This article will focus on strategies for capturing trading opportunities amid volatility.

This week's economic highlights—consumer confidence, inflation data, and employment market dynamics—have triggered significant fluctuations in Bitcoin, Ethereum, and other altcoins. Is your trading strategy ready? What changes can we expect in the market next week?

Seizing Opportunities in the Crypto Market: Key Events This Week

Global economic events are increasingly impacting the cryptocurrency market, making it crucial for traders to stay updated on the latest developments. This week's economic calendar includes several important data releases, such as the Consumer Confidence Index, Personal Consumption Expenditures (PCE) Inflation Report, and Unemployment Claims Data. These data points could be key drivers of volatility in the Bitcoin (BTC), Ethereum (ETH), and altcoin markets.

These economic events present profit opportunities for the market, but they also come with potential risks.

This article will focus on:

Strategies for capturing trading opportunities amid volatility.

The most noteworthy economic data to watch this week.

How these data points may impact the Bitcoin, Ethereum, and altcoin markets.

Economic Data Highlights

- ### Consumer Confidence Index (U.S.) - Tuesday

Why It Matters: The Consumer Confidence Index is an important indicator of consumer sentiment regarding the current economic situation and future expectations, directly influencing consumption trends and market liquidity, and significantly affecting sentiment in the cryptocurrency market.

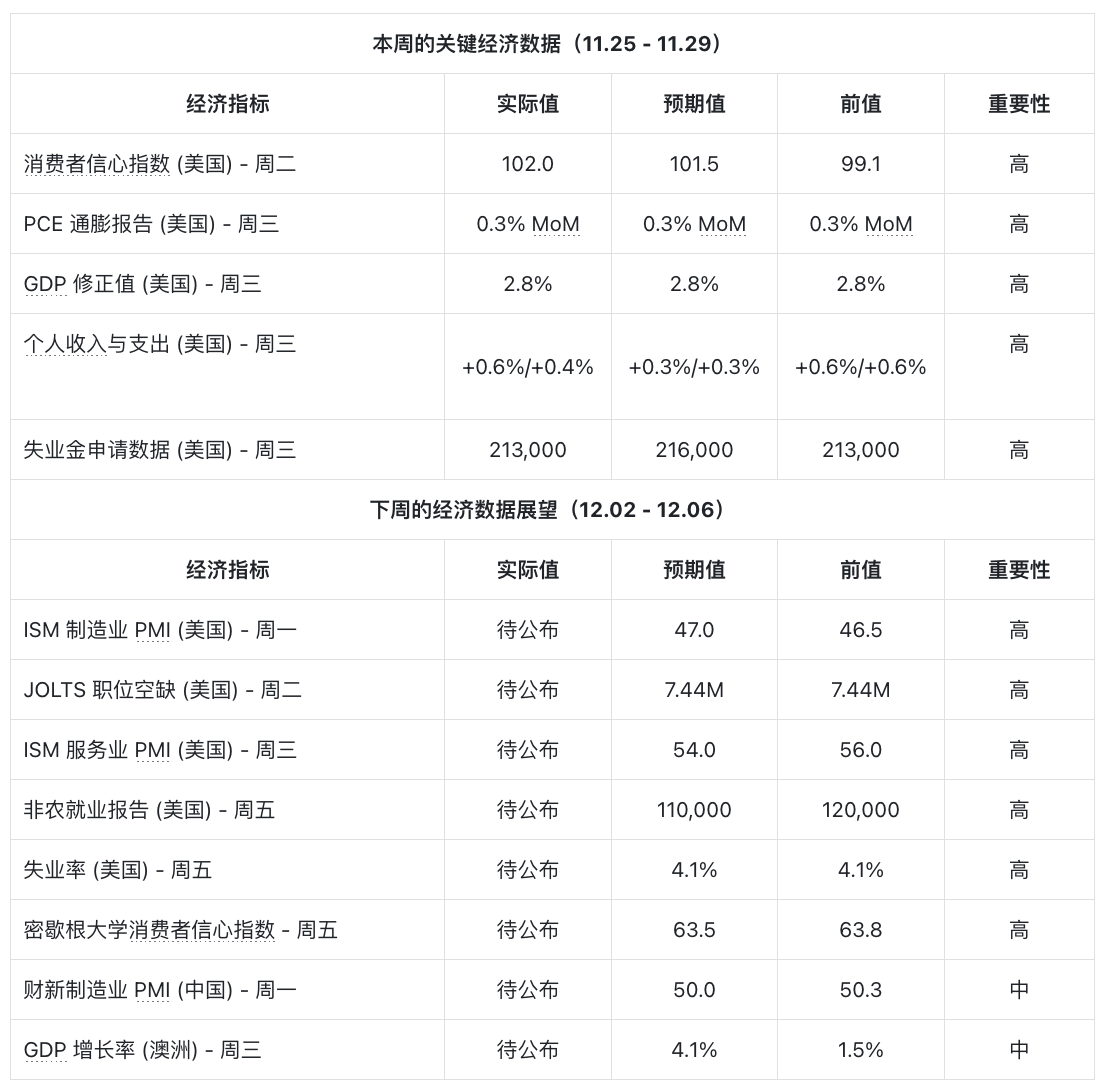

Image Source: The Conference Board Consumer Confidence Index

Data Review: The Consumer Confidence Index for November rose to 102.0, up from 99.1 in October, indicating that consumers are optimistic about the future economic outlook. However, the present situation index slightly declined to 138.2, reflecting some divergence in consumer views on the current economy and job market.

Impact on the Crypto Market:

Positive for Altcoins: Increased consumer confidence boosts demand for speculative assets, especially altcoins.

Stable Support for Bitcoin: Bitcoin continues to attract conservative investors due to its safe-haven properties.

Stablecoin Hedging: Using stablecoins as a hedging tool against short-term market volatility helps reduce risk.

