In September 2024, OpenEden received a strategic investment from Binance Labs, the venture capital and incubation arm of Binance. Binance Labs, as the venture capital department of Binance, has been dedicated to identifying, investing in, and empowering promising blockchain entrepreneurs, startups, and communities. This investment in OpenEden reflects its optimism about the RWA (Real World Assets) sector and its trust in the OpenEden team.

Key Reading Points

- Overview of OpenEden's U.S. Treasury Bond On-Chain Protocol

- OpenEden's Project Operation Mechanism and Advantages

- OpenEden's Competition with Protocols like Ondo

- Latest Market Data for OpenEden

- Future Outlook for OpenEden

Overview of OpenEden

OpenEden is an RWA (Real World Assets) tokenization protocol, currently focusing primarily on the on-chain U.S. Treasury bond sector. It was established in early 2022 by Jeremy Ng, former head of Asia-Pacific at Gemini, and Eugene Ng, former head of business development for Asia-Pacific. OpenEden has launched its first product—OpenEden TBill Vault. This product aims to allow stablecoin USDC holders to earn returns by minting TBILL tokens.

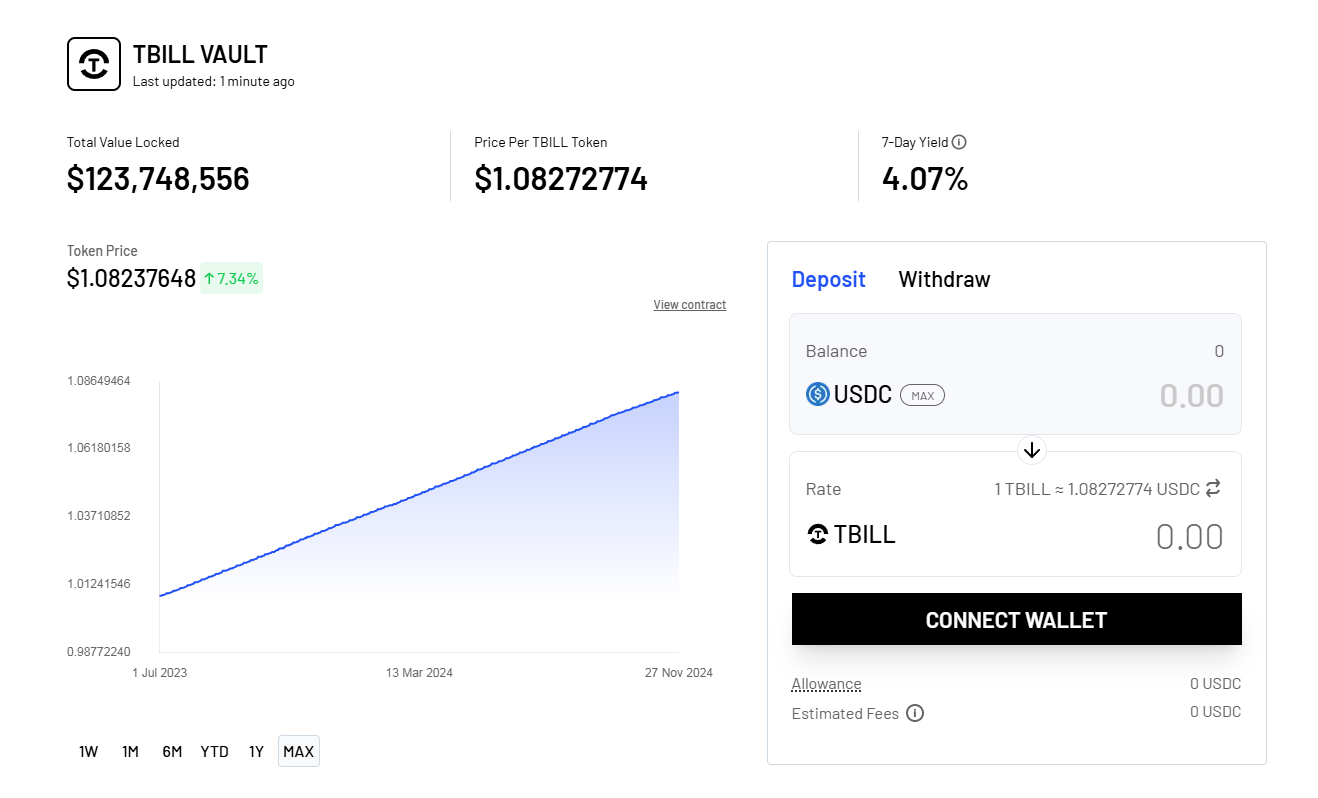

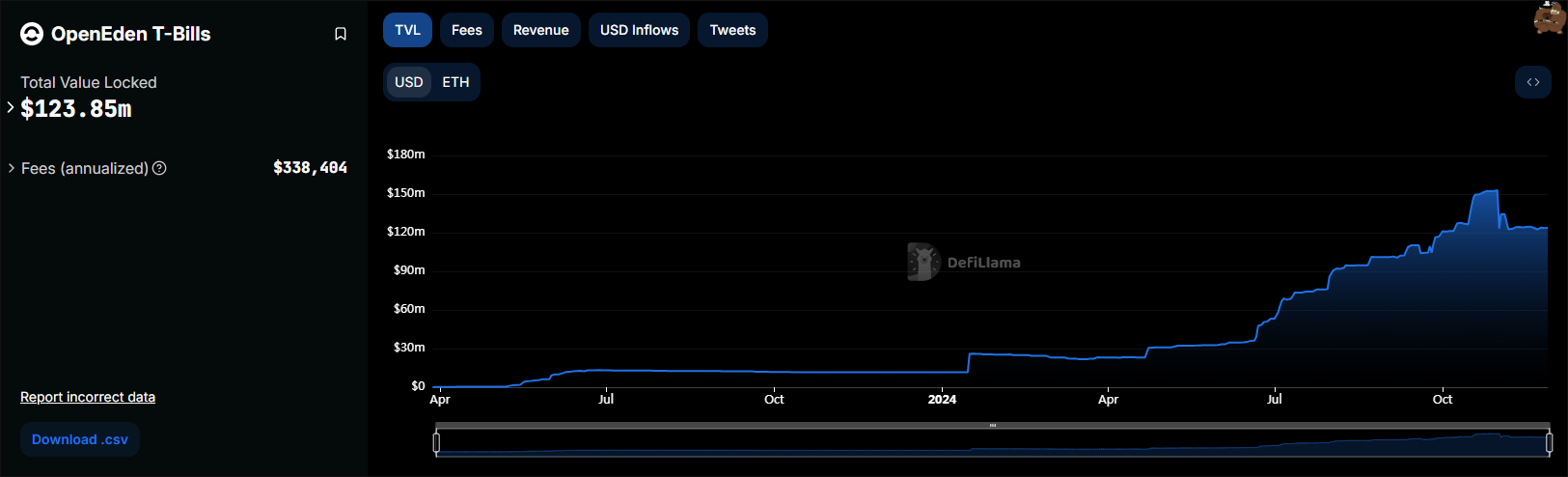

Currently, the Total Value Locked (TVL) is $125 million, placing it in the mid-range of the sector, with only the $TBILL product available for now. Its highlight is the establishment of a reserve mechanism that helps investors quickly exit liquidity, with the reserve ratio dynamically adjusted by the team in real-time.

Development History of OpenEden

The project was founded in 2022 by two former senior regulatory executives from the Gemini exchange. Jeremy Ng and Eugene Ng, leveraging their extensive experience in the financial sector, recognized the immense potential of tokenizing physical assets (RWA) and thus founded OpenEden. They are committed to building a bridge to a new financial system, providing investors with more diversified investment options.

