In November in Bangkok, the humid air is filled with intense anticipation. The crowd at the Devcon venue reflects the frenzy of Bitcoin's price breaking $90,000 at that time, while rumors about memecoins reaching a million circulate on social media.

Traffic here is stagnant, with ride-hailing apps showing red like veins; red also appears under the nearby overpass, where local children shake red transparent plastic cups towards passersby, mostly empty. On the other side of the night, the same red appears in the eyes of the hackathon developers: the high-pressure development in a short time leaves them exhausted yet excited.

At the BNBChain Bangkok hackathon venue, the air conditioning is ample, and the space is generous. The snack area quickly runs out of a certain flavor of Lay's Tom Yum chips, while Coca-Cola is the most popular drink. Within 24 hours, over 100 developers submitted 38 projects, with 8 teams getting the chance to showcase, half of which are from India, and 3 teams winning prizes to enter the next stage. Teams whisper in the audience, some shake hands and say they'll come again next time. The low-key and quiet competition feels like a small tide, as if gathering strength.

In the past three years, BNBChain has held over 20 hackathons, covering tens of thousands of developers from more than 35 countries, with over 1,000 projects submitted and a total prize pool of about $50 million.

"The Silent Three Years"

There was once a voice in the community saying, "No one is playing with BNBChain anymore." It wasn't until recently that the launch of Thena (THE) and various memecoins on Binance sparked some attention.

During the "silent" period of the past three years, BNBChain appeared calm on the surface, but the data reveals another dimension.

According to DeFilama data from November 2024, BNBChain still ranks second after Ethereum, with stablecoins currently ranking third in market capitalization, and a TVL (Total Value Locked) of over $8 billion, placing it fourth. Its weekly trading volume accounts for one-sixth of the entire on-chain world.

BNBChain currently offers 218 types of developer tools, with over 800 active applications, excelling in DeFi, gaming, and AI sectors.

Launched in 2021, the MVB (Most Valuable Builder) program is a crucial part of BNBChain's support for early projects. According to publicly disclosed information, out of the 131 projects incubated in the past seven MVB sessions, 75 projects have attracted attention from top investment institutions including Binance Labs, Coinbase Ventures, Delphi Capital, and ZhenFund. Binance Labs has invested in 39 of these projects. According to incomplete statistics, over 60 projects have completed their TGE, with more than 60% listed on top centralized exchanges, including Galaxy, Mobox, SpaceID, SleeplessAI, and Altlayer, which launched on Binance LaunchPool.

Given the high elimination rate in the Web3 industry, the survival rate of these early projects supported by BNBChain is remarkable. However, this data often goes unnoticed by the outside world.

While users have recently embraced the meme culture wave on Solana, the BNBChain community, like many other public chains, feels envious of this explosive user growth and attention.

From an objective data perspective, the number of memecoins launched on BNBChain still differs significantly from Solana. Currently, there are long-lived meme projects like 1MBABYDOGE, SimonCat (CAT), WHY, and CHEEMS that have launched on Binance contracts or spot markets. With the completion of infrastructure like the Four.meme launch platform and long-term community support, there is hope to see a more vibrant "Meme Season" on BNB Chain.

"Turning Towards the Sea"

If Ethereum resembles a group of idealistic geniuses and Solana is a pioneer adept at capturing attention, then BNBChain is more like a silent craftsman working diligently.

The important role Binance plays in this ecosystem is undeniable. However, the BNBChain community lacks star figures and dazzling technical geniuses; instead, it consists of a group of individuals with smaller egos, focused and pragmatic. Their constant contemplation is: Should we follow the short-term tide? What are the truly valuable things in the long term?

Meme represents public opinion, carries the community's emotions, and is also the direction supported by BNB Chain, but the industry cannot be solely about memes. Through countless discussions within the community and teams, BNBChain has gradually formed a clear positioning: Web3 needs to move towards broader and more practically meaningful application scenarios.

From both time and space dimensions, BNBChain has patiently laid out a comprehensive support system for developers and users.

In terms of time, it has initially hosted hackathons to discover and support potential developers and projects; the BIA (Incubation Alliance) supports projects in capital connections, followed by several weeks of resource investment and support through the MVB incubation academy. In the mid-term, it incentivizes user activity (DAU), total locked value (TVL), and trading volume after project deployment, while also providing technical and market support. In the later stage, it connects resources across the entire ecosystem, including but not limited to investment and listing resources, as well as the subsequent development of projects.

This timeline advancement model often starts with a 1-2 year companionship.

