Original Author: Dan Morehead, Founder of Pantera Capital

Translation: Odaily Planet Daily Azuma

A Thousandfold Profit

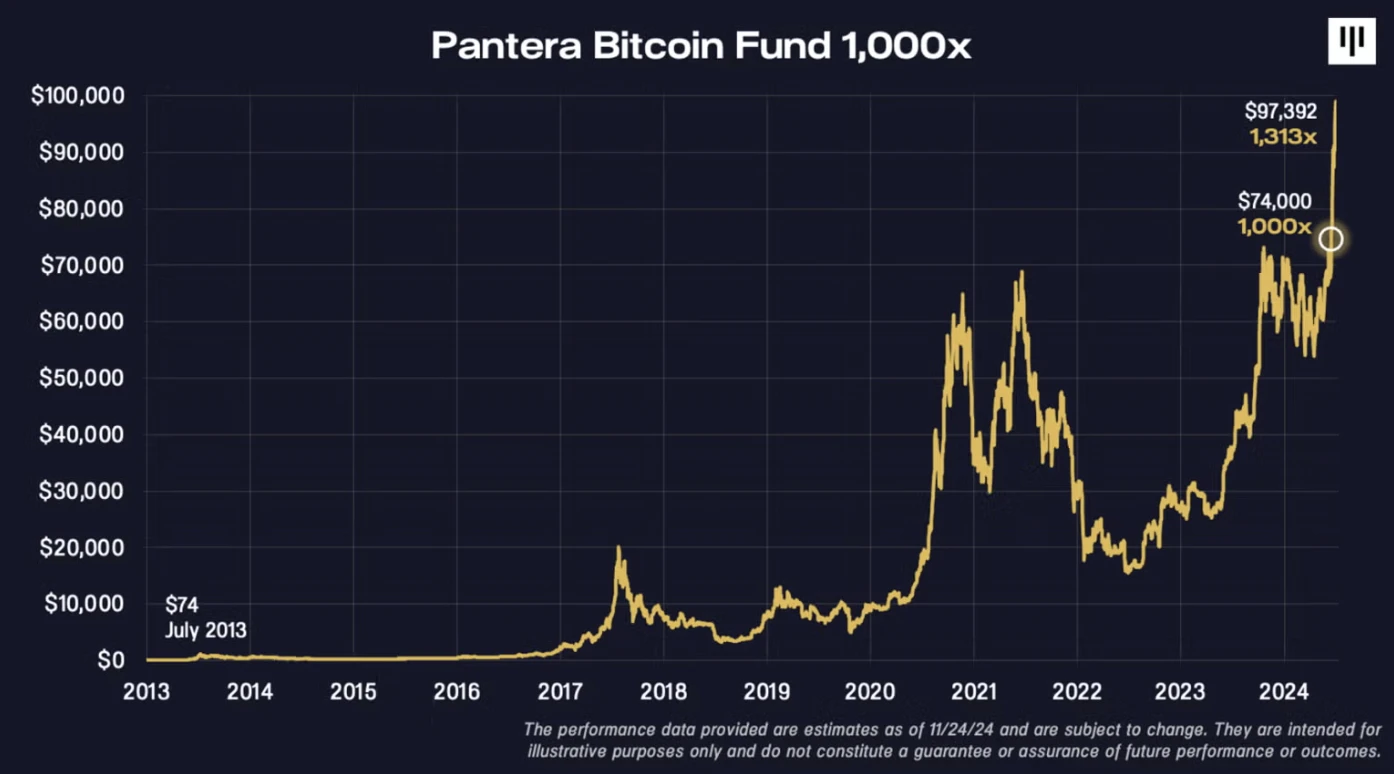

Pantera's Bitcoin Fund has recently achieved a crazy milestone — a thousandfold profit.

With BTC soaring nearly 30% after Trump's victory, the fund's total return since inception, after fees and expenses, stands at 131,165%.

I want to share our initial logic, as it remains compelling to me even today.

