Author | Dan Morehead, Founder of Pantera

Translation | Wu Says Blockchain

Original link:

https://panteracapital.com/blockchain-letter/1000x-pantera-bitcoin-fund/

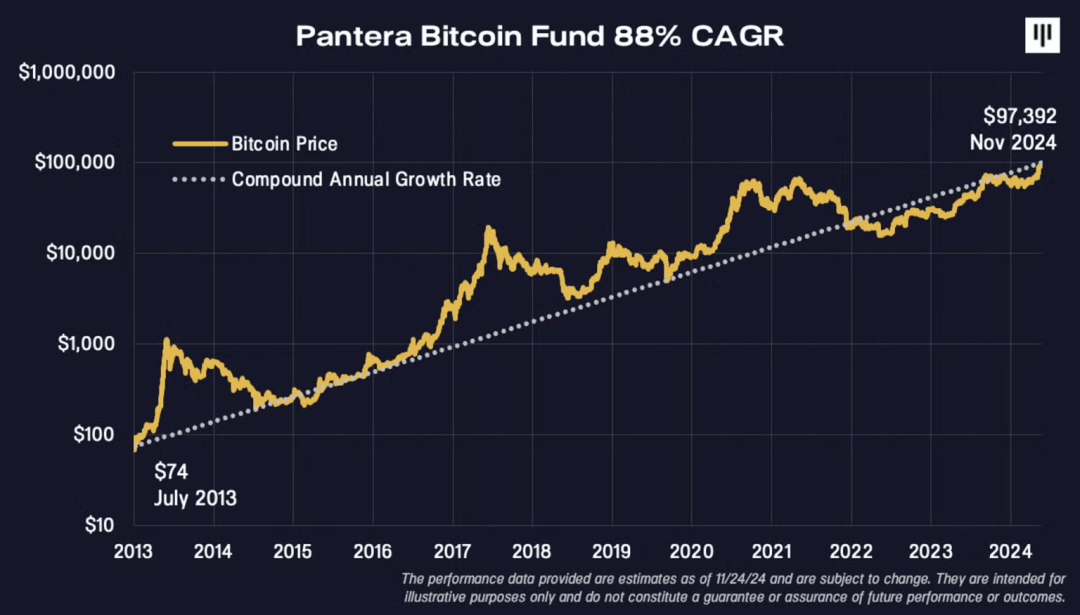

The post-election surge has further increased the fund by 30%. The fund's total return has now reached 131,165% (net of fees and expenses).

I want to share the initial logic—because it remains very compelling to me even today.

