Pump is the most active MEME trading and issuance platform on the Solana chain, generating daily revenues of thousands of SOL. Countless MEME coins are born, developed, and grow here, while many more memes also perish.

Normally, since Pump has been around for a while, there would be no need for further introduction. However, considering that many new friends and users entering the space are still unfamiliar with what this platform is and how to use it, this article will provide a detailed introduction and overview.

1. What exactly is Pump?

Pump, also known as Capsule, has a logo that resembles a pill. This project was launched in January 2024, primarily focusing on MEME on the Solana chain. Initially, it did not gain much traction, but a few months later, with the explosive growth of Solana, Pump rode this wave and its revenue once surpassed that of Uniswap.

In simple terms, Pump is a coin issuance and trading platform on the Solana chain. Developers or project teams can issue a meme on Pump and start trading it immediately. Additionally, Pump provides community and live streaming features. Users trading this meme can comment and discuss in the community. Developers can also communicate with users through live streaming, creating a positive meme atmosphere.

2. What are the differences between Pump's coin issuance and Solana's coin issuance?

The differences between memes created on Pump and standard Solana token issuances mainly focus on the following aspects:

Permission Differences: Coins issued on Pump have their permissions controlled by Pump and cannot be modified. In contrast, standard Solana token issuances have permissions held by individuals, who can choose to relinquish or utilize them.

Quantity Differences: The fixed quantity for PUMP issued coins is 1 billion. Standard Solana token creations can have a customizable quantity.

Internal and External Market Differences: Memes created on PUMP can initially only be traded on Pump's internal market. In contrast, coins issued on Solana can be directly listed on the Raydium external market. (Note: Internal market = Pump trading, External market = Raydium trading)

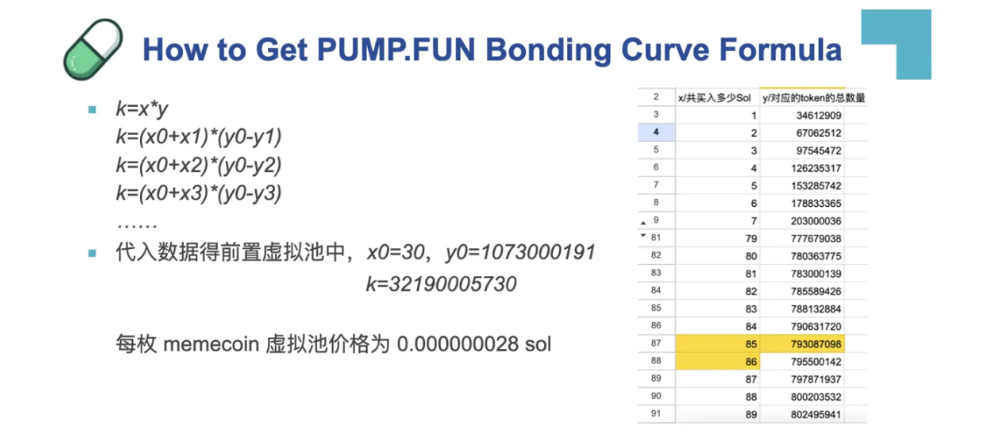

Liquidity Pool Differences: PUMP uses a joint curve model and a virtual liquidity pool, allowing project teams to start trading immediately without adding liquidity. Standard Solana token issuances require manual addition of liquidity to Raydium before trading can begin.

Holding Differences: Tokens created on PUMP will have all their initial tokens allocated to Pump's joint curve pool. The issuer or developer must purchase tokens to obtain holdings. In standard Solana token issuances, all tokens go directly to the issuance address.

3. Basic and Advanced Strategies for Pump

Let's first look at the basic strategies from the perspective of the official platform.