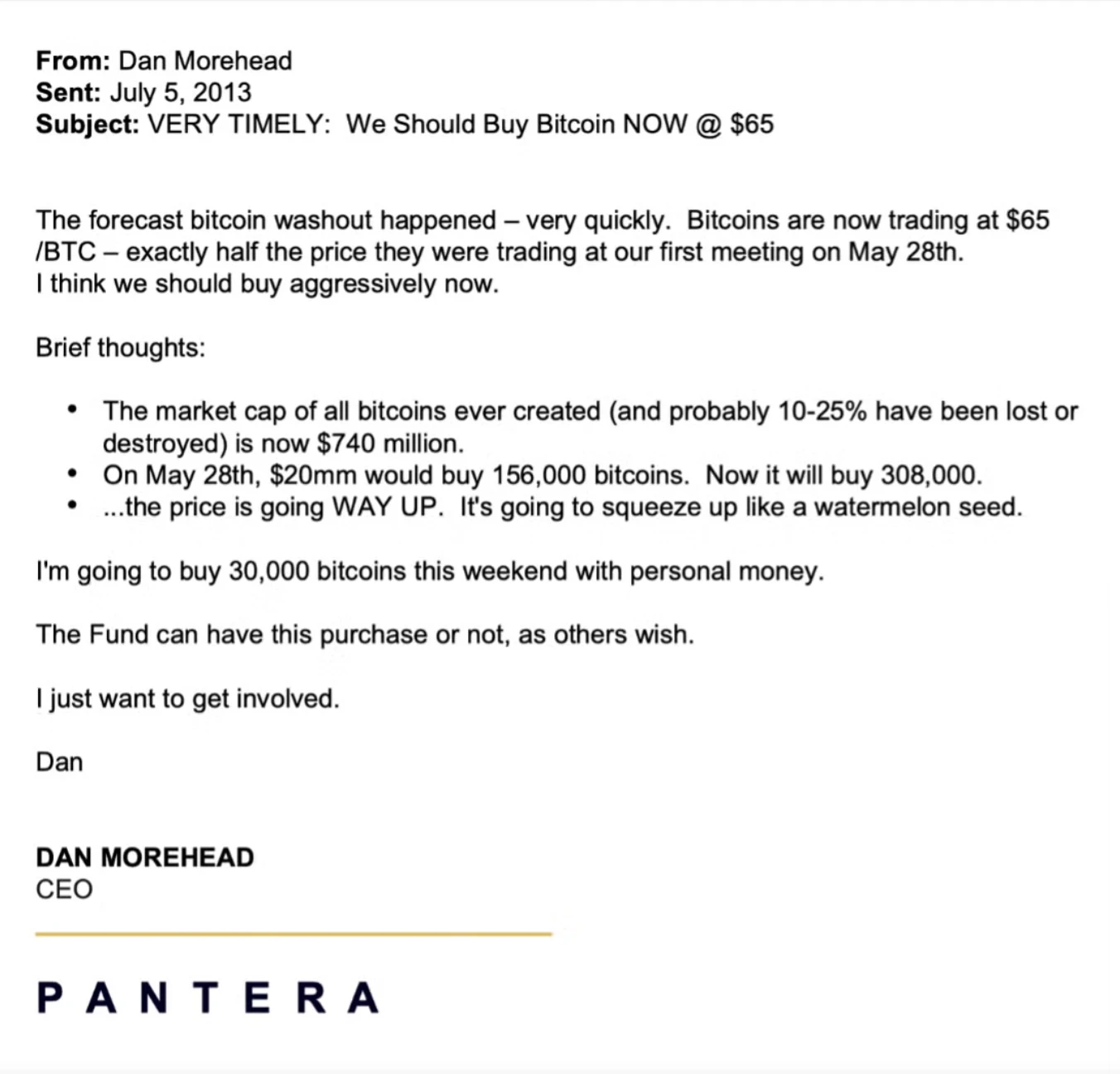

Odaily Note: In an email dated July 5, 2013, Dan, as CEO, urged Pantera to buy BTC at a market price of $65, stating he had personally decided to buy 30,000 coins, while others could decide whether the fund itself would purchase. Two days later, on July 7, the Pantera Bitcoin Fund was officially established.

