The main theme of this round has become quite clear:

1/ Memecoins and AI are the absolute main tracks

This year's Memecoins are significantly different from previous ones, having moved away from the concept of "speculating on dog coins." They correspond to the DeFi concept of 2020 and essentially represent a brand new asset issuance method. All infrastructure and services must rely on asset issuance, with the leftist route of asset issuance being Memecoins, and the right route being RWA and VCcoins.

The left route represents a global opportunity, while the right route is more about structural opportunities, such as the revival trend of DeFi, the evil axis of ENA + Sky + Morpho, and the noticeable business growth of older protocols like Curve and AAVE. Additionally, there are some structural opportunities in BTCfi, CeDefi, and Payfi.

Therefore, I still do not have a positive outlook on ETH. Currently, ETH can only support secondary narratives. Although Coinbase will greatly benefit from the main narrative, it seems more like various warlords each with their own agendas rather than a united front. One likely scenario is that ETH's exchange rate cannot keep up with BTC on the upside, cannot compete with Solana in the middle, and cannot outperform DeFi blue chips on the downside.

2/ The impact of Western policy narratives has only played a small part

During the election phase, the narratives of Trump and Musk have already shown great potential. There are two bigger events coming up: ① official inauguration ② replacement of the SEC chairman. Meanwhile, ETH and MSTR have taken over the tasks of the previous cycle's Grayscale, and more enterprises and sovereign nations will begin to allocate, which will only be larger than in 2020.

The Western bull market continues.

With the combination of the above internal and external factors, the importance of ecosystems has become very clear. For ecosystems that already have strong or secondary consensus, I won't elaborate further, but I will mention two ecosystems that are still receiving very low attention:

3/ Bittensor Ecosystem

I recommend Vitlik's recent interview, which has nothing to do with ETH but contains some interesting viewpoints, including thoughts on the authoritarian monopoly of AI and the future of AI symbiosis. The big Beta in the Memecoin space is undoubtedly ACT, and the Beta answer in the Alts sector is also very clear: Crypto AI can only be deAI or Fair AI, so Bittensor > Worldcoin.

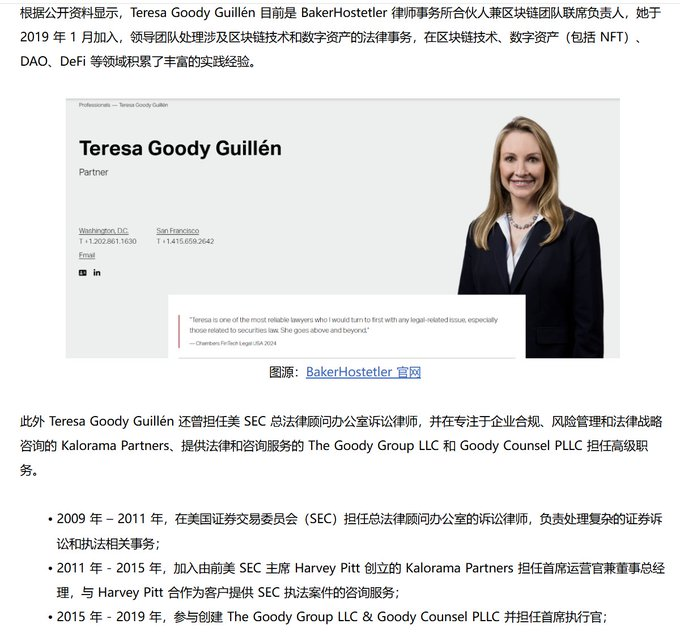

It's worth mentioning that last week, media reports revealed that the most likely candidate for the new SEC chair is Teresa Goody Guillén, a partner at BakerHostetler law firm and co-head of the blockchain team, who is also the legal partner for Bittensor's first subnet, Masa. Since the news broke a week ago, despite BTC's pullback, $MASA has still risen by about 30%.

4/ Near Ecosystem

As the saying goes, "Those who are quick get the meat, while those who are too late get the scraps." Near falls into this category. Earlier this year, when Solana Memecoins were just gaining popularity, Near's Memecoins quickly followed suit, producing two projects: Black Dragon and One Dragon. Near's founder @ilblackdragon also participated in NVIDIA's AI conference.

However, for a while, Memecoins and AI were lukewarm. Now, the wind of Memecoins and AI has finally picked up, reaching Solana, Base, SUI, and BNBChain, but Near players have been left behind.

The good news is that there is a mystical theorem: from DeFi to X2E, then to NFTs and inscriptions, Near always manages to catch the last train and get the last bite of something warm, while other public chains that are later than Near miss out entirely. Near is the type that, while it eats, it also arrives, and it tends to create events with a broader vision. I just checked, and the Memecoin with three meters of grass on its grave @dragonisnear and the inscription with five meters of grass @inscriptionneat still have $7 million and very good exit liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。