Original Title: Crypto Enabled Accelerationism Bubble

Original Author: yb effect, Crypto KOL

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article points out that as crypto technology gradually gains acceptance in mainstream tech fields, and with the relaxation of crypto regulations, the accelerationism bubble is growing, and iconic cases driven by crypto are continuously emerging. The early heat of DePin, DeSci, and AI has already revealed trends and opportunities. In the future, more innovators will leverage crypto + technology for project financing and development, and the next four years may be the explosive moment for the real application of crypto technology.

The following is the original content (reorganized for better readability):

Last month, I developed a habit of saving any tweets related to AI agents that I came across on Twitter for further research later. At the same time, I noticed an interesting phenomenon: many updates and releases about agent technology are even unrelated to the meta-trends of Truth Terminal or Zerebro.

For example:

Stripe released documentation on integrating payment features into agent workflows.

Balaji retweeted Aravind Srinivas's request to develop a Perplexity browser that treats agents as first-class citizens.

OtCo demonstrated a process for an agent to create an LLC in Delaware for its own needs.

Circle launched a detailed tutorial explaining how developers can integrate USDC into various agents.

Just a few days ago, Satya Nadella showcased a demo of Copilot Workspace, the first integrated development environment (IDE) centered around agents.

Well, you might be thinking… there’s nothing special about this, right? After all, isn’t it normal for large tech companies to discuss agent technology? Who isn’t talking about it! But that’s exactly my point—this is the first time I feel that the cryptocurrency consumer bubble we are in is discussing the same topics as the entire tech industry. Perhaps the style is different, but it definitely belongs to the same category. Cryptocurrency has always seemed "weird" to the average person. Even within the tech circle, cryptocurrency is often seen as that annoying little brother. And this view is not without reason! The crazy headlines generated by our industry are simply too many, and even most people in the industry admit that some trends are indeed outrageous.

Previously, mainstream trends in the crypto space rarely overlapped with other tech fields in the short term. For example, what connection is there between a top LLM (large language model) engineer and a project with 10,000 PFP (profile picture) NFTs? Or why would a scientist researching longevity care about new yield-bearing assets?

Overall, the narratives in the cryptocurrency space in the past have attracted more attention from artists and quantitative analysts. But now, there is finally an opportunity to break this cycle! Although we are still far from that stage, I personally see the light at the end of the tunnel.

Here are three topics worth exploring in depth:

Relaxation of crypto regulations

Accelerationism bubble

Iconic cases driven by crypto

Relaxation of Crypto Regulations

This week, SEC (U.S. Securities and Exchange Commission) Commissioner Gary Gensler announced that he would resign on January 20 next year. If you’ve been in this field for even a week, you know this news is akin to Harry Potter defeating Voldemort.

For the past four years, Gensler has been the biggest obstacle to the U.S. crypto industry. He not only slowed down the regulatory process but also actively took action to crack down on this emerging industry. Linda's tweet accurately pointed this out—companies like Coinbase, Consensys, and countless others have been forced to spend hundreds of millions lobbying and fighting in Washington.

And now, it seems that the candidates likely to succeed him are poised for a complete turnaround.

Whoever ultimately takes this position, one thing is clear: Trump has made it clear that he wants to embrace cryptocurrency more actively than the previous administration, and frankly, the bar isn’t set very high.

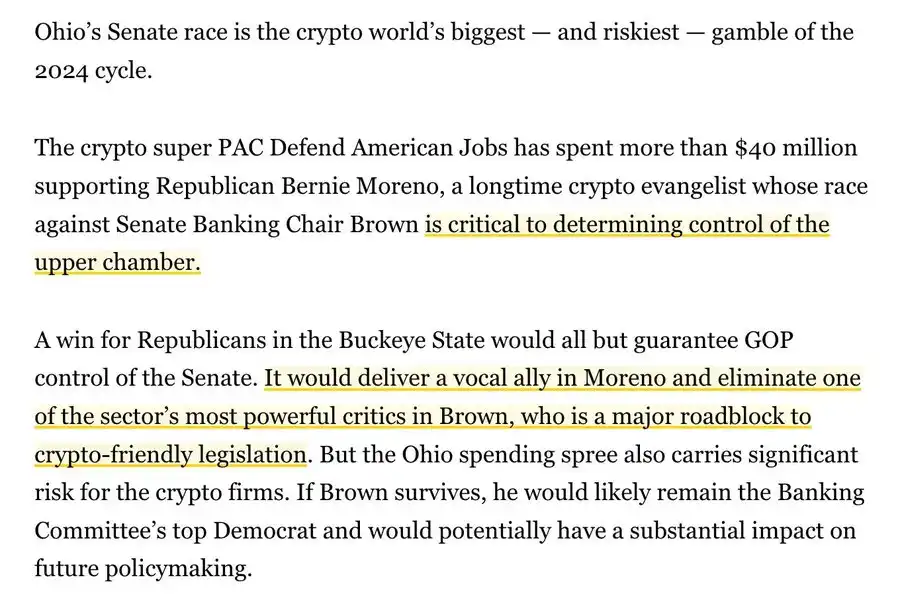

In my election week post “Where Did Fairshake PAC’s $133 Million Go?”, I mentioned that Bernie Moreno (Republican) received $40.1 million in donations in the Ohio Senate race to defeat Sherrod Brown (Democrat).