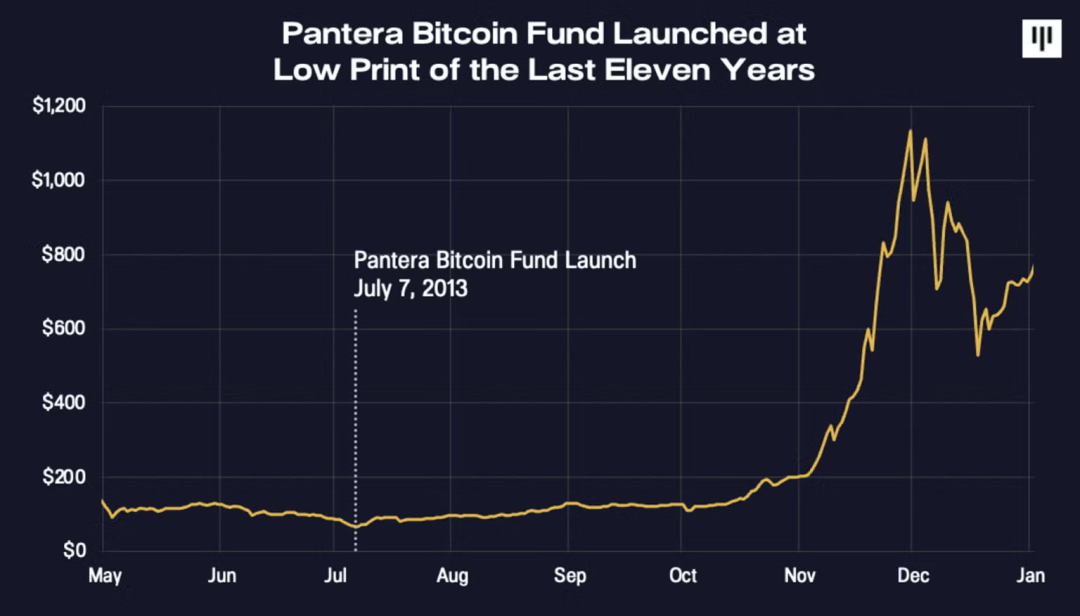

The day we chose to launch the Pantera Bitcoin Fund was actually the lowest point in the past eleven years.

That initial investment memo still reads clearly today.

From 2013 to 2015, we purchased 2% of the world's Bitcoin.

Note: If Pantera bought 2% of the world's Bitcoin from 2013 to 2015, it would be approximately 280,000 Bitcoins. In comparison, as of November 24, 2024, MicroStrategy holds 386,700 Bitcoins.

Even after eleven years, Bitcoin continues to be squeezed upward like a watermelon seed.

Frankly, I can't help but think that we still have many years of very attractive returns ahead.