Jeremy Ng (Co-Founder)

Highlights: CFA (2002), Goldman Sachs, JPMorgan, Deutsche Bank, Leonteq, Gemini.

Eugene Ng (Co-Founder)

Highlights: Barclays Capital, Citigroup, Deutsche Bank, Matrixport, Gemini, DWF LABS.

Graduated with top honors from Singapore Management University, majoring in Business Administration, and pursued a master's degree at Hong Kong University of Science and Technology, obtaining a Master's in Finance, followed by a top-ranking International Master's in Finance from New York University's Leonard N. Stern School of Business.

In April 2023, OpenEden launched its first product—OpenEden TBill Vault. This product aims to allow stablecoin USDC holders to earn returns by minting TBILL tokens.

In September 2024, it received strategic investment from Binance Labs. The investment from Binance Labs brings new development opportunities for OpenEden. This not only recognizes the OpenEden project but also provides strong financial support and resource integration capabilities for its future development.

In October of the same year, OpenEden rapidly expanded, achieving a project lock-up TVL annual peak of $150 million, ranking among the top five tokenized treasury bond issuers globally; although overall data has slightly declined, it still maintains a relatively leading position.

Unique Operating Mechanism of OpenEden

As an RWA (Real World Assets) tokenization protocol, OpenEden primarily focuses on the on-chain U.S. Treasury bond sector, and its operating mechanism is unique.

