With Trump's election as President of the United States, his promise to replace the SEC chairman on his first day in office is set to be executed ahead of schedule. Last week, SEC Chairman Gary Gensler announced that he would step down on January 20, 2025, around the time of Trump's inauguration. Following this news, market sentiment in the crypto space improved, causing a surge of nearly 30% in "SEC securities coins" like XRP and ADA, which have long faced regulatory pressure from the SEC.

Seen as the Number One Opponent in the Crypto Space During His Tenure

Since taking office, Gary Gensler has adopted a strict regulatory stance towards the cryptocurrency industry. He has repeatedly emphasized that BTC is the only cryptocurrency with commodity characteristics, while other cryptocurrencies are largely viewed as securities. This position has drawn considerable controversy and criticism. During his tenure, Gensler took enforcement actions against multiple entities, including Coinbase, Kraken, Robinhood, OpenSea, Uniswap, and MetaMask, completing thousands of enforcement cases and collecting approximately $21 billion in fines, making him the number one opponent in the crypto space. Previously, attorneys general from 18 U.S. states even united to sue the SEC and its five commissioners, accusing the SEC, under Gensler's leadership, of unconstitutional overreach and unfair suppression of the cryptocurrency industry.

However, despite Gensler's tough stance on cryptocurrencies, he approved spot ETFs for Bitcoin and Ethereum during his tenure, which undoubtedly injected a boost into the development of crypto. This seemingly contradictory behavior is based on a common logic: integrating cryptocurrencies into the U.S. regulatory framework, which is also a key policy of the Biden administration.

Pressure on SEC Securities Coins Eases

Gensler's departure not only relieved many investors and crypto companies suffering from regulatory pressure but also brought hope to tokens significantly impacted by the SEC, most notably Ripple, the flagship "SEC securities coin."

As early as December 2020, the SEC began accusing Ripple of illegally issuing unregistered securities. Platforms like Coinbase and Robinhood even temporarily delisted XRP, causing its price to plummet. This marked the official start of the lawsuit between the SEC and Ripple, drawing widespread attention from the crypto market. The question of whether cryptocurrencies are considered securities and whether they fall under SEC regulation has been highly controversial, making the final ruling in this case significantly impactful for the entire cryptocurrency sector.

Every time news breaks, XRP experiences significant volatility, affecting the prices of other altcoins similarly accused by the SEC of being securities, such as ADA, MATIC, SOL, FIL, and dozens of other projects, creating a unique sector of "SEC securities coins."

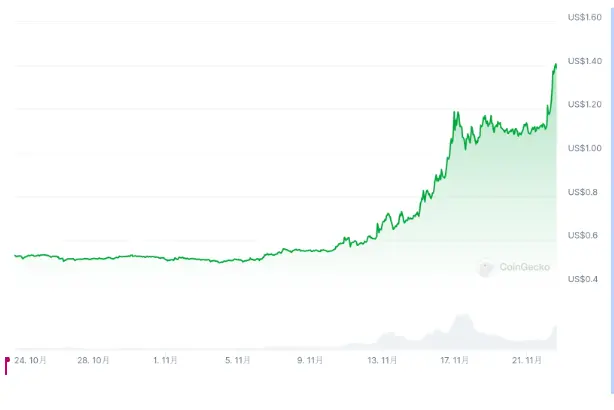

Now, with the SEC chairman's departure, Ripple, which has been embroiled in a lengthy lawsuit with the SEC, has transformed into a "SEC revenge" concept coin, experiencing a rebound. Other tokens that have long faced SEC regulatory pressure, such as ADA and SOL, have also seen similar increases.

Which Crypto Companies Targeted by the SEC May Benefit?

Currently, Trump has not officially announced his preferred candidate for the new SEC chairman, but several popular candidates are friendly towards cryptocurrencies and have publicly expressed support for them. Under a crypto-friendly policy, it is expected that SEC enforcement actions in the crypto space will significantly decrease, and some staff within the SEC who have taken aggressive enforcement actions may face layoffs.

