Author: @Web3_Mario

Abstract: Last week we discussed the potential for Lido to benefit from changes in the regulatory environment, hoping to help everyone seize this wave of "Buy the rumor" trading opportunities. This week, an interesting topic is the popularity of MicroStrategy, with many experts commenting on the company's operational model. After digesting and researching, I have some personal insights to share. I believe the reason for MicroStrategy's stock price increase lies in the "Davis Double Play," which ties the appreciation of BTC to the company's profits through a business design that finances BTC purchases. This innovative design, which combines traditional financial market financing channels, provides the company with leverage that allows it to achieve profit growth beyond the appreciation of its BTC holdings. As the holding volume expands, the company gains a certain degree of BTC pricing power, further reinforcing this profit growth expectation. However, the risk lies in the fact that when BTC experiences volatility or reversal risks, profit growth from BTC will stagnate. Additionally, due to the company's operating expenses and debt pressure, MicroStrategy's financing ability will be significantly reduced, impacting profit growth expectations. Unless new support can further boost BTC prices, the positive premium of MSTR's stock price relative to its BTC holdings will quickly converge, a process known as the "Davis Double Kill."

What is the Davis Double Play and Double Kill

Those familiar with me should know that I am dedicated to helping more non-financial professionals understand these dynamics, so I will replay my thought process. Therefore, I will first supplement some basic knowledge about what "Davis Double Play" and "Double Kill" are.

The so-called "Davis Double Play" was proposed by investment master Clifford Davis and is typically used to describe the phenomenon of a company's stock price rising significantly due to two factors in a favorable economic environment. These two factors are:

- Company profit growth: The company achieves strong profit growth, or optimizations in its business model, management, etc., lead to increased profits.

- Valuation expansion: Due to the market's more optimistic outlook on the company, investors are willing to pay a higher price, thus driving up the stock's valuation. In other words, the stock's price-to-earnings ratio (P/E Ratio) and other valuation multiples expand.

The specific logic driving the "Davis Double Play" is as follows: first, the company's performance exceeds expectations, with both revenue and profits growing. For example, strong product sales, expanded market share, or successful cost control will directly lead to profit growth. This growth will also enhance market confidence in the company's future prospects, leading investors to accept a higher P/E ratio and pay a higher price for the stock, causing the valuation to begin expanding. This linear and exponential combined positive feedback effect usually results in accelerated stock price increases, known as the "Davis Double Play."

To illustrate this process, suppose a company's current P/E ratio is 15 times, and its future profits are expected to grow by 30%. If, due to the company's profit growth and changes in market sentiment, investors are willing to pay an 18 times P/E ratio, then even if the profit growth rate remains unchanged, the increase in valuation will significantly drive up the stock price, for example:

- Current stock price: $100

- Profit growth of 30%, meaning earnings per share (EPS) increase from $5 to $6.5.

- P/E ratio increases from 15 to 18.

- New stock price: $6.5 × 18 = $117

The stock price rises from $100 to $117, reflecting the dual effects of profit growth and valuation increase.

In contrast, the "Davis Double Kill" is used to describe a rapid decline in stock price due to the combined effects of two negative factors. These two negative factors are:

- Company profit decline: The company's profitability decreases, possibly due to reduced revenue, increased costs, management errors, etc., leading to profits falling below market expectations.

- Valuation contraction: Due to profit declines or worsening market prospects, investor confidence in the company's future decreases, leading to a decline in its valuation multiples (such as P/E ratio) and a drop in stock price.

The entire logic is as follows: first, the company fails to meet expected profit targets or faces operational difficulties, resulting in poor performance and profit decline. This further deteriorates market expectations for its future, leading to insufficient investor confidence, who are unwilling to accept the currently overvalued P/E ratio and only willing to pay a lower price for the stock, causing the valuation multiple to decline and the stock price to fall further.

To illustrate this process, suppose a company's current P/E ratio is 15 times, and its future profits are expected to decline by 20%. Due to the profit decline, the market begins to doubt the company's prospects, and investors start to lower its P/E ratio. For example, reducing the P/E ratio from 15 to 12. The stock price may thus drop significantly, for example:

- Current stock price: $100

- Profit decline of 20%, meaning EPS decreases from $5 to $4.

- P/E ratio decreases from 15 to 12.

- New stock price: $4 × 12 = $48

The stock price falls from $100 to $48, reflecting the dual effects of profit decline and valuation contraction.

This resonance effect usually occurs in high-growth stocks, especially evident in many tech stocks, as investors are typically willing to assign high expectations for future growth to these companies. However, such expectations often have significant subjective factors supporting them, leading to considerable volatility.

