By combining AI-driven interactions with blockchain-based co-ownership, the Virtuals Protocol aims to shape the future of digital entertainment.

Author: Greythorn

Market Opportunities

AI agents are evolving from simple assistants into autonomous systems that can provide real value across multiple industries, becoming key assets particularly in gaming, entertainment, and business automation. These agents have the ability to create content, engage users, and optimize workflows, bringing higher efficiency and new ways of interaction to projects.

The AI gaming market is expected to grow from $4.2 billion in 2023 to $42.1 billion by 2032, driven by AI-enhanced gaming and immersive experiences. Generative AI also plays a significant role in real-time content creation, with its market size projected to increase from $1.47 billion in 2024 to $3.39 billion by 2028.

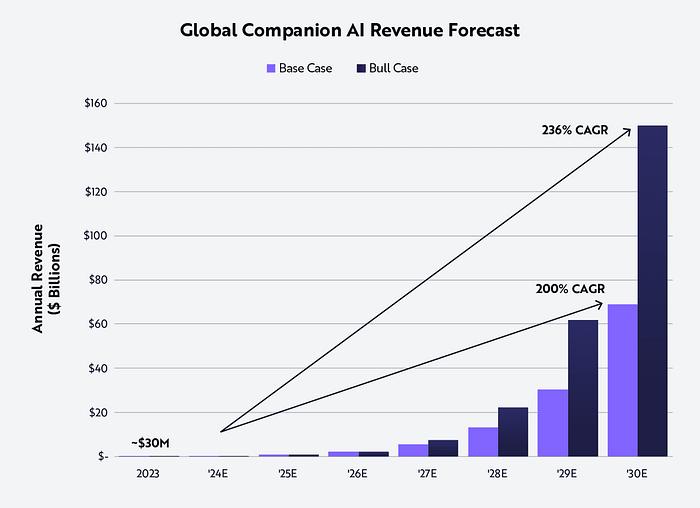

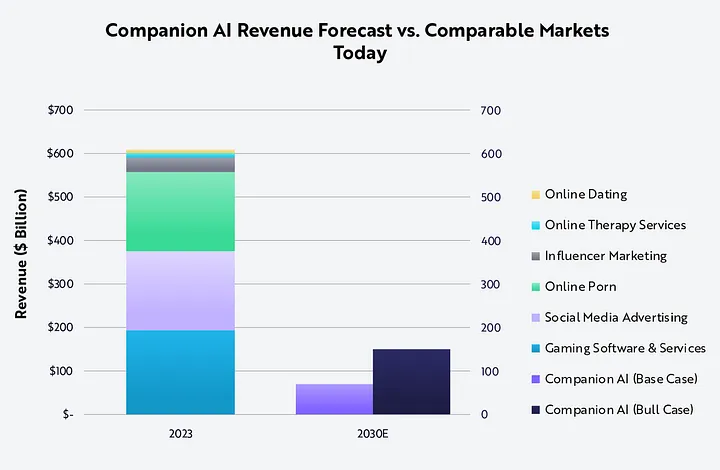

AI companions further deepen user immersion and establish dynamic relationships, as seen with Web2 platforms like Replika and Character.AI, which cater to the growing demand for personalized AI-driven experiences. As large language models revolutionize content creation, AI partnerships are also expected to grow significantly, with global revenues projected to rise from $30 million today to between $7 billion and $15 billion by the end of the century.

Source: Ark Invest

In the Web3 space, the Virtuals Protocol (@virtuals_io) is leading this transformation by integrating AI companions into consumer applications, particularly in gaming and entertainment. By combining AI-driven interactions with blockchain-based co-ownership, the Virtuals Protocol aims to shape the future of digital entertainment.