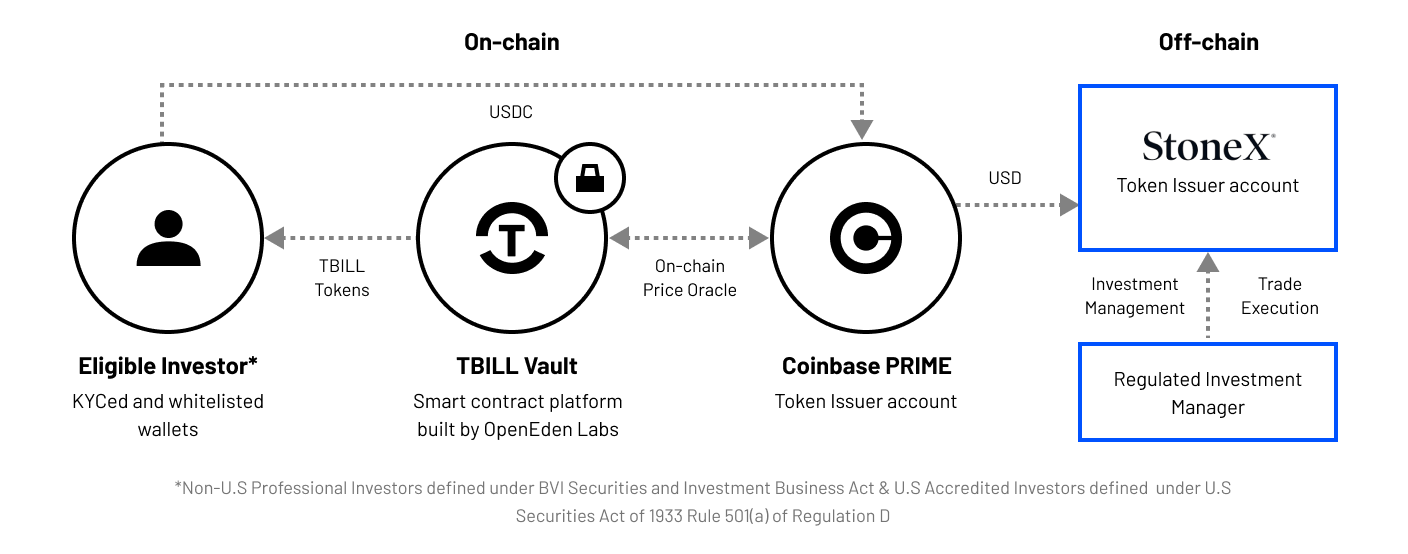

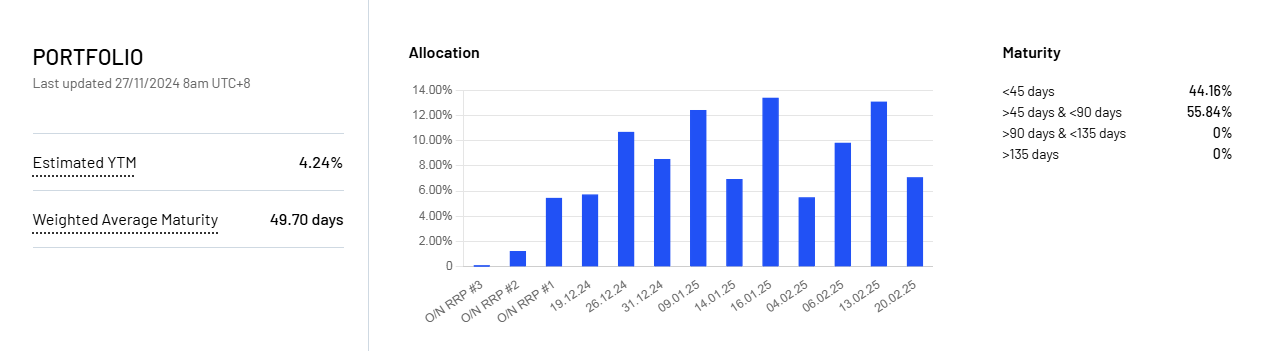

First, OpenEden provides users with a new channel for investing in U.S. Treasury bonds by directly investing most of its assets in off-chain short-term U.S. Treasury bonds. During the investment process, OpenEden strictly implements KYC and AML checks to ensure the safety and regulatory compliance of investments. At the same time, a small portion of USDC remains on-chain to ensure instant withdrawals around the clock, providing liquidity assurance for users.

Second, the first product launched by OpenEden—OpenEden TBill Vault—allows stablecoin USDC holders to earn returns by minting TBILL tokens. The TBILL tokens are backed by short-term U.S. government treasury bills and are secured in value and reliability by a reverse repurchase agreement. In the issuance process, OpenEden employs advanced technological means to ensure the security and stability of the tokens.

TBILL is the ERC-20 standard RWA token used by OpenEden, with each $TBILL pegged to $1, and the yield fluctuates with the short-term U.S. Treasury bond TBill. Currently, a total of $110 million worth of TBILL has been minted, with a YTM of 4.31%.

- To purchase $TBILL, investors must first pass OpenEden's KYC certification. The protocol requires investors to meet the definition of "Professional Investors" as defined by the British Virgin Islands Securities and Investment Business Act 2010, as well as the criteria for "Accredited Investors" under Regulation D, Rule 501(a) of the Securities Act, which requires investors to have assets exceeding $1 million.

- After passing KYC certification, investors transfer $USDC to the designated $TBILL address, and Coinbase Prime acts as the token issuer to purchase assets from the fund manager, which are then held by an off-chain custodian. The minted RWA tokens are sent to the investor's registered whitelist wallet, completing the entire purchase process.

Additionally, OpenEden has partnered with Solayer to launch the tokenized U.S. Treasury stablecoin sUSD, providing investors with more investment options. sUSD operates using Solayer's Request for Quote (RFQ) protocol, pairing engine for decentralized trading markets, allowing users to submit quotes in USDC, which the system automatically matches with qualified tokenized institutions to bring U.S. Treasury bonds (RWA) on-chain, thereby generating sUSD. All transactions are executed automatically by smart contracts, eliminating the need for third-party fund custody, ensuring transaction transparency and security.

In summary, OpenEden's operating mechanism provides investors with a safe, convenient, and efficient investment method by bringing U.S. Treasury bonds on-chain, while also offering a new pathway for the integration of traditional finance and the crypto world.

Significant Development Advantages of OpenEden

OpenEden has many notable features and advantages that make it stand out in the RWA platform.