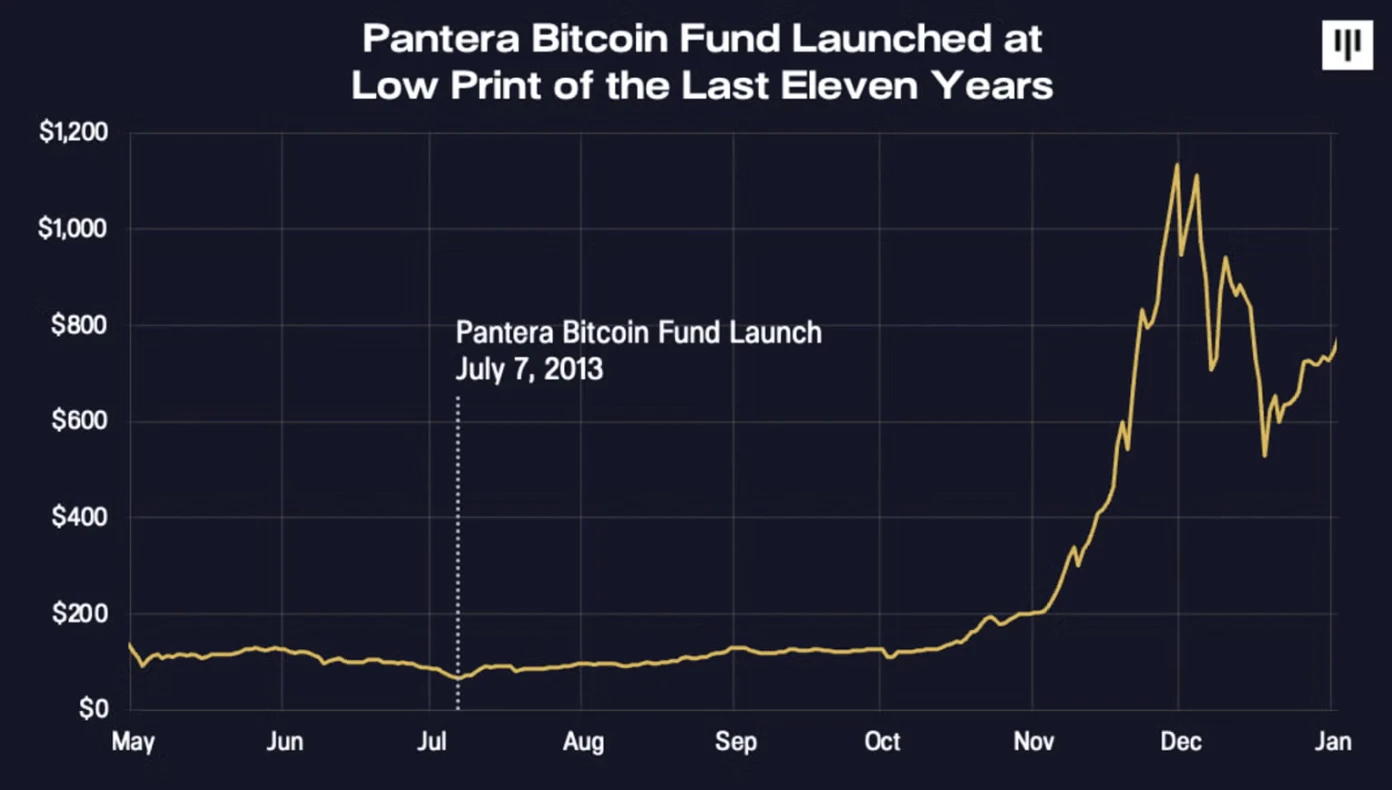

The day we chose to launch the Pantera Bitcoin Fund was the lowest point for BTC in the past eleven years.

The first investment memo is still impressive to read today.

From 2013 to 2015, we bought 2% of the world's Bitcoin.

Even after eleven years, Bitcoin is still being "squeezed and lifted like watermelon seeds."

To be honest, I still can't help but fantasize that for many years to come, we can achieve very substantial returns through BTC.