2. PCE Inflation Report (U.S.) - Wednesday

Why It Matters: PCE inflation data is a key reference for the Federal Reserve in formulating monetary policy, directly affecting market liquidity and investor sentiment, and playing an important role in cryptocurrency pricing.

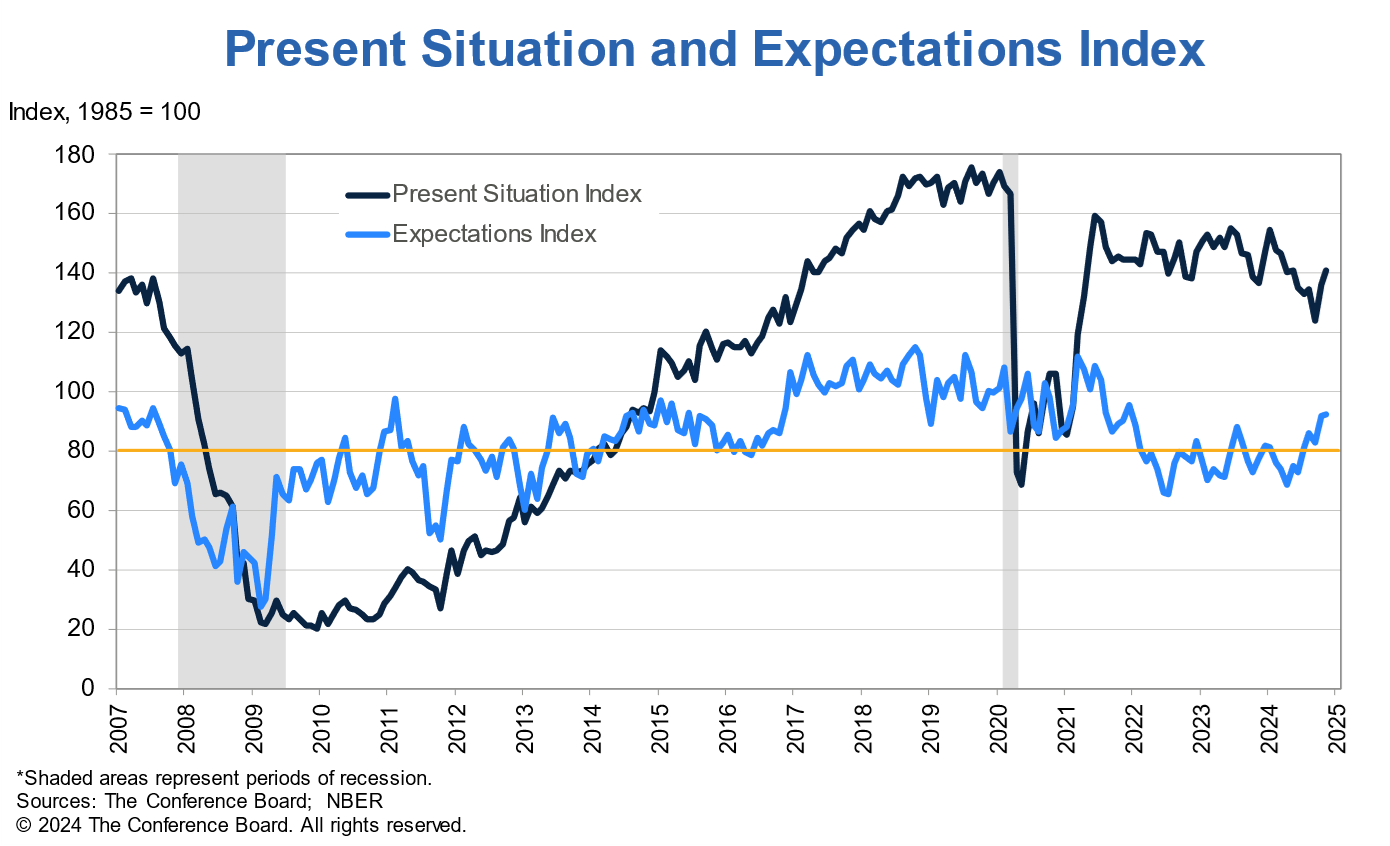

Image Source: Trading Economics

Data Review: The core PCE index for October increased by 0.3% month-over-month and rose by 2.8% year-over-year, meeting market expectations and reaching a six-month high. Service prices rose by 0.4%, while goods prices fell by 0.1%.

Impact on the Crypto Market:

Positive for Bitcoin: Stable inflation data may alleviate market concerns about further interest rate hikes, boosting optimism, with Bitcoin and other high-yield assets performing better in this environment.

Pressure on Altcoins: Higher-than-expected inflation data may raise concerns about tightening policies, weakening market liquidity and negatively impacting altcoin performance.

3. Other Data Releases

a. GDP Revision (U.S.) - Wednesday

Why It Matters: GDP revision data provides a more accurate reflection of economic growth, significantly influencing investor confidence and market risk appetite.