1. Investing in U.S. Treasury Bonds with Attractive Returns, Expected Annual Yield of 5.5%

OpenEden provides investors with a channel to invest in U.S. Treasury bonds, currently offering an expected annual yield close to 5%, which is quite attractive compared to many traditional low-interest financial channels and some highly volatile crypto investment categories. OpenEden's U.S. Treasury bond investment brings higher returns to investors.

2. Flexible Trading: Not Restricted by U.S. Trading Hours and Supports 24/7 Redemption

One of OpenEden's major features is breaking the "shackles" of traditional U.S. Treasury bond investments limited to U.S. trading hours. Leveraging the borderless nature of blockchain technology, users can freely conduct U.S. Treasury bond purchases at any time, 24 hours a day. This provides great convenience for investors, who need not worry about trading time restrictions and can invest according to their needs at any time. Additionally, users can redeem TBILL 24/7, ensuring ample liquidity for their funds.

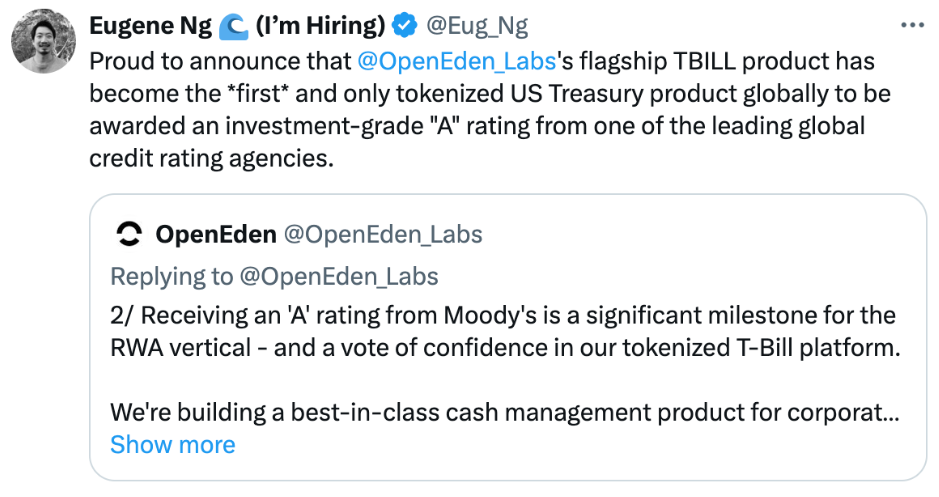

3. Backed by Authoritative Ratings: The First RWA Token to Receive Moody's "A" Rating

As early as June 2024, OpenEden successfully obtained an "A" rating from Moody's, thanks to its solid operational foundation, rigorous compliance risk control system, and innovative and efficient business structure. As a globally recognized and highly credible rating agency, Moody's endorsement undoubtedly labels OpenEden as a "high-quality asset," allowing it to stand out in the mixed RWA market and become a trusted quality target for many institutional and individual investors.

4. Cumulative TVL Reaches $150 Million, Attracting Over 150 Institutional Clients

As of now, its Total Value Locked (TVL) has soared past the $150 million mark (currently slightly down to around $125 million), and its partnership landscape continues to expand, successfully attracting over 150 institutional clients to join in, collectively building a large and active investment ecosystem. The participation of institutional clients further enhances OpenEden's market influence and credibility. The involvement of institutional clients also brings more funds and resources to OpenEden, helping to drive the project's continuous development.

Competing with Ondo Finance

OpenEden and Ondo Finance both focus on the asset tokenization sector, but there are many differences in their business focus and operational logic.

In Terms of Business Model

OpenEden primarily focuses on the on-chain U.S. Treasury bond sector, providing investors with a channel to invest in U.S. Treasury bonds by directly investing most of its assets in off-chain short-term U.S. Treasury bonds. At the same time, OpenEden has made several improvements to the Vault, including on-chain price oracles, faster smart contract transactions, Uniswap widgets, enhanced security, institutional-grade protection, and user interface improvements.

