As the infrastructure of PolyFlow, the seeds of PayFi have long been sown, waiting for the flowers to bloom, with a promising future ahead.

The recent State of Crypto Report 2024 released by A16z Crypto has clearly stated that stablecoins have become one of the most prominent "killer applications" in the Web3 space. Thanks to the widespread adoption of smartphones and the implementation of blockchain technology, stablecoins may become the greatest financial empowerment movement in human history.

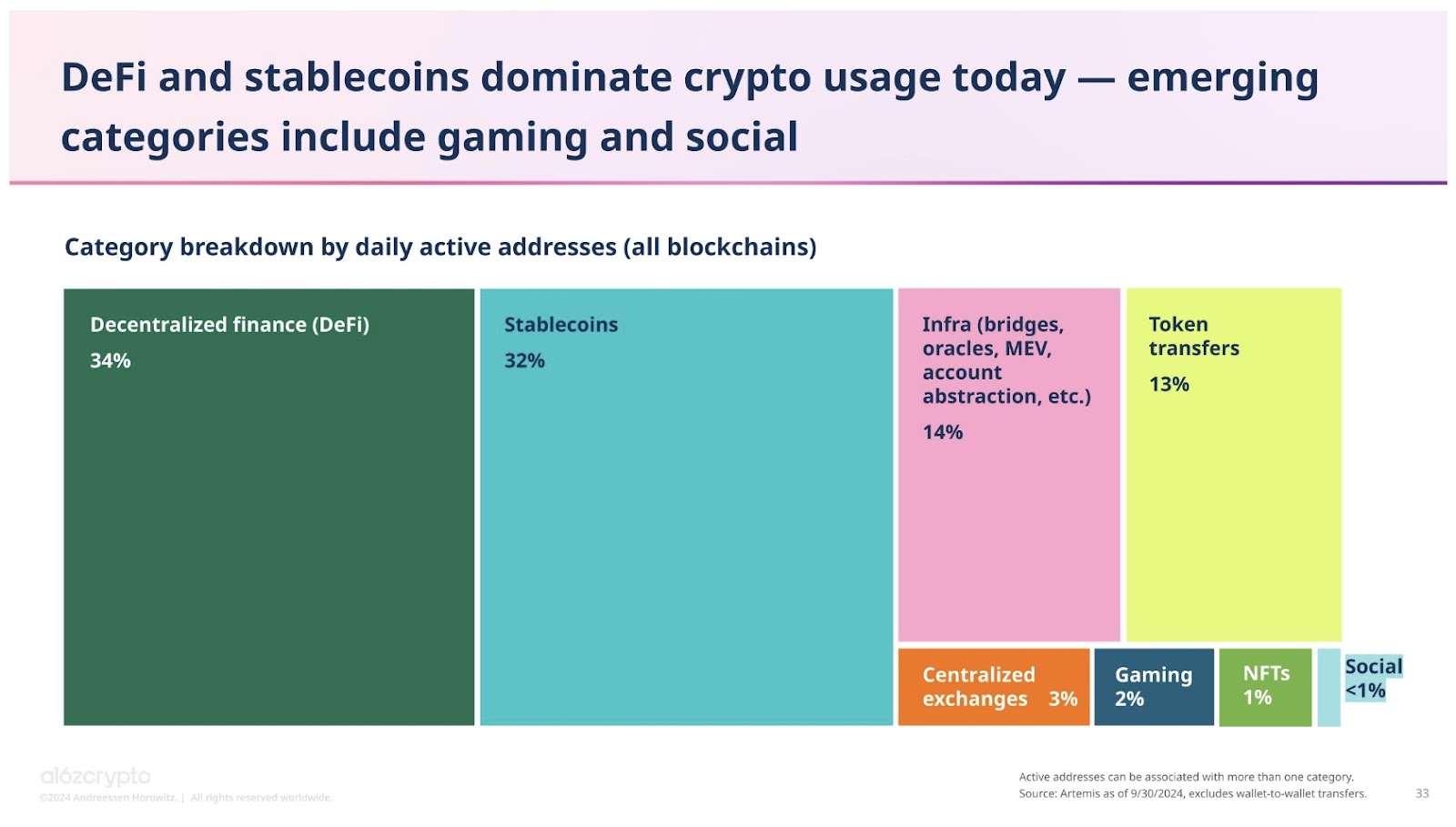

Stablecoins simplify value transfer, with quarterly transaction volumes already more than double Visa's $3.9 trillion, settling assets worth trillions of dollars annually, fully demonstrating their practicality. Additionally, measured by daily active addresses, stablecoins account for nearly one-third of daily cryptocurrency usage at 32%, second only to decentralized finance (DeFi) at 34%.

