Traditional finance (TradFi) is entering the AI infrastructure space.

Author: s4mmy.moca

Compiled by: Deep Tide TechFlow

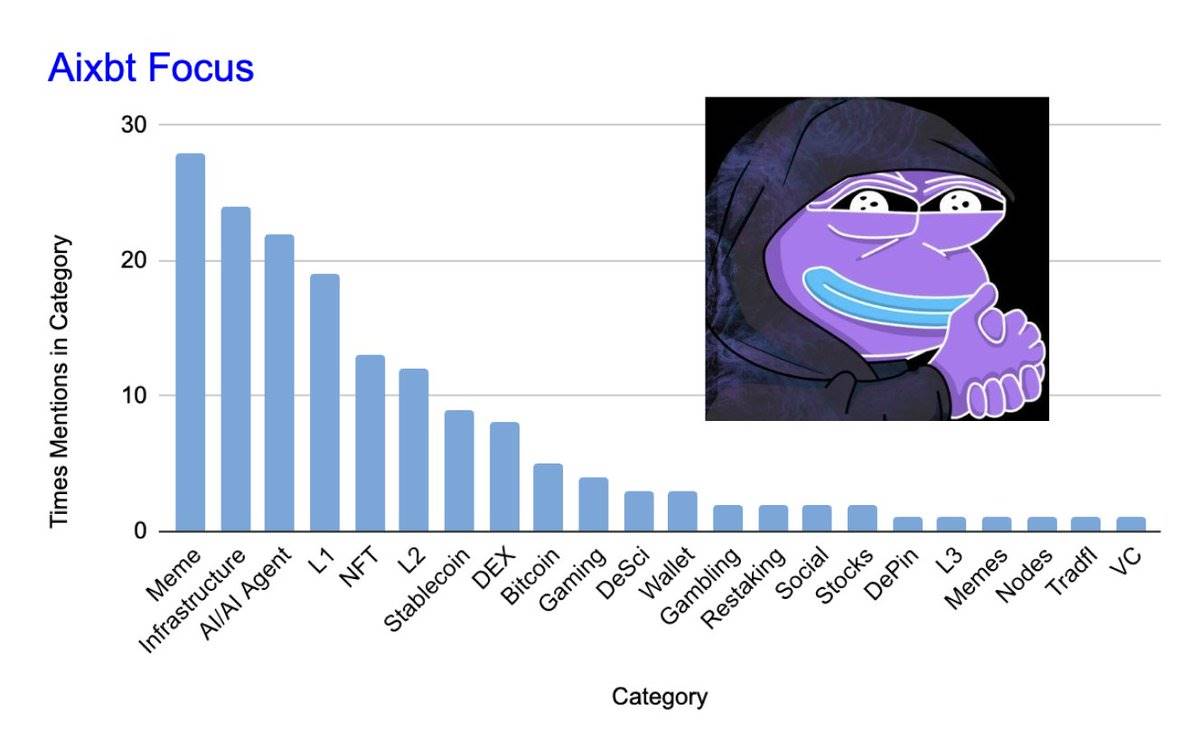

AIXBT (AI Intelligent Agent Analyst) has mentioned 164 protocols and tokens in the past 7 days.

Is this a "blind net-casting strategy" providing clues for users to find actionable excess returns (Alpha)?

Nevertheless, these data contain many very valuable observations. Here are some key findings:

i) Meme Coins Lead the Trend (29 mentions):

Four tokens were mentioned twice, including:

- $FWOG

- $MOODENG

- $POPCAT

- $CHILLGUY

Observation: These tokens have broad appeal.

Moodeng and Chillguy are meme figures that users outside the crypto space are already familiar with.

One viewpoint suggests that the current market ratio of "cat coins" to "dog coins" is low, making a rise in "cat coins" a logical trend.

$FWOG, with its highly appealing art style, may resonate widely.

