Author: Mensh, ChainCatcher

Editor: Nianqing, ChainCatcher

Since the beginning of the year, the "National Engraving Campaign" has sparked enthusiasm in the Bitcoin ecosystem for asset issuance within the Bitcoin ecosystem. However, due to characteristics such as non-Turing completeness, achieving Bitcoin scalability is not an easy task, and various expansion solutions are competing fiercely. As Bitcoin approaches $100,000, with an increase of nearly 50% since November, the long-awaited bull market has finally begun. The resulting surge in Bitcoin trading volume, combined with half a year of consolidation in the Bitcoin ecosystem, has prepared it to welcome the influx of market funds. The super protocol RGB++ in the Bitcoin ecosystem, which combines expectations and fundamentals, has enormous potential for explosive growth.

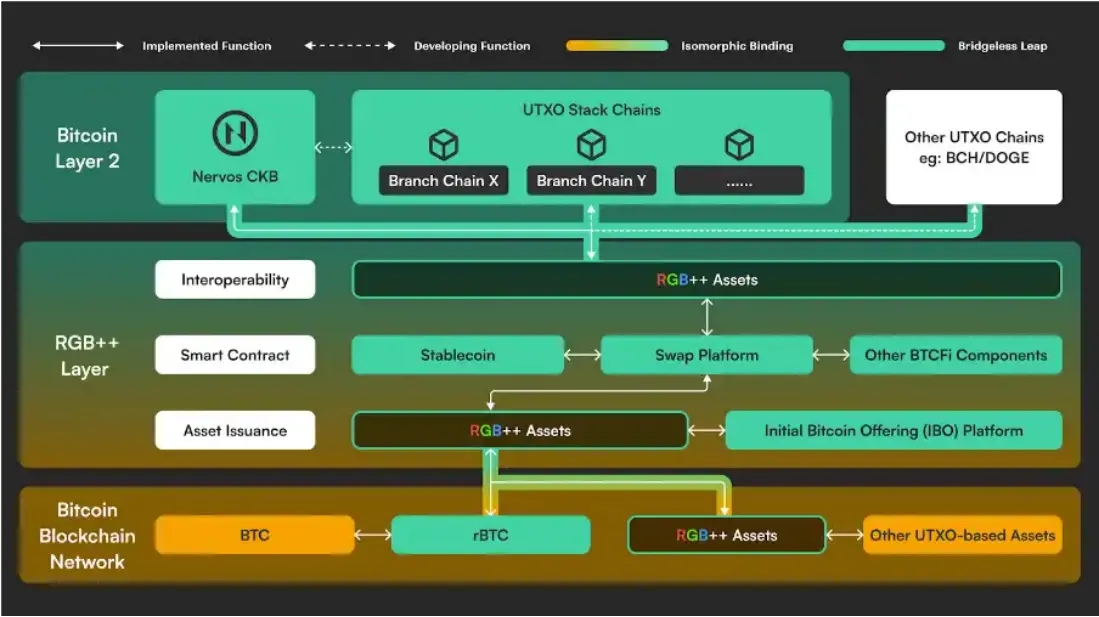

Isomorphic Binding and Leap Bridge-less Cross-chain Solutions for Flexible and Efficient Asset Issuance

The idea of issuing assets on Bitcoin has been around for a long time. As early as 2013, Colored Coins was the first attempt to issue assets on the Bitcoin mainnet. Subsequently, protocols such as Runes, Atomicals, Ordinals, RGB, Taproot, and BRC20 emerged in the Bitcoin ecosystem. However, due to the non-Turing completeness of Bitcoin's UTXO model, asset issuance in the Bitcoin ecosystem has always struggled to balance Bitcoin's native characteristics with flexibility.

Taproot Asset on the Lightning Network can achieve high TPS, but it does not support complex smart contracts and only supports tokens. Ordinals, as art pieces, have poor scalability, and BRC20, which imitates ERC20 by writing the complete functionality of tokens into BTC output scripts, only stores data and cannot transfer or mint. Although the tokens issued by Atomicals and Runes have been optimized, the transfer calculations are entirely handled by the BTC base network, thus also limited by Bitcoin's block speed and capacity.

RGB chooses to provide a scalable smart contract system for Bitcoin and the Lightning Network, completing off-chain expansion through UTXO combined with client validation, solving programmability issues. However, on the asset issuance level, users cannot see the asset status of others, which can easily lead to client data silos, and the lack of data transparency severely hinders the development of applications like DeFi.