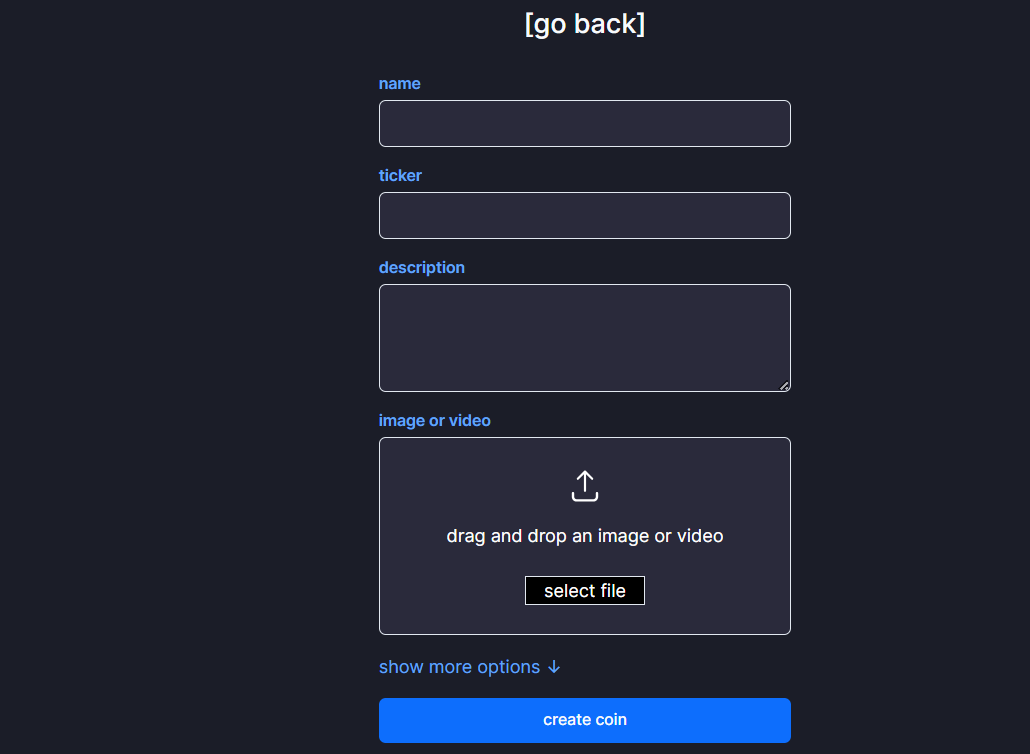

First, you need to have a Solana wallet account with 0.1 SOL. Then connect to Pump.fun and follow their operational process to create a token.

For developers (which is you), you can buy a certain amount when creating a meme. The specific amount to buy is entirely up to you. If you choose to buy, you will not have any holdings.

Once created successfully, the Pump platform will provide you with a token page where you can see the meme's name, logo, introduction, etc. You or users can trade, buy, and sell here, as well as comment and communicate.

This is the basic gameplay of Pump; now let's move on to advanced strategies.

Homepage Ranking: The homepage of Pump will continuously scroll through different memes, with recently completed transactions temporarily pinned at the top for greater exposure. If you want your token to consistently rank on the homepage, you need to continuously boost trading volume. This can be achieved through PandaTool's anti-squeeze volume feature.

