Hello everyone, I am Boss Hu. After the price of Bitcoin dropped back to $90,800 last night, the market began to hear voices of a strong rebound supported by the $90,000 level. Many cryptocurrency friends believe that after hitting the bottom at $90,000, Bitcoin's price will rebound strongly and rise back above $100,000. This perception is incorrect. First, we need to understand the current price trend cycle of Bitcoin. It is clear that Bitcoin's price is currently in a bullish adjustment cycle. What is a bullish adjustment cycle? Simply put, it is a rapid decline followed by consolidation. Conversely, a bearish adjustment cycle is characterized by a rapid rebound followed by consolidation. The premise of bullish and bearish adjustments is that the overall trend is upward or downward.

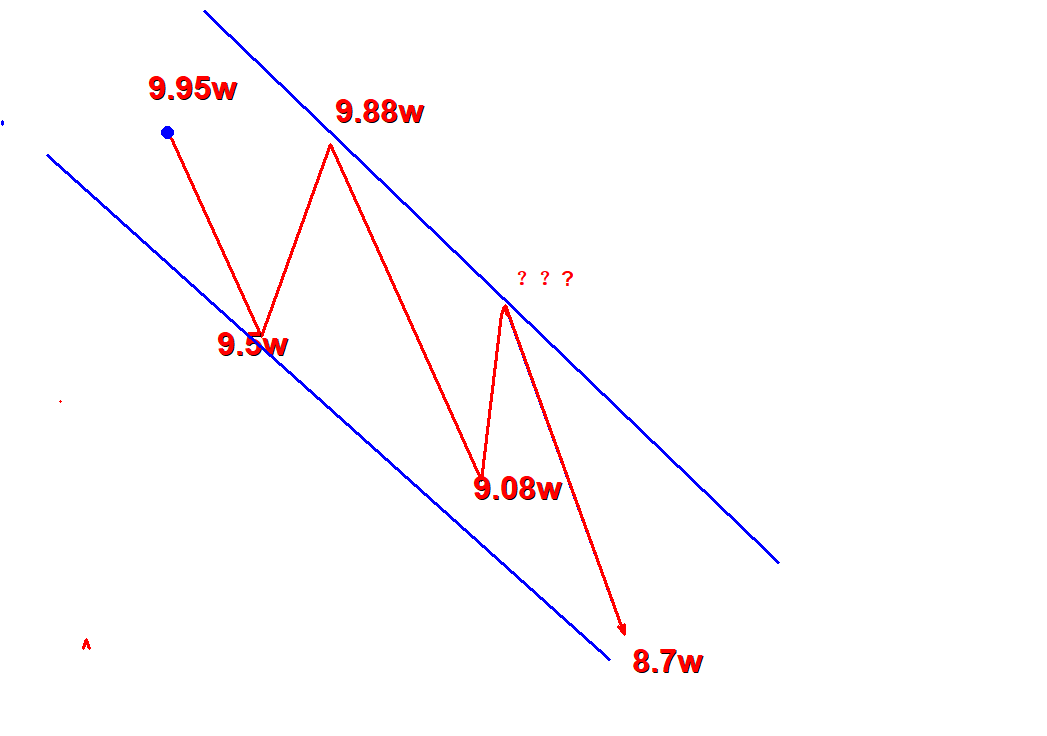

Why do we say that Bitcoin's price is in a bullish adjustment cycle now? First, after experiencing a significant rise following Trump's election, Bitcoin's price reached around $99,500. It is evident that the price could reach this level due to a buying frenzy from retail investors, along with the actions of major players in accumulating positions and liquidating shorts, which allowed the price to reach such a position. Therefore, a short-term price adjustment is an inevitable phenomenon. We can observe that the recent price adjustments of Bitcoin have shown a trend of dropping to $95,000, then rebounding to $98,000, and then dropping to $91,000. This trend, from a technical perspective, is a small cycle wave downward trend. We are currently in the fourth wave rebound trend of the downward wave. As of now, on November 27, 2024, at 23:46, Bitcoin's price has rebounded to around $95,500, searching for the high point of the fourth wave in the downward wave.

We previously discussed $95,000 as a key support level based on two hourly retracement points, so this position has a certain level of chip support, forming a short-term support level. However, during the continuous decline and adjustment on the 25th and 26th, the support at this position was insufficient and has been broken in terms of formation. Therefore, the bullish chips at this position have only two forms: either they are liquidated or they are trapped. As the price touches the bottom and rebounds back to $95,000, there will inevitably be selling pressure and liquidation actions. Thus, the range of $95,000 to $97,000 is gradually forming a short-term pressure process. There is a risk in chasing long positions at this level, while there is profit potential in shorting.

From a formation perspective, we have already analyzed. The current market sentiment should gradually lean towards neutrality. The short-term liquidity should have a long-short ratio with bulls slightly in the lead. Market sentiment should gradually calm down; a consensus pullback has occurred, but the extent of the pullback is still insufficient. Therefore, to reach the consensus pullback position of $87,000, Bitcoin's price formation will inevitably show wide fluctuations and a strange pattern. From the MACD indicator, the hourly line's DIF and DEA lines have broken through the zero axis and are moving upward, but the bullish volume may be prematurely expanding or about to exhaust. The four-hour line is still in the process of forming a golden cross with bearish volume contraction, but this position is very likely to form a golden cross trap. Even if the bulls continue to rise, they may only return to around $97,000, and breaking the new high of $100,000 may still take time. There is a risk in chasing long positions. I prefer to wait until the $97,000 position to set up short positions.

That's all for today's sharing. Thank you for watching. If you think what I said makes sense, I hope you can give a three-fold support. If you have your own views on the market, feel free to share them in the comments! See you next time!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。