Gold in 1000 BC

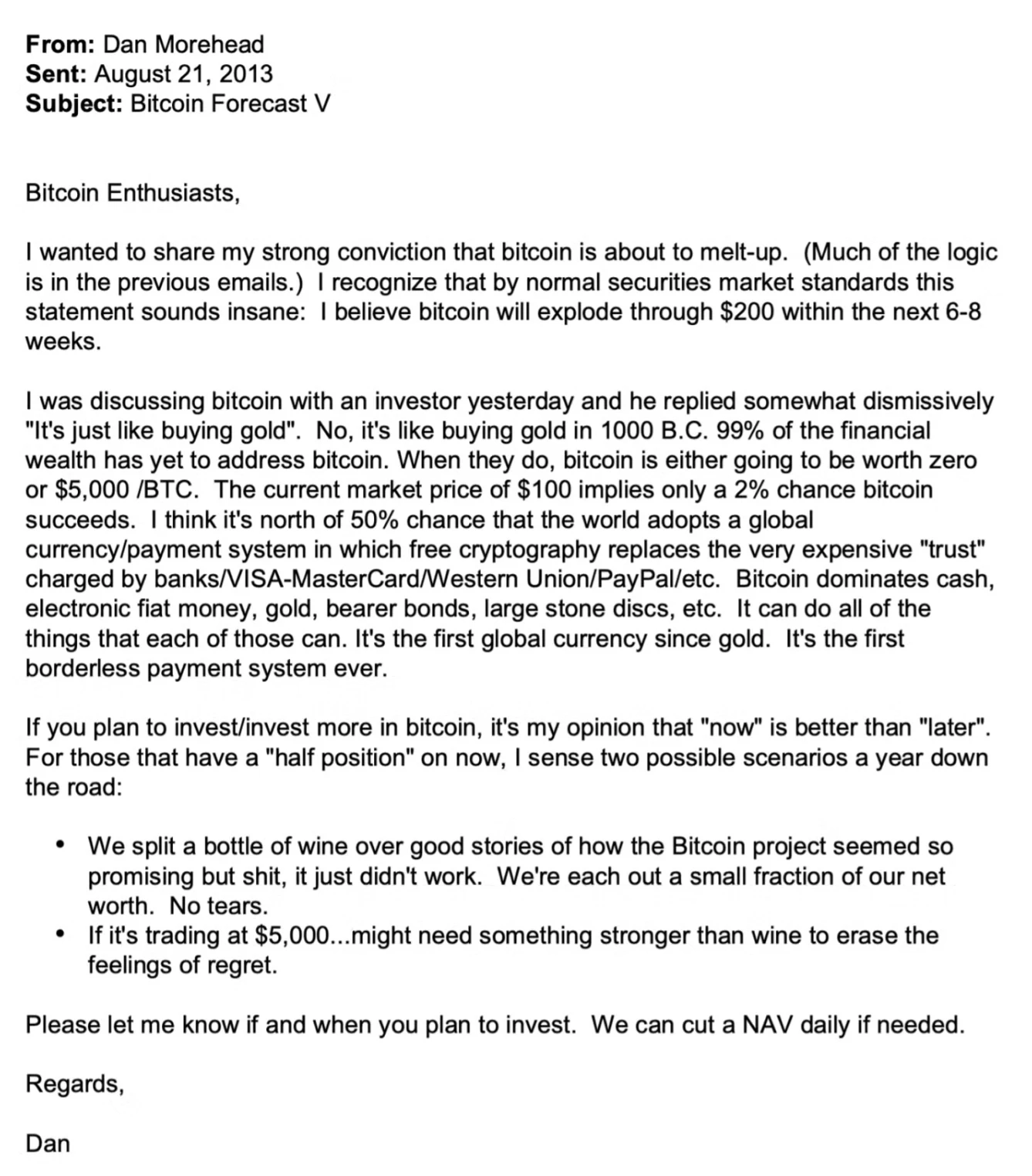

About a month later, I wrote down my core views on BTC.

"Yesterday I discussed Bitcoin with an investor, who somewhat dismissively said it was like buying gold… completely wrong! It's like buying gold in 1000 BC! 99% of financial wealth has yet to touch Bitcoin, and when they start doing so, Bitcoin's value will either be zero or will grow by several orders of magnitude (ten, hundred, thousand, ten thousand…)."

As an emerging industry, we have achieved some milestones today. It can now be said that "only" 95% of financial wealth has yet to fully invest in Bitcoin.

From 5% in 2024 to higher numbers, there are now some clear catalysts: improved regulatory attitudes in the U.S.; institutional giants like BlackRock and Fidelity are now providing low-cost, efficient entry channels for all investors with economic accounts. This convenience will ultimately enable tens of millions of investors to access this important new asset class.

We believe that the entire industry will greatly benefit after the first U.S. president explicitly supports blockchain. We think the success of blockchain aligns with the best interests of the nation, and we believe that everyone in Congress will eventually adopt a neutral or supportive stance towards blockchain. These things are happening, and the regulatory headwinds for blockchain that have persisted for 15 years are turning into tailwinds.

