Historical "Thanksgiving Market"

According to statistics from AICoin (ai.com), from 2019 to 2023, the probability of BTC dropping before Thanksgiving is 60%, but there has been an upward trend within a week after the holiday.

November 28, 2019: Increased by 8.9% three days before the holiday, and rose by 2.23% one week after.

November 26, 2020: Increased by 5.83% three days before the holiday, plummeted by 17% on Thanksgiving Day, and rebounded by 2.14% within a week after.

November 25, 2021: Decreased by 7.3% three days before the holiday, and the price rose by 3.33% one week after.

November 24, 2022: Decreased by 2% three days before the holiday, and increased by 3.35% within a week after.

November 23, 2023: Decreased by 2.72% three days before the holiday, and rose by 3.7% within a week after.

Below is the display of Bitcoin price changes during Thanksgiving over the past five years, shown through AICoin's multi-window feature.

Image source: AICoin

Looking back over ten years, Bitcoin has also shown a significant appreciation trend after Thanksgiving during bull markets, with only three instances of decline in the "Thanksgiving Market" over the past decade.

Even four years ago in 2020, Bitcoin experienced a "Thanksgiving Massacre" on Thanksgiving Day, dropping below $16,000 with a decline of 17%, but after the holiday, Bitcoin's most remarkable increase reached 400%, breaking through the $60,000 mark.

Users can also use Ace Smart Search within AICoin to inquire about historical BTC Thanksgiving market information.

Market Still Optimistic About BTC

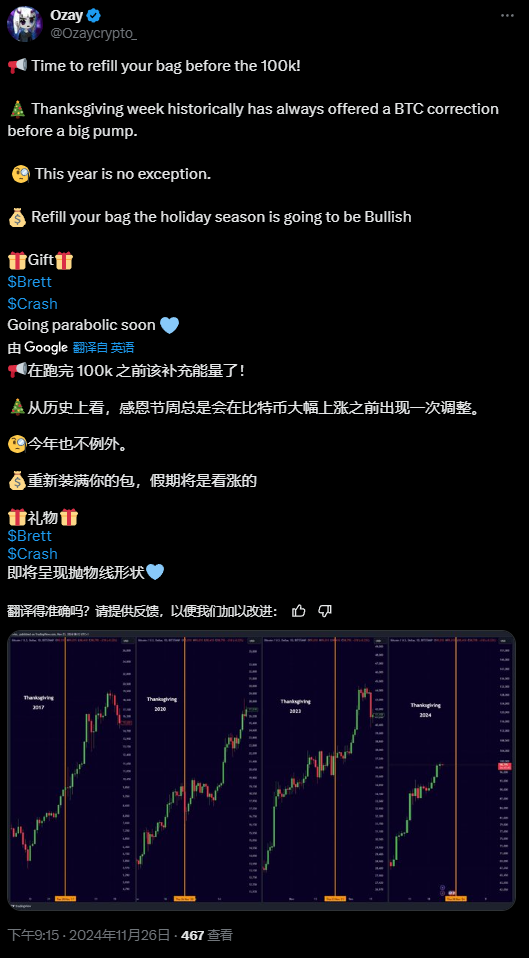

Ozay tweeted, "Historically, the week of Thanksgiving always sees a correction before a significant rise in Bitcoin," and is optimistic about BTC's performance during the holiday, stating, "The holiday will be bullish."

Image source: x

Trader Bruce J noted that while caution is needed for potential volatility during Thanksgiving, he also pointed out that the overall direction of the bull market remains unchanged.

Image source: x

The founder of EMJ Capital stated that the Thanksgiving period is usually a springboard for bullish trends in cryptocurrency, and a real market structure is about to form. Additionally, new crypto regulations from the U.S. SEC and the potential expansion of global adoption and U.S. strategic Bitcoin reserves may become significant catalysts for Bitcoin, triggering the next bull market.

Conclusion

Considering the current market environment and historical data, there may be trading opportunities in the Bitcoin market during Thanksgiving, but investors should remain vigilant about potential risks. The market may continue to experience fluctuations in the short term, and it is advisable for investors to maintain flexible investment strategies and closely monitor market dynamics and policy changes.

The historical Bitcoin market during Thanksgiving has certain reference value, but investors should also focus on analyzing macroeconomic and policy factors to make more informed decisions amid market volatility. Regardless of how the market changes, rationality and caution are always essential cornerstones for successful investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。