If you engage in day trading and execute a small number of trades during each trading session, theoretically, your account funds will grow faster.

Author: adam

Compiled by: Deep Tide TechFlow

Before diving into the main topic, please remember that trading is a complex and high-risk activity.

There is no method that allows you to quickly grow your account in a short time without experiencing any losses.

In fact, those who can rapidly grow their accounts often do so by taking on significant risks, sometimes even close to gambling everything.

The focus of this article is not to tell you to patiently wait for ideal market conditions, nor is it to teach you how to analyze the market in depth.

Instead, I will share some methods to help you achieve rapid account growth while reasonably controlling risk.

If you are not familiar with basic concepts like "risk management," I strongly recommend you read this article on risk management first.

If you find this article helpful, you might want to check out other content on the blog or join the Tradingriot Bootcamp for complete video courses, access to a private Discord group, and regularly updated trading strategies.

Why Choose to Trade Lesser-Known Markets?

If you primarily trade large markets like BTC, ES (S&P 500 futures), major forex pairs, or gold,

you will be directly competing with retail traders like yourself, as well as large institutional players and quantitative firms.

This is mainly because these markets have extremely high liquidity, allowing large capital players to easily participate in the competition.

While trading these markets is not impossible, if you do not have sufficient capital, you will actually have more advantages in markets with lower liquidity.

For example, many altcoin derivatives, NFTs, or on-chain coins are not very attractive to large players because these markets lack the liquidity to meet their trading scale needs.

When I began to delve deeper into the altcoin market, I often found the clearest trading signals in markets with lower liquidity.

At first, I was confident in these "low-barrier" markets, but when I tried to execute large positions, I found my orders stood out significantly on the order book, which made me realize the disadvantages of insufficient liquidity.

However, for small account traders, this issue does not need to be overly concerning, as liquidity issues will only truly affect you when your order size reaches high five or six figures.

