The focus of MicroStrategy is to initiate a positive flywheel effect, making Bitcoin and MicroStrategy's market value a perpetual motion machine for growth. Delving into the details can further uncover the intricacies of this model.

Written by: WOO

Background: Up nearly 500% this year, outperforming Bitcoin

It is well known that MicroStrategy's CEO Michael Saylor is a fervent believer in Bitcoin, continuously accumulating coins regardless of bull or bear markets. Following Trump's election victory, Bitcoin surged, approaching the $100,000 mark, while MicroStrategy, holding 386,000 Bitcoins, saw its stock price rise significantly, increasing by about 500% this year, outperforming Bitcoin by 121%.

How does MicroStrategy's strategy work? Can MicroStrategy continue to rise? Is it a leveraged version of Bitcoin or the next Luna? Let's take a look with WOO X Research!

What strategy does MicroStrategy use to purchase Bitcoin?

Currently, most people's impression of MicroStrategy is limited to its Bitcoin purchases. In fact, MicroStrategy is a technology company founded in 1989, primarily providing data analytics solutions to help businesses with data analysis and decision-making.

In August 2020, CEO Michael Saylor recognized the value of Bitcoin, viewing it as a scarce digital asset with long-term appreciation potential that could combat inflation and preserve value. This led to the conversion of the company's $250 million reserves into Bitcoin, marking the beginning of MicroStrategy's aggressive accumulation.

As of November 2024, MicroStrategy holds approximately 386,700 Bitcoins, accounting for 1.8% of the total global Bitcoin supply.

How did they achieve this?

- MicroStrategy issues debt to purchase Bitcoin:

- The company raises funds by issuing bonds (such as convertible bonds) and then uses these funds to buy Bitcoin.

- This is the starting point of the strategy, leveraging to increase Bitcoin holdings.

- Bitcoin price rises, MicroStrategy's market value increases:

- As the price of Bitcoin rises, the value of MicroStrategy's assets (the large amount of Bitcoin held) also increases, driving the company's stock market capitalization growth.

- Market value increases, raising the stock's weight in indices:

- The growth in market capitalization increases the weight of MicroStrategy's stock in financial indices (such as S&P 500, NASDAQ, etc.).

- More index funds need to allocate MicroStrategy stock, further driving up the stock price.

- MicroStrategy issues stock to purchase Bitcoin:

- After the market value rises, MicroStrategy takes advantage of the demand for its stock, issuing new shares at a premium, selling them, and purchasing Bitcoin.

- Bitcoin price rises, further boosting market value:

- Newly purchased Bitcoin appreciates in value, further increasing the company's asset value and market capitalization.

- The growth in market capitalization again enhances the stock's attractiveness in the market.

- MicroStrategy issues stock again, repeating the cycle:

- MicroStrategy leverages the increase in stock market value to repeat a new round of stock issuance and Bitcoin purchases, creating a "flywheel effect."

The key for MicroStrategy is to initiate a positive flywheel cycle, making Bitcoin and MicroStrategy's market value a perpetual motion machine for growth, with deeper exploration revealing the model's intricacies.

Currently, MicroStrategy has five convertible bonds in the market, with a principal value of $4.25 billion, maturing between 2027 and 2032, representing medium to long-term debt, and most are zero-coupon bonds, meaning the principal does not need to be repaid before maturity, which also reduces MicroStrategy's default risk.

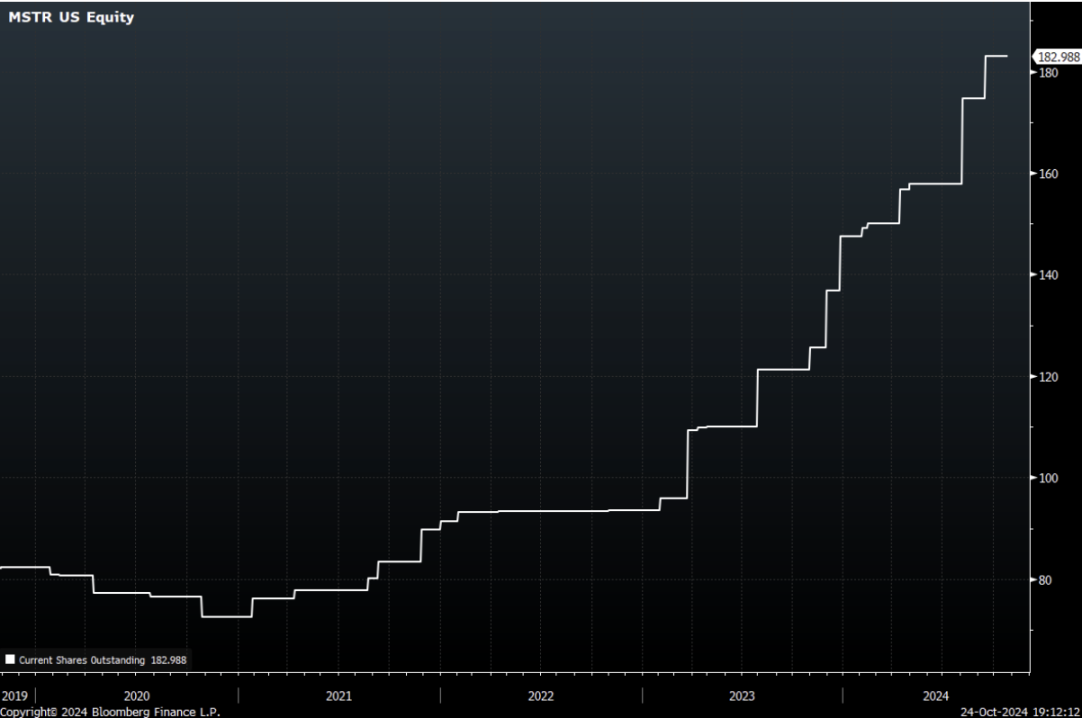

In terms of stock issuance, since the launch of the Bitcoin strategy, MicroStrategy has announced five stock issuances, raising as much as $4.4 billion in funds.

