Author: DMD, Crypto KOL

Compiled by: Felix, PANews

Since the rise of DeFi, it has become clear for participants in the crypto market that there is a need for a decentralized, censorship-resistant stablecoin. So far, MakerDAO's DAI has been in the lead, only temporarily surpassed by UST in market capitalization in 2022.

However, DAI's over-collateralization model is capital inefficient, and the fees generated by the MakerDAO protocol only benefit the DAO, not the stablecoin holders. Ethena Labs' USDe is an excellent product in many ways, especially considering that USDe investors can achieve substantial returns by productizing futures basis + financing trading through Ethena.

This article aims to analyze why Ethena's USDe is destined to surpass DAI as the leading decentralized stablecoin and to explore the current stablecoin landscape, the tokenomics of USDe, and the valuation and scenario analysis of ENA.

Current Stablecoin Landscape

There are many significant trends occurring in the stablecoin space:

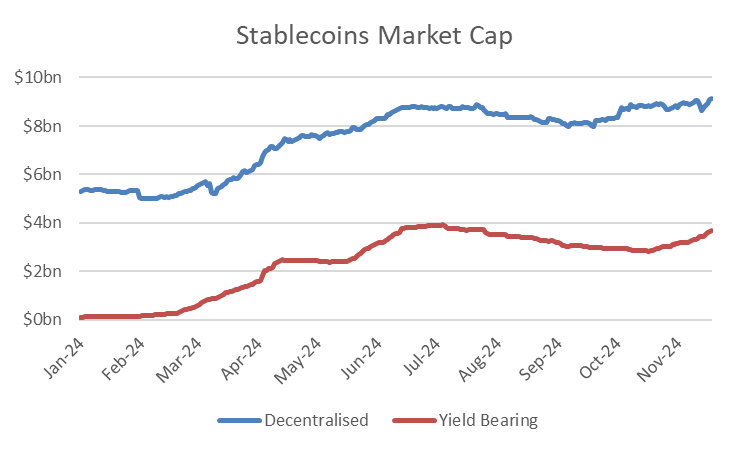

- The market share of decentralized stablecoins is increasing: from 4.1% at the beginning of the year to 5% in November.

- The market share of yield-bearing stablecoins is continuously expanding: from 0.1% at the beginning of the year to 2.1% in November.

- Although these changes may seem small, they represent significant growth, as the overall stablecoin market has grown by over 40% this year, reaching $183 billion.

Ethena's USDe is both a decentralized stablecoin and a yield-bearing stablecoin. USDe has grown from $85 million at the beginning of the year to $4 billion now.

It is not unreasonable to expect the stablecoin market cap to grow to $1 trillion by the end of the century, especially with the potential for Trump to win and stablecoin regulations expected to pass as soon as this year. Therefore, Ethena has enormous growth opportunities.

USDe Tokenomics

The tokenomics of USDe consists of two parts:

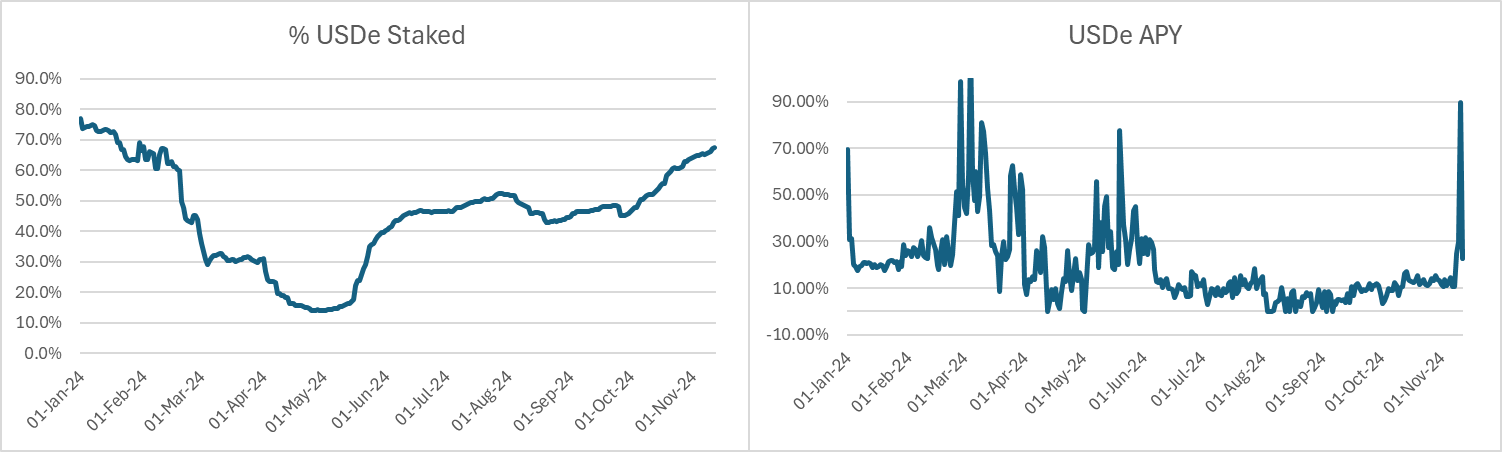

- Returns paid to USDe stakers: based on the total supply of USDe, the staking ratio, and the earnings generated by the Ethena protocol. Data shows that the average return for USDe stakers this year is 19.4%, with about 45% of USDe staked.

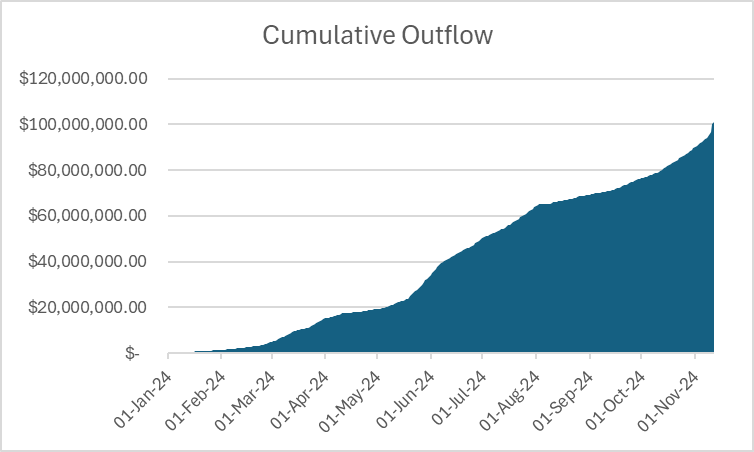

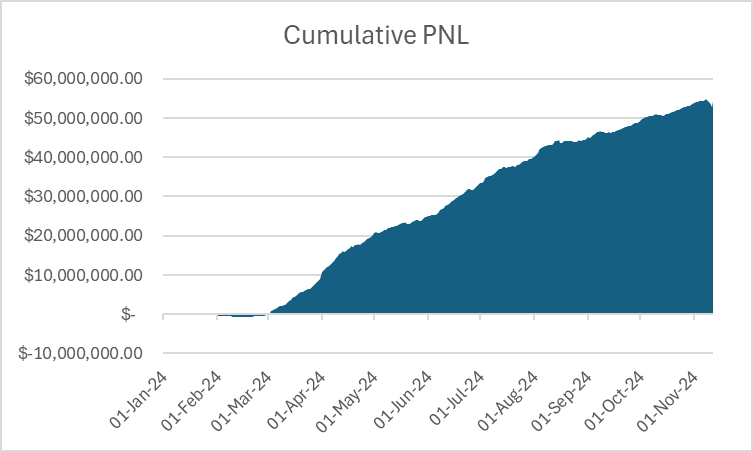

The following image shows that over $100 million has been paid out to USDe stakers:

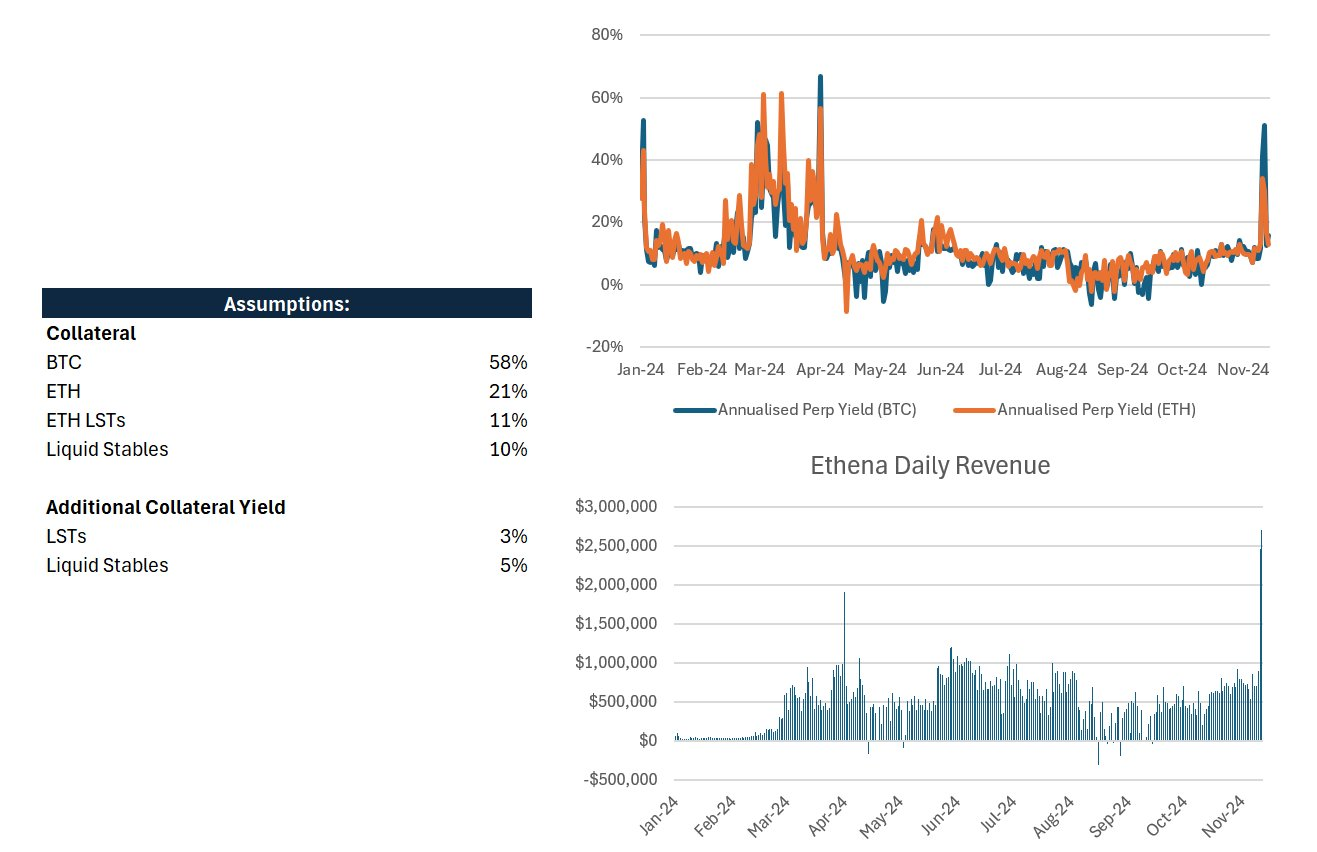

- Collateral returns: When users mint USDe, they deposit one of several other stablecoins. Ethena converts these stablecoins into one of several collateral types and then shorts these collaterals using futures. Thus, it maintains delta neutrality in the collateral while earning both basis and funding rates.