In terms of horizontal spatial dimensions, the multi-chain ecosystem centered around BNB includes: the smart chain BSC, the high-performance layer two opBNB, and the storage chain Greenfield, providing developers and users with a complete "oneBNB" multi-dimensional infrastructure system.

The sea is right there. The ship has been built, but where are the caravans and the flow of people going?

"The Direction of the Tide: AI+"

In the ebb and flow of cryptocurrency, building a solid ecosystem in its own way.

According to DappBay, in the past 30 days, 5 out of the top 10 projects by active addresses on BNB Chain are AI-related infrastructures and tools, with 3 being gaming projects.

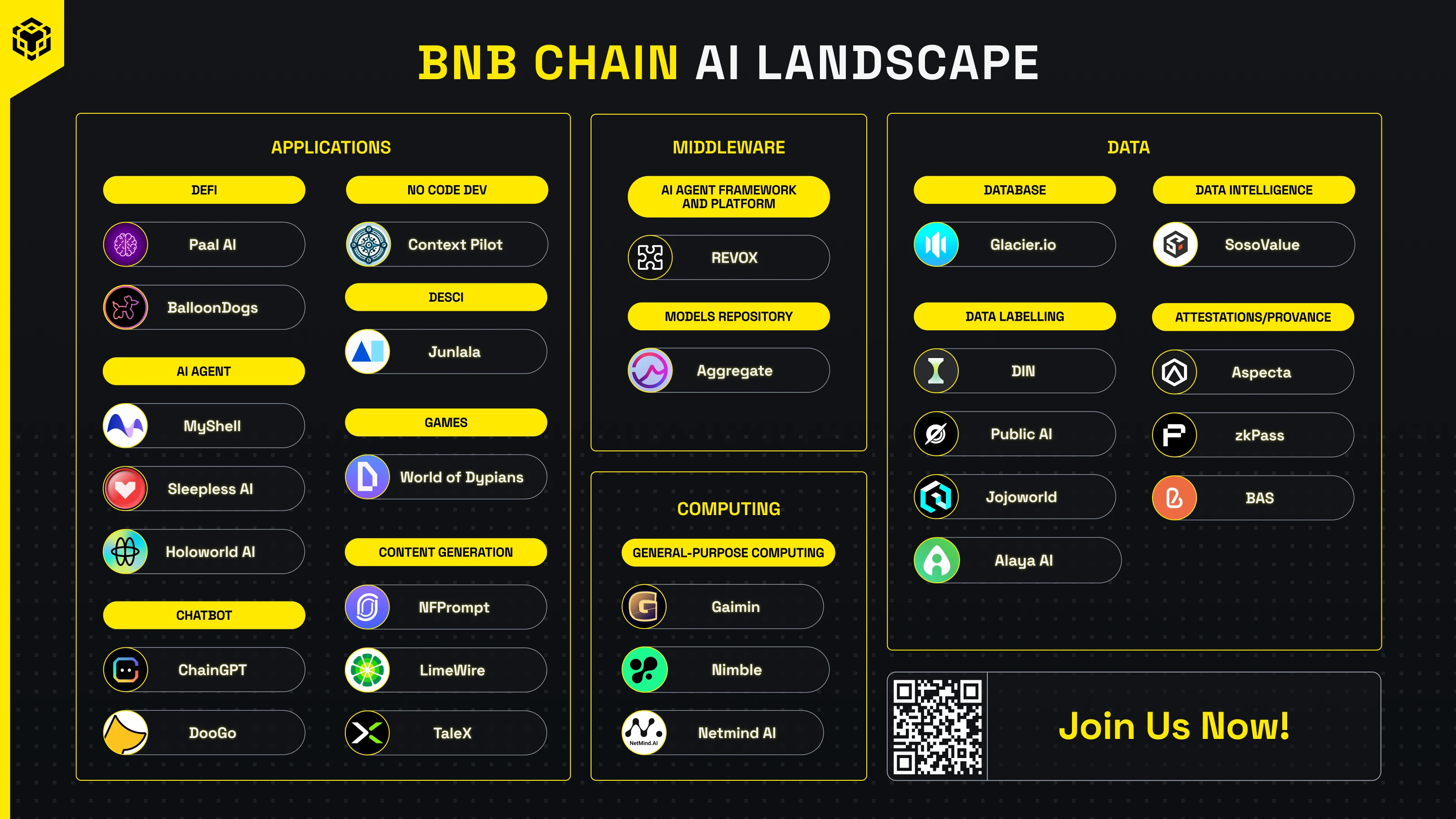

Currently, there are over 30 active projects related to the AI ecosystem deployed on BNBChain, such as AI Agent types: My Shell, HoloWorld AI, Sleepless AI; content creation applications like NFPromt; middleware REVOX, Aggregata. With the support of the Greenfield storage chain, the proportion of data-related projects is high, such as data labeling projects (Data Labelling) like DIN, Alaya AI, JoloWorld, etc. According to DappRadar data from November 20, DIN ranks first among all AI applications with nearly 700,000 weekly active addresses.