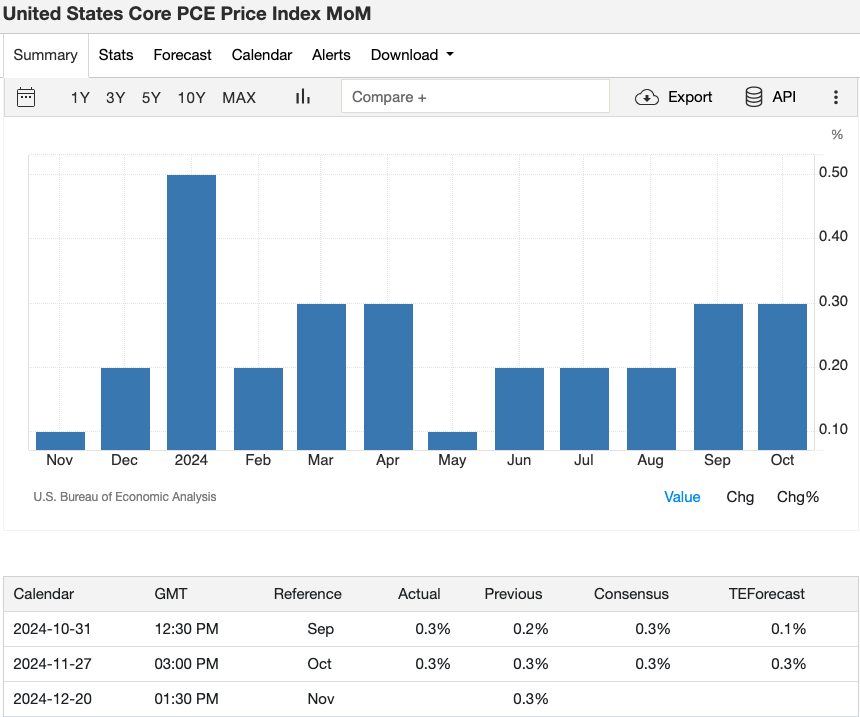

Image Source: Trading Economics

Data Review: The annual growth rate of U.S. GDP for the third quarter was 2.8%, meeting market expectations but lower than the second quarter's 3%. Consumer spending grew by 3.5%, and exports increased by 7.5%, but business investment only rose slightly by 0.3%. Meanwhile, the personal savings rate fell to 4.8%.

Impact on the Crypto Market:

Positive Signal: Stable GDP growth indicates economic resilience, potentially boosting investor confidence and driving up demand for cryptocurrencies.

Liquidity Considerations: Slower growth may prompt more cautious monetary policy, indirectly affecting market liquidity.

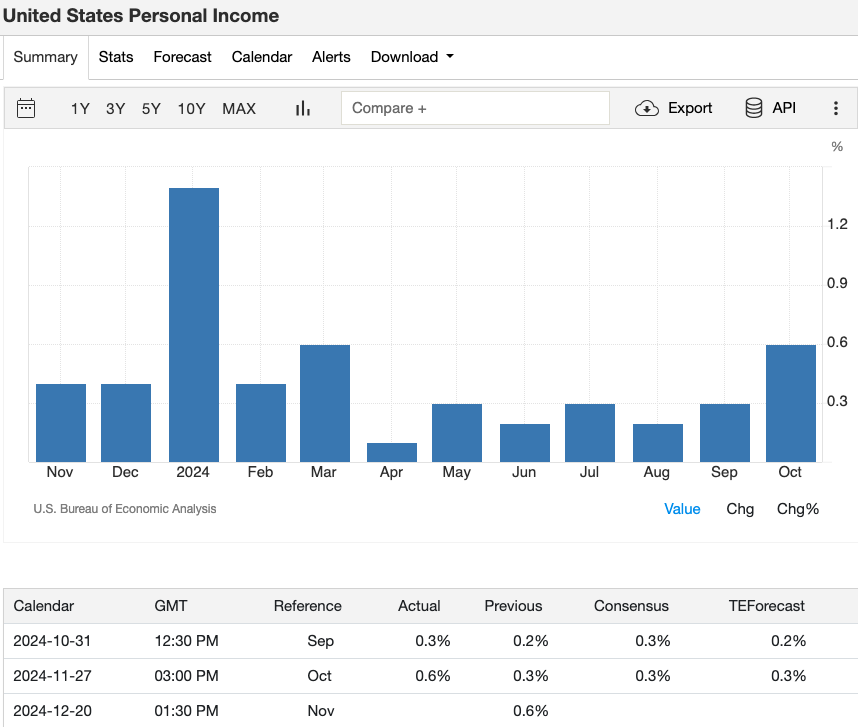

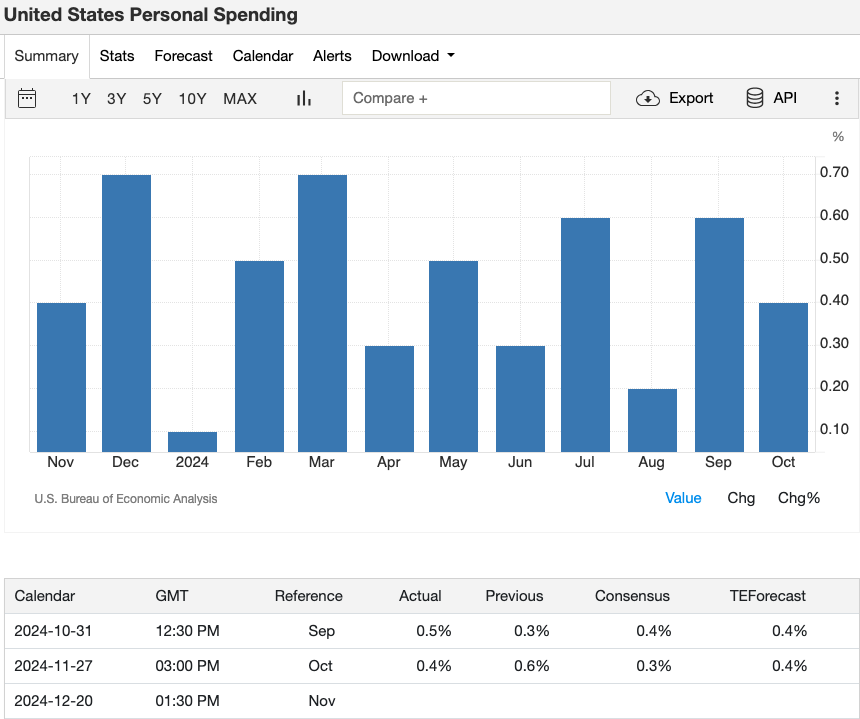

b. Personal Income and Spending (U.S.) - Wednesday

Why It Matters: Personal income and spending data reflect consumers' financial health and purchasing power, serving as important indicators of market liquidity and economic activity.

Image Source: Trading Economics

Image Source: Trading Economics

Data Review: Personal income increased by 0.6% month-over-month in October, marking the largest gain in seven months, while personal spending rose by 0.4%, exceeding market expectations. Service spending was the main driver of growth, while goods spending remained flat.