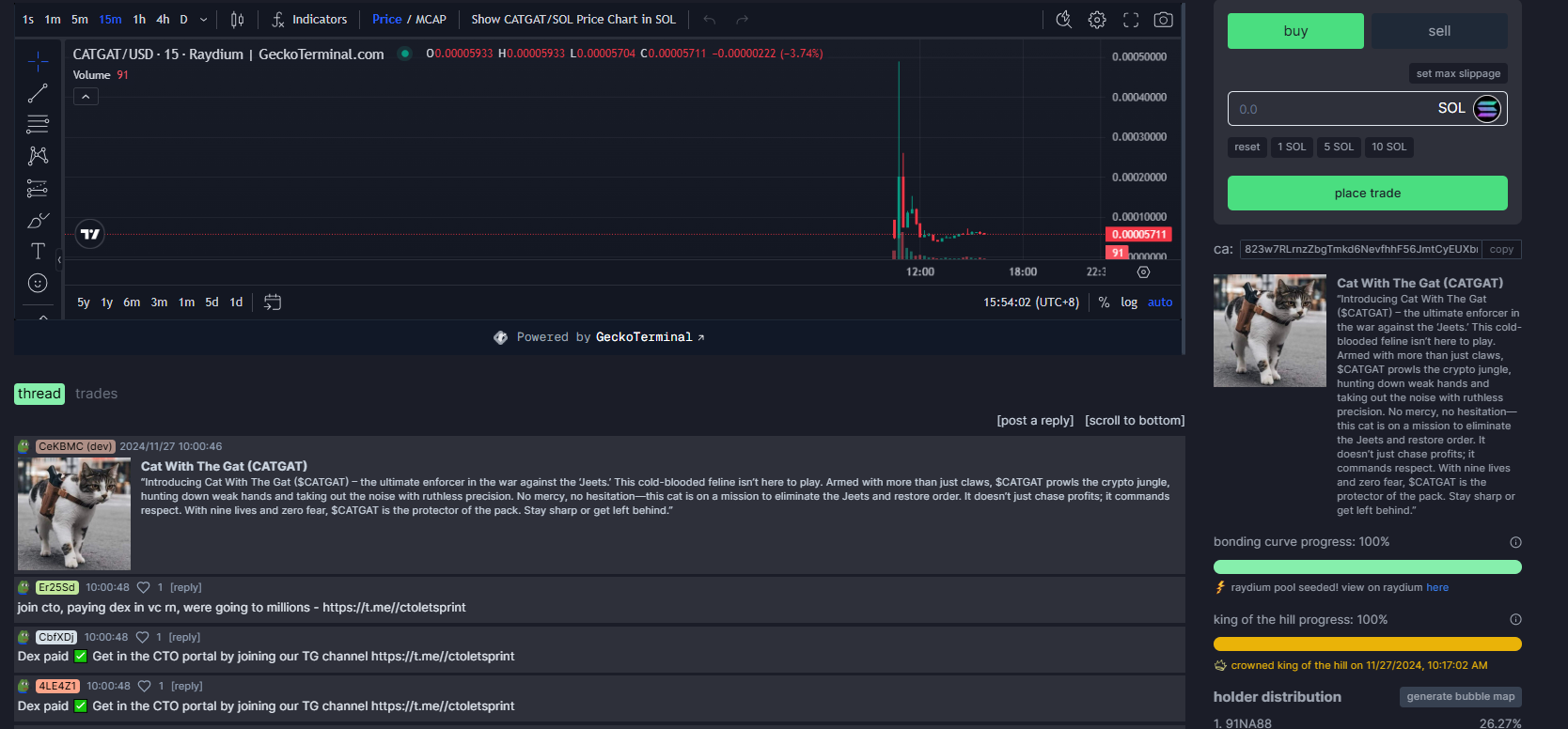

King of the Hill: At the top of the Pump homepage, there is a position called King of the Hill. When a token's market cap reaches approximately $30,000, it can dethrone the current king. Therefore, if you want your token to become the King of the Hill, you can use PandaTool's market cap management tool to quickly raise the price through pump tools.

Comments and Live Streaming: These two features essentially serve as community tools, guiding community atmosphere through comments and attracting more users through live streaming. However, these features are not easy to manage; the live streaming function has been temporarily disabled by Pump due to misuse by overseas users. The comment feature relies entirely on manual operation, as bot-generated comments can easily trigger risk control and be deleted.

4. Pump's Pricing Model and Fee Standards

The entire process of Pump is: coin issuance → trading → launch. All pricing models and fee standards revolve around this process.

Coin Issuance Stage: When issuing coins on Pump, the default quantity is 1 billion and cannot be modified. After successful issuance, Pump constructs a virtual pool for the coin using its joint curve model, adding 30 SOL to it. Note that this is virtual and does not involve any real SOL. Thus, your token's initial price is 0.000000028 SOL. (In fact, its initial price is calculated based on 30 SOL and 1,073,000,191 tokens; the calculation method is too complex to elaborate here.)

All tokens are treated equally, with 1 billion and 0.000000028 SOL, with no distinction. At this stage, you need to pay a creation fee ranging from 0.02 to 0.05 SOL. Of course, if you choose to bundle and buy, you will also need to pay a purchase fee. Pump will take 1% of this fee as a service charge.

- Your total cost will be: 0.05 creation fee + initial purchase amount + 1% service charge + miscellaneous gas fees

Trading Stage: The trading stage is complex, whether for personal trading or user trading, our ultimate goal is to increase the pool's SOL to 85, thus completing the listing.

Therefore, you or users will start a continuous buying and selling process, ultimately raising the pool's SOL to 85 and purchasing nearly 800 million tokens. At this point, the token price is 0.00000041 SOL, which is 14.64 times the initial price. During this process, Pump will charge a 1% service fee on each transaction amount, collected in SOL.

- Your total cost will be: trading losses + 1% service charge

Launch Stage: Once the pool reaches the standard, it enters the launch process. At this point, Pump will first take 6 SOL as the listing fee for Raydium and add the remaining SOL to Raydium to create liquidity, allowing external trading to begin.

Your total cost will be: none. The listing fee is covered by the pool, so you do not have a direct out-of-pocket expense.

It is worth noting that once the Raydium launch is successful, the LP will be directly destroyed and cannot be withdrawn from the pool, ensuring the fairness of MEME.