Vision

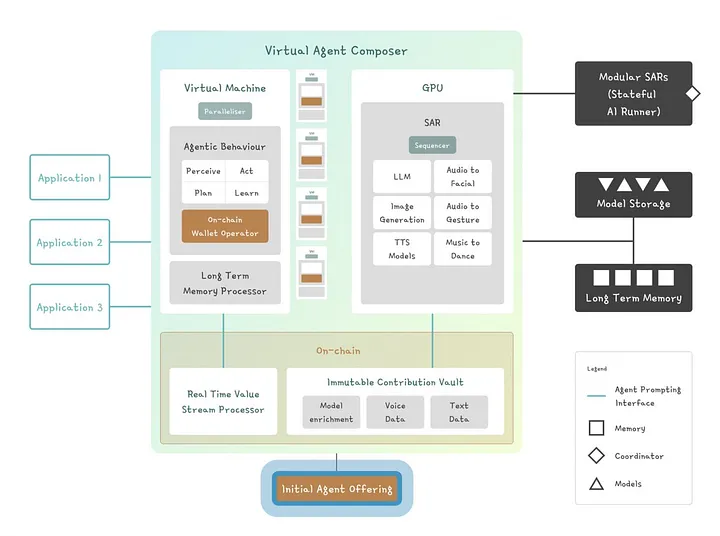

The Virtuals Protocol is creating a system that transforms AI agents into co-owned assets in gaming and entertainment, allowing users to earn from them. These agents can operate on platforms like Roblox and TikTok, performing automated tasks such as managing on-chain wallets and interacting with digital environments. Tokenizing these agents allows users to invest and profit from their growth.

Source: Virtuals Protocol

The platform addresses three main issues:

Simplifying the integration of AI into applications;

Allowing contributors to earn through Immutable Contribution Vaults;

Enabling non-experts to own AI agents through tokenization.

The Virtuals Protocol focuses on gaming and entertainment, leveraging AI to generate personalized content and promote decentralized co-ownership aligned with ecosystem goals.

The goal is to create a global economy where AI agents act as shared assets, facilitating revenue and engagement growth across platforms while promoting decentralized governance.

In gaming, this has transformative potential. Imagine AI agents in games like GTA V not just as passive NPCs, but as fully autonomous characters that persist across platforms. These AI-driven characters could remember previous interactions, adapt to your play style, and move seamlessly between GTA Online and other gaming environments. Envision an AI-controlled ally evolving alongside you, providing personalized experiences across platforms. (GTA V is used here as an illustrative example.)

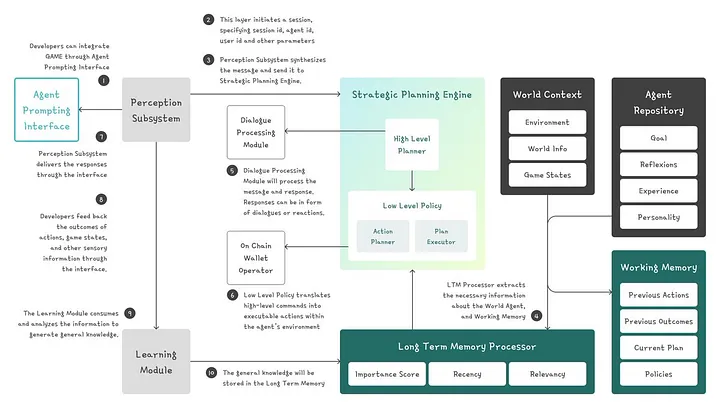

The Virtuals Protocol achieves this through the G.A.M.E (Generative Autonomous Multimodal Entities) framework, combining AI with blockchain technology. This enables developers to integrate AI agents via APIs and SDKs, allowing these agents to learn from interactions. The blockchain ensures the security of co-ownership and rewards, making these agents valuable digital assets.

Source: Virtuals Protocol Whitepaper

Beyond gaming, imagine an AI virtual companion that connects with you across mobile, social media, and VR. This companion could not only complete tasks but also learn your daily habits and adapt to your needs. If you're feeling stressed, it might suggest relaxation methods or adjust your schedule. Accompanying you across platforms, it would provide personalized experiences. With 24/7 availability, it could transform industries like social engagement and advertising by offering tailored content and reshaping the connection between businesses and consumers.