(State of Crypto Report 2024: New data on swing states, stablecoins, AI, builder energy, and more)

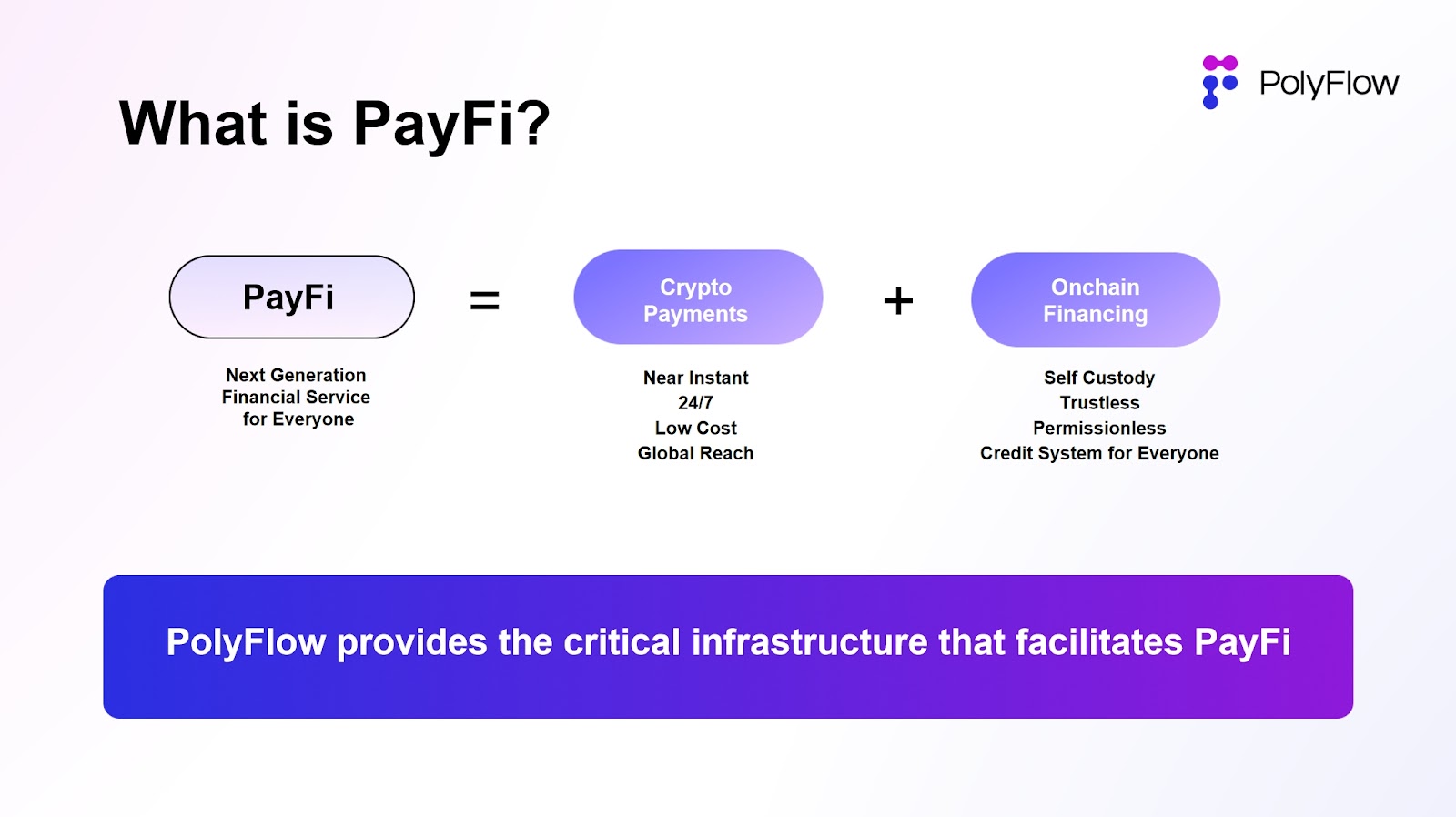

The recently emerging PayFi is also an innovative application that integrates Web3 payments with decentralized finance (DeFi).