Assuming a specific collateral split (see below) and obtaining the returns from the collateral from Ethena's dashboard (https://app.ethena.fi/dashboards/hedging/BTC), we can derive the earnings generated by the protocol:

Combining these two points, we can derive the total profit and loss (PNL) of the Ethena protocol: the estimated annualized PNL is $62 million:

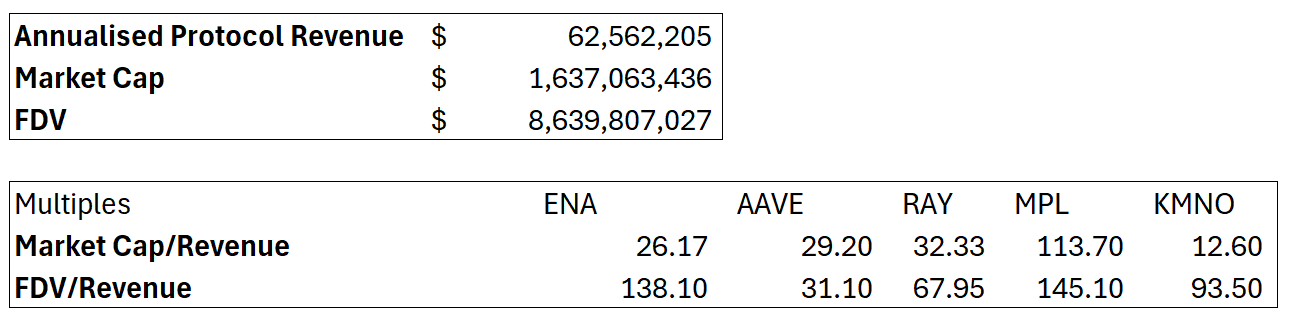

This results in an MC/revenue multiple of 26 for ENA, which is more attractive than some other leading DeFi projects (though not based on FDV, as token unlocks are a significant resistance for the project).

ENA Valuation: Scenario Analysis

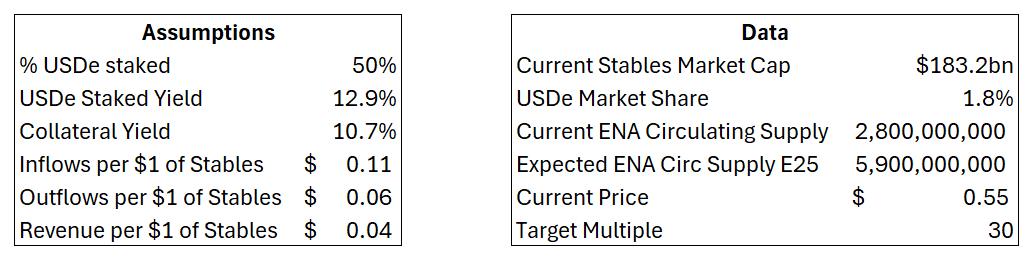

From the above, we can derive some assumptions that can be used to estimate ENA's valuation by the end of next year. These assumptions are crucial for the following analysis.

One point to note is that Ethena's business model relies on a certain proportion of USDe not being staked. This allows them to pay returns to USDe investors that exceed the returns they earn from the collateral while still maintaining an operating income margin of $0.04 per $1 USDe market cap.

Note: The collateral yield is based on the collateral split shown earlier and applied to the entire year. Therefore, actual numbers may vary slightly.

Ethena's growth is based on two numbers:

- The growth of the total market cap of stablecoins

- The market share of USDe

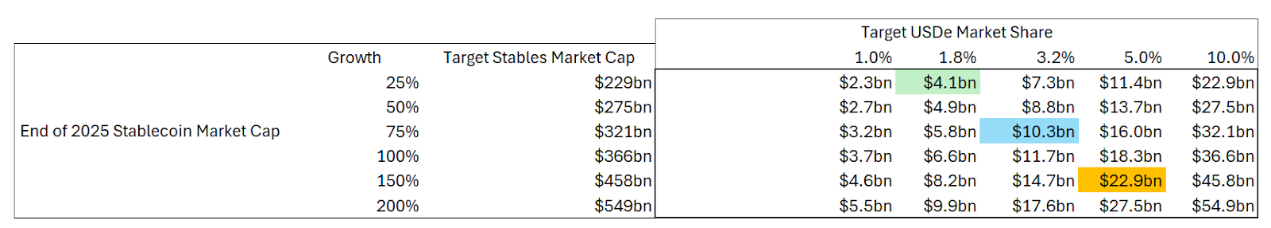

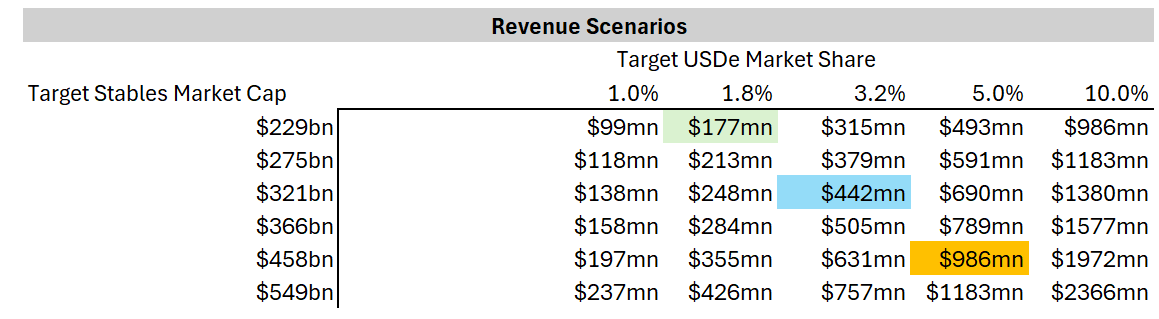

The base case is highlighted in blue: where USDe's market share doubles, and the stablecoin market grows by 75% next year. This estimate is considered quite conservative by the author, while the bullish case (in orange) is also very reasonable: USDe grows to a 5% market share, with total stablecoin growth of 150%, bringing USDe's market cap close to $23 billion. The green represents the bearish case, where USDe's market share does not grow, and the total stable market cap grows slightly by 25%.

Based on the above assumptions of a $0.04 income margin, ENA's revenue situation for next year is as follows:

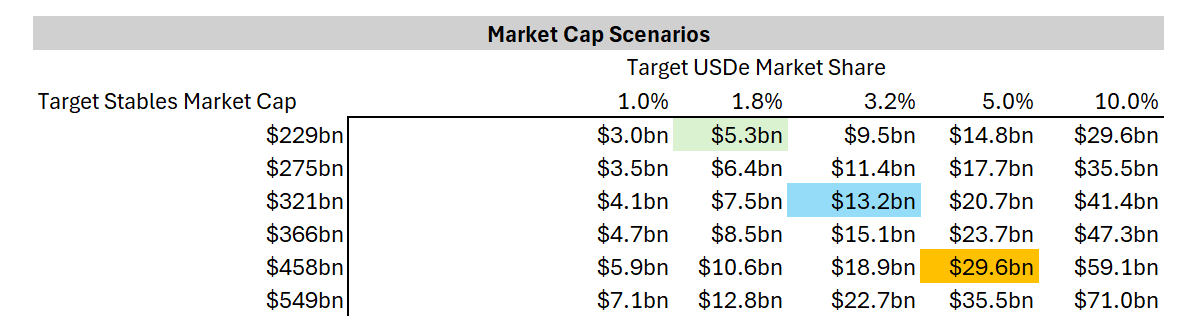

Using the assumed 30x revenue multiple, we can derive ENA's market cap in the table below. Note that the author expects 2025 to be a very strong year for crypto assets, with valuations exceeding fundamentals. A 30x multiple is only slightly above ENA's current 26x, so the potential upside in the following scenario analysis is much higher:

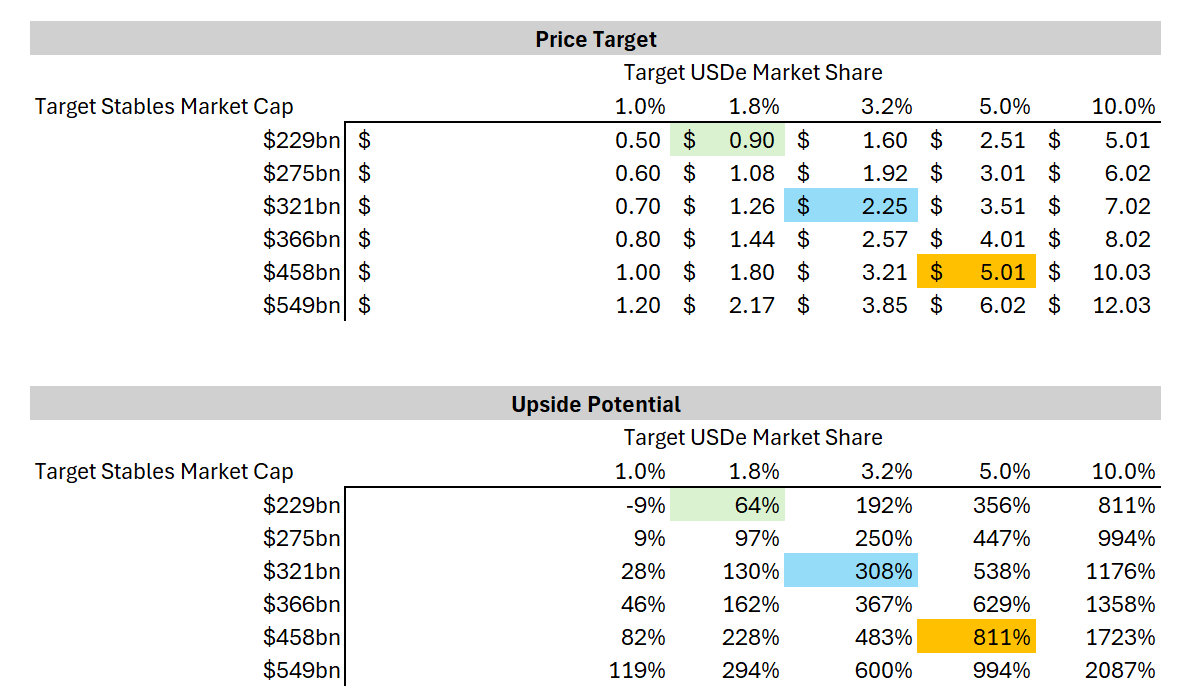

Finally, price targets and upside potential can be derived from the market cap table and ENA's expected circulating supply (which will nearly double by the end of 2025) (see the previous data table).

Conclusion

The author's basic prediction is that ENA's target price will be $2.25 by the end of next year, representing a 300% appreciation. The author's optimistic prediction is a target price of $5, which corresponds to over 800% returns. The author emphasizes that a 30x price multiple is conservative, and actual returns may be even higher.

Ethena is experiencing multiple catalysts, which gives the author confidence in the above scenarios:

USDe has been added as collateral for margin on Deribit:

https://x.com/DeribitExchange/status/1859905540912288192

USDe has been added as collateral for Aave, with sUSDe set to launch soon:

https://x.com/ethena_labs/status/1857232687326802306

A recent governance proposal, where Ethena Labs' protocol revenue will be used to benefit the protocol and ENA holders, with more details to be announced at the end of the month:

https://x.com/EthenaFndtn/status/1857470376655385070

Of course, ENA also faces some risks, namely protocol-related risks (smart contracts, funding gaps, liquidation risks), but the author believes the team has extensively considered these issues and will continue to take measures to address them. Finally, while token unlocks are certainly a concern, the author believes that the growth opportunities for Ethena outlined in this article far outweigh the selling pressure from token unlocks.

Looking forward to USDe surpassing DAI, once this happens, Ethena will continue to grow into one of the most important DeFi protocols in cryptocurrency, alongside Aave, Uniswap, Lido, and Raydium. Both USDe and ENA token holders can benefit from this growth.

Related reading: Business Analysis of Ethena: After an 80% Drop, Is ENA Worth Buying?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。