Impact on the Crypto Market:

Positive for Risk Assets: Growth in income and spending indicates economic resilience, potentially boosting market demand for cryptocurrencies.

Industry Trends: Increased service spending may enhance the appeal of payment-oriented blockchain projects, while growth in durable goods spending could drive market sentiment related to DeFi and NFT ecosystems.

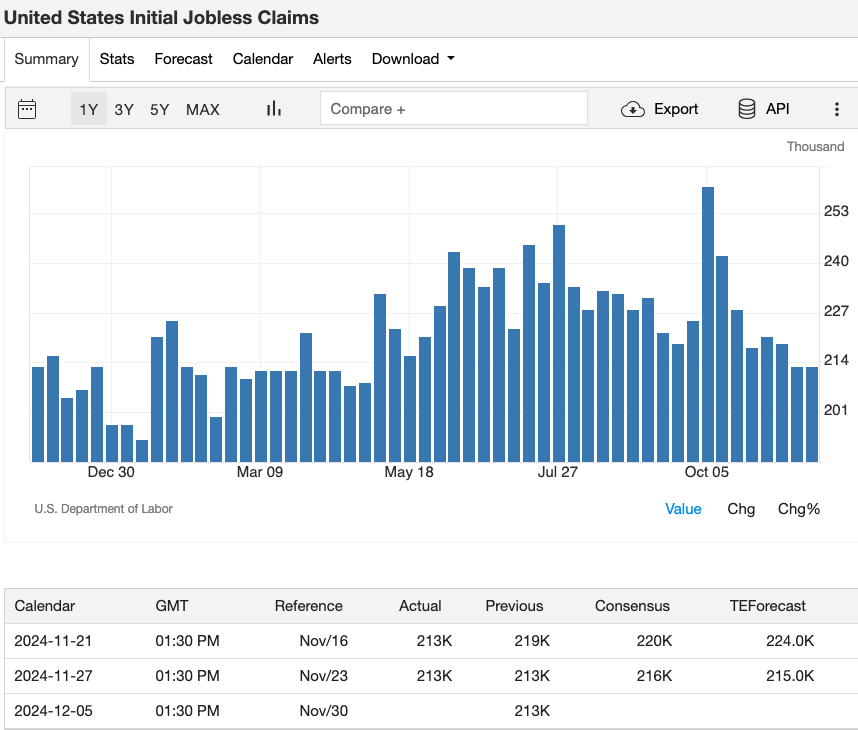

c. Unemployment Claims Data (U.S.) - Wednesday

Why It Matters: Unemployment claims data is an immediate indicator of labor market health, significantly impacting consumer confidence and spending trends.

Image Source: Trading Economics

Data Review: The number of initial unemployment claims remained at 213,000, below the market expectation of 216,000. However, the unadjusted unemployment claims rose sharply to 243,389, indicating increased employment pressure in some regions.

Impact on the Crypto Market:

- Liquidity Impact: Continued strength in the labor market may delay the implementation of easing policies, affecting trading volumes and price volatility in cryptocurrencies.

Crypto Market Outlook and Trading Opportunities

Current Market Trends

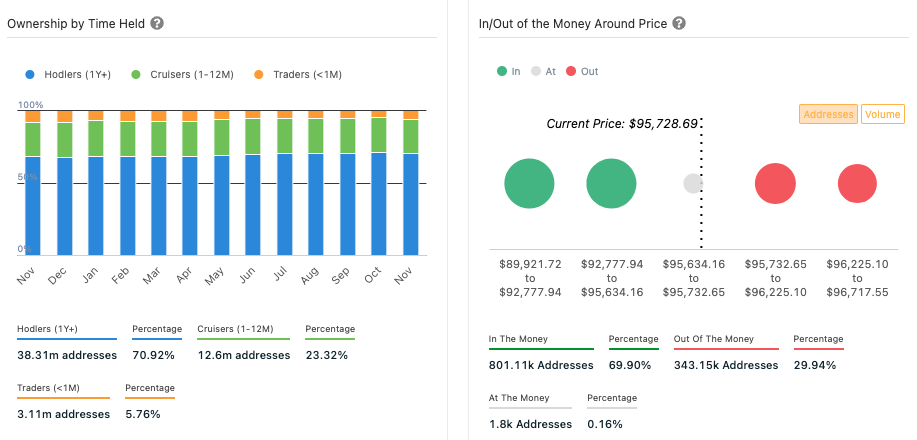

- Bitcoin (BTC): Bitcoin is currently priced at approximately $95,943. Although it has retreated from a high near $100,000, continued buying by institutional investors (such as MicroStrategy) shows long-term confidence in Bitcoin.

Image Source: IntoTheBlock

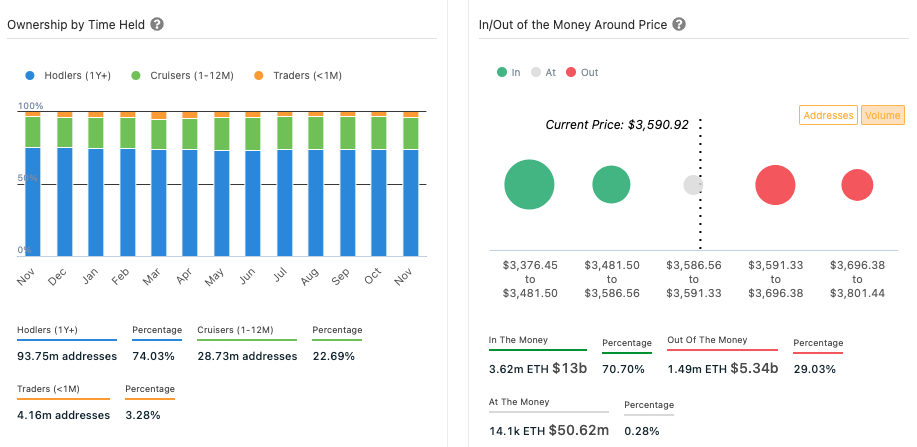

- Ethereum (ETH): Ethereum is currently priced at $3,677, benefiting from the rapid development of decentralized finance (DeFi) and the increasing popularity of Layer-2 scaling solutions.