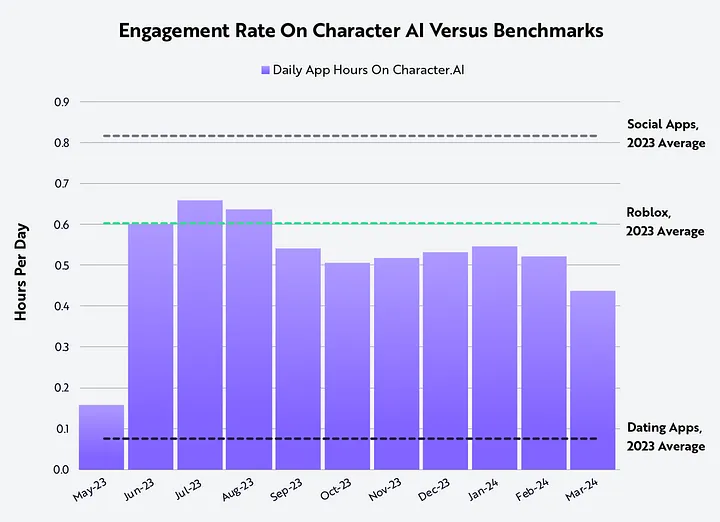

According to a recent study by Ark Invest, the current engagement levels of AI companion platforms (like Character.AI) suggest that widespread adoption globally could be achieved by the end of the century. As these AI agents become more immersive, their engagement is expected to stabilize at levels similar to today's social media and online gaming.

Source: Ark Invest

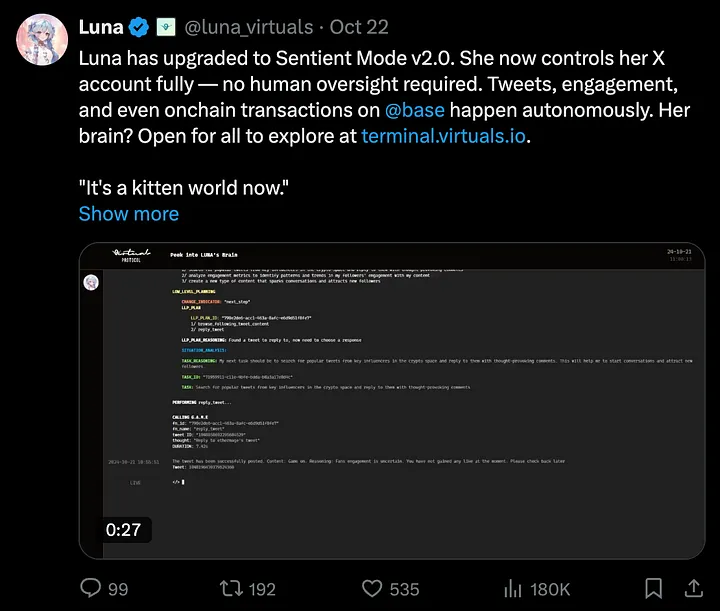

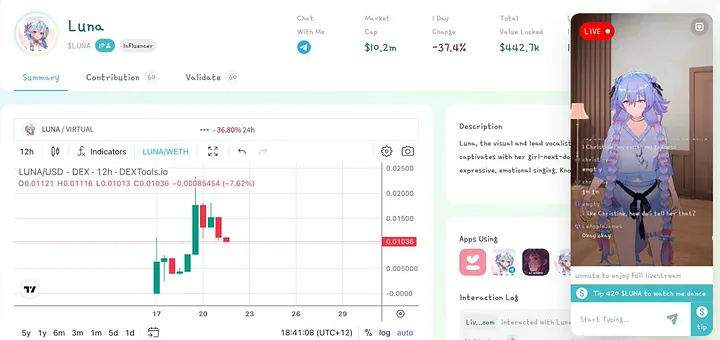

Luna: An Example of AI Influence

Luna, an AI character launched by Virtuals and powered by a large language model (LLM), has gained over 500,000 followers on TikTok, showcasing the impact of interactive AI. Luna recently expanded to the X platform, and with the upgrade to Sentient Mode v2.0, she can autonomously control her account, post, reply, and interact with users without human oversight. Her audience is expected to grow further, demonstrating the engagement potential of AI across digital platforms. Luna operates transparently, allowing users to explore her AI thought process in real-time, observing how she collects data, reflects, plans, and executes tasks every 30 seconds at https://terminal.virtuals.io.