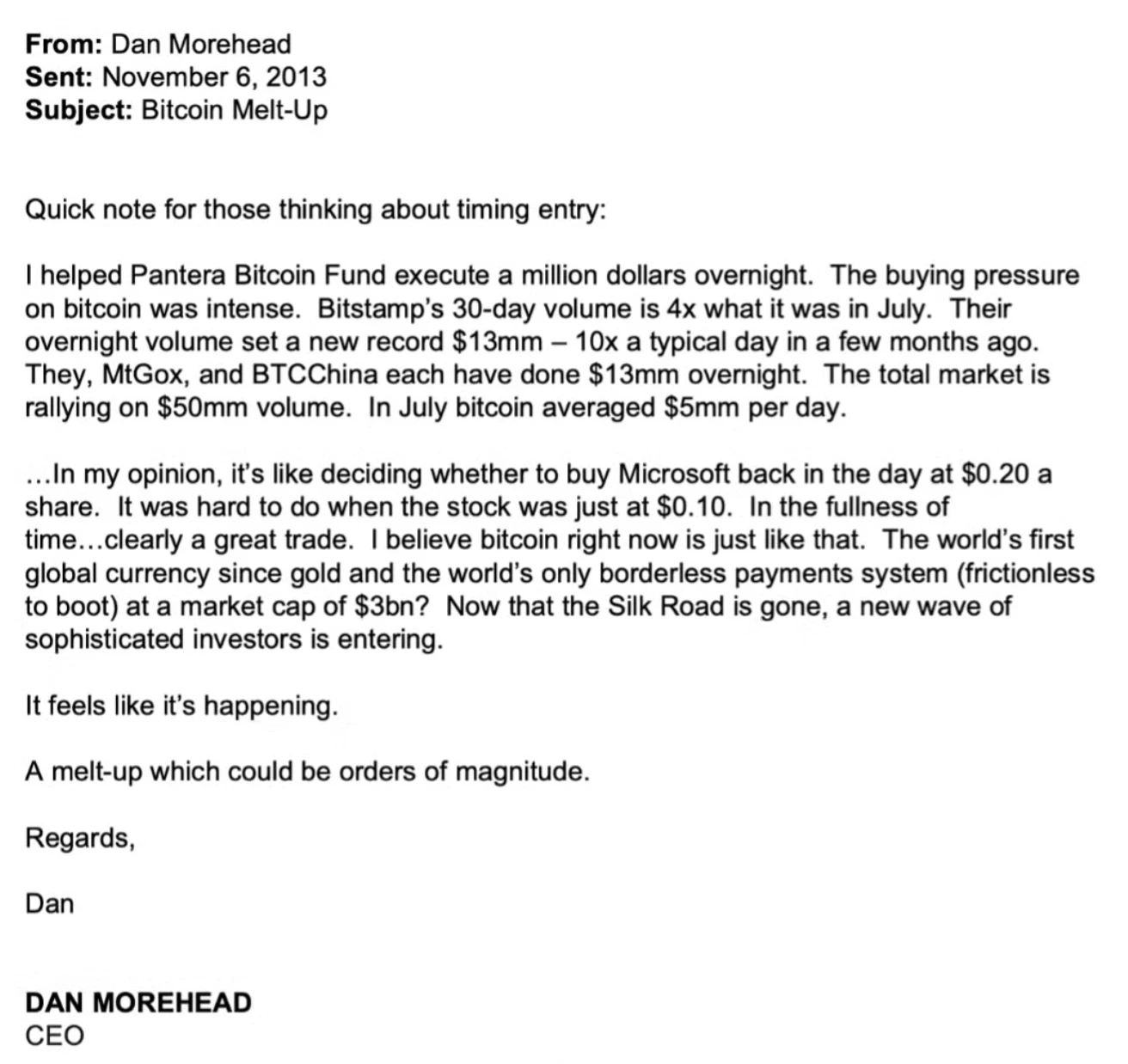

Odaily Note: In an email dated August 21, 2013, Dan again enthusiastically supported BTC and predicted a "melt-up" market.

I still believe in what I wrote 11 years ago.

"I believe the probability of the world adopting a global currency/payment system is over 50%, in which free cryptographic technology will replace banks, VISA, MasterCard, Western Union, PayPal, etc. Bitcoin can replace cash, electronic fiat currency, gold, bearer bonds, and so on. It can do all of these things. This is the first global currency since gold, and it is also the first borderless payment system in history."

This is still exactly how I feel. We are still in the early stages. 95% of financial wealth has yet to engage with blockchain, and they are just beginning this massive transformation. When they do, the price of Bitcoin could be $740,000.

Odaily Note: In an email dated November 6, 2013, Dan revealed that the Pantera Bitcoin Fund purchased $1 million worth of BTC in a single day.

BTC indeed experienced a "melt-up" market, and within a month of this email being sent, the price of BTC broke through $1,000 — and the current price is nearly three orders of magnitude higher than that.