As the infrastructure for PayFi, PolyFlow is integrating the transformative power brought by digital currencies and blockchain technology to create a new PayFi crypto payment network, helping accelerate the implementation of PayFi applications, promoting a shift towards innovative financial paradigms, and unlocking the true value of Web3. Ultimately, it aims to make the grand vision outlined in the Bitcoin white paper a reality.

1. What is PayFi

PayFi, or Payment Finance, refers to an innovative application model that combines payment functions with financial services based on blockchain and smart contract technology. The core of PayFi is to use blockchain as a settlement layer, leveraging the advantages of Web3 payments and decentralized finance (DeFi) to facilitate the efficient and free flow of value (Value Movement).

The goal of PayFi is to realize the vision of the Bitcoin white paper, constructing a peer-to-peer electronic cash payment network that does not require a trusted third party, while fully utilizing the advantages of DeFi to create a brand new financial market, including providing new financial experiences, building more complex financial products and application scenarios, and ultimately integrating a new value chain.

PayFi was first proposed by Lily Liu, the chair of the Solana Foundation, at the 2024 Hong Kong Web3 Carnival. In her view, PayFi is a new financial market built around the time value of money (TVM). These are often difficult or impossible to achieve in traditional finance.

In this new PayFi financial market, not only can Web3 payments achieve efficiency improvements over traditional finance—such as instant settlement, reduced costs, transparency, and global reach—but it can also realize decentralization, permissionless access, asset ownership, and personal sovereignty based on decentralized finance (DeFi).

(https://x.com/Polyflow_PayFi)

2. PolyFlow — PayFi Infrastructure

The original intention of PolyFlow is to build a decentralized infrastructure that helps more PayFi applications land and participate in the construction of a global payment network, alleviating regulatory compliance pressures and eliminating the risks of fund custody, while minimizing third-party involvement as much as possible.

The core concept of PolyFlow is to effectively separate the transaction information flow and capital flow previously controlled by centralized institutions through modular design, allowing various processes of transactions to better comply with regulatory standards, eliminate custody risks, and connect the DeFi ecosystem using the characteristics of blockchain, promoting the large-scale implementation of PayFi applications.