Image Source: IntoTheBlock

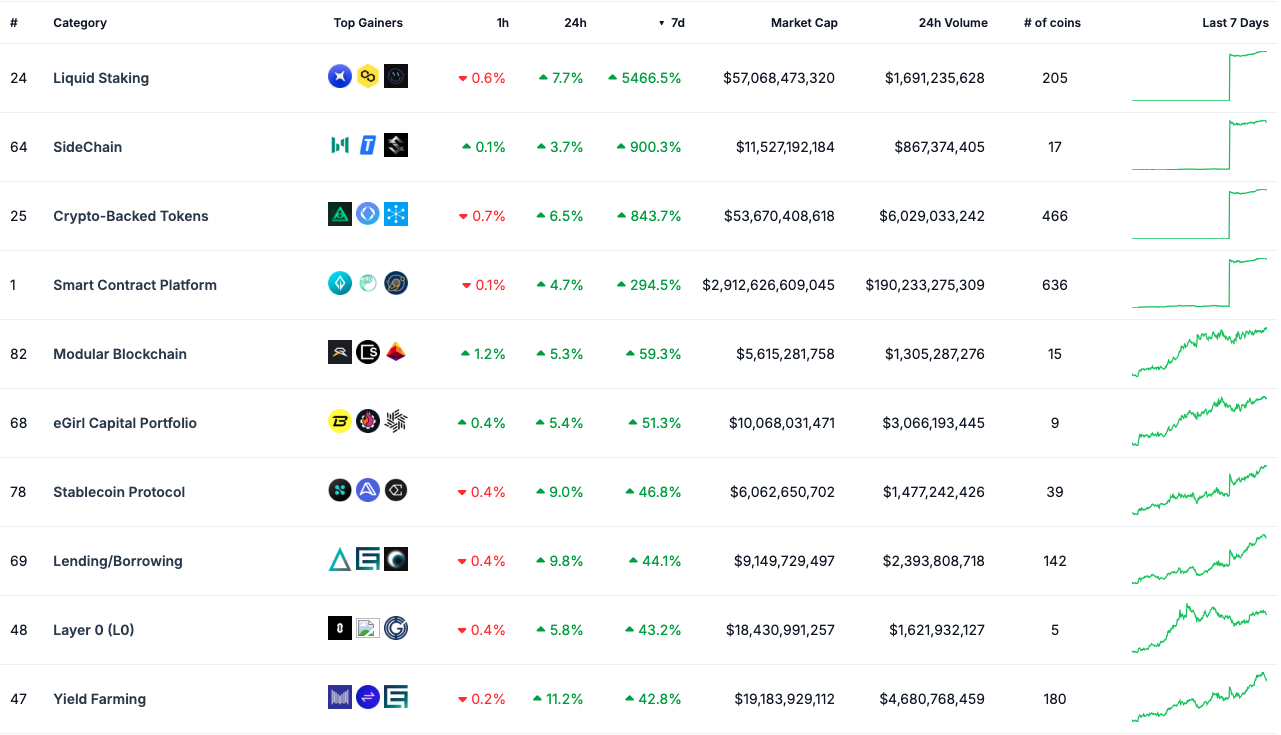

- Altcoins: Dogecoin surged 17.2% last week. Additionally, tokens related to Liquid Staking, Layer-2, modular blockchains, and crypto lending are gaining attention and becoming market hotspots.

Image Source: CoinGecko

Trading Opportunities

Seizing Market Volatility: Recent price fluctuations in Bitcoin and Ethereum have provided excellent opportunities for short-term traders, particularly suited for scalping and swing trading.

Institutional Buying Support: Continuous accumulation of Bitcoin by institutions like MicroStrategy not only enhances market stability but also provides strong support for future price growth.

DeFi Yield Opportunities: Stablecoin lending and staking platforms (such as Aave and Curve) offer robust yields in an uncertain macro environment, making them ideal choices for investors.

Risks to Watch

Regulatory Policy Uncertainty: Although the recent regulatory environment has eased for cryptocurrencies, sudden policy changes could have a significant impact on the market, requiring close attention.

Market Correction Pressure: Bitcoin's failure to break the $100,000 high reflects some downward pressure in the market, which could trigger broader market volatility.

Liquidity Risk: If inflation persists or the Federal Reserve maintains a hawkish stance, market liquidity may tighten, particularly adversely affecting speculative tokens and small-cap altcoins.

Leverage Risk: High-leverage trading can trigger forced liquidations during extreme volatility, leading to greater losses for investors.

Strategic Recommendations

Traders should adopt flexible strategies to capitalize on short-term opportunities arising from market volatility while focusing on long-term growth areas such as DeFi and blockchain infrastructure. Utilizing stablecoins to hedge against market risks, combined with effective risk management strategies, can help maintain an edge in a rapidly changing market environment.

Outlook: Key Economic Indicators Next Week

As we enter the first week of December, several key economic data releases will significantly impact market sentiment. These data points may directly affect the performance of Bitcoin, Ethereum, and other cryptocurrencies.