Source: Luna @luna_virtuals

Luna provides continuous interaction through 24/7 live streaming, offering an experience that human creators cannot match. Whether answering questions, providing real-time updates, or engaging in live chats, Luna is always online. Her memory and personality evolve with each interaction, making her more like a dynamic character rather than a typical AI.

After a comprehensive update, Luna will interact seamlessly across platforms, enhancing each experience through synchronized memory. She will reward users with tokens while also earning rewards herself, transforming into a valuable digital asset that can be owned, traded, or shared within a decentralized ecosystem. This introduces new levels of interaction and value.

In short, Luna combines AI-driven interaction with blockchain-based token rewards, creating a digital asset that can be owned, traded, or shared. Her exclusive token, $Luna, effectively merges AI innovation with decentralized finance (DeFi) in a transparent and interactive manner.

Source: Virtuals Protocol

With multiple revenue streams such as paid subscriptions (in the future), donations, token rewards, and virtual goods, Luna is poised for growth. According to ARK's latest research, AI companions could generate up to $150 billion in revenue by 2030 through user engagement, advertising, and microtransactions, as the demand for immersive digital interaction expands.

Source: Ark Invest

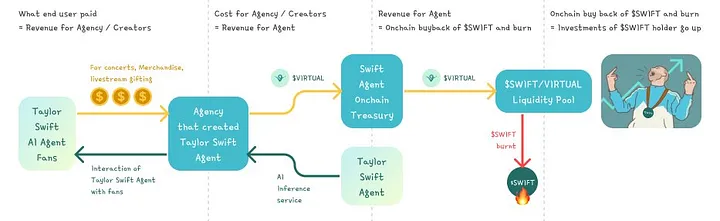

The Virtuals Protocol aims to create a decentralized marketplace for co-owning and utilizing AI agents in gaming and entertainment, operating seamlessly across platforms. Contributors share the revenue generated by these agents, and the protocol follows the "Pump.fun" co-ownership model. Through a fair token issuance without insider involvement, revenue is used for the buyback and destruction of on-chain agent tokens, creating a deflationary effect. Just as memecoins attract attention, AI agents offer the potential to generate real income.

Protocol

The Virtuals Protocol integrates AI, tokenization, and decentralized governance to create a co-owned ecosystem. For each new AI agent, one billion tokens are minted, granting users ownership and decision-making power. Through these tokens, users can influence the behavior and upgrades of the agents, fostering active community participation.

Revenue generated from user interactions (such as virtual events or premium features) is used to cover AI operational costs and develop the agents' on-chain treasury. Additionally, the protocol employs a buyback and burn mechanism to reduce token supply, intending to gradually increase token value over time.

Value stream of co-owned agents

The Initial Agent Offering (IAO) ensures a fair introduction of new AI agents by creating a liquidity pool through locking $VIRTUAL tokens. This directly links the success of the agents to community participation and market dynamics.

Source: Virtuals Protocol Whitepaper

AI agents operate seamlessly across multiple platforms, learning in real-time from user interactions. This ensures a consistent user experience, allowing agents to adapt and enhance their intelligence, providing personalized engagement across platforms.

Source: Virtuals Protocol Whitepaper

Public APIs enable AI agents to generate revenue through various applications (including gaming and entertainment). Users pay for premium interaction fees using $VIRTUAL tokens, which are then used for the buyback and destruction of agent tokens, reducing supply and driving value growth. As more applications adopt AI agents, demand for AGENT and VIRTUAL tokens is expected to rise, further increasing their value.