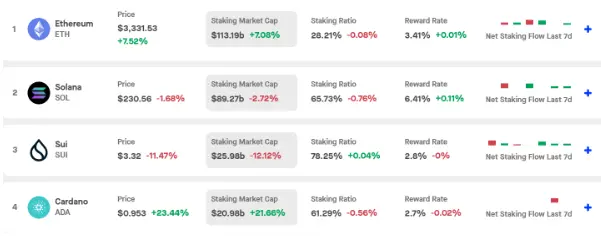

This means that "SEC securities coins" like Ripple, which were previously suppressed and sued by the SEC, may see their lawsuits soften, settle, or even be withdrawn. Additionally, projects that have refrained from issuing tokens or empowering tokens due to fear of the SEC may become the biggest direct beneficiaries. Furthermore, this could also promote Ethereum staking services, such as spot ETH ETFs providing staking rewards, thereby increasing the price of ETH. Here are a few representative projects that may directly benefit:

1. XRP: Regulatory Clouds Lift, Market Performance Anticipated

As an early public chain project, XRP's initial vision was to become the global CBDC settlement layer. However, due to competition and lawsuits, this solution has not been fully realized, and it is currently attempting to expand and transform its TOC business by supporting some sidechain projects to introduce smart contract functionality.

Due to its business positioning, XRP's market data performance has not been very strong. However, it has a large user base and fan following, as well as relatively advantageous background resources. XRP's historical accumulation and brand effect are its biggest highlights and leverage points, still holding considerable potential in a thriving industry ecosystem. This gives it a significant opportunity to easily leverage the market in the TOC aspect, improving its market performance. If XRP can achieve certain results in the TOC direction, it will greatly enhance the project's market value and TOB business, providing ample funds and space for the official expansion of TOB's cross-border settlement business.

This time, Gensler's resignation has led to XRP's rise being driven not just by sentiment but also as a reaction to multiple market expectations. First, XRP may be relisted on more exchanges, expanding its market liquidity, as seen with Robinhood relisting Ripple (XRP) on November 13. Second, Ripple's business operations will focus more on core technology rather than legal battles. Since the SEC filed a lawsuit against it, Ripple has been fully engaged in this legal fight. In the second half of 2023, Ripple's CEO stated that the company had paid over $200 million in legal fees.

Additionally, it is worth noting that several ETF issuers, including 21Shares and Bitwise, have already submitted applications to the SEC to launch an XRP spot ETF, further highlighting the market's positive expectations for XRP's future development.

2. ADA: Greater Elasticity Under Whale Effect

Cardano, a project born in 2017, has its native token ADA viewed as an innovative platform centered on technical robustness and academic-driven development, giving it a sense of "stability." It is relatively low-key but has immense potential, consistently ranking in the top ten of the cryptocurrency market capitalization leaderboard. As an established public chain, Cardano's current ecosystem performs relatively average compared to several well-known public chains on the market, leading many in the industry to view it as a "meme coin." The significant gap between its market value and project development is related to the centralization of the ADA token and whale control.

According to statistics from stakingrewards.com, Cardano (ADA) ranks fourth among cryptocurrencies in total value staked, with a total staking value of nearly $21 billion and a staking rate exceeding 61%. This indicates that ADA has undergone centralized lock-up, controlling the market circulation to some extent.

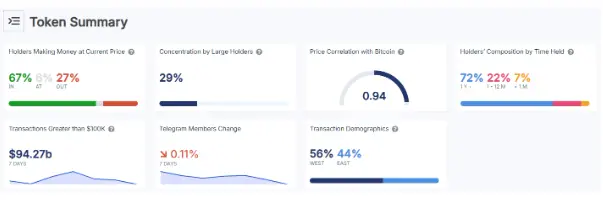

Moreover, data from blockchain analysis platform IntoTheBlock shows that 72% of ADA holding addresses have not transferred funds for over a year, and currently, as much as 67% of holders are in profit at the current market price, indicating that its investor base primarily consists of long-term holders. This "faith layer" provides stable support for ADA's price and reflects the market's optimistic expectations for its future growth.

From the data, nearly half of Cardano's circulating supply is controlled by about 400 addresses, which somewhat weakens market liquidity, making ADA's price more susceptible to large capital inflows. This also shows the confidence and interest of whales in the price increase of ADA.

ADA Holding Addresses

Currently, the crypto market remains strong, with rising investor risk appetite and noticeable sector rotation, leading to a rebound in altcoins. Although Cardano's ecosystem still needs improvement, as a well-known established public chain, its high staking rate and whale holding ratio provide greater elasticity and growth potential for its price.