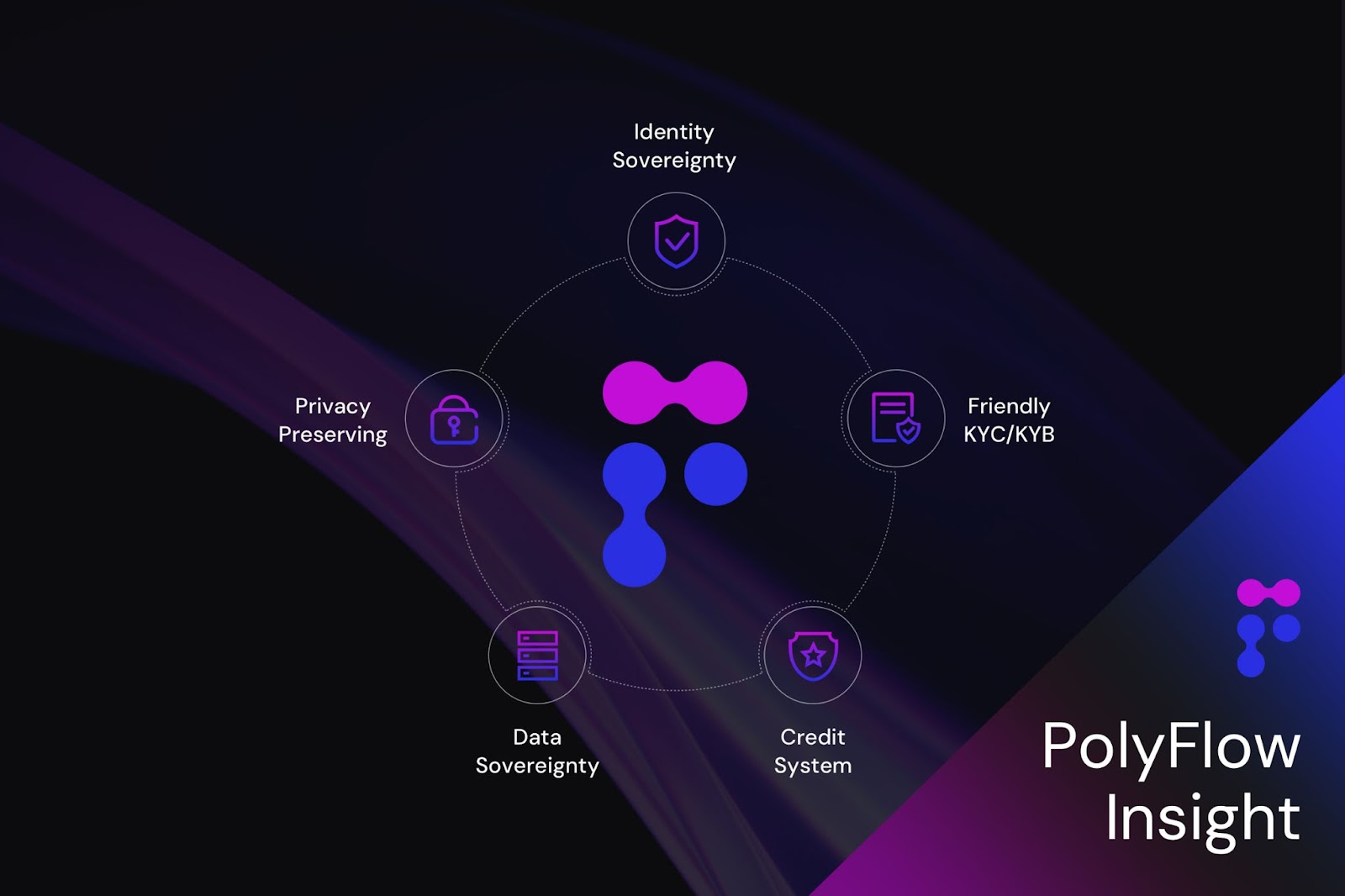

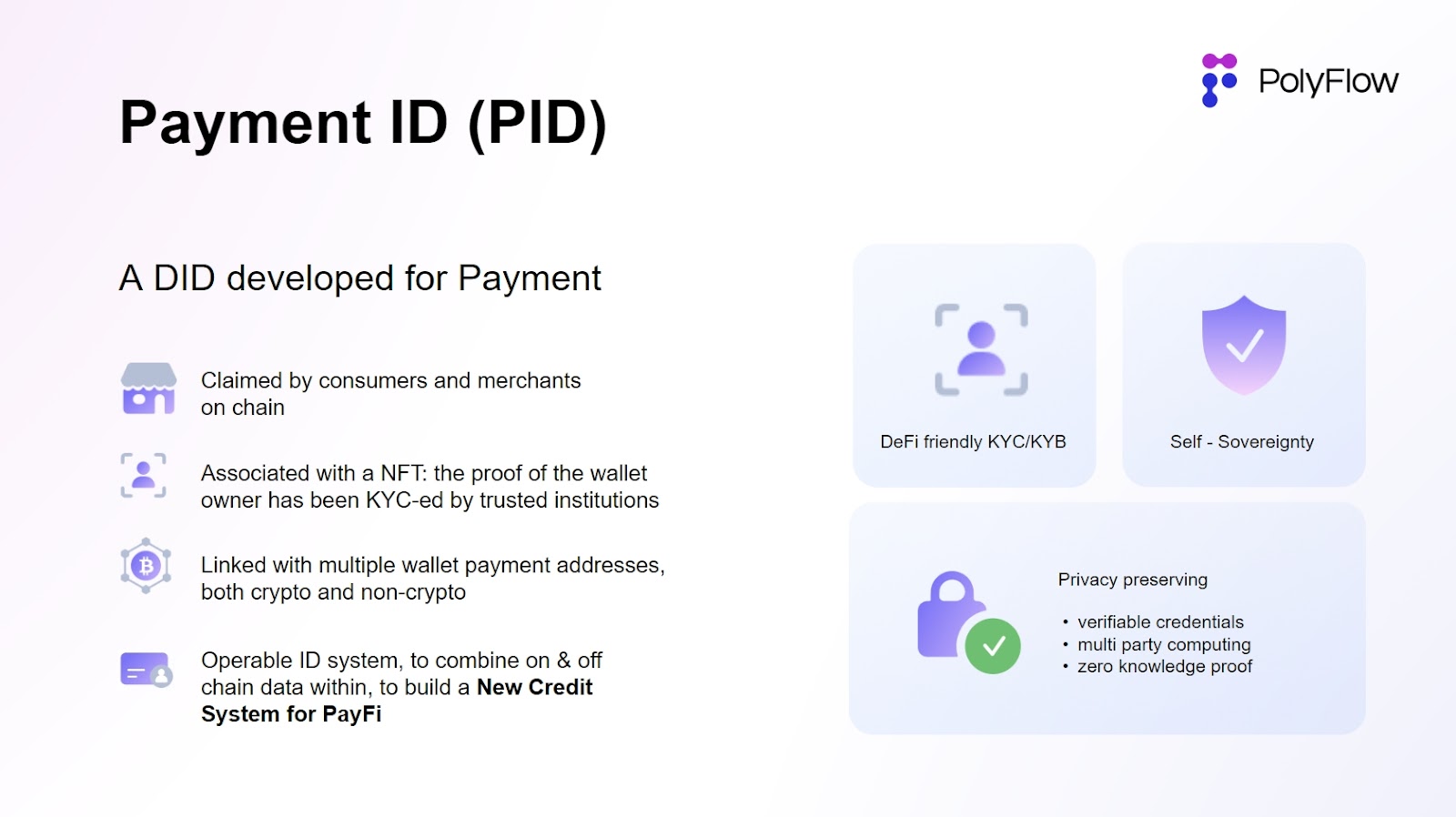

PolyFlow has launched two key components: Payment ID (PID) and Payment Liquidity Pool (PLP):

PID is associated with the information flow and serves as a powerful tool for user identity verification and compliance access, privacy protection and data sovereignty, AI data processing, and X to earn functionalities;