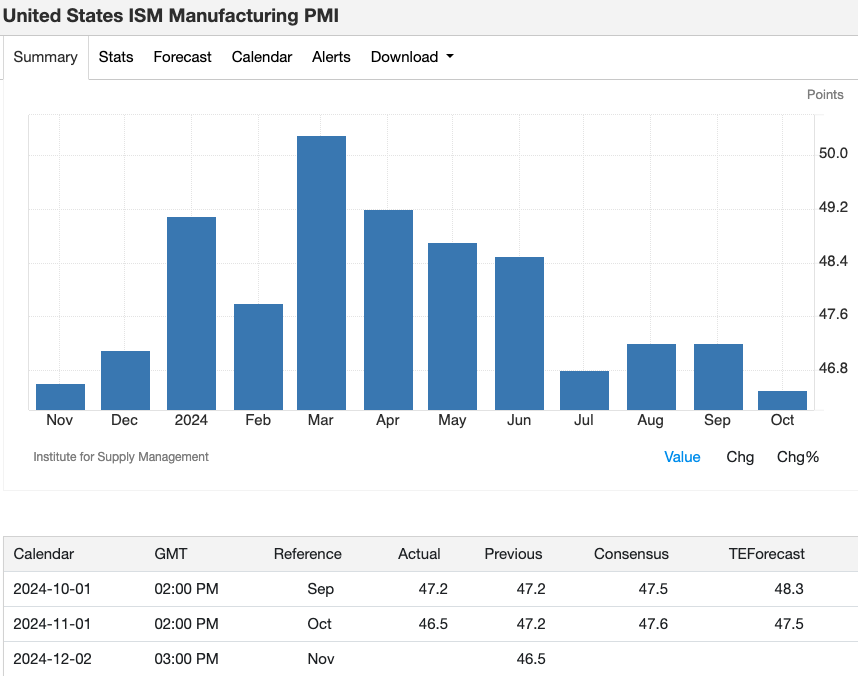

1. ISM Manufacturing PMI (U.S.)

Release Date: December 2 (Monday) Why It Matters: The ISM Manufacturing PMI is an important indicator of the activity level in the U.S. manufacturing sector; a reading below 50 indicates potential economic contraction, affecting global market risk appetite.

Image Source: Trading Economics

Impact on the Crypto Market:

Weak Data: Increased attractiveness of Bitcoin as a safe-haven asset.

Strong Data: Investors may lean towards the stock market, reducing the likelihood of capital flowing into the crypto market.

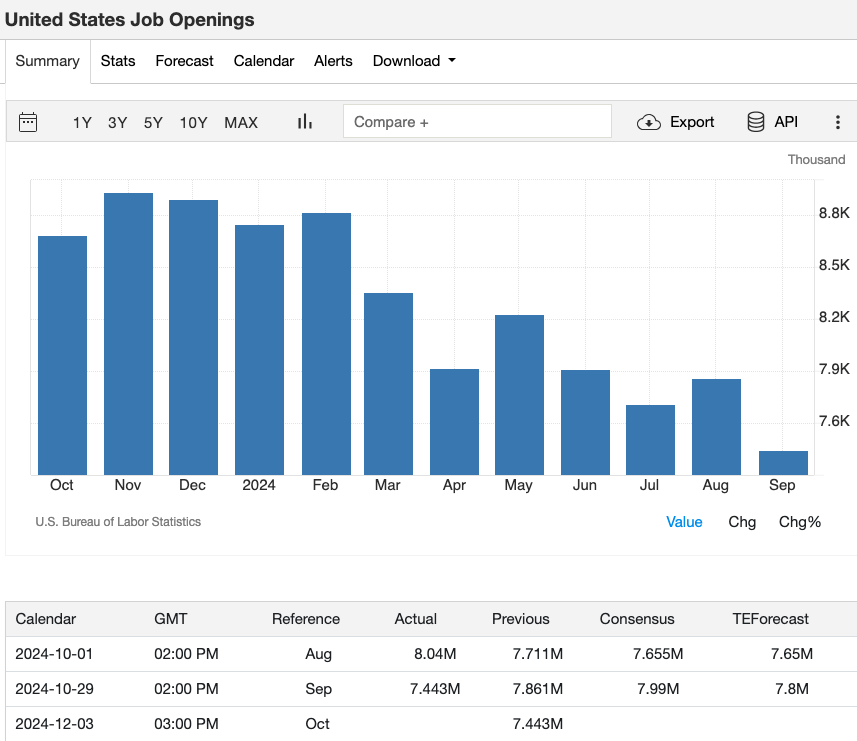

2. JOLTS Job Openings (U.S.)

Release Date: December 3 (Tuesday) Why It Matters: JOLTS data reflects the vitality of the labor market and serves as an important reference for assessing economic momentum.

Image Source: Trading Economics

Impact on the Crypto Market:

- If job openings decrease, it may raise market expectations for easing policies, which would be positive for Bitcoin and Ethereum.

3. ISM Services PMI (U.S.)

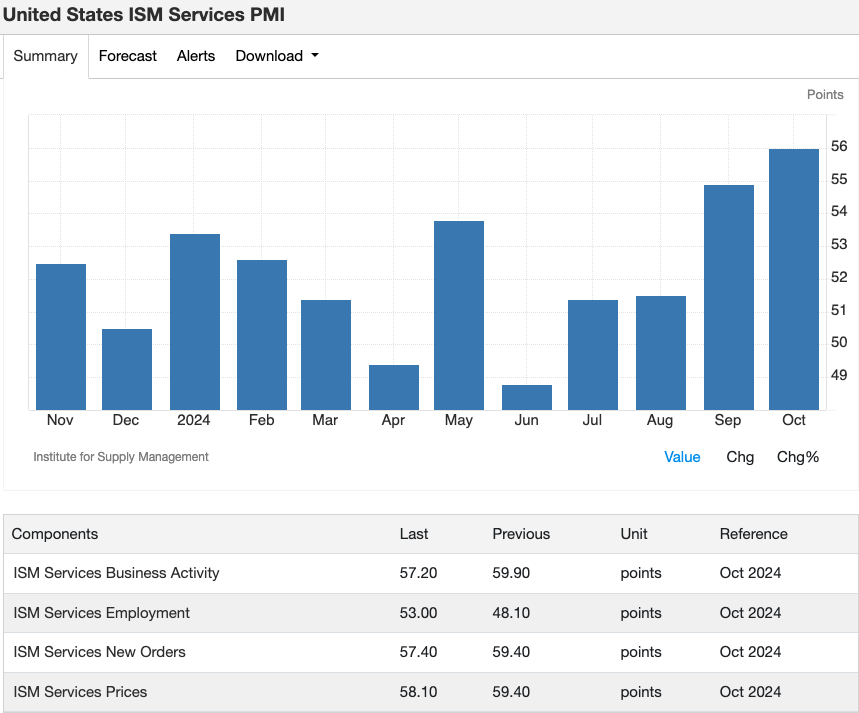

Release Date: December 4 (Wednesday) Why It Matters: The services sector plays a significant role in the U.S. economy, and this data can reveal the health of the service industry, which can significantly influence market sentiment.

