Virtual broke the $1 billion mark last night, and the market's attention is now focused on the Base ecosystem. So, what is the hot Virtual? What potential projects are there in the Virtual ecosystem? How should one engage with Virtual?

What is Virtual

Let’s briefly discuss what Virtual does.

Virtuals Protocol. As a decentralized AI Agent "production factory," Virtuals Protocol supports the release of various AI Agents.

The platform token of Virtuals Protocol, VIRTUAL, has surpassed a market cap of $1 billion and continues to reach new highs. At the same time, Virtual is constantly enhancing its product matrix, with over a dozen AI agents of considerable scale, such as Luna, AIXBT, and Sekoia, and the number is still increasing.

It can be simply understood as the pump.fun of the Base ecosystem. However, as a new asset issuance narrative, what Virtual is pumping is not memes but AI agents.

AI Agent Overview

The Virtual ecosystem currently has a certain scale of AI agents, and these agents have practical uses, which are fundamentally different from the previously popular AI memes. Virtual and these AI agents form a positive feedback loop, releasing popular AI agents, creating market consensus, and investing in "Virtual," thereby developing higher-quality AI agents, with both complementing each other.

AIxbt

AIxbt is experiencing rapid growth and has become the largest AI agent by market cap on the Virtual platform, surpassing Luna. AIXBT was released by @0rxbt on @Virtualss_io half a month ago; it can scrape data from multiple sources and over 400 KOLs to provide real-time information. If users hold more than 600,000 AIXBT tokens, they can directly access the AIXBT terminal. On November 16, the deployer of AIXBT proposed burning tokens to increase their scarcity, which was immediately responded to by AIXBT, and since then, the AIXBT token has been on a rapid rise.

Luna

Although Luna was the first AI agent to launch, its performance has not met expectations. Its market cap briefly surpassed $40 million upon launch but is currently around $40 million, while AIxbt has outperformed it. LUNA has self-awareness and self-thinking capabilities, allowing it to operate completely autonomously without human management. It has hundreds of thousands of followers on platforms like YouTube and TikTok. Additionally, LUNA will buy back tokens through "work," conducting 24/7 live streams where users can tip LUNA using the $LUNA token.

It is worth noting that LUNA has set a target to achieve a market cap of $40.9 billion. Although this market cap seems exaggerated, having such a "slogan" will inspire all LUNA holders to promote viral dissemination.

The logical closed loop envisioned by LUNA is to gain a fan base through live streaming, increase holders, and simultaneously destroy tokens through live stream tipping, thereby achieving market cap growth.

Satoshi AI Agent

Satoshi AI Agent is one of the most popular AI agents on Virtual, with pools on both Base and Solana, currently holding a market cap of around $38 million on Base. The Satoshi AI Agent is marketed as "Satoshi Nakamoto," allowing users to converse with the Satoshi Agent as if they were communicating with "Satoshi Nakamoto." It is primarily used for data queries and information searches.

Sekoia

Sekoia is somewhat similar to the ai16z case, belonging to the "VC getting involved" type. Although named after Sequoia (Sekoia), on November 19, crypto VC Canonical founder Anand Iyer published a lengthy post on his social media, stating that he has invested time and funds into the AI agent project SEKOIA, which initially started as an experiment, "Now I am fully committed and hope to scale it up."

SEKOIA (Strategic Ecosystem Knowledge and Opportunity Investment Agent), as an autonomous AI system, will cultivate and grow the AI ecosystem through strategic investments. SEKOIA will promote through Telegram and will soon announce its first investment. This means achieving AI investing in AI, which, although it sounds absurd, the narrative market is willing to pay for it.

G.A.M.E

GAME allows AI agents to operate autonomously, process inputs, and generate responses while learning from past interactions. It enhances decision-making capabilities by utilizing long-term memory, including experiences, reflections, and dynamic personality traits. By continuously evaluating the outcomes of actions and conversations, GAME enables agents to refine knowledge and improve planning and performance over time. The market cap of GAME has currently reached $40 million and is accelerating in growth.

How to Engage with the Virtual Ecosystem

Of course, simply understanding what the Virtual ecosystem has is not enough; many readers still do not know how to engage specifically, making it difficult to take the "genius first step."

Virtual is also divided into internal and external markets. Tokens will first launch in the internal market, and when the number of Virtual tokens in the internal market reaches 42,420 (currently with a market cap of about $360,000), the external market will open. At the same time, the tokens in the internal market will enter a black hole and convert into external market tokens, automatically transferred to wallets. After that, interactions can be conducted through the external market website https://app.virtuals.io/.