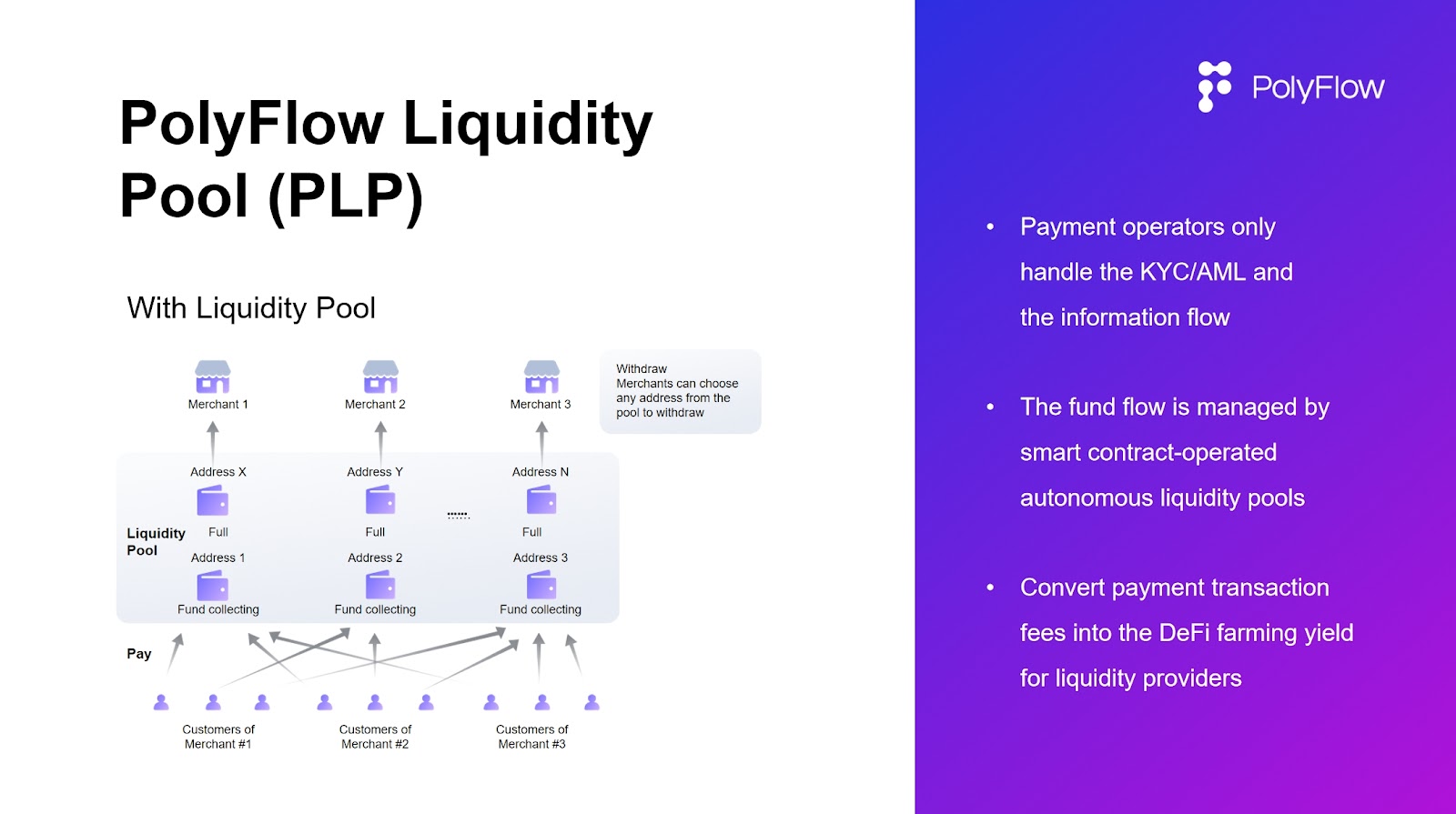

PLP is associated with the capital flow, managed by smart contracts for payment transactions, providing a secure and compliant framework for the circulation, custody, and issuance of digital assets, while also introducing the composability and scalability of the DeFi ecosystem.

Thus, PolyFlow builds a business architecture for PayFi applications that is lightly regulated, free from custody risks, and compatible with the DeFi ecosystem, along with a secure and compliant framework for the circulation, custody, and issuance of digital assets.

(https://x.com/Polyflow_PayFi)

It is important to understand that the Bitcoin and its blockchain network created by Satoshi Nakamoto represent a new solution to financial currency issues that emerged in the digital age, aiming not only to solve the age-old problem of how to allow value to flow across time and space but also to address the trust issues related to third parties in transactions. These are the goals that PolyFlow aims to achieve.

3. How PolyFlow Helps PayFi Applications Land

Currently, Web3 payments are still in a relatively early stage of basic services and primitive states, primarily using digital currencies as a medium for payment transactions, such as cross-border remittances, OTC, and Payment Cards. This centralized approach struggles to connect with the decentralized finance (DeFi) ecosystem, resulting in limited scenarios.

To fully integrate Web3 payments with decentralized finance (DeFi) and build innovative PayFi applications, we need a new infrastructure—PolyFlow—and its key modules, Payment ID (PID) and Payment Liquidity Pool (PLP).

PayFi applications can freely choose a universal blockchain settlement layer (Transaction Settlement Layer) and currency layer (Currency Layer) based on their application scenarios to meet their needs. For example, selecting the Solana high-performance blockchain to create a usage scenario for the PYUSD stablecoin based on the Paypal ecosystem.

On top of this, PayFi needs to address the most critical aspect of the technology stack—asset custody and compliance access.

3.1 Asset Custody

Asset custody is crucial in the financial sector (on-chain/off-chain). Especially for off-chain payment applications, fund custody generally requires obtaining a qualification license and meeting strict compliance requirements. For on-chain payment applications based on blockchain, considerations include ensuring the security of smart contracts, private key management, and compatibility with traditional finance and DeFi.

To address this, PolyFlow's Payment Liquidity Pool (PLP) uses smart contract addresses to receive funds for payment transactions, achieving on-chain custody of funds rather than relying on the traditional method of expensive enterprise wallets from centralized institutions.

