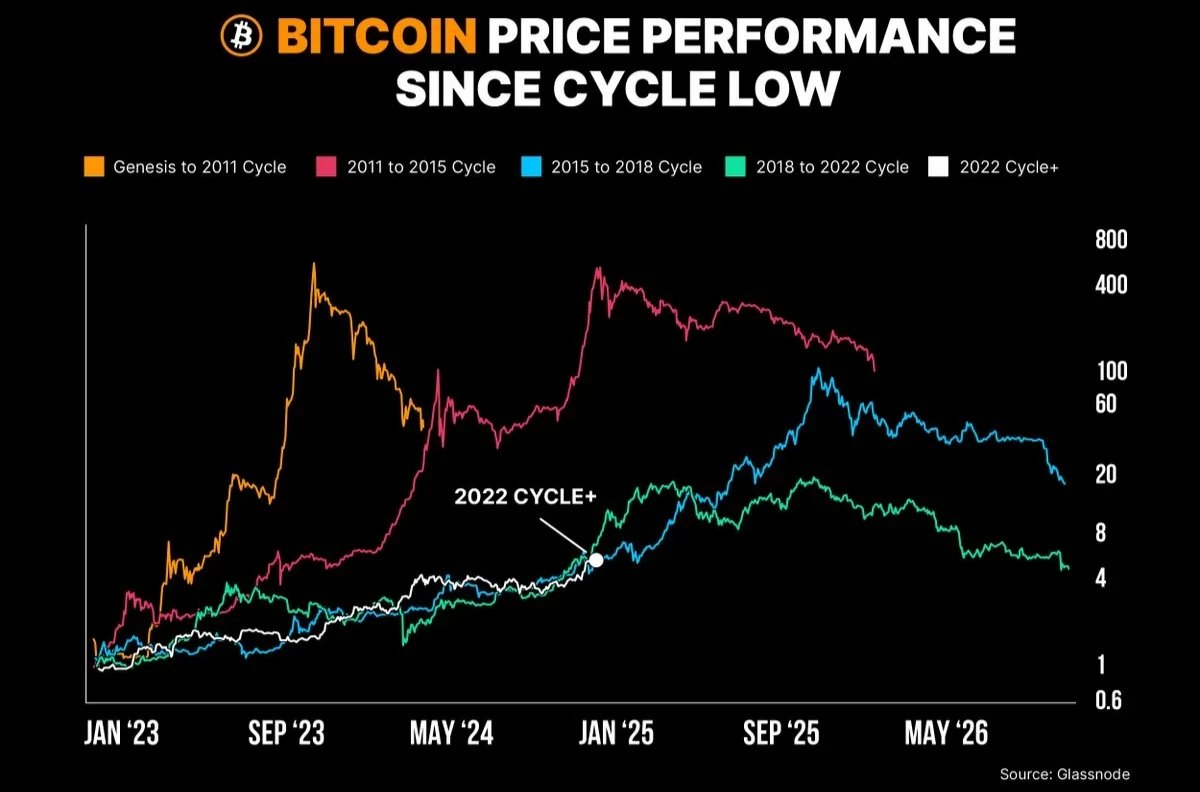

Furthermore, the current price trajectory of Bitcoin has surpassed the growth rate of the market cycle from 2015 to 2018. The current acceleration indicates that market momentum is stronger than in previous cycles, driven by institutional investment and supportive regulatory developments. While some investors may worry about missing out on opportunities, market analysts believe it is not too late to participate in this upward trend. The change in policy foundations and institutional involvement may support long-term growth, providing potential opportunities for new entrants.

Conclusion

The "Trump effect" on Bitcoin is not merely a speculative bubble but could represent a fundamental turning point for Bitcoin and the broader cryptocurrency market. The new government's policies may legitimize crypto assets at the highest levels of government and finance, paving the way for unprecedented growth and integration into the global financial system.

References:

https://coingeek.com/donald-trump-plans-and-support-for-the-crypto-industry/

https://www.panewslab.com/en/articledetails/z33bvmf4.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。