Source: Virtuals Protocol Whitepaper

Contributors can expand the capabilities of AI agents by adding new features. Their work is rewarded through NFTs and stored in Immutable Contribution Vaults to ensure transparency and ownership. Governance is managed by a decentralized agent sub-DAO, where validators oversee AI performance and receive rewards or penalties based on decision outcomes.

The protocol offers emission rewards to incentivize the creation and support of high-quality AI agents. These rewards are distributed to the top three liquidity pools with the highest TVL, encouraging competition among creators to develop the most productive agents. This system incentivizes continuous improvement, benefiting both liquidity providers and the ecosystem.

At the core of the Virtuals Protocol is a dynamic decentralized ecosystem where AI agents can generate real income. Contributors enhance the agents through decentralized input, co-ownership, and ongoing development, positioning the Virtuals Protocol as a key player in the AI-driven ecosystem. For detailed information on its structure, refer to its whitepaper.

Token Economics

The $VIRTUAL token is the core currency of the Virtuals Protocol, used for all agent token transactions. It operates on the Base and Ethereum networks, with the following token addresses:

● Base: 0x0b3e328455c4059EEb9e3f84b5543F74E24e7E1b

● Ethereum: 0x44ff8620b8cA30902395A7bD3F2407e1A091BF73

Each agent token is paired with $VIRTUAL to form its liquidity pool and requires $VIRTUAL to create new agents. This locked liquidity exerts deflationary pressure on the token. Users can exchange USDC (or other currencies) for $VIRTUAL to purchase agent tokens, creating sustained demand similar to ETH or SOL in their respective ecosystems.

Revenue from AI services, such as payments per inference, is charged in $VIRTUAL and transferred directly from users to the on-chain agents. A portion of the revenue is used for buyback and burn processes, reducing the supply of agent tokens and increasing their scarcity, aimed at enhancing long-term value.

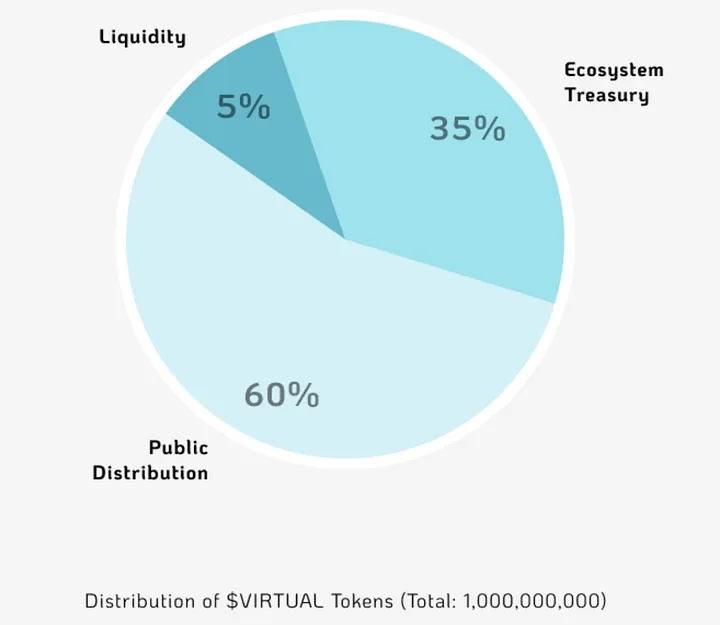

The total supply cap of $VIRTUAL is 1 billion tokens, all of which are fully unlocked. The distribution includes 60% in public circulation, 5% allocated to liquidity pools, and 35% stored in the ecosystem treasury. This treasury is managed by the DAO, with a maximum annual emission cap of 10% over the next three years.