Gold in 1000 BC

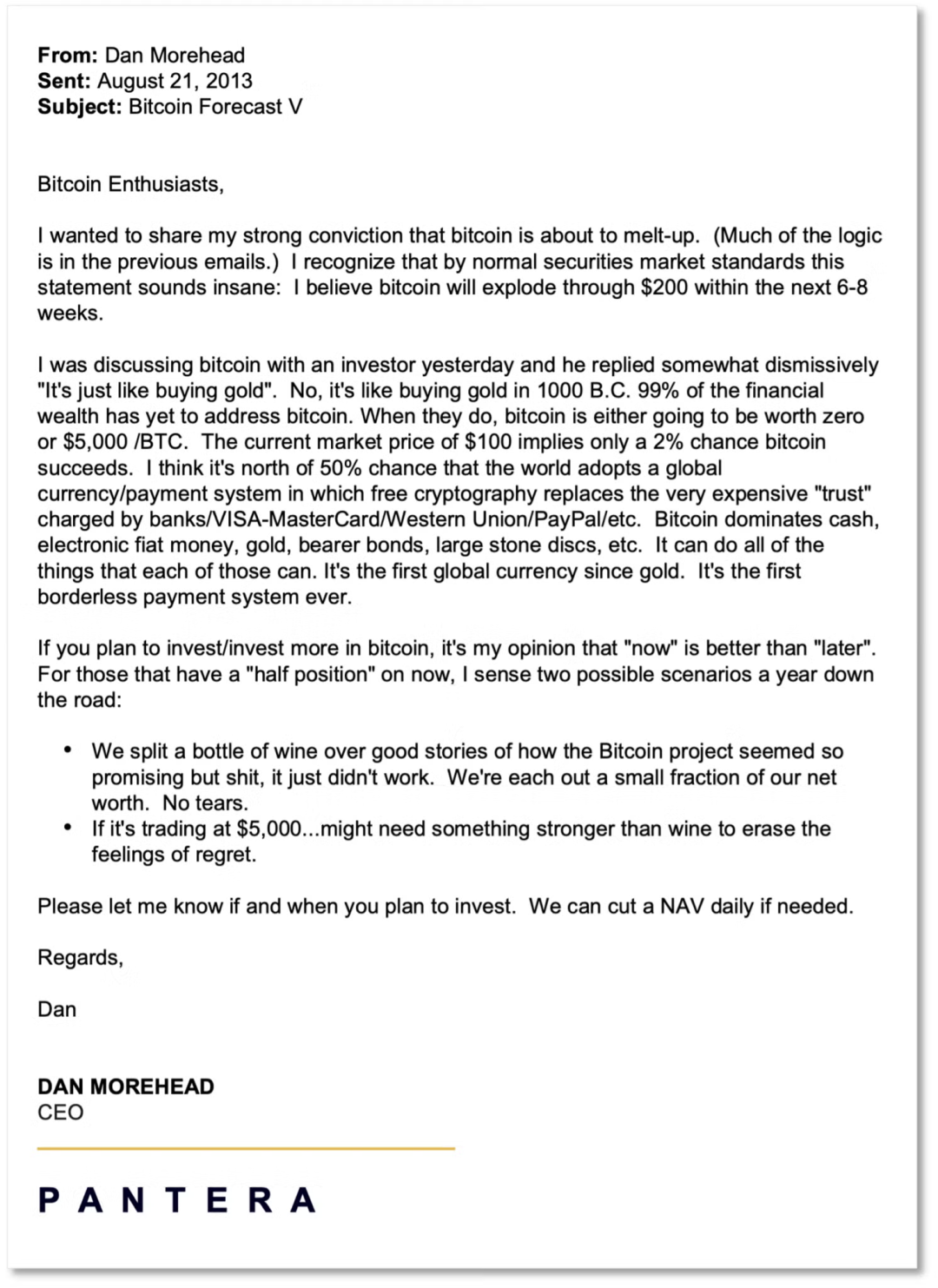

My core point was written down a month later:

“Yesterday, when discussing Bitcoin with an investor, he somewhat disdainfully responded, ‘It's like buying gold.’ No, no, it's like buying gold in 1000 BC. 99% of financial wealth has yet to touch Bitcoin. When they start to participate, Bitcoin will either become worthless or [rise to an order of magnitude].”

As an industry, we have made some progress. Now, only “about” 95% of financial wealth has yet to be fully allocated.

The catalyst for changing from 5% in 2024 to a higher proportion has just occurred: regulatory clarity in the U.S. Large institutional managers like BlackRock and Fidelity now provide extremely cheap and efficient Bitcoin investment channels for anyone with a brokerage account. This new convenience will ultimately allow tens of millions of investors and individuals to access this important new asset class.

We believe the entire industry will greatly benefit from the first pro-blockchain U.S. president taking office. In our view, the success of blockchain aligns with the nation's best interests, and we believe that everyone in Congress will eventually take a neutral or supportive stance on blockchain—this trend has already begun. The 15 years of regulatory headwinds for blockchain are turning into tailwinds.

I still fervently believe in the viewpoint I wrote down eleven years ago:

“I believe the probability of global adoption of a global currency/payment system is over 50%, in which free cryptographic technology replaces the high ‘trust’ fees charged by banks, Visa-MasterCard, Western Union, PayPal, etc. Bitcoin replaces cash, electronic fiat currency, gold, bearer bonds, large stone discs, etc. It can do all these things. It is the first global currency since gold. It is the first borderless payment system in history.”

At that time, the price of Bitcoin was $104.

This is still how I feel. We are still in the early stages. 95% of financial wealth has yet to touch blockchain. They are just beginning this massive transformation. When they participate, Bitcoin could reach levels like $740,000/BTC.

