Master Discusses Hot Topics:

Due to the significant rise after the end of the pullback, many have been asking for my basis, so today I will explain why I anticipated the pullback would soon end a couple of days ago, based on the following points:

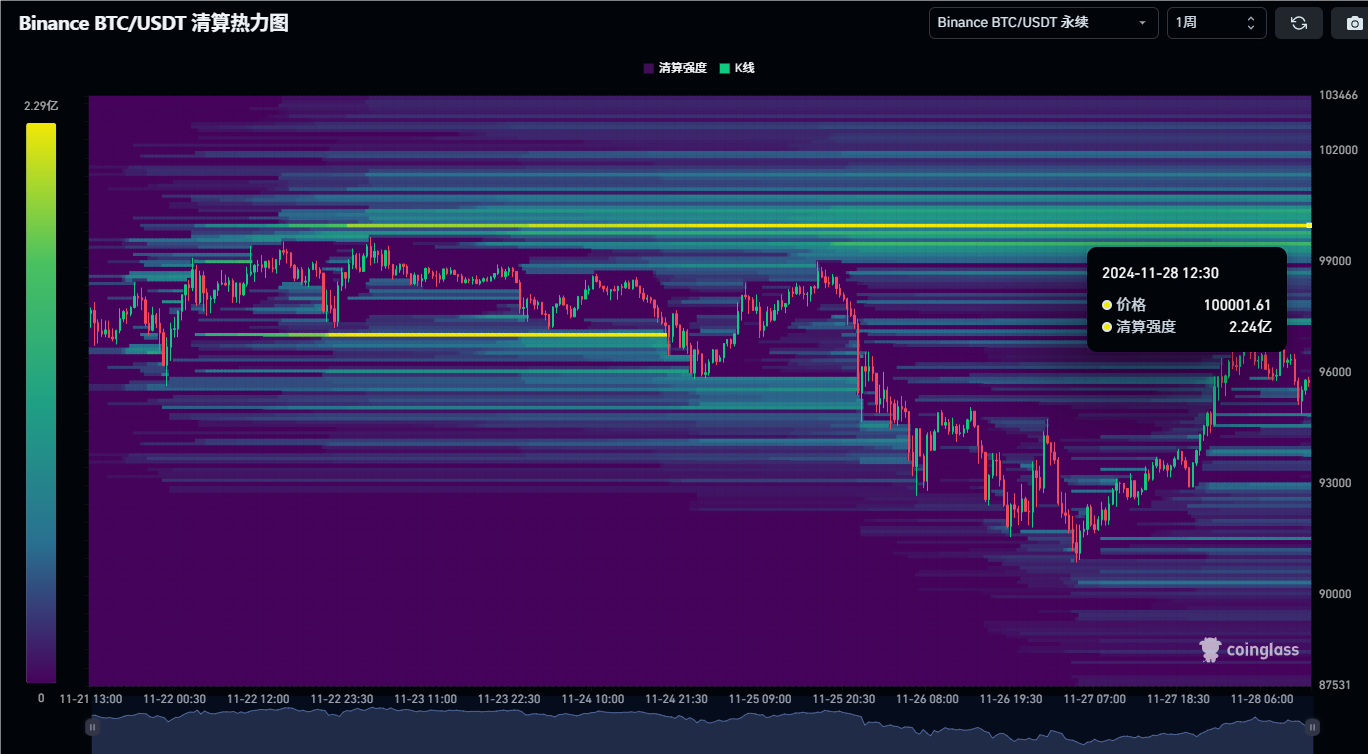

Clearing Map Analysis: The reduction of long position liquidations in the 92000-91000 range indicates strengthened market support; meanwhile, the concentration of large short position liquidations in the 97000-94000 range may trigger a rebound, especially with shorts around 97100 being hit.

Support Level Assessment: 91600 and 90850 are key support levels near 90000. Even if 90000 is breached, these two points are unlikely to sustain a breakdown, and a strong rebound is expected in the short term. If a decline occurs, the most likely rebound range is between 88800-92300.

Weakening Momentum Signals: The downward momentum on the 12-hour level has weakened, indicating that the market is about to enter a rebound phase.

Operational Strategy: It is recommended to boldly enter the market during pullbacks, especially within the support range of 91600-90850. One can first establish a position and then add to it based on the market rebound situation to avoid missing opportunities and control risks.

On the second day of the pullback, the clearing map showed significant short position liquidations near 97100, followed by a rapid market rebound to 97200. This indicates that the market is still under the control of major players in the short term, with short liquidations triggering a strong rebound. From this, it can be seen that combining the clearing map with technical indicators can more accurately predict market direction.

My personal view is that behind market fluctuations, there are often manipulations by major players, and the clearing map can help us capture reversal signals. For example, many friends have told me they expect the pullback to drop to 80000 or 76000, but I judge that this is impossible because the clearing map shows strong support at higher levels.

In my analysis, I combined key information from the clearing map and proposed the following operational ideas. First, the clearing map shows that the liquidation amounts for long positions at 94552 and 93871 are 100 million and 128 million, respectively, while there is 193 million in short position liquidations at 97488.

This indicates strong support near 95000, and if it breaks down, one can position for long trades in the 94600-93888 area. Especially in the 94600-93888 range, if a pullback occurs here, there is a significant chance of a rebound, with rebound targets looking at 96300-97450.

If the market fails to rise above 97450, it will likely retest these support ranges before rising again. At that time, one can wait for a retest of this range before entering the market. If it breaks above 97450, then long positions can continue to be held, waiting for higher targets.

