Increasing TVL is a core goal for many DeFi projects and is also the most critical issue.

There are mainly four methods:

1. Token Issuance Expectations: Attracting liquidity through incentive activities.

This method is the most direct and has the highest return on investment. In the early stages, there is no need to spend real money; just providing users with future expectations is sufficient.

It's like pulling a wolf out of thin air.

There are two core groups in the crypto space: traders and yield farmers. These two groups correspond to the secondary market and the primary market, respectively.

Traders are secondary market users who make money through trading; yield farmers are primary market participants who contribute data to projects by participating early and receive airdrop shares when tokens are issued.

For projects that have not yet issued tokens, a very effective marketing strategy is to conduct various airdrop activities.

By providing early users with incentive rewards, they can be attracted to participate, with the expectation that points can be exchanged for the platform's tokens or other rewards. This method can attract users and build a community without substantial capital expenditure.

2. Collaborating with Other Projects: Achieving asset interoperability and liquidity through partnerships with different projects.

This method relies more on the project's background and channels, essentially being a resource exchange.

For example, users can use tokens from other projects as collateral or payment methods on your platform.

A typical example is Merlin and Solv. After issuing tokens, the Bitcoin L2 Merlin collaborated with the Bitcoin staking protocol Solv to retain liquidity within its ecosystem, leading Solv to become the largest Bitcoin staking protocol.

Of course, Solv currently only supports Merlin as the Bitcoin L2, so liquidity remains with Merlin, which is the cost Solv incurs, ultimately resulting in a win-win situation.

3. Yield Incentives: A typical approach is liquidity mining, establishing liquidity pools, and attracting users to add assets to the liquidity pool through transaction fee rewards.

This is a very popular incentive mechanism where users provide liquidity to designated pools and receive rewards. This method can quickly increase TVL.

This approach requires a well-designed reward mechanism to avoid inflation caused by excessively high rewards, while also paying attention to risk management.

4. Creating More New Assets: Liquidity staking and liquidity re-staking are ways to create new assets, thereby attracting incremental funds.

Issuing new assets is not just to release the liquidity of already staked assets; more importantly, it can attract incremental funds. By creating new financial instruments, such as stETH (staked ETH certificates), it not only improves the liquidity of already staked assets but also creates new investment opportunities, attracting more capital.

Of course, the risk is the accumulation of risks brought about by layers of complexity.

If one link's token fails, then the associated assets and applications upstream and downstream will also encounter problems.

For example, if stETH fails, not only will the stability of the upstream Ethereum PoS mechanism be significantly affected, but also various re-staking protocols downstream that accept stETH assets, such as Eigenlayer, will face risks.

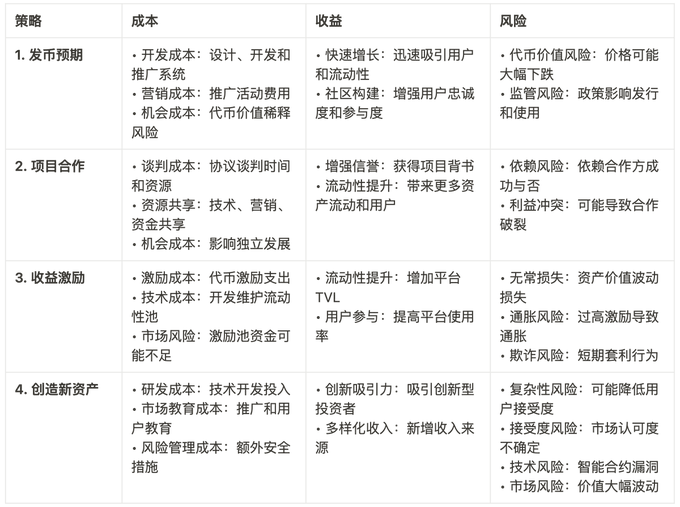

In summary, the costs, benefits, and risks of the four methods are listed as follows:

If we must prioritize the four methods from the project's perspective to maximize capital efficiency, the order is as follows:

Token issuance expectations first: low cost, high return;

Project collaboration second: low cost, just resource exchange;

Yield incentives third: higher cost, requires real money to share platform profits;

Creating new assets fourth: highest cost, requires maintaining the liquidity of new assets;

However, this prioritization is based on the assumption that the project aims to quickly establish market position and attract users while managing risks and maintaining effective resource utilization.

In practice, project teams need to adjust these priorities based on their resources, market conditions, and specific business goals.

Additionally, these methods are not mutually exclusive; project teams can combine these strategies based on the needs of different stages and market feedback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。