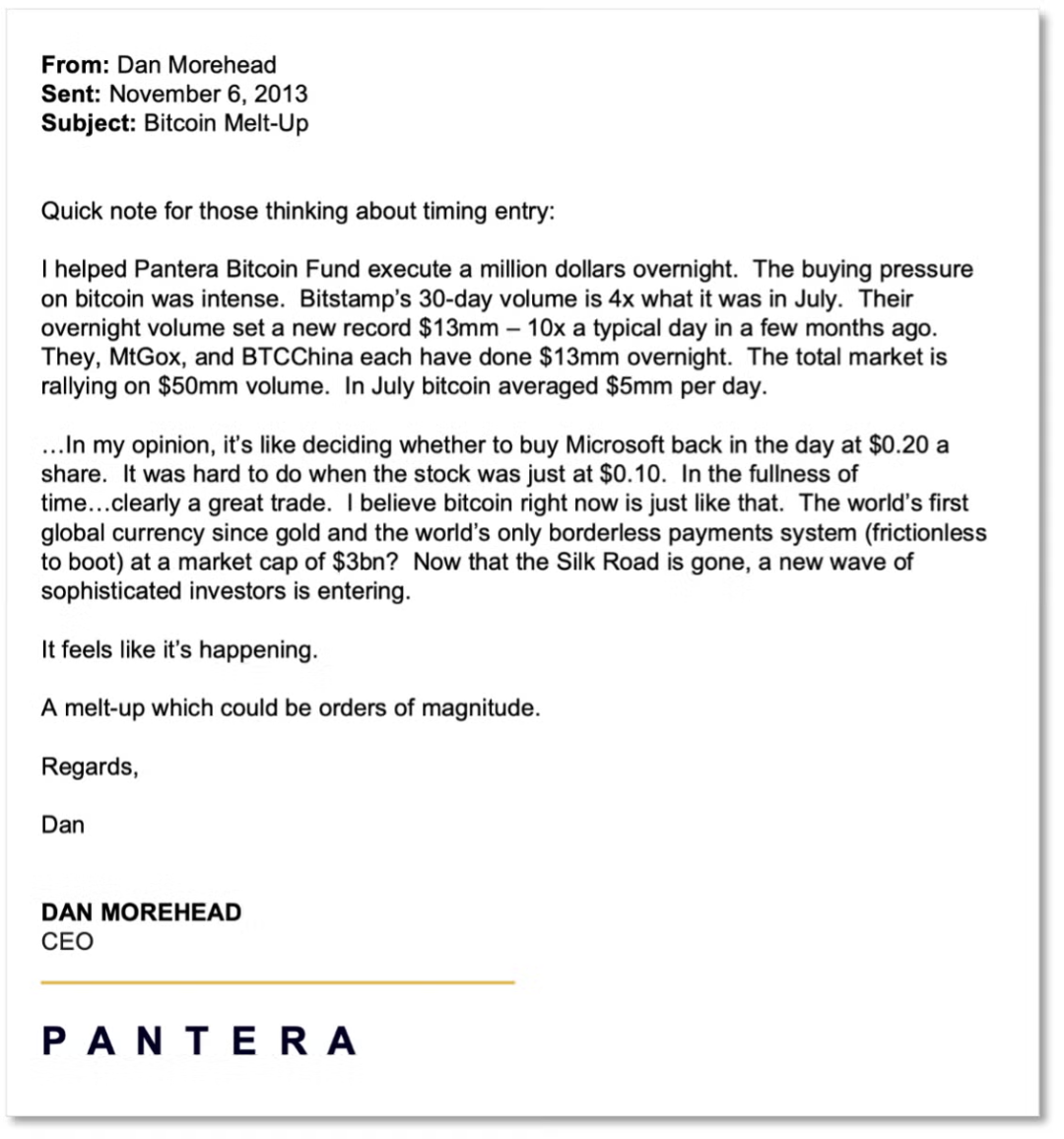

The market has indeed seen a rapid rise. It reached $1,000 in less than a month—and has now risen three orders of magnitude.

11-Year Compound Annual Growth Rate of 88%

I can imagine some investors thinking, “Bitcoin has doubled this year. Well, I probably missed it.” And then they give up.

No, this mindset is wrong. Bitcoin's average performance is nearly doubling every year. Since we launched the fund eleven years ago, its compound annual growth rate has been 88%.

Growth by Orders of Magnitude

Bitcoin has experienced growth by three orders of magnitude. Another order of magnitude of growth seems possible. If Bitcoin reaches $740,000/BTC, that would mean a market cap of $15 trillion. Compared to the total financial assets of $500 trillion, this number is not hard to imagine.

