Author: Web3 Farmer Frank

On November 21, a piece of news was fixed on the official website of the U.S. SEC, and the crypto world cheered.

Gary Gensler may not have expected that he would rise and fall with crypto. Even though it would be normal for him to leave after 26 years, he still decided to step down on the day Biden resigned and Trump was inaugurated.

The merits and demerits of Gary Gensler's tenure will be judged by future generations. However, aside from the pressure from Congress members and institutions, it cannot be overlooked that "crypto president" Trump had previously threatened to dismiss Gensler upon taking office and appoint crypto-friendly blockchain legal expert Teresa Goody Guillén as the chair of the U.S. SEC.

So who is Teresa Goody Guillén? Why has she won Trump's favor? If she takes charge of the U.S. SEC, what different variables might she bring to the crypto industry?

Image source: SEC Official Website

The Major Shift in U.S. SEC Crypto Regulation During the "Trump Era"

Since April 17, 2021, the U.S. SEC under Gary Gensler has become synonymous with a "big stick" in the crypto industry, almost encompassing all major crypto enforcement actions in recent years:

Whether it was the large-scale lawsuits against crypto exchanges Binance and Coinbase or the firm stance of classifying most crypto assets as securities, in just three and a half years, the U.S. SEC has completed over 2,700 enforcement actions and collected more than $21 billion in fines in the crypto industry.

As a former MIT professor who taught blockchain technology courses, Gary Gensler's iron-fisted regulatory policies have stirred up storm after storm in the crypto market, causing the high hopes the crypto industry had at the beginning of his tenure to dissipate. Evaluations quickly polarized, making him one of the most controversial figures in the crypto industry.

In the 2024 U.S. presidential election, Trump has become a beacon of hope for the crypto industry. Trump has repeatedly criticized Gary Gensler's crypto regulatory policies, even stating in public speeches that if he is successfully elected president, he will remove Gary Gensler from his position on his first day in office.

In Trump's reform plan, finding an SEC chair who understands both traditional finance and the crypto industry is of utmost importance. For this reason, Teresa Goody Guillén, with her unique cross-disciplinary background and industry support, has gradually become a potential frontrunner for the new SEC chair: this seasoned securities law expert not only has extensive experience in traditional finance but also maintains close collaborative relationships with blockchain companies, giving her a deep understanding of the operational logic of the crypto industry.

Who is Teresa, the "Potential Successor to the U.S. SEC"?

According to public information, Teresa Goody Guillén is currently a partner and co-leader of the blockchain team at BakerHostetler law firm. She joined in January 2019 and leads a team handling legal matters related to blockchain technology and digital assets, accumulating rich practical experience in areas such as blockchain technology, digital assets (including NFTs), DAOs, and DeFi.

Image source: BakerHostetler Official Website

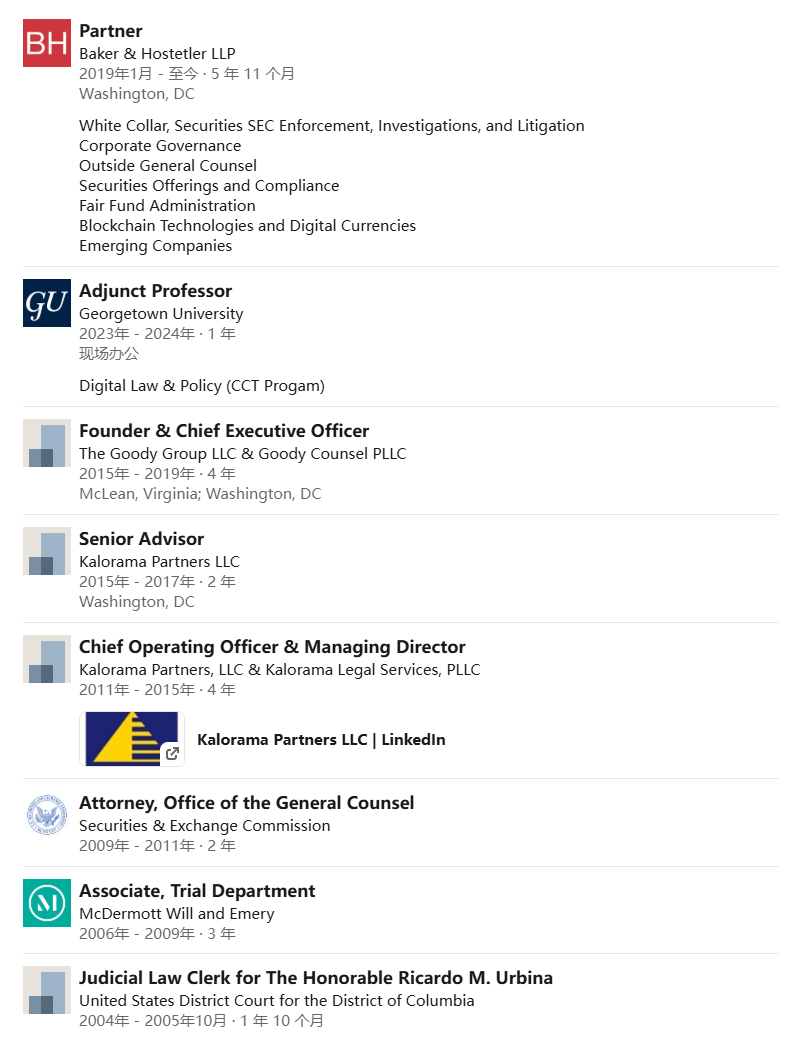

Additionally, Teresa Goody Guillén has served as a litigation attorney in the Office of the General Counsel at the U.S. SEC and held senior positions at Kalorama Partners, focusing on corporate compliance, risk management, and legal strategic consulting, as well as at The Goody Group LLC and Goody Counsel PLLC, which provide legal and consulting services.