Source: Bloomberg

Will MicroStrategy be liquidated if the coin price drops?

On November 21, the well-known short-selling firm Citron stated: "While Citron remains optimistic about Bitcoin, we have hedged by shorting MSTR. We have great respect for Saylor, but even he must know that MSTR is overheated."

So, is Citron's concern justified?

The design model of the asset flywheel inevitably reminds one of Luna/UST, which relied on two assets stepping on each other to drive prices up rapidly. It raises concerns about whether a price drop in one asset could trigger a cascading liquidation effect.

However, MicroStrategy's model is quite different from Luna:

Low debt ratio: Currently, MicroStrategy's market value is about $75 billion, with bonds totaling $4.25 billion, making the overall debt a low proportion of the company's financial structure, with maturities between 2027 and 2032.

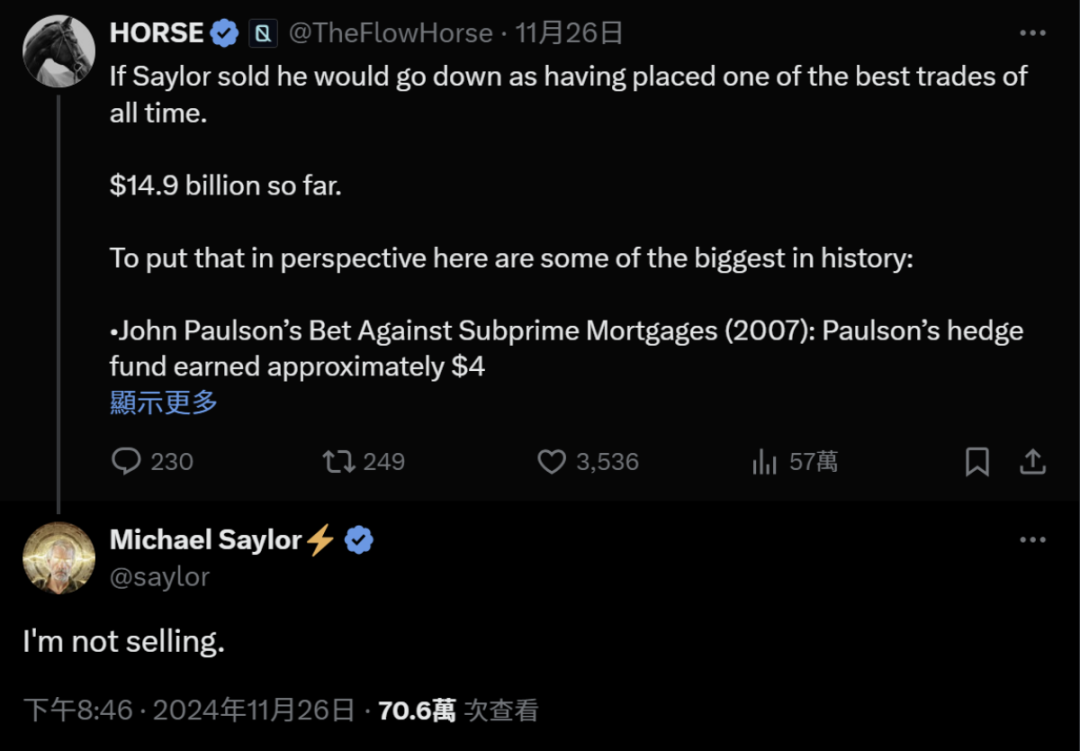

- No intention to sell Bitcoin: Well-known KOL @TheFlowHorse recently stated that if Michael Saylor sells Bitcoin, it would be the best trade ever. Michael Saylor replied that he would not sell Bitcoin.

- Such a commitment also ensures that MicroStrategy's "premium stock issuance" strategy can continue.

- Premium returns to 2021 levels: As seen in the chart below, MicroStrategy maintained a premium status even during the 2022 bear market and did not fall below.

The current green line is rapidly rising, indicating a rebuilding of market confidence in MicroStrategy's Bitcoin strategy, returning to levels seen during the 2021 bull market.

Source: CryptoQuant

The likelihood of MicroStrategy being forced to sell and triggering a cascading effect in stocks and coins if Bitcoin crashes is very low; the leverage is not as exaggerated as imagined.

Conclusion: MicroStrategy's success story sparks a trend of Web 2 companies accumulating BTC

The success of MicroStrategy's Bitcoin reserve strategy has led to imitation by other companies, including:

- RUMBLE: A video sharing platform that announced the purchase of up to $20 million in Bitcoin as reserves.

- Interactive Strength: A fitness equipment company that announced the purchase of $5 million in Bitcoin as reserves.

- Hoth Therapeutics: A biopharmaceutical company that announced the purchase of $1 million in Bitcoin as reserves.

There are countless other examples, with more and more companies (small caps) wanting to follow MicroStrategy's successful Bitcoin reserve model, but most are short-term gimmicks. Firstly, the success of the strategy is partly built on capital intensity, and secondly, small companies using this strategy often face skepticism from investors and regulatory scrutiny.

Nevertheless, Bitcoin will undoubtedly be the biggest winner.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。