Although past performance may not predict future results, if this trend continues, Bitcoin could reach $740,000 by April 2028.

I think it may take a few more years, but I do believe this possibility exists.

This has always been my mindset: I won't bet my entire fortune, nor am I 100.00% certain that blockchain assets will grow, but when you multiply the likelihood of its rise by the magnitude it could increase or more—this result is far better than the expected returns of other investable assets. In my nearly forty years of investment career, the expected value of this trade is the most attractive I have ever seen.

Not Easy

It may seem obvious now, but it was very difficult at the time.

After the 87% crash that began in December 2013, Bitcoin gradually lost attention. The market did not recover for more than three years. By 2016, almost everyone had lost faith in Bitcoin. Investors showed no interest.

That year, I flew around the world, conducting 170 investor meetings. The end result of all this effort—we raised only $1 million.

The management fee for this fund was $17,241. That’s an average of $100 earned per meeting.

We Could Have Bought a Hotel!!!

I am naturally a loyal team player. I have always wanted the Bitcoin team to win. Over the years, we have tried to help this community as much as we can. So, when Expedia announced it would accept Bitcoin in 2014, we paid for all our travel expenses in Bitcoin.

In 2015, our team was on business trips for 59 nights—averaging 1.5 BTC per night, totaling 88 Bitcoins.

That amounts to $8,683,136 today!?!

We could have bought two hotels!

Amazing Growth of the Blockchain Industry

In 2013, when we were preparing to launch the Pantera Bitcoin Fund, I opened accounts at several exchanges and transferred funds to get ready. When I first walked into Wells Fargo from our office on Market Street in San Francisco to wire money to Ljubljana, Slovenia, I didn’t even know how to spell Ljubljana. Everything seemed very suspicious. So much so that the bank manager came over and questioned me for a long time, asking what I was doing.

But at that time, I wondered if I was going crazy. Another wire transfer was sent to a similarly suspicious small startup.

At that time, the price of Bitcoin was about $130. In the following days, I watched Bitcoin's price drop from $130 to below $100. Looking back, it’s funny that this “fear, uncertainty, and doubt” (FUD) is still a common phrase among skeptics in today’s Bitcoin bear market. Even in the face of all these issues, when it dropped to $65, I decided to go all in—launching the Pantera Bitcoin Fund. Thirty years of trading intuition told me that was where the opportunity lay.

I sent the email mentioned above to a small list of Bitcoin enthusiasts, probably only twenty people, saying, “I just want to get involved.”

I logged into a startup called Coinbase, trying to buy 30,000 Bitcoins. A pop-up appeared, indicating that the fund's daily limit was $50—not the “$500,000” Wall Street slang, but a real $50 bill featuring Ulysses S. Grant. I nearly had a heart attack.

Since it was a trendy startup with no address or phone number, I hurriedly sent an email—surprisingly titled entirely in capital letters: “I WANT TO BUY $2 MILLION WORTH OF BITCOIN!” Four days later, their only employee—a guy named Olaf—replied, “Okay, your limit is now $300.” Even with my expanded trading limit, completing this transaction would take 6,667 days.

At that rate, I would have to trade for 2,522 days!

Fortunately, I bought those Bitcoins on Bitstamp, and the industry gradually grew. Today, the cryptocurrency market has a daily trading volume of $130 billion. The development of the industry to this point is indeed astonishing.

Blockchain as an Asset Class

Sometimes I feel like a gorilla discovering a shiny object in the forest… picking it up… turning it around… curious about what it is…

Bitcoin!

I certainly don’t fully understand all the nuances of the incredible technological projects in this field, but I feel like I’ve seen a similar scene before.

I was the first asset-backed securities (ABS) trader at Goldman Sachs. Today, everyone views ABS as an asset class. I was involved in the creation of the GSCI (Goldman Sachs Commodity Index). Now, everyone sees commodities as an asset class. In the 90s, I invested in emerging markets. Today, emerging markets (EM) are viewed as an asset class.