Image Source: Trading Economics

Impact on the Crypto Market:

- Strong Data Performance: May drive demand for payment-related altcoins and DeFi-related projects.

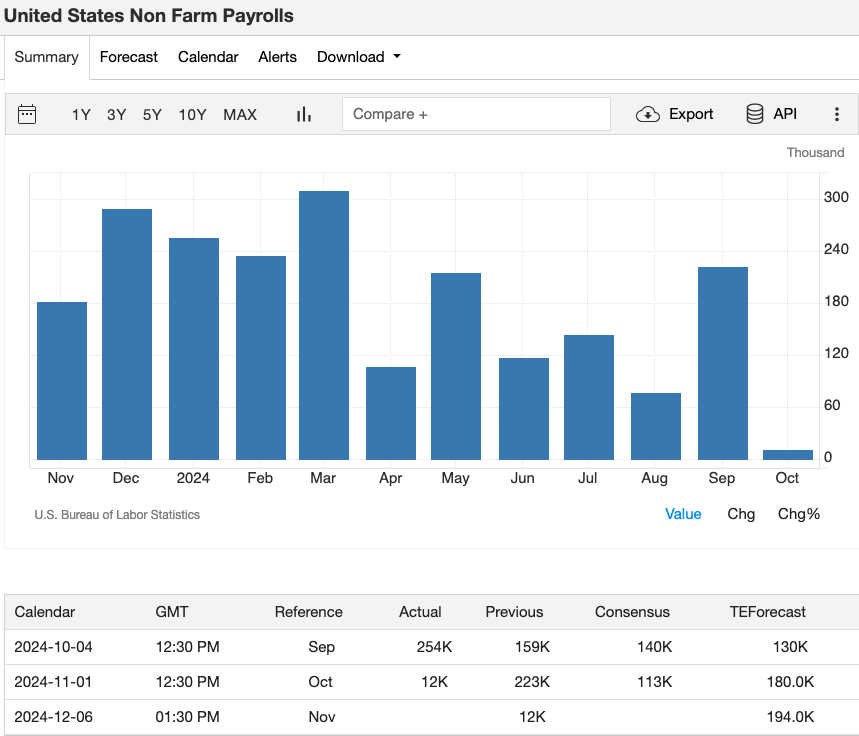

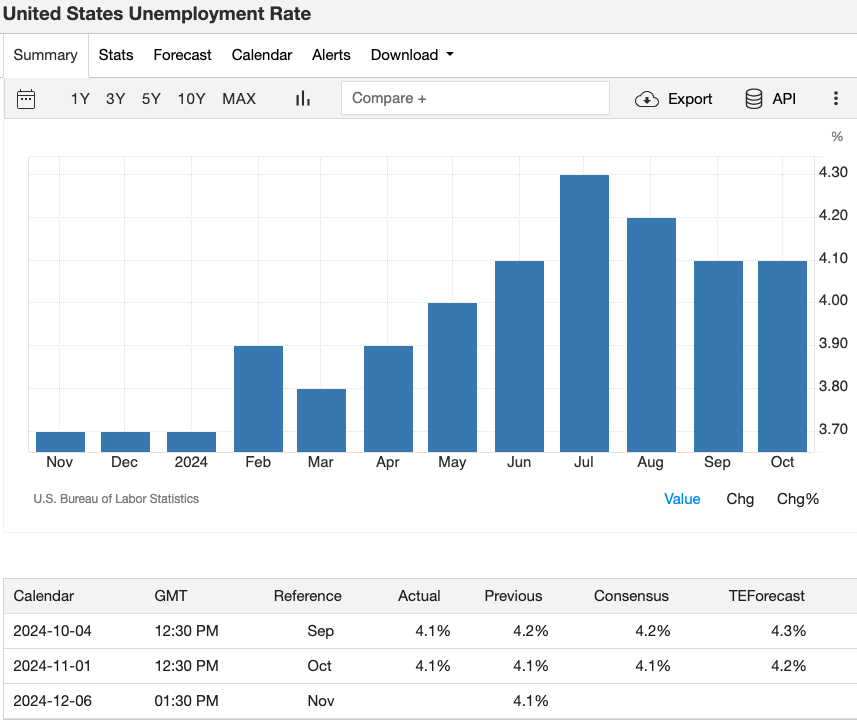

4. Non-Farm Payroll Report and Unemployment Rate (U.S.)

Release Date: December 6 (Friday) Why It Matters: Non-farm payroll data and the unemployment rate are crucial indicators of the health of the U.S. job market, directly influencing the Federal Reserve's policy direction and market risk appetite.

Image Source: Trading Economics

Image Source: Trading Economics

Impact on the Crypto Market:

Positive: If non-farm payroll growth is below expectations and the unemployment rate rises, it may enhance market expectations for the Federal Reserve to adopt an easing stance, benefiting Bitcoin and Ethereum.

Negative: If the data is strong or the unemployment rate declines, investors may worry about increasing inflation pressures, reducing interest in high-risk crypto assets.

