Original Author: BitMEX

Welcome back to our periodic options strategy analysis. This week, we will explore a trading opportunity that takes advantage of the current 150% volatility in XRPUSD. Over the past two weeks, driven by a series of positive factors, the price of XRP has more than doubled.

In this article, we will analyze the reasons behind the high implied volatility of XRP and how to profit by selling options. In the current market environment, this strategy may be particularly effective!

Let's get started.

XRP's Surge

Two significant events have driven XRP to surge over 100% in just two weeks, creating a perfect storm: First, with Trump's election victory, the resignation of SEC Chairman Gensler signals a shift in the regulatory environment towards being more favorable for cryptocurrencies. This could have a positive impact on Ripple's legal proceedings.

Additionally, speculation about two major potential developments is intensifying: the launch of an XRP ETF and Ripple's IPO plans. These developments will increase institutional investor participation and adoption of XRP (considering the successful precedent of Bitcoin ETFs), while also providing Ripple with more funding needed for expansion.

The market's reaction to these developments has been very significant. At one point, XRP's trading volume on South Korea's largest exchange, Upbit, exceeded that of Bitcoin, while its open interest also reached an all-time high, indicating high institutional participation.

However, it is worth noting that XRP has historically been a range-bound asset. Despite the current bullish market sentiment, we expect this wave to gradually fade over the next few weeks, leading to a decrease in volatility and entering a consolidation phase. This pattern is consistent with XRP's historical trading behavior and makes the current high volatility environment particularly suitable for options strategies.

Consider Selling an ATM Straddle

The current market may provide options traders with a unique opportunity to sell an at-the-money straddle:

The implied volatility of over 150% is significantly higher than historical levels. Are the options overvalued?

Market sentiment seems overheated, suggesting that prices may stabilize or pull back in the short term.

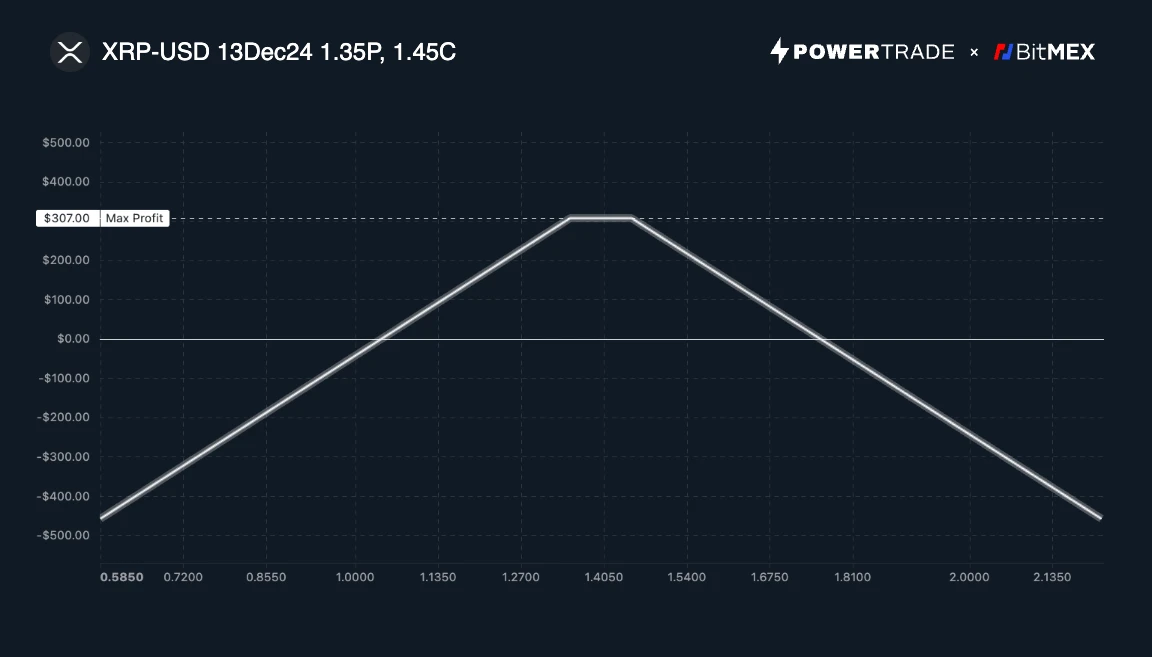

The high premiums on options provide an attractive risk-reward ratio. As long as XRPUSD remains within ±35% ($1.03 to $1.76) over the next 15 days, the trade will not incur a loss. The specifics are visualized below:

**Strategy Advantages:

**

Capitalize on the abnormally high volatility levels by collecting option premiums.

Particularly suitable for markets expected to enter a consolidation phase.

However, we need to be aware of the following important risks:

Trading Risks

The primary risk is the potential for unlimited losses.

Selling options requires margin.

Significant price movements in either direction can lead to rapid losses.

Stop-loss orders must be set to manage risk.

Timing and position management are crucial for optimizing risk-reward:

Enter the market when volatility peaks.

Use moderate leverage and maintain sufficient margin to cope with market fluctuations.

As long as risk management is in place, this strategy may yield substantial returns in the current high volatility environment.

Specific Action Plan

Trading Strategy:

Sell XRP put options with a strike price of $1.35 expiring on December 13.

Sell XRP call options with a strike price of $1.45 expiring on December 13.

Potential Returns: (Example with 1000 contracts)

Breakeven points: XRP price at expiration is $1.03 or $1.76.

Maximum profit: If XRP stays within the $1.35 to $1.45 range, a profit of $307 can be made.

Maximum loss: Significant price movements in either direction can lead to unlimited losses.

Scenario Analysis:

1. XRP Price Range-Bound: In this case, we will receive the full option premium as maximum profit. This is the best-case scenario for the trade, and as the expiration date approaches, profits will gradually be realized through time decay.

2. XRP Price Volatility: One option position will incur losses while the other approaches zero value. In this case, traders should consider timely stop-losses to effectively control risk exposure.

Key Risks:

1. Unlimited Loss Risk: Significant price fluctuations can lead to substantial losses. Stop-loss orders must be set.

2. Liquidity Risk: Compared to mainstream cryptocurrencies, the liquidity of the XRP options market may be lower, leading to slippage when closing positions.

Conclusion:

The currently extremely high implied volatility of XRP provides an opportunity for a straddle selling strategy. If you anticipate that prices will enter a consolidation phase soon, this strategy may be worth considering. However, strict risk management and appropriate stop-loss strategies are essential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。