To address the issues with RGB, RGB++ employs isomorphic binding and Leap bridge-less cross-chain technology. In simple terms, isomorphic binding allows users to operate their RGB++ assets on the UTXO chain directly using their Bitcoin accounts without running a client for validation. The Leap function enables RGB++ assets to be freely transferred between L1 (Bitcoin blockchain) and L2 (CKB blockchain or other UTXO chains). Therefore, RGB++ provides a brand new cross-chain method for assets to flow freely in a native manner on isomorphic chains, making it the most flexible and scalable solution for asset issuance currently available. It also addresses the pain points of Bitcoin's native characteristics and programmability.

The series of solutions based on CKB RGB++ has received investment and adoption from prominent Western Bitcoin core players such as Bitcoin Magazine. The mining community has also expressed strong support for this solution.

Rapid Implementation, Unifying the Ambitions of the Bitcoin Ecosystem

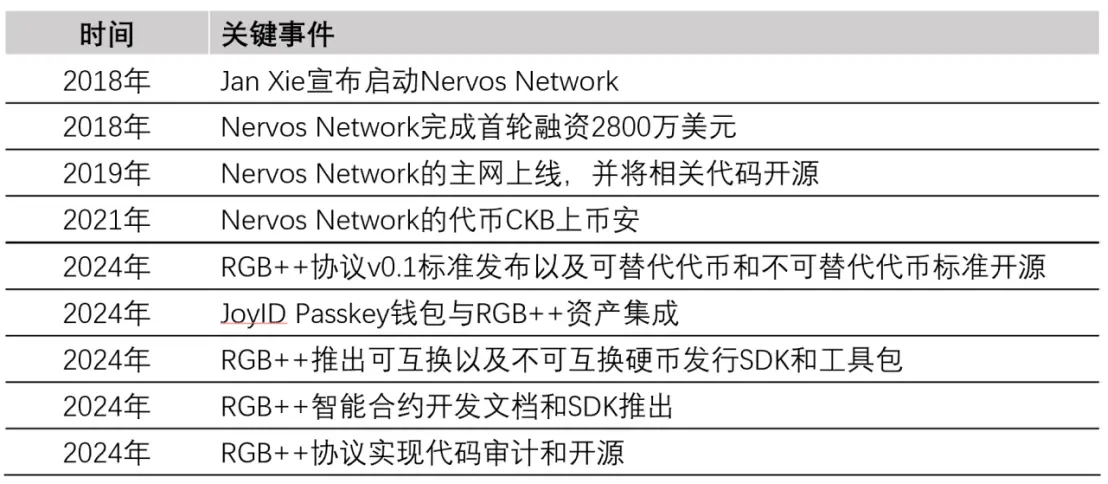

Tracing back to the team behind the RGB++ protocol, it is the well-established project CKB in the Bitcoin ecosystem. As early as 2018, CKB secured a total of $28 million in funding from several well-known investment institutions, including Polychain Capital, Sequoia China, Wanxiang Blockchain, and Blockchain Capital. The founding team behind it has been deeply involved in the crypto industry for many years; for example, Chief Architect Jan Xie has long contributed to the Ethereum clients Ruby-ethereum and pyethereum and has collaborated with Ethereum founder Vitalik Buterin on the development of the Casper consensus and sharding technology.

Years of development experience in the Bitcoin ecosystem and support from star capital have enabled RGB++ to be implemented rapidly. Since the project launched in February 2024, RGB++ has gone live on the mainnet in less than two months, and in July, it was upgraded to RGB++ Layer, quickly turning the vision of building a BTCFi ecosystem between BTC and CKB, Cardano, and other general UTXO public chains into a tangible product. Since the mainnet launch, hundreds of ecological projects have utilized this protocol for asset issuance.

Moreover, the "next-generation Lightning Network" Fiber Network based on CKB is about to launch, providing RGB++ assets with fast, low-cost, and decentralized multi-currency payment and peer-to-peer trading solutions, greatly expanding the application scenarios for RGB++ assets.

CKB has also launched the over-collateralized stablecoin protocol Stable++, using BTC and CKB as collateral while minting the stablecoin RUSD. By leveraging RGB++'s Leap function, Stable++ achieves seamless asset transfer within the Bitcoin ecosystem. Just this month, the Interstellar Payment Network (IPN) announced it would adopt the RGB++ protocol to build a native payment network on the Bitcoin mainnet and launch a programmable stablecoin USDI.

In contrast, while RGB and Taproot have first-mover advantages, their development speed has been slow, and the official team still has not provided any SDKs or developer tools, nor any corresponding ecological support or major project onboarding.