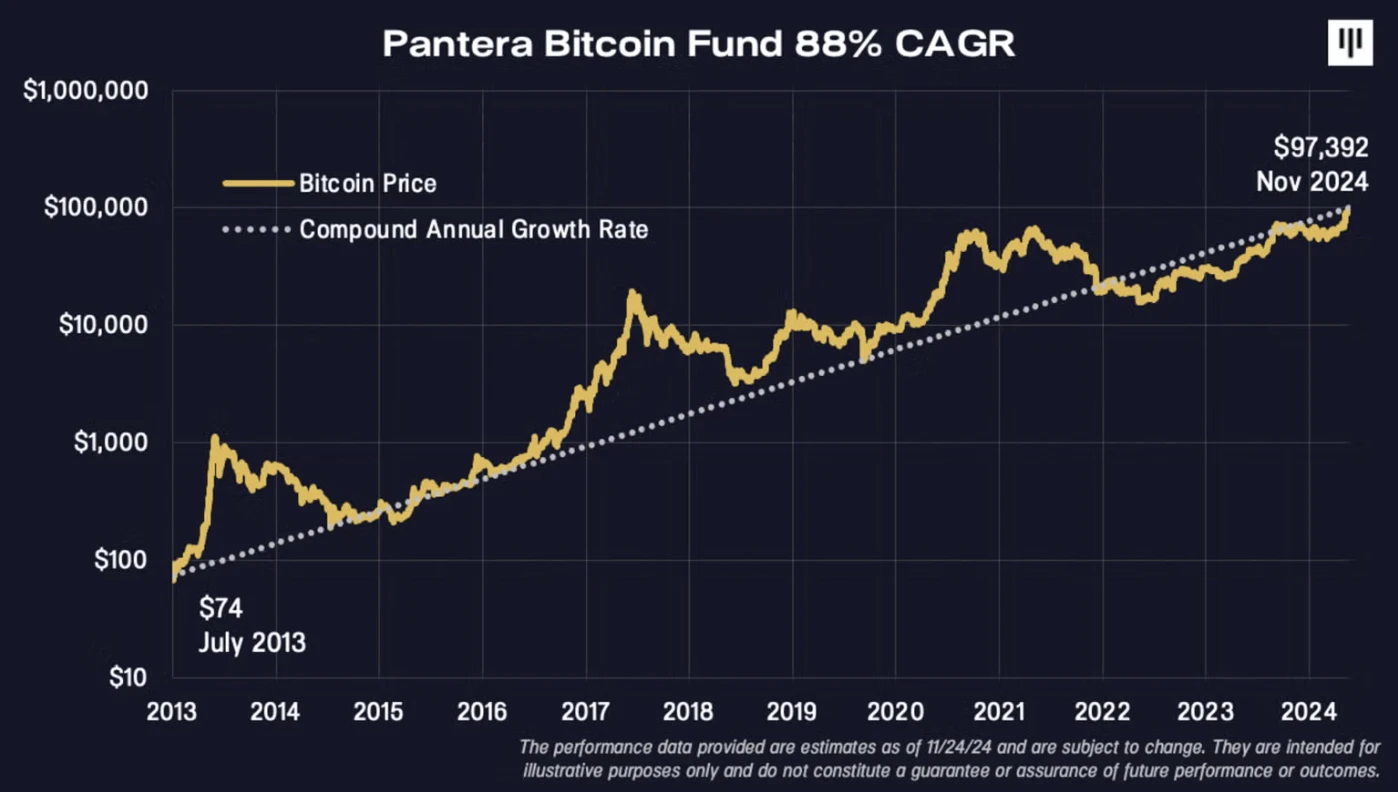

11 Years of Compound Annual Growth Rate: 88%

I know that many investors think when considering buying Bitcoin, "Bitcoin has doubled this year; I might have missed it"… and then give up on investing.

No, this is the wrong mindset. On average, BTC nearly doubles every year. Over the eleven years since the establishment of the Pantera Bitcoin Fund, our fund's annual compound growth rate has been 88%.

Magnitude Growth

Over the years, BTC has achieved multiple orders of magnitude growth, and further growth seems reasonable. If BTC reaches $740,000, its market cap will reach $15 trillion, which is not an unimaginable number compared to the total market cap of financial assets at $500 trillion.

While the past may not necessarily predict the future, if the trend continues, Bitcoin could reach $740,000 by April 2028.

I think it may take longer, perhaps a few more years, but I do believe BTC has a high probability of achieving this goal.

That is my mindset. I wouldn't bet my life on this, nor am I 100% certain that blockchain assets will continue to rise, but when you multiply the probability of an increase by the potential growth magnitude of the industry, you find that BTC's appreciation potential is much higher than other investable assets.

In my nearly forty years of experience, this is the most promising trade in terms of appreciation expectations.