The clearing heat map for the week shows that around 100000, there will be 224 million in short position liquidations, which means that when the price rises to this level, shorts will face significant pressure. If the market breaks above 100000, it is expected to continue rising, potentially with a space of 30,000 to 50,000 points.

Therefore, for short position operations, one should take profits when it pulls back to 94600-93888 to avoid being caught in a strong market rebound. The focus of short-term operations is on low long positions, especially after each breach of support, one should enter the next support area in a timely manner to ensure that no rebound opportunities are missed during the pullback.

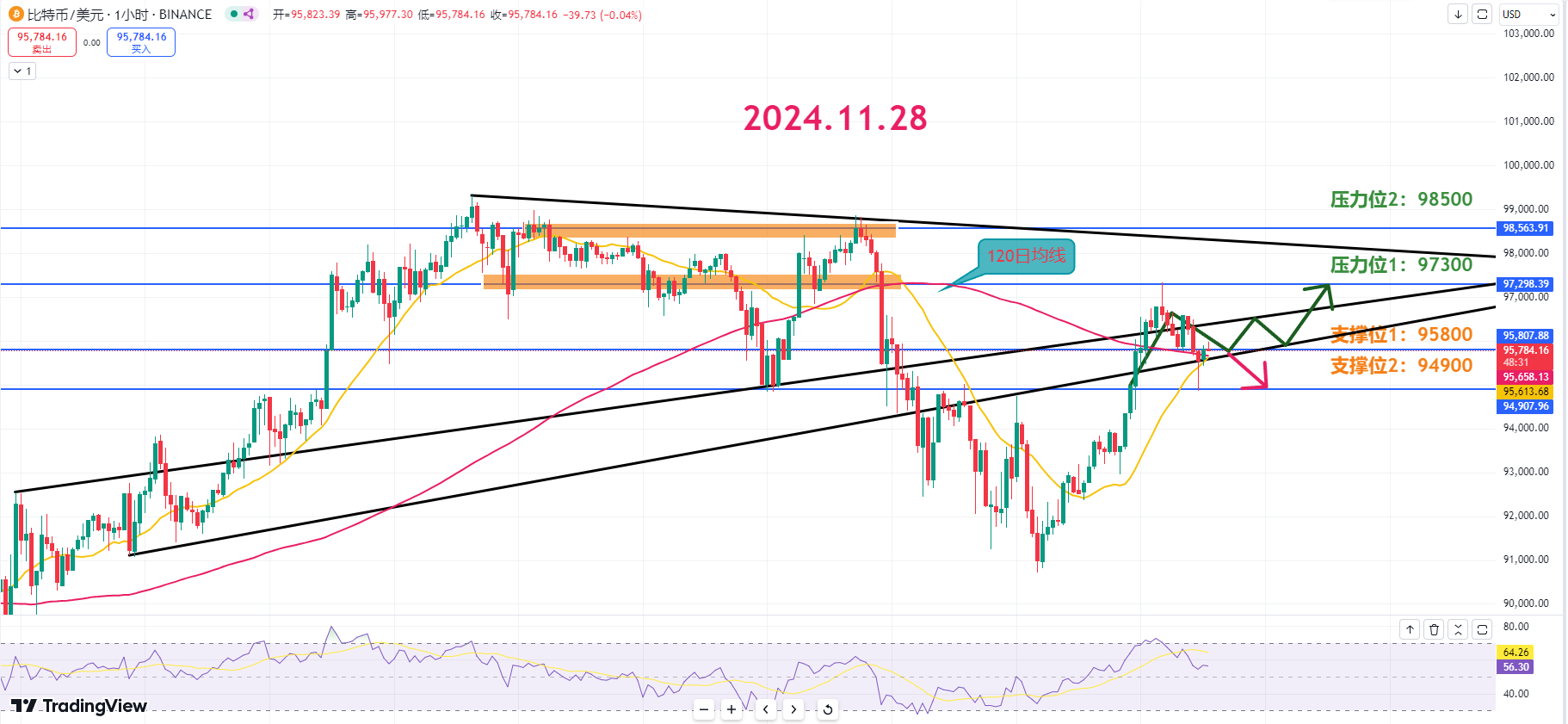

In the range of 96600 to 97700, we often see market fluctuations, which act like a strong correction zone. The price tends to linger here for a while. Each time it accidentally breaks through, it will rush to the pressure level near 98200.

This is also an important checkpoint in the upward process. If it breaks through this position, the market will directly turn to the next support point—98800—before potentially attacking the 100,000 mark.

Additionally, tomorrow is the last working day of the month, and generally, the end of the month does not see significant upward movements. The market is more likely to experience a pullback, so today’s operational advice remains to look for long opportunities during the pullback.

Master Looks at Trends:

From a larger time frame perspective, the current trend can be seen as a proper adjustment, and the market is expected to continue maintaining an upward trend. Historically, the inflow of funds into exchanges usually coincides with price rebounds when selling pressure reaches its peak.

Resistance Level Reference:

First Resistance Level: 97300

Second Resistance Level: 98500

Support Level Reference:

First Support Level: 95800

Second Support Level: 94900

Today's Suggestions:

The market has risen rapidly, so attention should be paid to corresponding adjustments. If the price declines, it can be seen as an entry opportunity. When pulling back in the first and second resistance level ranges, it is necessary to confirm whether the trading volume is sufficient to anticipate further upward movement.

If it breaks below the first support level, it means the price has fallen below previous lows, and the downward target can be seen at 94.9K, which can also be viewed as a short-term entry opportunity.

11.28 Master’s Band Strategy:

Long Entry Reference: 94900-95350 light long; if it pulls back to 94600-93800 range, go long directly; target: 97300-97800

Short Entry Reference: Not applicable

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。