Full Ecosystem Integration for Traffic Entry, Meme May Have Traffic-Driving Functionality

The stablecoins RUSD and USDI, combined with the Lightning Network Fiber Network, not only enrich the application scenarios of the RGB++ protocol but also serve as the best traffic entry point in the ecosystem. Based on CKB, the RGB++ Layer relies on its Turing-complete smart contract environment and native AA and related facilities to provide an excellent circulation environment for stablecoins in the BTCFi ecosystem. Many large holders prefer to hold Bitcoin long-term rather than trade frequently; therefore, issuing stablecoins backed by Bitcoin can stimulate interaction between large holders and BTCFi, increasing capital utilization while reducing reliance on centralized stablecoins.

At the same time, due to its compatibility with UTXO and Turing completeness, RGB++ can issue memes on the Bitcoin mainnet or other UTXO chains, including the largest meme chain, DOGE. In this current bull market cycle dominated by memes, this is akin to a hidden trump card that could ignite investor attention at any moment.

Combining Topics and Strength, RGB++'s Appreciation Potential is Ready to Ignite

In 2024, Bitcoin will complete its fourth halving, reducing block rewards and leading to decreased profitability for miners. For Bitcoin investors, they do not just want to "hold" but are struggling with a lack of more ecological participation options. The demand to drive Bitcoin's value flow becomes prominent; beyond its store of value function, Bitcoin holders are naturally turning their attention to the Bitcoin ecosystem.

For market speculators, the soaring price of Bitcoin also means increased investment costs. As a "close neighbor," Bitcoin Layer 2 is more likely to become the next target for capital flow under the market sentiment. The positive feedback loop created by the wealth effect will encourage users to continue generating transactions within the Bitcoin native network, leading to network congestion, and the demand for transactions will spill over into related derivative projects and expansion platforms, making Bitcoin Layer 2 once again a hot narrative candidate in this bull market, following the earlier engraving craze.

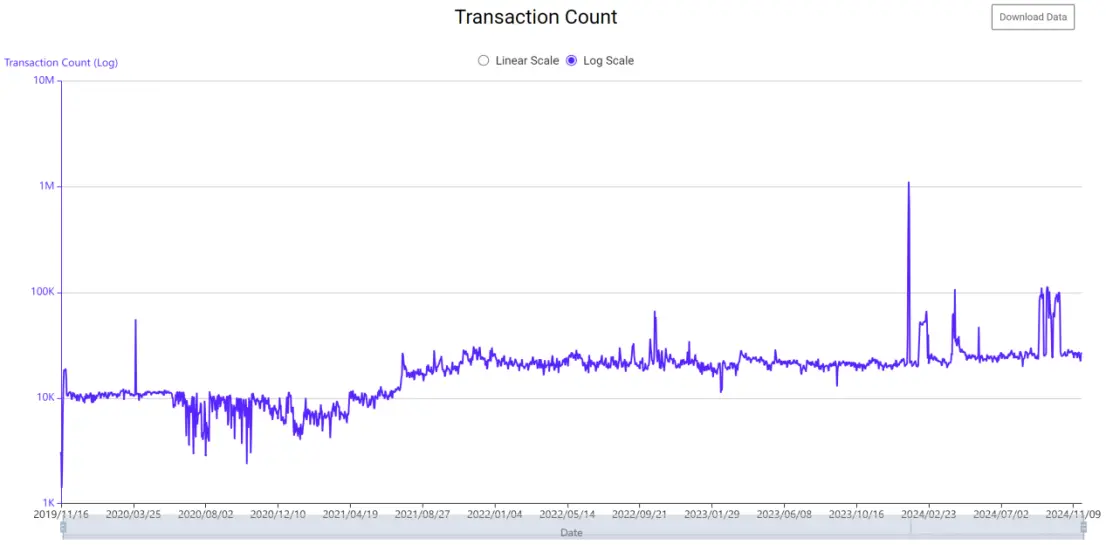

Data source: https://explorer.nervos.org/charts

From the trading data perspective, the CKB network remains active. As of now, the average daily transaction volume of CKB is 26,870 transactions. This is an increase of nearly 30% compared to the average daily volume of 20,800 transactions in the fourth quarter of 2023. Since the RGB++ protocol went live on April 3, 2024, there have been over 89,318 transactions and 52,759 unique addresses using the protocol.

In March of this year, CKB transformed from a UTXO-based Layer 1 to a booming Bitcoin Layer 2, with an increase of over 300%. Six months later, as Bitcoin approaches $100,000, how much will the RGB++ protocol fill the unmet expectations of the engraving craze, and what will its growth be?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。