- From 2009 to 2011, she served as a litigation attorney in the Office of the General Counsel at the U.S. SEC, handling complex securities litigation and enforcement-related matters;

- From 2011 to 2015, she joined Kalorama Partners, founded by former U.S. SEC chair Harvey Pitt, as Chief Operating Officer and Managing Director, providing consulting services for SEC enforcement cases;

- From 2015 to 2019, she participated in the establishment of The Goody Group LLC & Goody Counsel PLLC and served as CEO;

This showcases Teresa's unique cross-professional background: her experience at the SEC has given her a solid foundation in traditional securities law, while her deep involvement in the blockchain field makes her a rare professional at the intersection of law and technology. Coupled with her academic teaching experience, it further enhances her authority in the field of law and technology.

Notably, BakerHostetler has taken on several important blockchain-related cases in recent years and provided legal consulting services for multiple Web3 projects. The team led by Teresa is particularly adept at helping startups navigate complex regulatory challenges, such as developing compliance strategies, responding to regulatory investigations, and defending clients in litigation.

It is understood that the team under Teresa has collaborated with well-known blockchain projects like the decentralized "AI Data Chain" Masa, assisting in promoting the application of Web3 innovative technologies within a legal framework.

Teresa's public stance on the crypto industry has always been seen as "friendly." She has pointed out on multiple occasions that the U.S. should adopt a more open attitude when formulating crypto regulations and provide a supportive framework for technological innovation, rather than employing a hardline strategy of "enforcement over regulation." This viewpoint has earned her widespread support from the Web3 community.

Will the U.S. SEC Enter an "All-Out Embrace of Crypto" Era?

From the current signs, Teresa's emergence as a popular candidate for the U.S. SEC chair is not only due to her personal resume aligning with the comprehensive needs of a "Trump-era" SEC chair but also reflects the market's strong expectations for a "policy shift" in crypto regulation:

In the industry's view, she is an ideal candidate who can deeply understand traditional financial rules while providing support for Web3 innovation. If she ultimately succeeds Gary Gensler, it could lead the U.S. SEC down a completely different path, injecting new vitality into the U.S. crypto industry.

It is important to note that one of the biggest obstacles currently facing the U.S. crypto industry is regulatory uncertainty. The "Financial Innovation and Technology Act of the 21st Century" (FIT21 Act), which passed the House with an overwhelming majority of 279 votes to 136 on May 22, has a key point of delineating regulatory authority, clearly defining that there are two agencies responsible for regulating crypto assets: the U.S. Commodity Futures Trading Commission (CFTC) and the U.S. SEC.

Teresa has publicly expressed her desire to establish a new classification system for digital assets, allowing crypto assets to no longer be entirely subject to the traditional Howey test, and believes that the Howey test should not determine the future of the industry or technology. If this idea comes to fruition, it will undoubtedly provide the industry with a set of executable and clear rules, significantly reducing uncertainty, attracting more institutional capital into the crypto field, and promoting the institutionalization wave of crypto assets.

Brendan Playford, co-founder of Masa, commented: "Teresa is the change agent the U.S. SEC desperately needs. She focuses on light-touch regulation, believes that the Howey test should not determine the future of the industry or technology, and will end the current situation of 'enforcement replacing regulation.' She will unite all key participants from Wall Street and the crypto industry to jointly establish a clear market structure, allowing the crypto industry to thrive in the U.S. As a lawyer challenging the current SEC policies in Washington, D.C., and defending the rights of crypto innovators, her qualifications far exceed what is required—'Let the SEC be 'Goody' again!'"

Conclusion

If Teresa Goody Guillén is appointed, it will undoubtedly mark an unprecedented policy shift for the U.S. SEC, likely allowing it to break free from the current predicament of enforcement replacing regulation, and reshape the competitiveness of the U.S. crypto industry through light-touch regulation and clear market rules.

Especially as a legal expert well-versed in traditional financial rules and proficient in blockchain technology, her good collaborative experience with blockchain projects like Masa also means that the future crypto industry could establish more direct and pragmatic communication channels with the U.S. SEC through her. As a "bridge between technology and regulation," Teresa can more acutely capture industry needs and design a regulatory framework that balances innovation and compliance for the crypto market.

However, amidst the expectations, there are also challenges—can Teresa balance the interests of traditional financial institutions and the emerging crypto industry? How will she protect investor interests and maintain market stability during the transformation?

The answers to these questions may be revealed after her appointment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。