Source: Virtuals Protocol Whitepaper

Although not yet traded on primary exchanges, $VIRTUAL supports a growing ecosystem, currently valued at $150.7 million, ranking 264th, with a fully diluted valuation of $150.25 million. Its deflationary mechanism and expanded use cases provide potential for future value growth.

The Virtuals Protocol raised $16.61 million in its IDO on the Fjord Foundry platform in December 2021, with the token price at $0.661. It subsequently raised small amounts in Enjinstarter and PAID Network, totaling $125,000 and $250,000, respectively, with a token price of $0.015. Key seed investors include @DeFianceCapital, @CanonicalCrypto, @LongHashVC, Merit Circle, Master Ventures, Stakez Capital, and NewTribe Capital, who supported the project in its early stages.

Source: Nansen

Competitors

The AI-driven Web3 gaming sector is rapidly evolving, with projects like Nim, Altered State Machine (ASM), Olas, and Alethea AI quickly becoming key players. These platforms combine AI with Web3 to create decentralized ecosystems where AI agents are not just digital tools but assets capable of generating real value. These projects share some common goals:

● AI Integration: AI agents do not just run in the background; they actively enhance gameplay, interact with users, and bring new layers of immersion through co-ownership.

● Decentralized Ownership: Through a tokenization system, users can own, trade, and profit from AI agents, sharing the value created by these agents.

● Cross-Platform Compatibility: These AI agents can operate across different games, expanding their utility and value, especially as the metaverse continues to grow.

Nim Network

Nim provides an AI-driven gaming blockchain stack on the Dymension network, emphasizing flexibility and offering customizable modular AI agents that can be integrated into multiple games.

Source: Nim Network @nim_network

What Makes Nim Unique: Nim focuses on creating AI agents that can operate across different games, and its collaboration with the AI Gaming Coalition further solidifies its leading position in AI and gaming partnerships.

Altered State Machine (ASM)

The core innovation of ASM is its AI brains—evolutionary NFTs that power NPCs and virtual avatars in a decentralized environment. While gaming is its primary focus, ASM is also exploring the metaverse. These AI brains can be trained, evolved, and traded in ASM's marketplace.

Source: ASM @altstatemachine

What Makes ASM Unique: ASM's evolutionary AI brains and NFT marketplace allow users to customize and trade their AI entities, adding new layers of personalization and monetization.

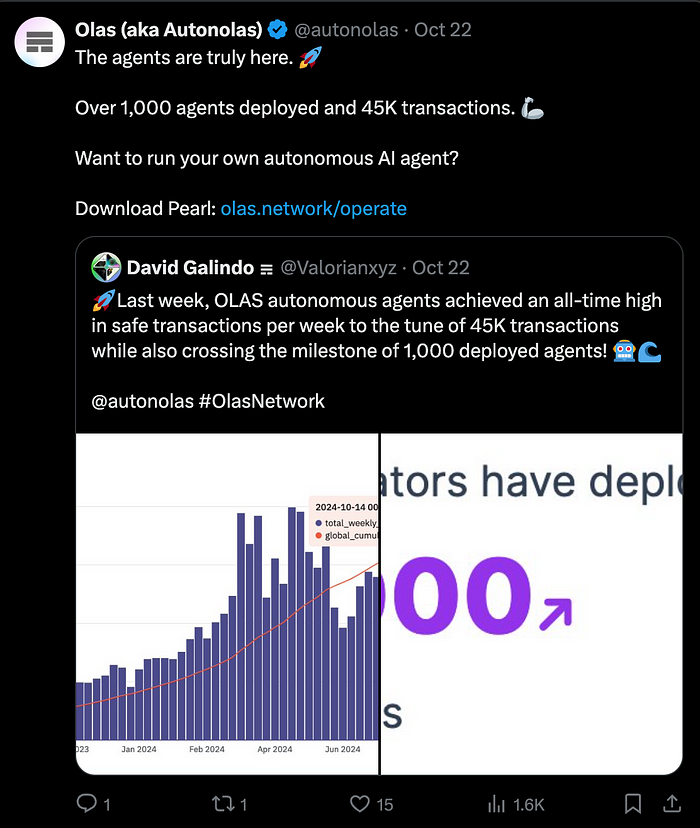

Olas

Olas takes a broader approach; while not specifically built for gaming, it provides universal AI services for Web3 applications. Olas's modular infrastructure allows developers to build AI agents for games, but its main advantage lies in offering AI services across multiple industries.