How MSTR's High Premium is Created and Why It Becomes the Core of Its Business Model

With this background knowledge supplemented, I believe everyone should have a general understanding of how MSTR's high premium relative to its BTC holdings is generated. First, MicroStrategy has shifted its business from traditional software to financing BTC purchases, and future asset management revenue cannot be ruled out. This means that the company's profit source comes from capital gains on BTC purchased with funds obtained through equity dilution and bond issuance. As BTC appreciates, all investors' equity will correspondingly increase, benefiting investors, making MSTR similar to other BTC ETFs in this regard.

The distinction lies in the leverage effect brought by its financing ability, as MSTR investors' expectations for future profit growth stem from the leverage gains obtained from its financing capabilities. Considering that MSTR's total market value is in a positive premium state relative to the total value of its BTC holdings, this means that MSTR's total market value exceeds the total value of its BTC holdings. As long as it remains in this positive premium state, whether through equity financing or convertible bond financing, the funds obtained will be used to purchase BTC, further increasing the equity per share. This gives MSTR a profit growth capability different from that of BTC ETFs.

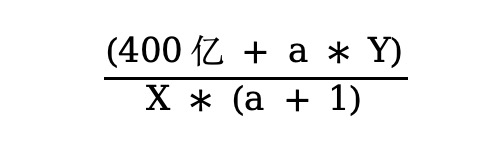

To illustrate, suppose MSTR currently holds $40 billion in BTC, with total outstanding shares X and total market value Y. At this point, the equity per share is $40 billion / X. In the worst-case scenario of equity dilution, if the new share issuance ratio is a, this means the total outstanding shares become X * (a + 1). If financing is completed at the current valuation, a total of a * Y billion dollars will be raised. If all these funds are converted into BTC, the BTC holdings will increase to $40 billion + a * Y billion, meaning the equity per share becomes:

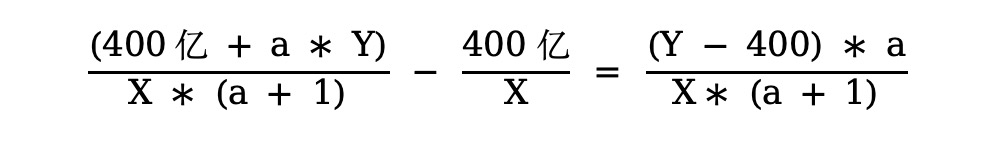

We will subtract this from the original equity per share to calculate the growth of equity per share due to dilution, as follows:

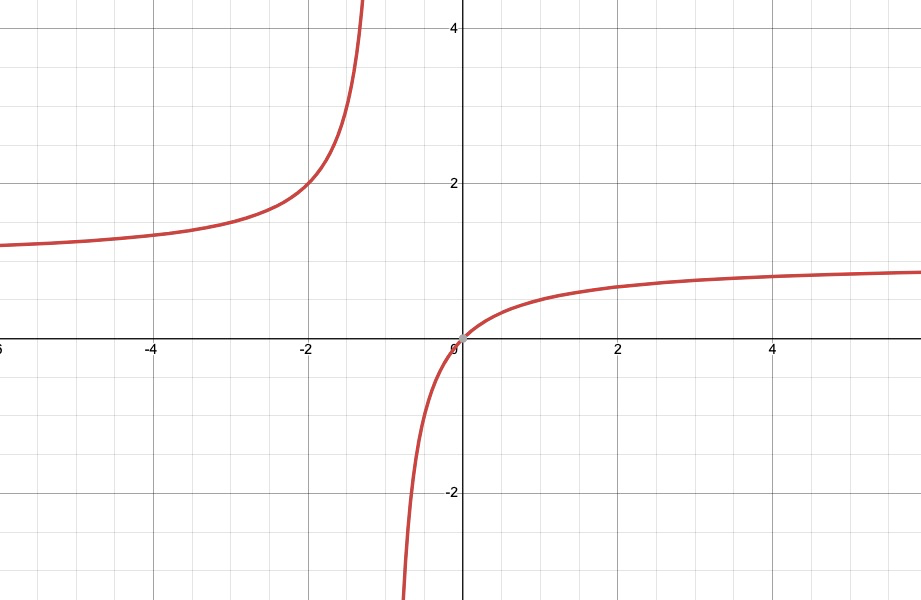

This means that when Y is greater than $40 billion, which is the value of its BTC holdings, it indicates the existence of a positive premium. Completing financing to purchase BTC will lead to a growth in equity per share that is always greater than 0, and the larger the positive premium, the higher the growth in equity per share, which is a linear relationship. As for the impact of the dilution ratio a, it presents an inverse proportional characteristic in the first quadrant, meaning that the fewer shares issued, the higher the growth rate of equity.