Staying the Course is Not Easy

While it may seem easy now to buy BTC at a low price and hold it until now, it has actually been very difficult.

Since December 2013, BTC experienced an 87% crash and faded from people's view. More than three years later, the market was still declining. By 2016, almost everyone had given up on BTC, and investors showed no interest.

That year, I traveled around the world, holding 170 investor meetings, but ultimately raised only $1 million.

That year, our management fee was $17,241, averaging $100 per meeting…

We could have bought that hotel!

I am naturally a team collaborator. I have always hoped that the Bitcoin community would ultimately win. Over the years, we have tried in various ways to help the community.

So, when Expedia announced in 2014 that they would accept BTC, all our travel expenses were paid using BTC through Expedia.

In 2015, our team spent 59 nights on the road — averaging 1.5 BTC per night — totaling 88 BTC.

At today's prices, that amounts to $8.6831 million, and we could have bought two hotels!

The Amazing Development of the Industry

In 2013, when we were preparing to launch the Pantera Bitcoin Fund, I set up accounts at several exchanges and started wiring money for preliminary preparations. When I first walked into a Wells Fargo on Market Street in San Francisco to wire money to Ljubljana, Slovenia, I didn't even know how to spell "Ljubljana," leading the bank manager to question me for a long time about what I was doing.

- PS: I now know that Slovenia is a beautiful country, just to the right of Venice and below Austria…

But at that time, I doubted whether I was crazy. I also wired money to another unknown small startup, which sounded equally dubious.

At that time, the price of BTC was around $130. In the following days, I watched helplessly as the price of BTC dropped from $130 to $100. Looking back, it's amusing that the FUD (Fear, Uncertainty, Doubt) expressed by skeptics during the recent bear markets is essentially no different from what was said back then. When BTC fell to $65, despite various issues, I decided to go all in — launching the Pantera Bitcoin Fund. Thirty years of trading intuition told me that this was the day to act!

I had sent the above email to a small community of Bitcoin enthusiasts, which had about twenty people at the time, all of whom were interested in participating. Now, this community has grown to hundreds of thousands, and those emails have been read 2.7 million times.

I logged into a startup called Coinbase, trying to purchase 30,000 BTC, but the trading platform popped up a message saying the daily trading limit was only $50 — not the "bucks" that Wall Street lingo sometimes refers to as millions; they meant $50… I nearly had a heart attack.

Since they were still a startup, they had no address or phone number. In a panic, I sent an email to their customer support address — the subject line unusually in all caps — "I WANT TO PURCHASE TWO MILLION DOLLARS WORTH OF BITCOIN." Four days later, their only employee — a guy named Olaf — replied, "Okay, your limit is now $300."

This meant that even with the limit raised, I would need 6,667 days to complete this transaction. Eleven years later, I still need to buy for another 2,522 days…

Fortunately, I eventually managed to buy those BTC on Bitstamp. To this day, the industry has experienced rapid growth, with the cryptocurrency market now seeing daily trading volumes of $130 billion. The distance this industry has traveled is truly astonishing.

The Path of Blockchain as an "Asset Class"

Sometimes I feel like a gorilla in the forest, noticing a shiny object on the ground… picking it up… spinning it… wondering what it is…

Wow, it's Bitcoin!

I certainly don't understand the nuances between the incredible tech projects in the industry, but I feel like I've seen these scenes before.

I was the first asset-backed securities trader at Goldman Sachs, and now everyone views ABS as an asset class; I was there when they did GSCI, and now everyone views commodities as an asset class; in the 90s, I invested in emerging markets, and now everyone views emerging markets as an asset class.

Blockchain will be the same. I believe that in the near future, every investment firm will have a blockchain team, and there will be a sizable, permanent allocation to blockchain assets.

Asymmetric Trading

My global macro background is what initially drew me into the blockchain space. The asymmetry of this trade — working in the largest market in the world — makes this opportunity much larger than the trades we typically chase around the globe. I believe this is the most asymmetric trade I have ever seen.

A comparison from the second Pantera Blockchain Summit in March 2014 illustrates this theme. Nathaniel Popper noted this in his 2015 book "Digital Gold."