Blockchain will be the same. I believe that in the near future, every investment firm will have a blockchain team and allocate a substantial and long-term investment to blockchain.

Asymmetric Trade

My global macro background is what initially drew me to blockchain. The asymmetry of this trade—operating in the largest market in the world—makes this opportunity far surpass the trades we have pursued globally in the past. I believe this is the most asymmetric trade I have ever seen.

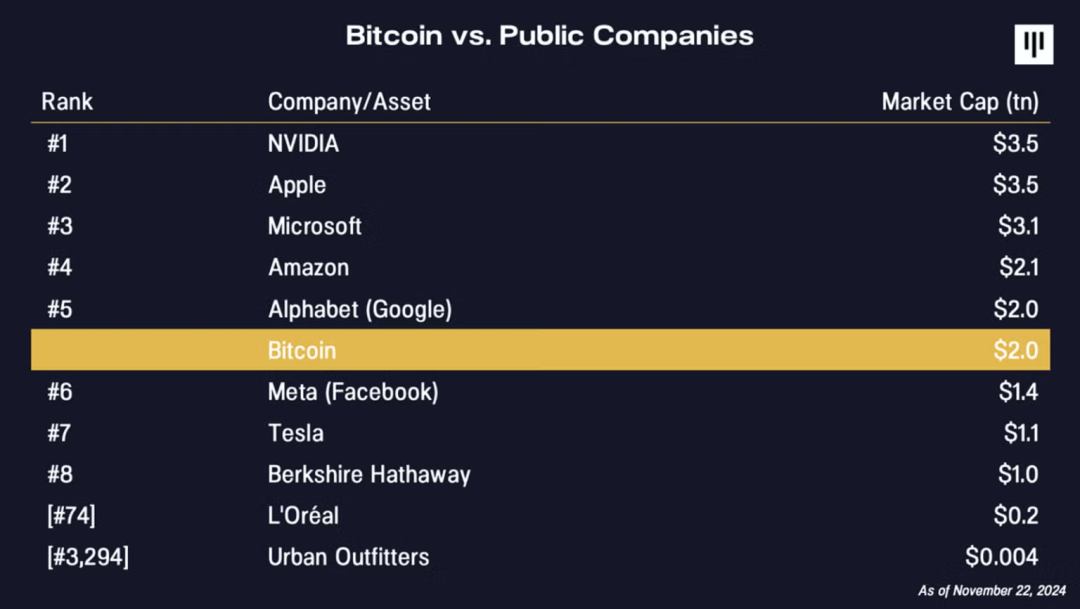

The best illustration of this theme comes from a comparison made at the second Pantera Blockchain Summit in March 2014:

“During a dinner before a late-night poker game, Morehead jokingly mentioned that the total value of all Bitcoin in the world at that time was roughly equivalent to that of Urban Outfitters, a company selling ripped jeans and dorm decor—about $5 billion. ‘Isn’t that crazy?’ Morehead said.

‘I think that when they dig up the remnants of our society like in Planet of the Apes, centuries from now, Bitcoin may have a greater impact on the world than Urban Outfitters.’”

—Nathaniel Popper, 2015, "Digital Gold"

When I updated this statement in November 2020, Bitcoin's market cap was comparable to that of L'Oréal. Waterproof mascara is undoubtedly an amazing invention, but I still believe Bitcoin has the asymmetry.

Digging deeper…

“At L'Oréal, our mission is to provide the best quality and accessible beauty products in skincare, makeup, haircare, and hair color to the masses.”

That's great. And Bitcoin's mission sounds surprisingly similar: to achieve the democratization of financial access.

I believe the democratization of finance will ultimately be more important.

Recently, Bitcoin has surpassed Meta (formerly Facebook). Photo sharing is indeed cool, but I believe that achieving financial inclusion for every person on Earth with a smartphone will be more meaningful.

Five more targets to surpass…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。