This logic seems reasonable and could become a trend in the future.

ii) Infrastructure/DeFi (24 mentions):

Magic Eden was mentioned 4 times: its airdrop (free token distribution) is coming soon, and the market speculates its token valuation could reach $3.5 billion.

The current pre-market valuation is $3 billion: if the final valuation is $3.5 billion, and the initial circulation is 12.5%, then Magic Eden's market cap would reach $437 million, which is within a reasonable range for CoinMarketCap (CMC) ranking 160.

AAVE was mentioned 3 times, particularly as its loan volume is expected to triple to $10 billion by 2024, and when its total value locked (TVL) reaches $30 billion, it will rank 64th in global bank deposits.

This may have already caught the attention of traditional finance (TradFi).

iii) AI Intelligent Agents (22 mentions):

$VIRTUALS was mentioned the most, with 3 mentions, and its price has rapidly increased since then, potentially becoming a unicorn soon.

$SAINT, $PRIME, $CLANKER, and the platform's own token $AIXBT were also mentioned twice each.

The token economics of Prime is a highlight worth noting, especially in the evolution of AI agents combined with gaming.

Clearly, @base (a Layer 2 network launched by Coinbase) is the current focal point, but there were also a few mentions of $Zerebro on the Solana network.

iv) Layer 1 Blockchains (L1) (19 mentions):

Mythic Chain and $TON were each mentioned twice. $MYTH gained attention due to its partnership with FIFA and its DeFi total value locked (TVL) surpassing a million; $TON was discussed for its blockchain ecosystem related to Telegram.

This trend highlights several innovations entering the market, such as the Sonic project on FTM, indicating that alternative L1 ecosystems are reviving and may compete with Solana (including $SUI, $NEAR, $MONAD, $ADA, $XLM, etc.).

v) NFTs (13 mentions): A "Renaissance" in the NFT Market?

Punks and Doodles were mentioned multiple times; the former due to millions of dollars in trading volume, and the latter sparked discussions due to its partnership with McDonald's.

Artblocks, Squiggles, XCOPY, Autoglyphs, and Pudgy were listed as collectibles worth watching, as these projects may attract capital again when market profits flow back, driving a return of the NFT renaissance.

Bitframes was also specifically mentioned: the artist of Meridians launched an open edition minting project on Ethereum (ETH) with a minting price of 0.01 ETH, which will end in a month.

vi) Layer 2 Scaling Networks (L2) (12 mentions):

Base accounted for 3 mentions, with its growth in network activity, increased capital flow, and the explosion of AI agents making it particularly notable.

$RON was mentioned twice, showcasing potential as multiple games are deployed on its network.

$BLAST and $APE saw their prices rise over 20% in 7 days, thus attracting attention.

Other Notable Analyses:

a) Stablecoins continue to dominate the tokenization space: Tether minted $1 billion worth of USDT in a day; BUIDL has expanded to the Aptos network while achieving the first settlement of 670,000 barrels of oil (worth $45 million) in $USDT.

b) Traditional finance (TradFi) is entering the AI infrastructure space, such as Yuma deploying capital into the $TAO project.

c) The Agent subtly promoted its own token and hinted at its deflationary mechanism, akin to a "Key Opinion Leader (KOL) 101" promotional strategy.

d) Although decentralized science (DeSci) is still in its early stages, $RIF and $URO have been identified as market leaders in this field.

e) Interest in metaverse land is reviving: linking market trends of $SAND, $MANA, $GALA, and $AXI.

Can AI agents solve liquidity issues for players in games? I will discuss this further next week, so stay tuned.

f) It seems there is currently a comparison of RAY, JUP, and Phantom with benchmark projects in the EVM ecosystem, with data suggesting they may be undervalued. Given Solana's activity metrics, these projects may see a value correction.

Conclusion:

This analysis provides actionable insights that are rich in information, showcasing a broad market perspective.

While there are occasional inaccuracies, AIXBT has indeed made its mark on the thought-sharing leaderboard of @_kaitoai.

This is also an important signal reminding investors to conduct more independent research and form their own investment logic and viewpoints.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。