(https://x.com/Polyflow_PayFi)

This more decentralized model of PLP can achieve:

Decentralized fund custody: Providing PayFi applications with a convenient, secure, and compliant custody method, minimizing the need for intermediaries while ensuring fund safety.

Liquidity pool: Gathering transaction funds through smart contract addresses, providing liquidity for financing needs in payment transactions.

DeFi compatibility: Centralized applications cannot be compatible with the decentralized DeFi ecosystem; the PLP built on blockchain can seamlessly connect with the DeFi ecosystem and bring DeFi's business logic to PayFi applications.

Risk-free RWA yield category: The yields generated by the protocol can be directly reflected in the PLP, providing a stable source of income based on real-world payment transaction scenarios for DeFi.

This PLP architecture can flexibly integrate with the DeFi ecosystem, ensuring that PayFi applications can adapt to the ever-changing digital asset landscape.

3.2 Compliance Access

It is well known that only by conducting user compliance access can the healthy development of the financial payment ecosystem and services be further promoted. The fundamental requirement at this level is to ensure that all transactions and capital flows comply with KYC/AML/CTF requirements while adapting to the laws and regulations of local jurisdictions.

To address this, PolyFlow has introduced Payment ID (PID), a DID that can be bound to encrypted user privacy-protected KYC/KYB proof information, linking users' verifiable credentials across multiple platforms, enabling:

Compliance Access: PID can contain multiple verification information across different platforms, helping partners simplify the verification process.

Privacy Protection: PID utilizes various technical means such as zero-knowledge proofs to help fulfill obligations like anti-money laundering/anti-terrorist financing (AML/CTF) without leaking user privacy. This is a prerequisite for users to participate in traditional finance/DeFi ecosystems.

Data Sovereignty: On one hand, PID can provide information about fund flows to regulators to meet compliance requirements; on the other hand, it can return on-chain behavioral data to users.

AI-Driven: In addition to KYC/KYB data, PID can also associate transaction data uploaded off-chain or collected on-chain. AI can help analyze rich daily transaction data to extract additional value for PID owners. This plays a crucial role in establishing an on-chain credit system.

The innovative introduction of PID provides transformative advantages for the industry, not only building a bridge between traditional finance and the DeFi ecosystem but also offering users a flexible and reliable way to manage digital identities, participate in cross-platform transactions, and build on-chain credit.

(https://x.com/Polyflow_PayFi)

4. PolyFlow's PayFi Application

Based on the aforementioned universal blockchain settlement layer and currency layer, as well as the asset custody and compliance access modules built by PolyFlow, real applications of PayFi can be implemented, achieving interconnectivity with decentralized finance (DeFi).