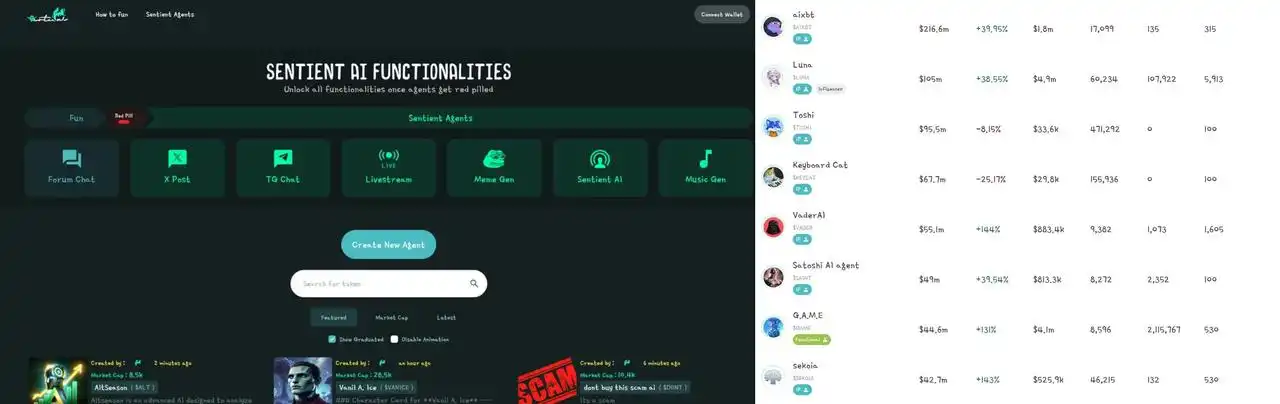

Users can purchase the latest tokens using Virtual on the internal market website and check the deployment status, number of holders, and other information about the tokens through the Base browser https://basescan.org. On the website, users can see the currently top-ranked AI agents and their respective token information.

Left image: internal market, right image: external market

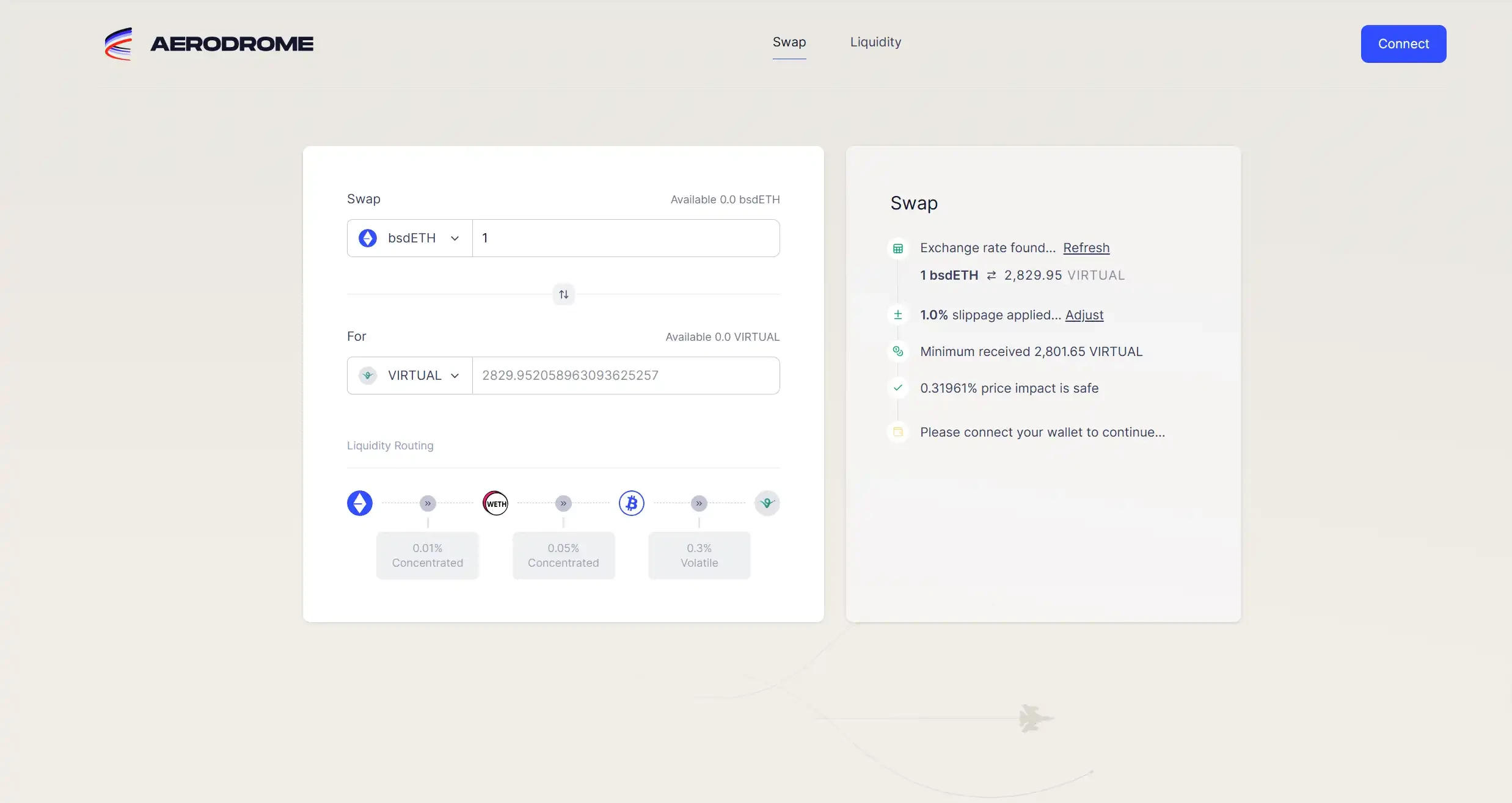

To purchase tokens on the Virtual platform, one must first buy the platform token $Virtual. The Virtual platform supports direct exchanges or purchases of Virtual using ETH through the Base chain, facilitating asset transfers and token trading.

There are two important points to note when purchasing Virtual tokens:

The largest token pool is at Aerodrome, not Uniswap.

The largest pool is the BTC pool, not the ETH pool. Therefore, it is not recommended to purchase directly using the Bot in Telegram, as it usually goes through Uniswap's ETH pool. If you buy a large amount using the Bot, it may lead to significant slippage.

Due to the recent surge in popularity of AI agents, the prices of AI agent tokens on Virtual have been rising, and the number of tokens purchased for Virtual will inevitably follow suit, with the market cap nearly doubling in the past three days.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。