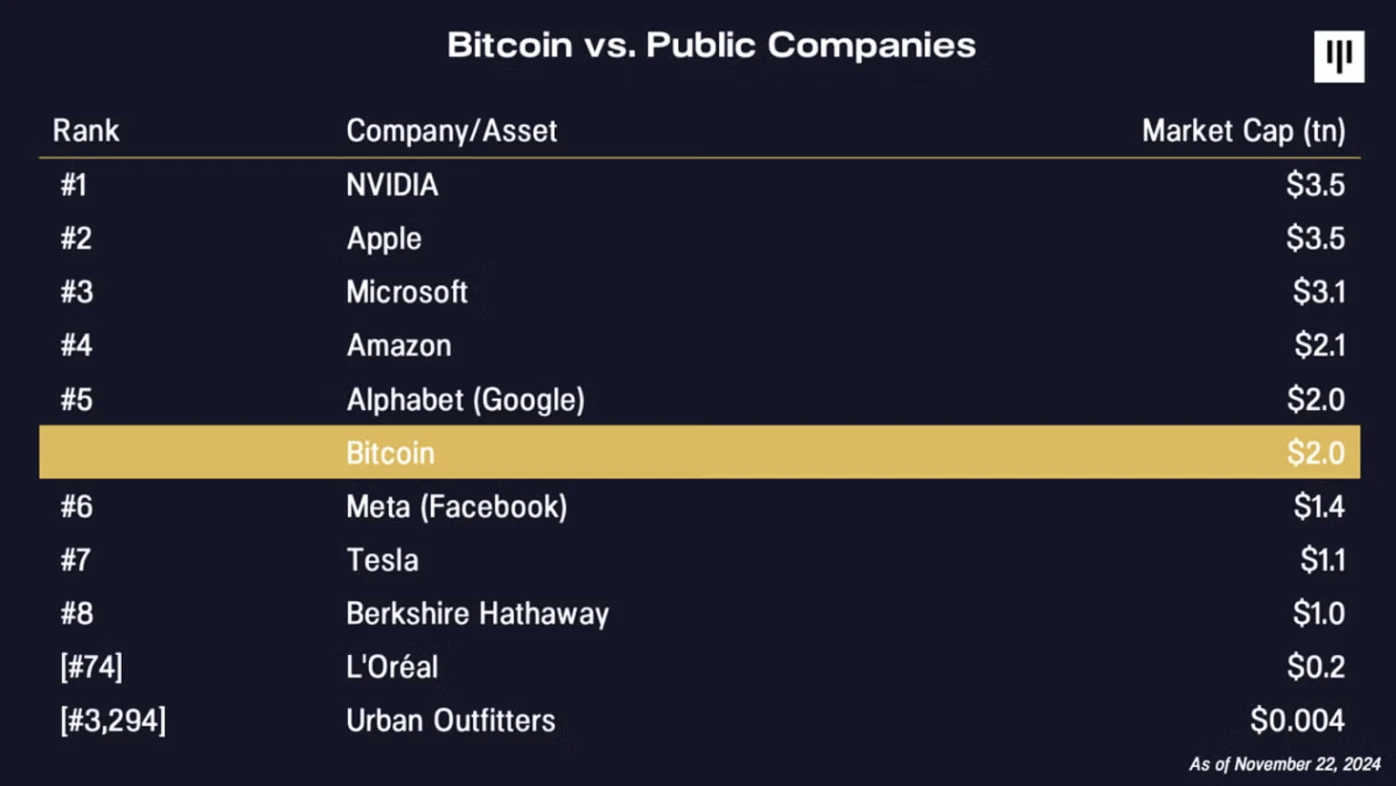

"At dinner a few hours before a late-night poker game, Morehead joked that the total value of all Bitcoin in the world was about the same as the market cap of Urban Outfitters, a supplier of jeans and dorm decor, which was about $5 billion. Morehead said, 'This is crazy, right? I think when people look back on our current society centuries from now, Bitcoin's impact on the world will be greater than that of Urban Outfitters.'"

When I updated this data in November 2020, Bitcoin's market cap had reached a level comparable to L'Oréal. Of course, waterproof mascara is undoubtedly an amazing invention, but I still believe there is asymmetry here.

Let's explore further… "At L'Oréal, our mission is… to democratize the best beauty products in skincare, makeup, haircare, and hair color."

This sounds fantastic, and Bitcoin's mission of "financial democratization" sounds remarkably similar — but I believe the ultimate scale of finance will clearly be larger than that of cosmetics.

Bitcoin's market cap has recently surpassed that of Meta (formerly Facebook). Sharing photos on the internet is indeed very cool, but I think the significance of enabling financial inclusion for everyone on Earth with a smartphone is even greater.

Now, Bitcoin only has five entities left to surpass (NVIDIA, Apple, Microsoft, Amazon, Google)…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。