The deep integration of both in asset issuance, circulation, payment, and ecological applications has brought unprecedented market imagination to the Bitcoin ecosystem.

Written by: Alex Liu, Foresight News

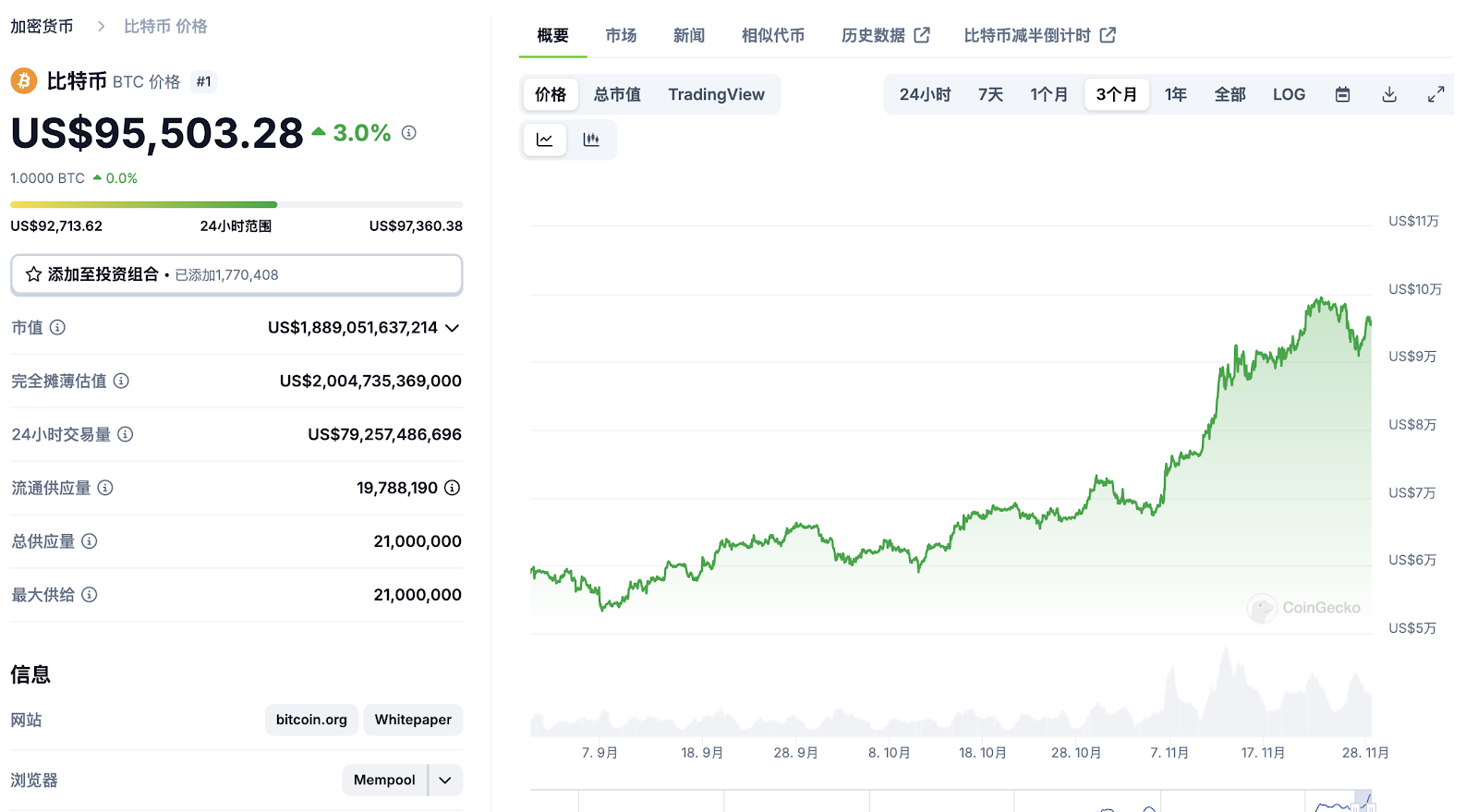

As the price of Bitcoin (BTC) broke through $90,000 and once approached $100,000 this year, market enthusiasm continues to soar. Bitcoin is no longer just synonymous with digital gold; it is becoming an important engine driving blockchain technology innovation and industrial ecosystem expansion. Against this backdrop, topics surrounding Bitcoin's scalability, asset issuance, and ecological construction have become industry hotspots. Among them, the CKB project and its RGB++ protocol, along with the upcoming Fiber network, play a key role in advancing the Bitcoin ecosystem (BTCFi) to a new stage. This article will explore how RGB++ and Fiber can unleash a new round of development dividends for BTCFi from multiple perspectives, including technology, market potential, and industry impact.

The "Overflow Effect" of the Bitcoin Ecosystem and the Rise of BTCFi

In the history of Bitcoin ecosystem expansion, asset issuance has always been a challenging proposition. The infrastructure of Bitcoin, due to its non-Turing complete design, inherently lacks support for smart contracts. This limitation has caused many innovative asset protocols to face bottlenecks in functionality. However, as Bitcoin prices continue to reach new highs, the market's demand for Bitcoin assets and Bitcoin finance has gradually emerged, forming a broad "overflow effect."

The Insight from the Inscription Boom and Asset Issuance Demand

At the beginning of 2023, the rise of Bitcoin inscriptions (Ordinals) demonstrated the strong market demand for on-chain asset issuance. The inscription protocol allows users to permanently record data on the Bitcoin blockchain, sparking a boom in art, NFTs, and some asset issuance. However, the inscription protocol can only store data and cannot meet the needs for more complex asset functionalities. For example, while the BRC20 protocol attempts to mimic Ethereum's ERC20, its tokens lack transfer and minting functions, making it difficult to adapt to mainstream asset issuance scenarios.