This trend is not hard to understand; BNBChain has its own layer two high-speed opBNB and data storage chain Greenfield infrastructure, providing an efficient, secure, and private data storage platform, which is the core foundation for deploying decentralized AI applications.

The BNB community's supportive attitude towards AI can be described as "clear-cut," as most of the projects mentioned above were incubated through MVB, with Binance Labs investing in 7 of them. Support began even earlier than MVB and investment stages—such as StoryChain, a project that emerged from last year's BNBChain hackathon, which made it into the MVB eighth session's selection list, with the mainnet set to launch next year.

The initial intention behind laying out the storage chain may stem from optimism about decentralized social (DeSoc). Interestingly, the infrastructure of BNB Chain's data storage chain combined with the NFTization of intellectual property, along with the flourishing development of the AI+Data ecosystem, perfectly aligns BNBChain with the recently rising wave of decentralized science (DeSci).

DeSci typically requires strong data storage capabilities and rapid access support, and this data is often sensitive and private. The existing ecosystem of BNBChain can help researchers share data more safely and effectively, provide lower-cost data computing resources, and ensure fair distribution of scientific results through smart contracts.

This positions BNB Chain as a potential nurturing ground for the DeSci wave, aiding in more transformative scientific progress for humanity.

"Pragmatic and Diverse Ocean Vision"

In addition to the strong data-related AI field, BNBChain's ecosystem is currently also making strides in DeFi, GameFi, and stablecoin payment sectors.

In the BTCFi sector, projects like Solv Protocol, Avalon Labs, Lorenzo, Lombard, and Kinza rank at the forefront in terms of TVL. Among them, Solv, Lorenzo (formerly MEP), and Kinza are all projects incubated through the MVB program and have received investment from Binance Labs. Avalon, on the other hand, is a new member of MVB's eighth session, and according to Messari's Q3 report, its TVL has grown by over 300% since joining the BIA (Incubation Alliance).

Gaming has always been the stronghold of BNBChain; during the last GameFi summer, over 40% of gaming projects were built on BSC, attracting a large number of gaming users and developers. Currently, the most active projects in terms of user numbers and transactions include: Seraph, TG mini-game World of Dypians, Egg Drops, as well as Gomble Games (which has received investment from Binance Labs) and Elfin Metaverse. Their weekly active users range from 600,000 to 1 million, contributing to most of the transaction volume on BNBChain.

Many of the projects currently emerging on BNBChain are still quite young, but if we trace back to the incubation history of BNBChain and Binance Labs, we can see that they are not applications from the same period, but rather coincidences that have collided.

For example, the leading project in the RWA field, Ondo, is a project incubated in the third session of MVB; contemporaneously, there were also: the DeFi protocol Impossible Finance; the DeFi data tool and wallet Debank; and the trading platform Woo Network. Recently, the BTCFi protocol Solv Protocol, which has gained attention for its significant TVL growth, is one of the outstanding graduates of the fourth MVB session. Also from the fourth session are: the security network Goplus Security and the once-popular GameFi star StarSharks.

Although these projects belong to different fields and have fluctuated due to narrative changes, they have all survived in this fast-paced and brutal industry. Their commonality lies in providing application value for users in their respective fields, and these grown projects have injected more diversified possibilities into the BNBChain ecosystem and the entire cryptocurrency industry.

Hot topics in the industry are always emerging rapidly. What BNBChain has been doing for a long time can actually be summed up in one sentence—simply building infrastructure, attracting more developers and applications, and creating value for users.

All along, BNBChain has stated that its vision is to attract the next billion users into Web3—this statement may sound a bit distant and abstract. However, it seems that this community is proving its development philosophy and aesthetics through action: pragmatic, long-term, and value-creating.

Through continuous improvement of infrastructure, the rise of AI, and exploration in Gaming and DeFi, what BNBChain has always envisioned and is currently depicting is a more comprehensive and long-lasting Web3 ocean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。