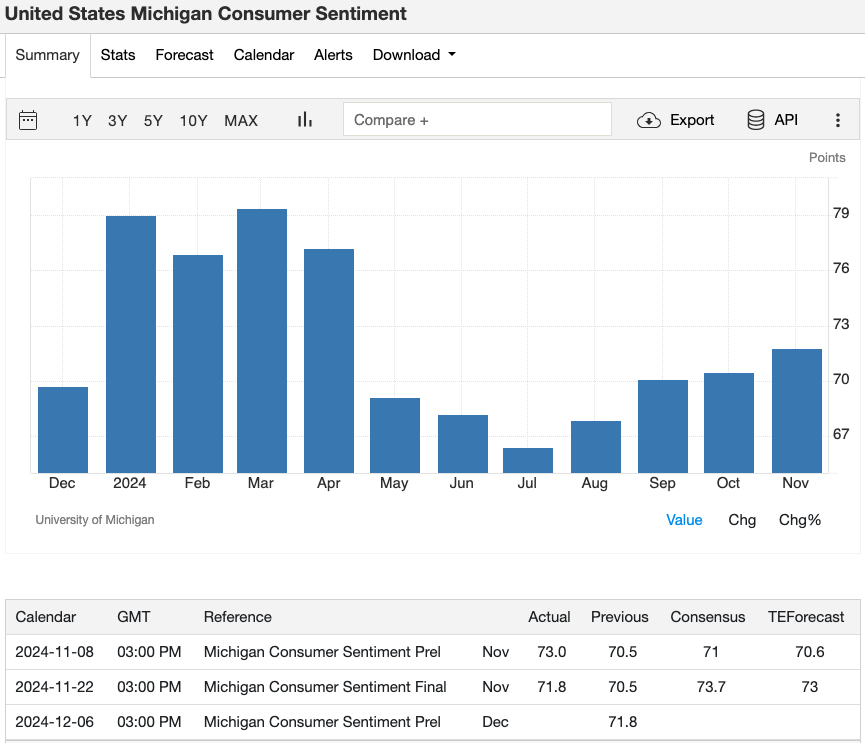

5. University of Michigan Consumer Sentiment Index (U.S.)

Release Date: December 6 (Friday) Why It Matters: This index measures U.S. consumer confidence in the future economy and can reflect retail consumption trends and market risk appetite.

Image Source: Trading Economics

Impact on the Crypto Market:

Other Indicators to Watch

Caixin Manufacturing PMI (China)

Release Date: December 2 (Monday) Why It Matters: As a barometer of China's manufacturing sector, positive data may enhance global market risk appetite, indirectly benefiting the altcoin market.

Image Source: Trading Economics

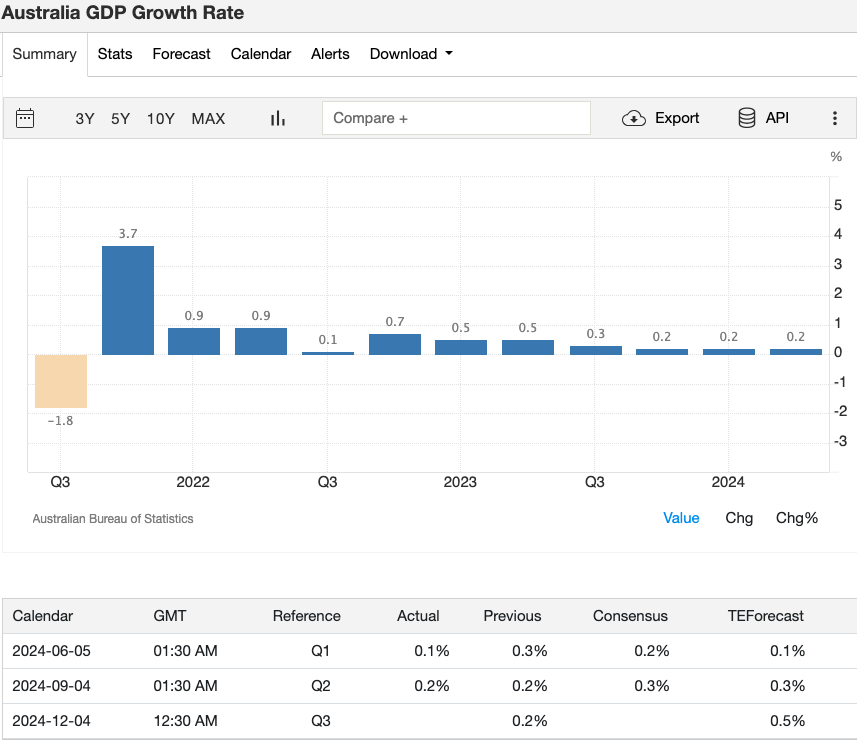

GDP Growth Rate (Australia)

Release Date: December 4 (Wednesday) Why It Matters: If Australia's economic growth exceeds expectations, it may stimulate activity in cryptocurrency trading during the Asian session.

Image Source: Trading Economics

Conclusion

This week's economic calendar clearly demonstrates the profound impact of macroeconomic factors on the cryptocurrency market. From consumer confidence to inflation data and employment market performance, these key indicators not only influence market sentiment but also have direct effects on liquidity and investment direction.

Key Points for Traders to Focus On

Responding to Market Volatility:

- Closely monitor high-impact events such as the PCE report and non-farm payroll data, as they may trigger significant fluctuations in the crypto market.

Pay Attention to Liquidity Changes:

- Economic data will directly influence the Federal Reserve's policy direction, thereby affecting market liquidity, which is crucial for the performance of Bitcoin, Ethereum, and other crypto assets.

Diversification Strategy:

Emphasize Fundamentals:

Key Events to Focus on Next Week

Upcoming key economic data, including ISM Manufacturing PMI, JOLTS Job Openings, and Non-Farm Payroll Report, will provide clearer signals for the economic trends at the end of the year. This data is crucial for both short-term traders and long-term investors, as it will directly impact the performance of the crypto market in December.

Are You Ready for Market Volatility?

Are you ready for market volatility? Join XT.COM, the world's first social trading platform, to access real-time crypto market data, powerful trading tools, and exclusive market insights. Register now to seize opportunities and turn market volatility into investment returns!

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality coins and 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options, including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。