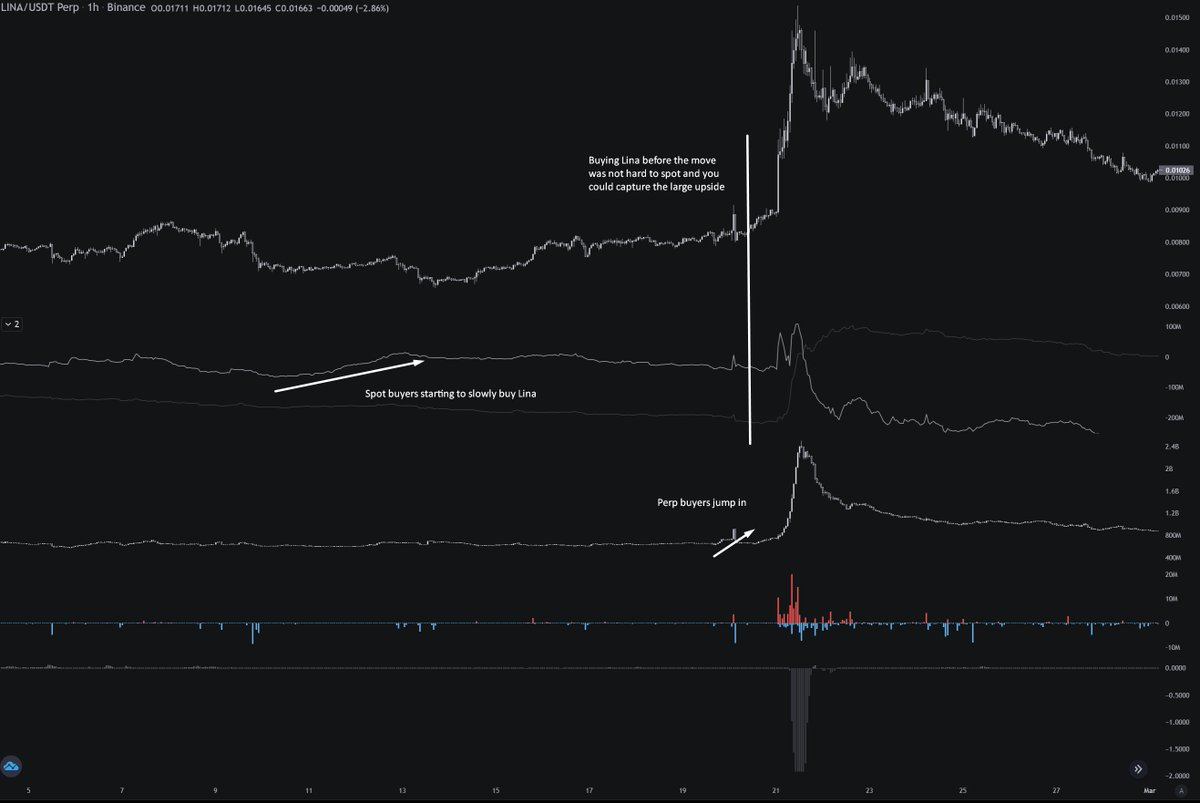

Taking Velo's Lina as an example, the chart shows that potential breakout signals for Lina could be observed days before the breakout occurred.

Such opportunities can lead to significant gains, but we also need to consider the potential risks.

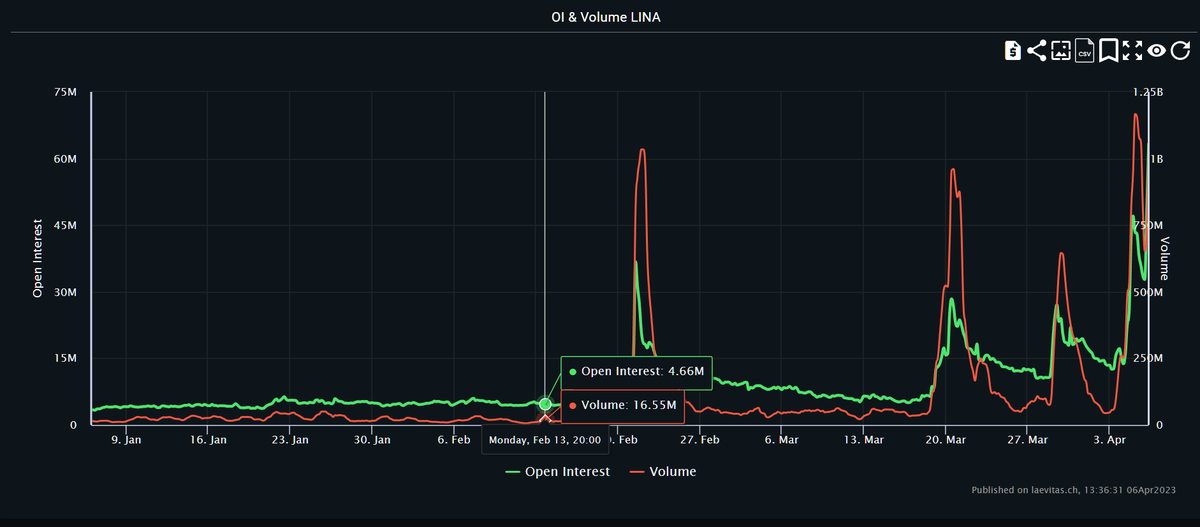

By checking Lina's trading volume and open contract data on the Laevitas platform, we can see that before the breakout, Lina's daily trading volume was 16 million, with open contracts at 4.5 million.

If this trade fails and you hold a large position, your stop loss may result in actual losses far exceeding expectations due to slippage. But for small account traders, their position sizes are smaller, and stop losses can often be triggered close to invalid points, so they do not face this issue.

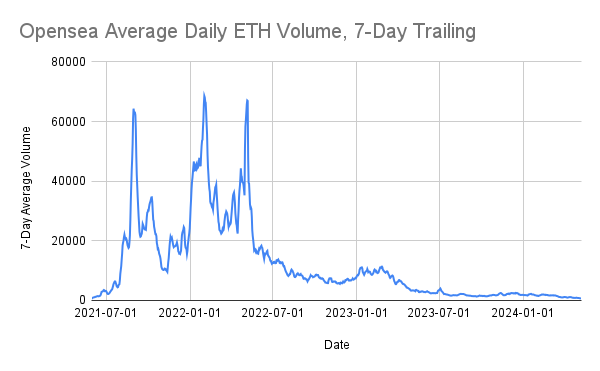

Low market cap alternative derivatives are not the only things you can participate in. On-chain tokens or NFTs are similar.