In contrast, the RGB++ protocol, with its design that combines Bitcoin's native properties and flexibility, has become a highly anticipated solution in the market. By introducing isomorphic binding and Leap bridge-less cross-chain technology, RGB++ endows Bitcoin assets with native cross-chain and flexible operational capabilities, laying the foundation for further development of the BTCFi ecosystem.

RGB++: Redefining Bitcoin Asset Issuance

The core innovation of RGB++ lies in its ability to break through the limitations of the traditional RGB protocol, not only addressing the pain points of Bitcoin asset programmability but also significantly enhancing the efficiency and liquidity of asset issuance.

Isomorphic Binding: The Convenience of Native Assets

The traditional RGB protocol uses off-chain verification, requiring users to run a client to operate assets, which can easily lead to data silo issues and limit the protocol's application in decentralized finance (DeFi). The isomorphic binding feature of RGB++ allows users to directly manage and operate assets using their Bitcoin accounts, simplifying the interaction process while ensuring data transparency and interoperability.

Leap Technology: A Breakthrough in Bridge-less Cross-Chain

Leap technology is another core feature of RGB++. By deeply integrating assets with the Bitcoin UTXO (Unspent Transaction Output) model, it achieves seamless flow of assets between the L1 Bitcoin main chain and the L2 CKB blockchain. This bridge-less cross-chain approach not only reduces the technical complexity of asset cross-chain transactions but also significantly lowers the associated transaction costs and risks.

The technical architecture of RGB++ provides a new paradigm for asset issuance and circulation in the Bitcoin ecosystem, and its flexibility and efficiency have been validated by the market, garnering attention and support from multiple core players in the Bitcoin space.

Fiber: Igniting the Spark for the BTCFi Market

The Fiber network is the next-generation public lightning network launched by the CKB team to meet the payment needs of the Bitcoin ecosystem, providing fast, low-cost, and decentralized multi-currency payments and peer-to-peer transactions for RGB++ assets. Expected to launch in mid-December, the Fiber network not only meets the high-speed payment demands of Bitcoin assets but also provides critical infrastructure for the deployment of decentralized applications.