Ondo Finance has launched a tokenized fund that provides institutional investors with opportunities to invest in U.S. Treasury bonds and institutional-grade bonds. Its product OUSG primarily offers liquidity exposure to short-term U.S. Treasury bond ETFs, with the vast majority of the portfolio invested in iShares short-term Treasury bond ETFs.

Regarding Returns

OpenEden's expected annual yield is 5.5%, offering a high investment return.

The yield to maturity of Ondo Finance is relatively close to that of OpenEden. However, there may be differences in the stability of returns and risk between the two. OpenEden's value and reliability are secured by a reverse repurchase agreement, and it has received a Moody's rating of "A," giving it a certain advantage in investment value and reliability.

Current Market Development of OpenEden

OpenEden struggled in its operations last year, with its TVL hovering below $20 million. However, it experienced a surge this year, with TVL accelerating in the second half, growing from $35 million to $100 million within three months.

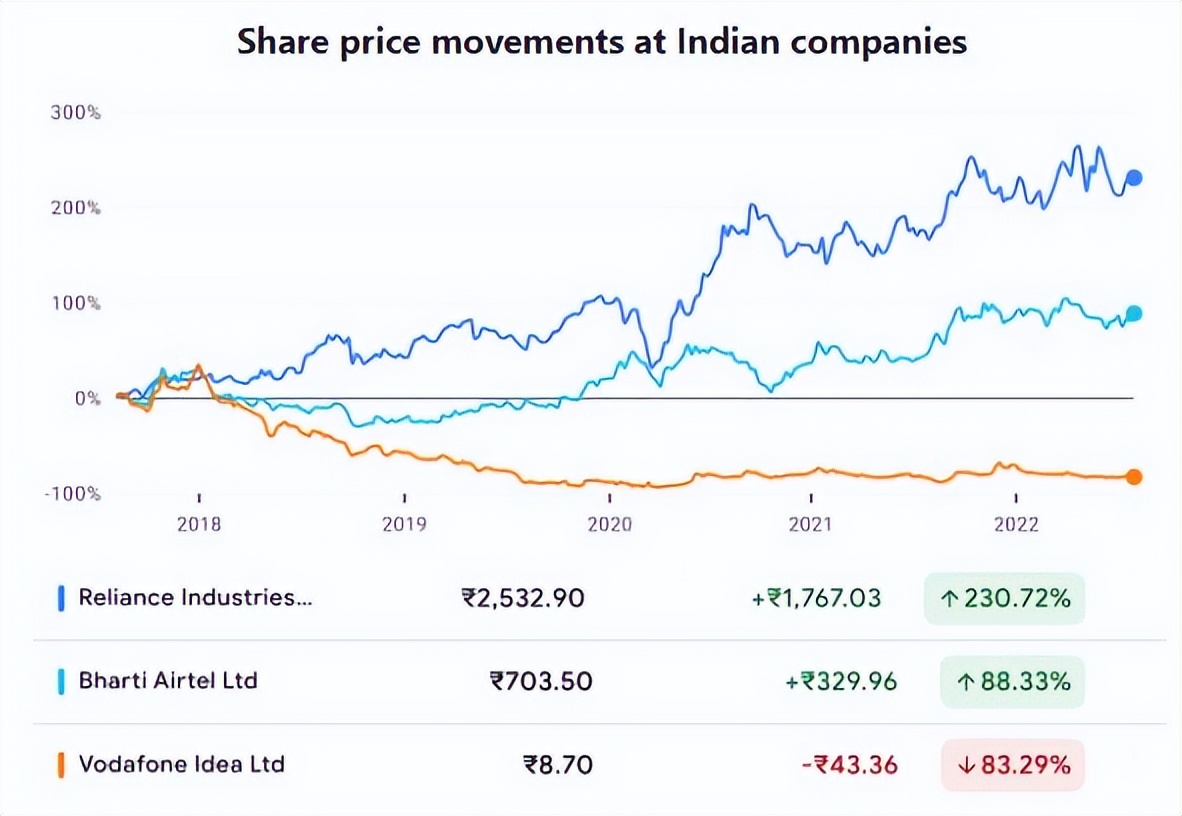

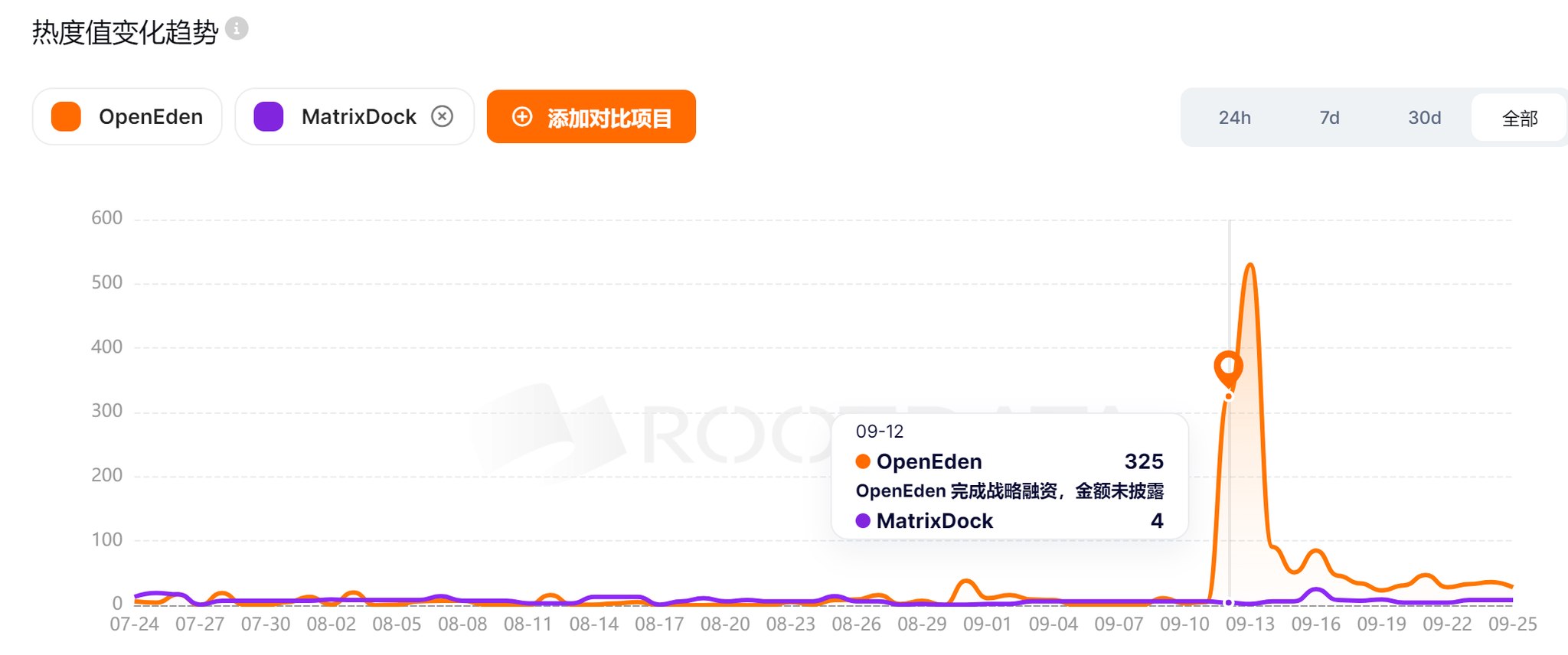

The poor performance of OpenEden in the first half of the year was largely due to competition from another RWA project based in Singapore: MatrixDock.

MatrixDock is an RWA protocol under MatrixPort, a crypto asset management platform founded by Wu Jihan, aimed at providing KYC-approved users with exposure to TBill risks, with its RWA token being $STBT.

