The logic of MSTR is somewhat similar to a Ponzi scheme, but in the long run, it makes strategic sense for large American capital to hoard BTC.

Written by: Uncle Jian

MSTR (MicroStrategy) has risen from $69 at the beginning of the year to a peak of $543 last week, far outpacing Bitcoin! What impresses me is that while BTC was being dragged down due to election-related corrections, MSTR continued to soar. This made me rethink its investment logic: it is not just riding the BTC concept but has its own gameplay and logic.

MSTR's Core Gameplay: Issuing Convertible Bonds to Buy BTC

MSTR originally focused on BI (Business Intelligence reporting systems), but that industry is now in decline. Its core strategy now is to raise funds by issuing convertible bonds, buying large amounts of BTC, and making it a significant part of the company's assets.

1. What are convertible bonds?

In simple terms, a company raises funds by issuing bonds, and investors can choose to receive the principal and interest at maturity or convert the bonds into the company's stock at a predetermined price.

If the stock price rises significantly, investors will choose to convert to stock, diluting the shares.

If the stock price does not rise, investors will choose to take back the principal and interest, and the company will need to pay a certain cost of funds.

2. MSTR's Operational Logic:

Use the money raised from issuing convertible bonds to buy BTC.

In this way, MSTR's BTC holdings continue to increase, and the BTC value per share is also growing.

For example: According to data from early 2024, the BTC corresponding to every 100 shares increased from 0.091 to 0.107, and by November 16, it had risen to 0.12.

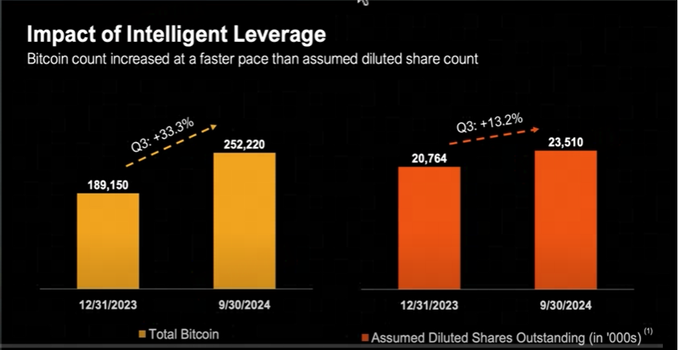

Understanding this with the chart below will be clearer: The relationship between the BTC acquired through convertible bonds and the diluted shares in the first three quarters of 2024.

In the first three quarters of 2024, MSTR increased its BTC holdings from 189,000 to 252,000 (a 33.3% increase) through convertible bonds, while the total number of shares was only diluted by 13.2%.

The BTC corresponding to every 100 shares rose from 0.091 to 0.107, gradually increasing the equity in BTC holdings. Calculating at the beginning of the year: 100 shares of MSTR stock priced at ($69) $6900, 0.091 BTC (priced at $42,000) valued at $3822, which seems quite unprofitable compared to directly buying BTC (-45%). However, according to this growth model, through continuous bond issuance, the amount of BTC held per share will keep increasing.

3. Latest Data:

On November 16, MSTR announced the acquisition of 51,780 BTC for $4.6 billion, bringing its total holdings to 331,200 BTC. Following this trend, the BTC value corresponding to every 100 shares is now close to 0.12. From a coin-based perspective, MSTR shareholders' BTC "equity" is continuously increasing.

MSTR is the "Golden Shovel" of BTC

From a model perspective, MSTR's gameplay is similar to using Wall Street leverage to mine BTC:

Continuously issuing bonds to buy BTC, increasing the BTC holdings per share through share dilution;

For investors, buying MSTR shares is equivalent to indirectly holding BTC, while also enjoying leveraged gains from the stock price increase due to BTC rising.

At this point, I believe smart friends have already noticed that this gameplay is quite similar to a Ponzi scheme, using newly raised funds to subsidize the rights of old shareholders, continuing to drum up funds in rounds.

4. When will this model stop being sustainable?

Increased fundraising difficulty: If the stock price does not rise, subsequent issuance of convertible bonds will become difficult, making the model hard to sustain.

Excessive dilution: If the speed of issuing new shares exceeds the speed of increasing BTC holdings, shareholder equity may shrink.

Homogenization of the model: As more companies begin to imitate MSTR's model, its uniqueness may be lost after increased competition.

MSTR's Logic and Future Risks

Although MSTR's logic is somewhat similar to a Ponzi scheme, in the long run, it makes strategic sense for large American capital to hoard BTC. The total supply of Bitcoin is only 21 million, while the U.S. national strategic reserves may occupy 3 million. For large capital, "hoarding coins" is not just an investment behavior but a long-term strategic choice.

However, currently, the risk of MSTR outweighs the benefits, so everyone should operate cautiously!

If the BTC price corrects, MSTR's stock price may suffer a larger decline due to its leverage effect;

Whether it can continue to maintain a high growth model in the future depends on its fundraising ability and the competitive market environment.

Uncle's Reflection and Cognitive Upgrade

In 2020, when MSTR first hoarded BTC, I remember Bitcoin rebounding from $3,000 to $5,000. I thought it was too expensive and didn't buy, while MSTR bought a large amount at $10,000. At that time, I thought they were foolish, but BTC eventually soared to $20,000, and the fool turned out to be me. Missing out on MSTR made me realize that the operational logic and cognitive depth of American capital giants are worth learning from. Although MSTR's model is simple, it represents a strong belief in the long-term value of BTC. Missing out is not scary; what matters is to learn from it and upgrade one's understanding.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。