When trading, the most important thing is to be aware of where the "meta" currently is.

For example, NFTs were very popular a few years ago, but they have since faded away.

You need to understand the speed at which information spreads in this field to avoid taking on unnecessary risks while also not missing out on significant gains due to premature selling.

On-chain trading is very challenging. Although you may see many success stories on platform X, the likelihood of turning "1 SOL" into "1000" is very low.

In on-chain trading, there are some unique strategies you can use, such as tracking different wallets, analyzing position distribution, or simply relying on common sense to avoid tokens heavily promoted by KOLs.

In addition, you will find that using simple support and resistance levels or trading indicators is often sufficient for trading, especially for larger market cap tokens with lower risk of exit scams.

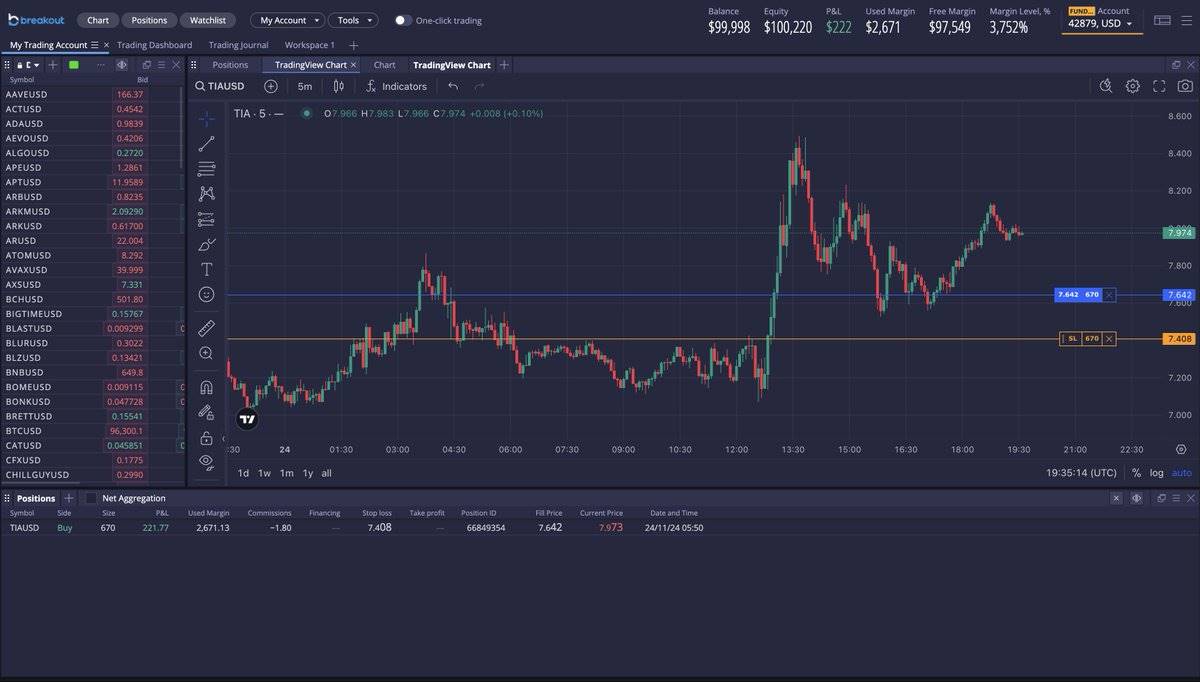

Day Trading

Prices have fractal characteristics. This means that if I show you a chart, you might find it difficult to determine whether it is a daily chart, a monthly chart, or a 5-minute chart.

Moreover, for highly liquid markets, if you are not familiar with them, it can be hard to distinguish which specific market it is.

For example, the chart above shows the 5-minute chart of XRP.

If you choose swing trading, the trading frequency will be relatively low. Even if you are profitable, most of the time you are just patiently waiting for opportunities, which usually only occur 1-2 times per week in each market.

I will discuss swing trading in detail later, but day trading is different; it provides immediate feedback, with many small fluctuations to trade every day.