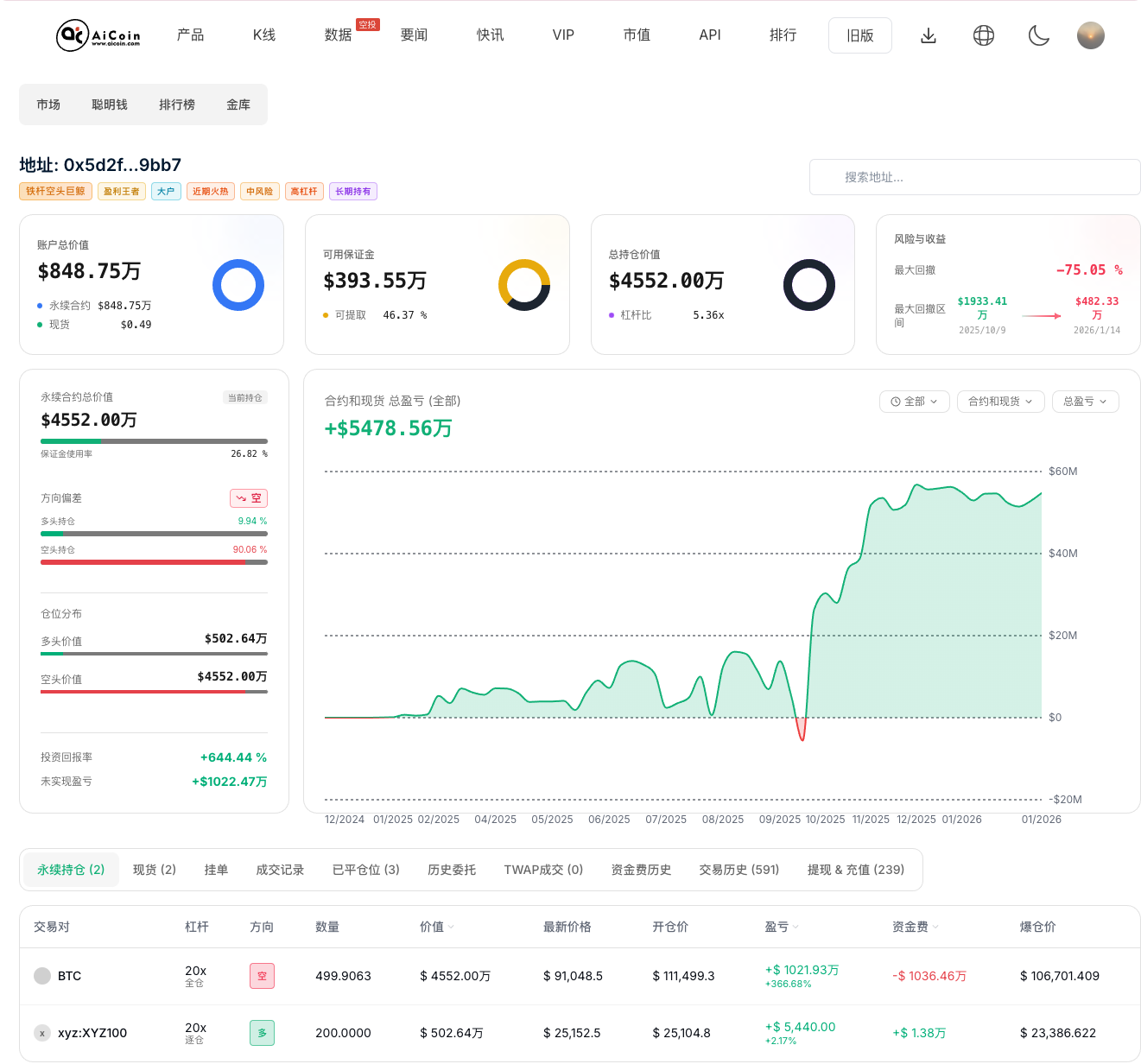

5. How to Better Navigate Pump?

After gaining a comprehensive understanding of Pump, as a developer or project team, how can we better participate in Pump? Or what methods can we use to navigate Pump more conveniently and efficiently? Let's discuss the three stages mentioned above:

Coin Issuance Stage: For normal Pump token creation, developers can purchase a certain amount from their wallets. If you want to hold more tokens or chips, you will need to use the PandaTool bundling tool to buy from 16 wallet addresses at once, which can be beneficial for later control.

Trading Stage: This mainly requires pump bots, dump bots, and the PandaTool volume boosting tool. Pumping and dumping are to manage the token's market cap for better operation and to prepare for external launch. Volume boosting helps your meme appear more frequently on the homepage for increased exposure. If you want to sell quickly, you can also use the Pump bundling selling tool.

Launch Stage: After the token is launched on Raydium, trading control and volume boosting are still necessary. PandaTool's market cap management bot supports Raydium trading, making it more convenient and efficient.

6. Technology Cannot Replace Stories

Although we have mentioned various tools and methods, these are merely small tricks and cannot be the key to success or failure. MEME needs a story and a group of people to spread that story. A good story, a few major KOLs promoting it, combined with tool assistance, can lead to success. Relying solely on stories without tools is not feasible, but having tools without a story cannot sustain success either.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。