High-Performance Payment Network

The Fiber network introduces more efficient off-chain channels, supporting multi-currency payments and peer-to-peer transactions, significantly enhancing the transaction throughput and cost efficiency of RGB++ assets. This feature provides strong support for DeFi applications and NFT (referred to as DOB in RGB++) transactions within the Bitcoin ecosystem, enabling RGB++ protocol assets to achieve rapid circulation on the Fiber network.

Decentralization and Scalability

Unlike traditional on-chain scaling solutions, the Fiber network adopts a decentralized architectural design, and its scalability can meet the growing transaction demands in the future. Additionally, Fiber is compatible with Bitcoin's lightning network, allowing RGB++ assets to integrate into Bitcoin's existing payment ecosystem, further expanding their application scenarios.

CKB's Advantages in the Global Competition

In the global competition of BTCFi, Eastern and Western solutions each have their strengths but also exhibit clear shortcomings:

- Eastern solutions like Runes and Ordinals innovate rapidly but lack sufficient supporting infrastructure and ecological completeness.

- Western solutions like RGB and Taproot, while starting earlier, have developed relatively slowly and lack effective market implementation.

In contrast, CKB demonstrates comprehensive competitive advantages in technology, ecology, and market implementation:

- Technological Leadership: The RGB++ protocol fills the gap in cross-chain asset issuance within the Bitcoin ecosystem through innovative technologies like Leap and isomorphic binding, giving it the potential to integrate the Bitcoin ecosystem.

- Ecological Completeness: The launch of the Fiber network provides solid infrastructure support for RGB++, while compliant stablecoin USDI, decentralized over-collateralized stablecoin RUSD, DEX UTXO Swap, and liquid staking management UTXO Stack further enrich the functional modules within the ecosystem.

- Market Recognition: The CKB project has long been deeply involved in the Bitcoin ecosystem, receiving investment from top global institutions including CMB International, Sequoia China, and Polychain Capital, as well as support from well-known miners like Bitmain and Broadeng, and mainstream mining pools such as F2Pool and Binance Pool have also supported CKB mining.

The Blue Ocean of BTCFi: Market Potential and Wealth Effect

The Positive Feedback Mechanism of the Bitcoin Ecosystem

The rapid rise in Bitcoin prices has brought a large influx of new users, who have higher demands for assets and services within the ecosystem. However, the capacity of the Bitcoin base network is limited, which has caused user transaction demands to begin overflowing to Layer 2 and related ecological projects. This overflow effect not only promotes the development of BTCFi projects but also provides a natural market flow for RGB++ and Fiber.

The Synergistic Effect of RGB++ and Fiber: The Engine Driving BTCFi Innovative Development

The combination of the RGB++ protocol and the Fiber network not only addresses technical challenges but also brings unprecedented market opportunities to BTCFi (Bitcoin Financial Ecosystem). The synergistic effect between the two permeates all aspects of asset issuance, circulation, payment, and ecological applications, injecting new vitality into the Bitcoin ecosystem. Let's discuss their synergistic value from multiple dimensions.

1 Enhancing Asset Circulation Efficiency: The Combination of Technology and Network

The RGB++ protocol introduces a new asset issuance model to the Bitcoin ecosystem, characterized by supporting flexible operations and cross-chain flow of native assets. However, protocol support alone is not enough; the circulation of assets in real transaction scenarios requires an efficient and secure payment network. The Fiber network precisely provides this critical link.

- High-Speed Peer-to-Peer Transaction Support

The Fiber network has virtually unlimited transaction throughput, capable of accommodating the large-scale circulation demands of RGB++ assets, especially in decentralized finance (DeFi) and NFT transaction scenarios. For example, a user issues an on-chain asset through RGB++ and can quickly pay or transfer on Fiber with extremely low fees, without waiting for long block confirmations on the Bitcoin main chain. Moreover, Fiber's high-speed, low-fee, and high-throughput characteristics can also align well with assets tokenized from traditional financial systems and RWA issued through RGB++.