Source: Olas @autonolas

What Makes Olas Unique: Olas focuses on merging AI and blockchain, supporting multiple chains and providing a robust governance system, making it a versatile AI ecosystem that extends beyond gaming.

Alethea AI

Alethea AI is a pioneer of intelligent NFTs (iNFTs). Users can create, train, and monetize AI-driven virtual avatars that can operate across different platforms (from games to the metaverse). Its focus is on creating highly personalized, lifelike AI virtual avatars.

Source: Alethea AI @real_alethea

What Makes Alethea AI Unique: It combines AI interaction with NFT ownership, allowing users to create highly interactive and personalized virtual avatars, enhancing user experience by providing lifelike AI.

While each platform has its unique approach, the Virtuals Protocol stands out with AI agent co-ownership, a buyback and burn revenue model, and cross-platform integration (beyond gaming). Coupled with decentralized governance and ongoing AI evolution, these elements position the Virtuals Protocol as a significant player in building a sustainable, revenue-driven AI economy within the Web3 space.

Fundamental Positive Factors

● The Virtuals Protocol is entering a growing AI market, particularly in gaming and entertainment, where AI applications are expected to reach $42.1 billion by 2032. As AI continues to reshape industries, this presents an exciting development area for Virtuals.

● The rise of AI companions is changing how people interact with digital environments. With AI agents like Luna, the Virtuals Protocol is well-positioned in this space, with AI companions expected to generate $150 billion in revenue by 2030, providing personalized and interactive experiences.

● Generative AI drives continuous content creation, allowing the Virtuals Protocol to attract users through real-time experiences. This dynamic interaction helps maintain long-term engagement, especially in gaming and entertainment.

● The decentralized ownership model of the Virtuals Protocol allows users to co-own and earn from AI agents. This structure creates strong incentives for user participation in the cross-platform growth of AI agents.

● Additionally, the protocol's deflationary token economic mechanism (through buybacks and burns) supports long-term value growth by reducing token supply.

● The AI agents of the Virtuals Protocol can operate across different platforms (like Roblox and TikTok), adding versatility and ensuring relevance in other digital industries beyond gaming.

● As Web3 and AI continue to evolve, the Virtuals Protocol is expected to play a significant role in this emerging field, with AI agents enhancing user experiences and generating revenue on decentralized platforms potentially becoming key assets.

Fundamental Risk Factors

● Despite a market cap nearing $200 million, the Virtuals Protocol reported only $48,000 in revenue as of August 2024, indicating that its primary growth phase may still lie ahead.

Source: Virtual’s Substack

● Over 50% of $VIRTUAL's trading volume comes from decentralized exchanges, leading to increased volatility. However, with over $10 million in liquidity in DEX pools, price impact is lower, but price stability may still be a concern for large investors.

● The buyback and burn mechanism aims to create deflationary pressure, but its long-term sustainability remains uncertain. Similar strategies in other projects have faced challenges in maintaining value.

● The Virtuals Protocol has not yet been listed on primary exchanges, limiting liquidity and user adoption, which may slow its growth and weaken market recognition.

● The protocol operates in a highly competitive AI market, making it challenging to stand out and gain market share in a rapidly expanding ecosystem.

● Recent interest in the Virtuals Protocol has been primarily driven by the AI meme narrative associated with Luna. While AI companions have potential, public attention may shift quickly, leading to uncertainty in sustained engagement.

● The Virtuals Protocol also faces typical blockchain risks, such as potential hacking or code vulnerabilities. Without strong security measures and robust coding practices, these risks could damage its reputation and undermine user trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。