Therefore, for Michael Saylor, the positive premium of MSTR's market value relative to the value of its BTC holdings is the core factor for the establishment of its business model. Thus, his optimal choice is how to maintain this premium while continuously financing, increasing his market share, and gaining more pricing power over BTC. The continuous enhancement of pricing power will further boost investor confidence in future growth even at high P/E ratios, enabling successful fundraising.

In summary, the secret of MicroStrategy's business model lies in the appreciation of BTC driving the company's profit increase, and a favorable growth trend in BTC implies a positive growth trend for the company's profits. With the support of this "Davis Double Play," MSTR's positive premium begins to amplify, so the market is betting on how high a positive premium valuation MicroStrategy can achieve for subsequent financing.

What Risks Does MicroStrategy Bring to the Industry

Next, let's discuss the risks that MicroStrategy brings to the industry. I believe the core issue is that this business model significantly increases the volatility of BTC prices, acting as an amplifier of volatility. The reason lies in the "Davis Double Kill," and BTC entering a high volatility phase marks the beginning of the entire domino effect.

Let's imagine that when the growth of BTC slows down and enters a consolidation phase, MicroStrategy's profits will inevitably begin to decline. Here, I want to elaborate on this point. I have seen some friends place great importance on their holding costs and unrealized gains. This is meaningless because, in MicroStrategy's business model, profits are transparent and equivalent to real-time settlement. In the traditional stock market, we know that the factors that truly cause stock price fluctuations are earnings reports. Only when quarterly earnings reports are released can the market confirm the actual profit levels. In the meantime, investors can only estimate changes in financial conditions based on some external information. This means that for most of the time, the stock price's reaction lags behind the company's actual revenue changes, and this lagging relationship is corrected when each quarterly earnings report is released. However, in MicroStrategy's business model, since both the holding size and the price of BTC are public information, investors can understand its actual profit levels in real-time, and there is no lag effect because the equity per share changes dynamically, equivalent to real-time profit settlement. Therefore, the stock price already reflects all its profits accurately, and there is no lag effect, making it meaningless to focus on holding costs.

Returning to the topic, let's see how the "Davis Double Kill" unfolds. When BTC's growth slows down and enters a consolidation phase, MicroStrategy's profits will continuously decrease, potentially even to zero. At this point, fixed operating costs and financing costs will further shrink the company's profits, possibly leading to losses. This ongoing consolidation will gradually erode market confidence in the future price development of BTC. This will translate into doubts about MicroStrategy's financing ability, further undermining expectations for its profit growth. Under the resonance of these two factors, MSTR's positive premium will quickly converge. To maintain the validity of its business model, Michael Saylor must uphold the state of positive premium. Therefore, selling BTC to buy back shares is a necessary operation, marking the moment MicroStrategy begins to sell its first BTC.

Some friends may ask, why not just hold onto BTC and let the stock price naturally decline? My answer is no, more precisely, it is not possible when the BTC price reverses; it can be tolerated during consolidation. The reason lies in MicroStrategy's current equity structure and what constitutes the optimal solution for Michael Saylor.

According to the current shareholding ratio of MicroStrategy, there are several top-tier consortiums, such as Jane Street and BlackRock, while the founder Michael Saylor holds less than 10%. Of course, through a dual-class share structure, Michael Saylor has absolute voting power because he holds more Class B common stock, which has a voting power ratio of 10:1 compared to Class A. Thus, the company is still under Michael Saylor's strong control, but his equity stake is not high.

This means that for Michael Saylor, the long-term value of the company far exceeds the value of the BTC he holds, as in the event of bankruptcy liquidation, he would not receive much BTC.

So what are the benefits of selling BTC during the consolidation phase to buy back shares to maintain the premium? The answer is obvious. When the premium converges, if Michael Saylor judges that MSTR's P/E ratio is undervalued due to panic, then selling BTC to raise funds and repurchasing MSTR from the market is a profitable operation. Therefore, at this time, the effect of reducing the circulating supply through buybacks will amplify the equity per share more than the effect of reducing equity per share due to a decrease in BTC reserves. When the panic subsides and the stock price rebounds, the equity per share will thus become higher, benefiting future development. This effect is easier to understand in extreme cases when BTC's trend reverses and MSTR experiences a negative premium.