3. Uniswap: Accelerated Empowerment

As the leader in DEX, Uniswap is one of the few projects in the crypto industry with sustainable high profitability. However, due to long-term regulatory pressure, the empowerment of the UNI token has remained unresolved. In February of this year, the Uniswap Foundation released a proposal regarding "initiating governance of the Uniswap protocol," suggesting that protocol fees be proportionally distributed to staked and delegated voting rights holders of UNI tokens. This news quickly sparked market enthusiasm, with UNI's price soaring from $7 to around $12 overnight. However, as of May, this fee distribution mechanism had not yet been implemented.

In April of this year, the SEC issued a warning to Uniswap Labs, planning to take enforcement action against it. This event negatively impacted market sentiment, and UNI's market performance became subdued. Until October of this year, Uniswap Labs announced plans to launch the Unichain, injecting new imaginative space into the Uniswap ecosystem and bringing the empowerment topic of the UNI token back into the market spotlight.

Now, with the SEC chairman's departure, the market shows a highly optimistic expectation for a more lenient future regulatory environment. In this context, the easing of regulatory pressure releases more potential for decentralized platforms and provides favorable conditions for the expansion of the Uniswap ecosystem, helping the UNI token gradually transform from a single governance token into a core asset with multiple functions, including governance, yield capture, and ecosystem empowerment. How this transformation will further empower UNI token holders through the fee distribution mechanism and the implementation of Unichain is worth the market's continued attention and anticipation.

4. Base: Increased Expectations for Token Issuance

Base, an Ethereum Layer 2 protocol incubated by Coinbase, has been under community scrutiny and anticipation for the issuance of its token since its official launch in August last year. At that time, Coinbase clearly stated that there were no plans to issue a token. The strategy of not issuing a token may have helped Coinbase avoid regulatory pitfalls under the pressure of the ongoing lawsuit with the SEC. In a recent inquiry from the community about the token issuance plan, Coinbase's Chief Legal Officer reiterated that there are no plans to issue a token but stated that issuing a token is a feasible option when regulations become clear in the future, and that Base does not rule out launching a token in the future.

It is worth noting that ConsenSys, the parent company of MetaMask, which is also under investigation by the SEC, was rumored earlier in the community to be canceling or postponing its token plans for the Layer 2 protocol Linea due to regulatory pressure, sparking market discussions. After Trump's victory, ConsenSys expressed an optimistic attitude towards token issuance in a more lenient regulatory environment and announced at the Devcon conference held in Bangkok that it would issue a token in Q1 of next year, indirectly fueling market expectations for Base's token issuance.

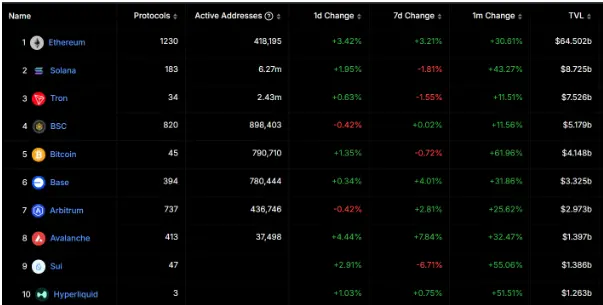

According to data from defillama, Base currently ranks 6th in total value locked (TVL) among DeFi protocols, with a total deposit amount of $3.3 billion, second only to ETH and BSC among EVM chains. With the easing of the regulatory environment and the continuous maturation of the Base chain ecosystem, whether to issue a token in the future and the specific design of the token will be the focus of market attention.

Currently, Trump's "cabinet formation" is basically complete, and several of his nominated ministers have expressed support for cryptocurrencies, indicating the significant political influence of cryptocurrencies in the United States. The market's optimistic sentiment regarding the future development of the crypto industry is also on the rise. 4E, as the official partner of the Argentine national team, supports spot and contract trading for over 200 crypto assets, including Bitcoin, Ethereum, SOL, XRP, and ADA, covering various sectors such as "SEC securities coins," memes, and DeFi, with high liquidity and low fees.

At the same time, 4E has integrated traditional financial assets into the platform, establishing a comprehensive one-stop trading system that covers everything from deposits to crypto assets, as well as U.S. stocks, indices, foreign exchange, and bulk gold, with over 600 different risk-level assets available for investment at any time with just USDT. Additionally, the 4E platform has set up a $100 million risk protection fund, adding another layer of security for users' funds. With 4E, investors can stay updated with market dynamics, flexibly adjust strategies and allocations, and seize every potential opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。