- Seamless Cross-Chain Transaction Integration

The Leap technology of RGB++ endows assets with bridge-less cross-chain capabilities, while Fiber can seamlessly connect with channels including the Bitcoin lightning network and Cardano Hydra. CKB achieves low latency and high reliability in the asset transfer process from the Bitcoin main chain to L2 (such as CKB blockchain, lightning network, DOGE, etc.) through the deep integration of RGB++ and Fiber. This bridge-less cross-chain approach is particularly suitable for financial and payment scenarios, reducing the risks of asset cross-chain operations.

2 Supporting the Prosperous Development of Diverse Assets

The flexibility designed in RGB++ allows it to support various types of on-chain assets, including stablecoins, tokens, NFTs, and other innovative assets. The Fiber network provides solid underlying support for the payment and circulation of these assets.

- The Combination of Stablecoins and Payments

Based on the RGB++ Stable++ Protocol, a new over-collateralization model is provided, allowing users to mint the stablecoin RUSD using Bitcoin and CKB. Additionally, the Interstellar Payment Network (IPN) has announced plans to build a native payment network on the Bitcoin (BTC) mainnet using the RGB++ protocol and to launch the first programmable compliant stablecoin USDI to facilitate the large-scale application of BTCFi and the lightning network. USDI will be pegged 1:1 to the corresponding currency, supported by 100% reserves from high-credit, high-liquidity assets. The use of the IPN network will strictly comply with relevant regulatory requirements such as anti-money laundering (AML), counter-terrorism financing (CFT), and know your customer (KYC), making it more favorable for compliant institutions to enter BTCFi. USDI and RUSD will provide native stablecoin support for all UTXO-structured blockchain systems, including BTC, CKB, DOGE, and BCH.

The high-performance transaction capabilities of the Fiber network make stablecoins like USDI and RUSD a more attractive choice for payments within the Bitcoin ecosystem, not only reducing payment costs but also enhancing the circulation capacity of stablecoins within the BTCFi ecosystem.

- Expansion of NFT Market Potential

The current NFT market is primarily concentrated in ecosystems like Ethereum and Solana, while the combination of RGB++ and Fiber opens new possibilities for NFTs in the Bitcoin ecosystem. For example, the Fiber network can support the display and trading of RGB++ NFTs across multiple chains, allowing users to purchase NFTs with Bitcoin native assets and quickly synchronize transactions across various chains.

- Empowering Meme Assets

RGB++ supports the issuance of meme tokens within the Bitcoin ecosystem and enables low-cost dissemination and trading through the Fiber network. In a bull market driven by memes, this model is likely to attract a large influx of young retail investors. Currently, the meme launch platform CKB.Fi based on CKB and RGB++ has gone live, and it is reported that the Bitcoin "pump.fun" based on BTC and RGB++ will also be launched soon.

3 Enhancing Asset Privacy and Security

In traditional blockchain networks, transaction privacy has always been a focal point for users, and RGB++ and Fiber achieve complementary advantages in this area.

- RGB++ Client Verification Model

The RGB++ protocol also allows users to run their own clients to directly verify and manage their assets without trusting third-party nodes, thereby enhancing the security and privacy of assets from the source.

- Fiber's Decentralized Design

This ensures the censorship resistance and data security of the payment network, allowing users to enjoy both efficiency and privacy.

This enhancement of asset privacy and security not only increases the trust of institutions and high-net-worth individuals in BTCFi but also provides a foundation for the construction of more complex financial applications.

4 Amplifying Ecological Network Effects

The combination of RGB++ and Fiber brings higher network effects to the entire Bitcoin ecosystem. The two not only integrate deeply on a technical level but can also achieve synergistic amplification in ecological construction.

- Accelerating Ecological Development

The Fiber network will provide developers with a complete SDK and toolkit, making the development of lightning network applications based on RGB++ more convenient. Developers can quickly build decentralized applications (DApps), including lending, payment, insurance, and asset management platforms, further promoting the diversification of BTCFi.