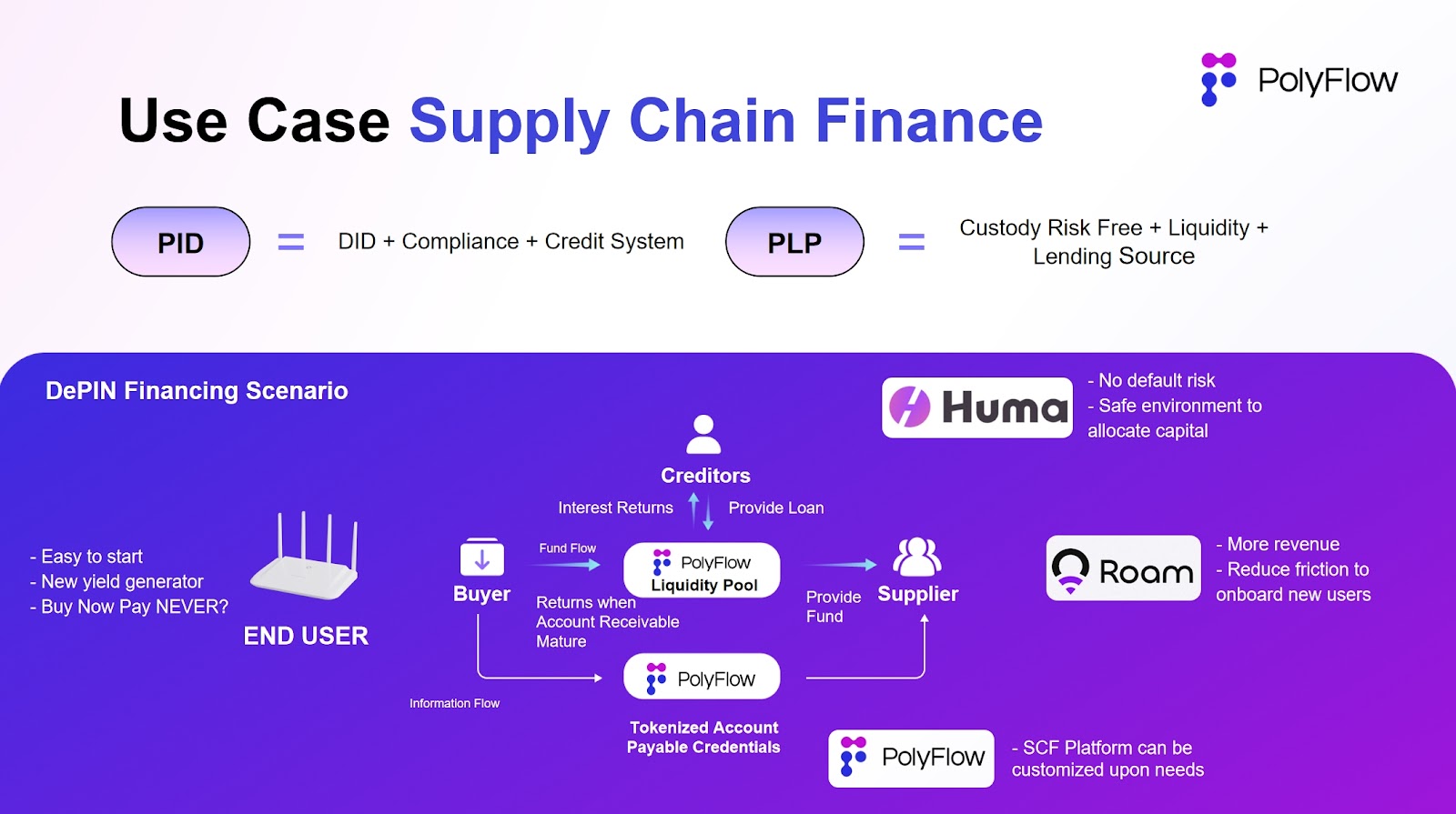

Recently, the DePIN project Roam partnered with the RWA platform Huma Finance to launch a DePIN hardware loan program, which will help Roam quickly deploy its basic hardware infrastructure and accelerate the development of a global decentralized Wi-Fi network.

PolyFlow provides key underlying support for the PayFi scenario of the DePIN hardware loan program.

(https://x.com/Polyflow_PayFi)

PID provides the credit foundation for loans, transmitting the credit of the entire Roam network to individual miner users (End Users), thus enabling small loans for single or multiple miner users. PLP serves as the carrier of loan funds, providing secure and compliant custody of funds, eliminating transaction intermediaries, and allowing all parties to eliminate the strong trust foundation that previously needed to be built based on the consensus ledger of the Solana blockchain.

Users can pledge future cash flows generated by Roam Growth products and use Roam Tokens or NFTs as collateral to quickly obtain loans for purchasing Roam's Wi-Fi hardware devices, participating in the construction of a global decentralized Wi-Fi network, and earning RoamPoints rewards.

This innovative PayFi model of "Buy Now Pay Never" built through PolyFlow creates a new financial application scenario (Micro Lending) for the DePIN industry, significantly accelerating the construction of the DePIN network and pushing the industry development into the next stage.

In addition, PolyFlow is actively collaborating with various traditional financial payment institutions, Web3 project parties, and other partners to explore more PayFi application scenarios, such as cross-border trade, Payment Cards, payment gateways, Wallet Settlement Networks, supply chain finance, DePIN, and more.

5. The Future of PayFi is Promising

The rapid rise of stablecoins over the past five years indicates that they have become a currency operating parallel to traditional financial infrastructure. At the same time, we have seen the construction of stablecoins in non-trading scenarios increasingly entering the lives of ordinary people.

The emergence of PayFi can further help stablecoins expand financial scenarios, making financial services accessible to global users and pushing Crypto towards true mass adoption.

As the infrastructure of PolyFlow, the seeds of PayFi have long been sown, waiting for the flowers to bloom, with a promising future ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。