Therefore, if you engage in day trading and execute a small number of trades during each trading session, theoretically, your account funds will grow faster.

However, day trading is one of the most challenging areas of trading. A slight distraction or a small mistake can lead you to lose all your profits in just a few minutes, just as quickly as you made money.

I recommend that every beginner trader try day trading, as it allows you to quickly receive market feedback and accelerates the learning process.

One major advantage of day trading is that you can focus on highly liquid markets, making trading scalable. If you focus on BTC, ETH, ES, NQ, gold, or major forex currency pairs, you will not encounter limitations on position size.

Nevertheless, day trading is very difficult and not suitable for everyone. It requires a high level of focus, quick decision-making, and decisive stop-loss abilities.

Therefore, it is crucial to develop a detailed trading plan and strategy for each step. Once you enter a trade, emotions can affect your judgment, and this is when your pre-prepared plan will come in handy.

There are many methods for day trading, such as operating based on price trends, order flow, news, technical indicators, etc. Each method has its applicable scenarios, and there is no absolute superiority or inferiority.

If you are interested in my day trading and swing trading methods, you can check out the Tradingriot Bootcamp, which is a training course designed specifically for traders.

Trading with Other People's Capital

In recent years, the online prop firm sector has developed rapidly.

If you are new to these companies, you need to pay an evaluation fee and comply with trading rules in a simulated account to gain access to a funded account.

This model allows you to trade with larger capital, with the only cost being the evaluation fee.

However, if you are not familiar with trading, you may waste money by frequently paying evaluation fees without ever obtaining a funded account.

Although prop firms often spark controversy, I believe they present a very good opportunity for those with trading skills but lacking capital.

As this sector rapidly expands, it becomes increasingly important to choose a reputable and stable company. In recent years, we have seen some companies refuse to pay profits, set rules that are nearly impossible to pass, or even go bankrupt outright.

I may be a bit biased here, as I am directly involved with the Breakout prop firm. But if you focus on cryptocurrency trading, Breakout is a very good choice. It offers daily payment services and has never refused to pay, while the evaluation rules are also very reasonable.

High Time Frame Analysis and Low Time Frame Execution

If you find that day trading is not suitable for you, do not be discouraged. This method can also help you quickly grow your account funds while being easier to operate.

In fact, this method is not limited to small accounts; I have personally completely shifted to this trading style because I no longer want to spend a lot of time staring at charts.

Nevertheless, I still want to emphasize that my experience over the past few years in day trading, studying different futures markets, and understanding market microstructure has been very important to me, and I am grateful to have gone through these experiences.

Although we mentioned that prices have fractal characteristics, key points in the market on higher time frames such as daily, weekly, or monthly charts often elicit a greater market reaction than points on a 1-minute chart. This is because more traders and algorithms pay attention to these key points on higher time frames and act accordingly.

For example, at the end of February 2023, Solana rose to a daily resistance level and then retraced to the next daily support level. If a short position was established at the daily close with a stop loss set based on the 1-day ATR, a 2.5 times risk-to-reward (R) could be achieved in 18 days.

Of course, achieving a 2.5 times return in 18 days is quite impressive. However, if your account is small, for instance, with a single trade risk of $100, then earning a return of $250 may not be very exciting; in contrast, if the single trade risk is $10,000, then earning $25,000 becomes very substantial.

If you want to quickly grow your account funds, you can switch to lower time frames while following the trading ideas of higher time frames (HTF). This means keeping your targets the same but executing trades on lower time frames (LTF) to narrow the stop loss range, thereby increasing position size.

You do not need to switch to 1-minute or 5-minute charts; H1 or H4 time frames are sufficient. Focusing too much on lower time frames may improve risk-to-reward, but it also significantly increases the risk of being washed out before the market moves.

If you choose H1/H4 time frames, it is still possible to miss ideal entry points or get stopped out before the market moves. However, in my experience, giving the trading ideas from higher time frames 1-3 attempts on lower time frames usually yields better results than relying solely on daily charts.

Conclusion

Trading is not easy; it requires time and patience. However, as long as you manage risk well, small amounts of capital can gradually grow into larger amounts.

In trading, always try to break out of fixed thinking patterns, maintain patience in execution, and develop a comprehensive trading plan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。