- Win-Win for Node Service Providers and Users

The payment functionality of the Fiber network and the asset issuance capability of RGB++ create a positive interaction between node service providers and users. Node service providers can earn more fees by supporting the RGB++ and Fiber networks, while users enjoy more efficient transaction services.

- Importing On-Chain and Off-Chain Traffic

The Fiber network can also integrate off-chain traffic from outside the Bitcoin ecosystem, introducing more users and funds to BTCFi through cross-chain payments and asset transfers. For example, off-chain payment giants and traditional financial institutions can access Bitcoin asset payment scenarios through Fiber, broadening application boundaries.

5 Activating Positive Wealth Effects

The synergy between RGB++ and Fiber not only brings innovations at the technical and application levels but also injects a new round of imaginative space into the capital market. Driven by the Bitcoin bull market, the narratives surrounding RGB++ and Fiber have become important factors attracting investor attention.

- Asset Appreciation Expectations

The flexibility of RGB++ and the high performance of Fiber directly enhance the market recognition of assets. Once the Fiber network goes live and achieves large-scale application, RGB++ assets are expected to experience explosive price growth.

- User Growth and Ecological Prosperity

RGB++ and Fiber can attract more users to participate in the BTCFi ecosystem, and the growth of users not only increases the liquidity of assets but also creates higher network value for the Bitcoin ecosystem. This positive feedback loop will further drive the maximization of the synergistic value of RGB++ and Fiber.

First Batch of Supported Assets on Fiber Network: Driving BTCFi Towards Practicality

As an important extension of RGB++, the Fiber Network will initially support four types of RGB++ assets' liquidity networks and staking yield mechanisms, injecting new vitality into Bitcoin native financial services (BTCFi).

The first batch of supported assets on the Fiber Network includes:

- $CKB (Nervos Native Token): Provides foundational value and fuel for the Fiber network, connecting BTCFi and the Nervos ecosystem.

- $USDI (Compliant Stablecoin): Offers stable solutions for on-chain payments and decentralized finance through RGB++.

- $ccBTC (1:1 Bitcoin Reserve Supported Token): Utilizes the Fiber network to achieve decentralized liquidity lending, expanding the financial attributes of BTC.

- $Seal (RGB++ Leading Asset): With strong community support and protocol advantages, Seal has become an innovative representative in the Bitcoin meme economy and BTCFi scenarios.

Market Heat and Future Potential of Seal

As the leading RGB++ asset supported by Fiber, Seal has shown exceptional strength in the past week, with a seven-day increase of up to 430%. The driving factors behind this are not only the rapid development of the RGB++ ecosystem but also the market expectations surrounding the launch of the Fiber Network mainnet.

Liquid Staking Yields: Unlocking New Ways for Bitcoin Asset Appreciation

Additionally, to accelerate the large-scale adoption of the lightning network, the UTXO Stack in the CKB ecosystem will launch a decentralized liquid staking layer based on the lightning network. Users can earn additional yields in the Fiber network by holding and staking RGB++ assets (including $Seal, $USDI, etc.).

- Technical Highlights:

The UTXO Stack leverages the high throughput of the lightning network and the flexibility of the RGB++ protocol to support trustless asset staking and yield distribution.

The UTXO model ensures transparency and security in asset management.

- Scenario Value:

For users, holding assets is not only an investment tool but also allows participation in deeper financial activities within BTCFi through staking, creating continuous passive income.

Future Outlook: The Core Driving Force Behind the Rise of BTCFi

The synergistic effect of RGB++ and Fiber is not just a combination of technological innovations but also an important driving force for the maturation of the BTCFi ecosystem. The deep integration of the two in asset issuance, circulation, payment, and ecological applications brings unprecedented market imagination to the Bitcoin ecosystem, and through the first batch of supported assets and liquid staking yield mechanisms, it directly promotes the practical landing and application scenario expansion of BTCFi. With the launch of the Fiber network, this synergistic effect will become even more apparent and may become the core driving force behind the rise of BTCFi.

In this new golden track of BTCFi, RGB++ and Fiber have already positioned themselves at the forefront of the times, and the future is worth watching for all market participants.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。