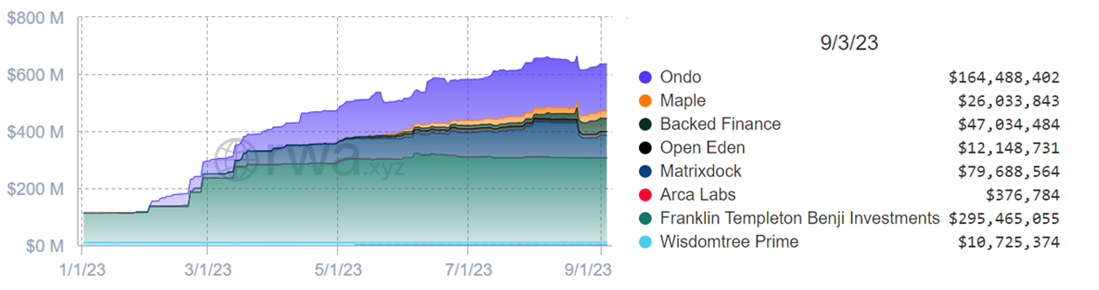

In September of last year, the RWA Treasury bond landscape was primarily composed of Franklin Templeton, Ondo, MatrixDock, Backed, Maple, and OpenEden.

At that time, $STBT had a TVL of about $80 million, peaking at $100 million, but now the positions of the two in the Treasury bond sector have effectively swapped. This may be partly due to OpenEden's active business expansion, resulting in an increase in TVL; on the other hand, it also benefited from consistent operations on Twitter, gaining a certain level of exposure and ultimately creating a snowball effect.

Currently, OpenEden is demonstrating strong development momentum in the market. Its tokenized U.S. Treasury bonds reached a peak TVL of over $150 million, ranking among the top five tokenized Treasury bond issuers globally. Although OpenEden's market share in the Treasury RWA market is relatively small at present, its growth rate is rapid.

Future Development Prospects of OpenEden

In the current trend of on-chain asset tokenization, OpenEden, with its focus on U.S. Treasury bonds and a series of advantages, shows tremendous development potential, such as:

- Launching tokenized U.S. Treasury bonds on the XRP ledger

- Institutional investment collaboration, with Ripple planning to establish a fund and invest $10 million in specific TBill tokens

- Partnering with Solayer to launch the tokenized U.S. Treasury stablecoin sUSD, providing investors with more investment options.

As the trend of on-chain asset tokenization continues to develop, OpenEden is expected to capture a larger share of the RWA market.

However, OpenEden also faces some challenges in its development process. Compared to its competitors, OpenEden has a relatively small market share and needs to continuously strive for innovation to enhance its competitiveness. Additionally, OpenEden must contend with regulatory uncertainties and risks brought about by technological innovations.

Having recently secured strategic investment from Binance (the amount has not been disclosed), its exposure and product positioning may propel OpenEden into a new stage of development.

Furthermore, when assessing OpenEden's future prospects, we can also refer to the successful experiences of Ondo Finance:

The Ondo Finance team has an outstanding TradiFi background, with members from renowned institutions such as Goldman Sachs and Merrill Lynch. Additionally, the protocol has a good relationship with BlackRock, possessing strong financial backing to support its TVL, combined with effective market-making operations after token issuance, making it the largest player in the RWA sector.

The OpenEden team also has a solid financial background and has now received support from Binance. Due to compliance reasons, many tokens cannot be issued in the Treasury bond market. If the OE team can resolve this issue and successfully issue tokens, it will become the second RWA token for Treasury bonds, making its future development prospects highly promising.

Creating content is not easy; if you need to reprint or quote, please contact the author for authorization or indicate the source. Thank you again for the support of our readers.

Written by: Cage / Mat / Darl / WolfDAO

Proofread by: Punko

Special thanks: Thanks to the above partners for their outstanding contributions to this issue's content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。