Considering Michael Saylor's current holdings, when a consolidation or downward cycle occurs, liquidity is usually tightened. Therefore, when he starts to sell, the price of BTC will accelerate its decline. The accelerated decline will further worsen investors' expectations for MicroStrategy's profit growth, leading to a further drop in the premium rate, which may force him to sell BTC to buy back MSTR, marking the beginning of the "Davis Double Kill."

Of course, another reason that forces him to sell BTC to maintain the stock price is that the investors behind him are a group of well-connected Deep State individuals who cannot passively watch the stock price go to zero without taking action. This will inevitably put pressure on Michael Saylor, forcing him to take responsibility for managing the company's market value. Moreover, recent information indicates that with ongoing equity dilution, Michael Saylor's voting power has fallen below 50%. Although I have not found specific sources for this information, this trend seems inevitable.

Does MicroStrategy's Convertible Debt Really Have No Risk Before Maturity?

After the above discussion, I believe I have fully articulated my logic. I would also like to discuss whether MicroStrategy has no debt risk in the short term. Some predecessors have introduced the nature of MicroStrategy's convertible debt, and I will not elaborate on that here. Indeed, its debt duration is quite long, and there is no repayment risk before the maturity date. However, my view is that its debt risk may still be reflected in the stock price in advance.

The convertible debt issued by MicroStrategy is essentially a bond with a free call option. At maturity, creditors can require MicroStrategy to redeem it with shares equivalent to the previously agreed conversion rate. However, there is also protection for MicroStrategy, as it can choose the redemption method actively, using cash, stock, or a combination of both. This provides some flexibility; if funds are sufficient, it can repay more in cash to avoid equity dilution. If funds are tight, it can issue more stock. Moreover, this convertible debt is unsecured, so the risk from debt repayment is indeed low. Additionally, there is a protection for MicroStrategy: if the premium rate exceeds 130%, MicroStrategy can also choose to redeem it at the original cash value, creating conditions for refinancing negotiations.

Thus, the creditors of this debt will only have capital gains if the stock price is above the conversion price and below 130% of the conversion price. Otherwise, they will only receive the principal plus low interest. Of course, as pointed out by Mr. Mindao, the main investors in this bond are hedge funds using it for delta hedging to earn volatility returns. Therefore, I have thought through the underlying logic in detail.

The specific operation of delta hedging through convertible debt mainly involves purchasing MSTR convertible debt while shorting an equivalent amount of MSTR stock to hedge against the risks brought by stock price fluctuations. As the price develops, hedge funds need to continuously adjust their positions for dynamic hedging. Dynamic hedging usually involves the following two scenarios:

- When MSTR's stock price falls, the delta value of the convertible debt decreases because the conversion right of the bond becomes less valuable (closer to "out of the money"). At this point, more MSTR stock needs to be shorted to match the new delta value.

- When MSTR's stock price rises, the delta value of the convertible debt increases because the conversion right of the bond becomes more valuable (closer to "in the money"). At this point, some of the previously shorted MSTR stock needs to be bought back to match the new delta value, thus maintaining the hedging of the portfolio.

Dynamic hedging requires frequent adjustments under the following conditions:

- Significant fluctuations in the underlying stock price: For example, large changes in Bitcoin prices lead to sharp fluctuations in MSTR's stock price.

- Changes in market conditions: For example, volatility, interest rates, or other external factors affecting the pricing model of convertible debt.

- Typically, hedge funds will trigger operations based on the magnitude of delta changes (e.g., every change of 0.01) to maintain precise hedging of the portfolio.

Let's illustrate this with a specific scenario. Suppose a hedge fund's initial position is as follows:

- Buy MSTR convertible debt worth $10 million (Delta = 0.6).

- Short MSTR stock worth $6 million.

When the stock price rises from $100 to $110, the delta value of the convertible debt changes to 0.65, requiring an adjustment of the stock position. The calculation for the number of shares to cover is (0.65−0.6)×$10 million = $500,000. The specific operation is to buy back $500,000 worth of stock.

When the stock price falls from $100 to $95, the new delta value of the convertible debt becomes 0.55, requiring an adjustment of the stock position. The calculation for the additional short stock is (0.6−0.55)×$10 million = $500,000. The specific operation is to short $500,000 worth of stock.

This means that when MSTR's price falls, the hedge funds behind the convertible debt will sell more MSTR stock to dynamically hedge the delta, further driving down MSTR's stock price, which will negatively impact the positive premium and, in turn, affect the entire business model. Therefore, the risk on the bond side will be reflected in the stock price in advance. Of course, during MSTR's upward trend, hedge funds will buy more MSTR, so it is also a double-edged sword.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。