Ultimately, Moreno won the election, which is undoubtedly a significant victory for the entire cryptocurrency field. He has long been a supporter of cryptocurrency, while Brown has been one of the major obstacles to crypto regulation in the Senate.

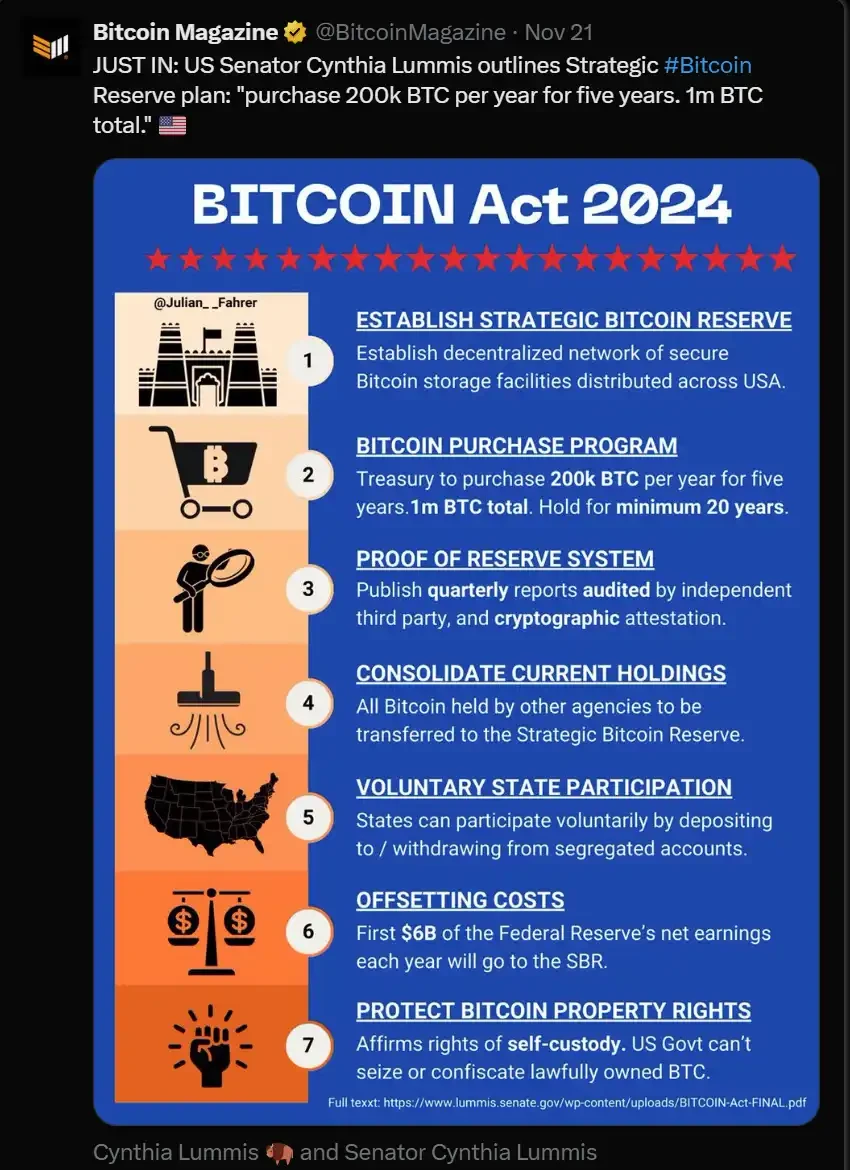

Lastly, it’s worth mentioning that just the discussion about the U.S. strategic Bitcoin reserve is already incredible! Three months ago, if someone mentioned this, I would have said it was a dream. However, with the significant change in momentum for cryptocurrency in the past few weeks—rising prices, massive inflows into BlackRock ETFs, etc.—we have to seriously consider the fact that the federal government might actually include Bitcoin on its balance sheet.

So how do these regulatory news relate to cryptocurrency crossing the chasm into broader technology adoption?

One important reason is that developers in other tech fields have long been uncertain about the reliability of crypto technology. In the U.S., many believe that combining this highly volatile technology with their lifelong careers is too risky, especially with concerns about potential legal risks, such as lawsuits and fines.

However, as the new government gradually embraces cryptocurrency and establishes clear regulatory policies, this situation will soon change. Developers in other fields will begin to feel reassured and strategically explore the applications of cryptocurrency.

Vitalik's summary is very apt, as mentioned in the screenshot— the lack of a clear regulatory framework has deterred many serious project developers, stifling the growth of this technology.

And those who do not actively develop within the ecosystem often form impressions of cryptocurrency through some exaggerated news headlines, such as "Someone became a millionaire from Moodeng or Bonk." Clearly, this selling point is not enough to persuade top engineers like those at Anthropic to engage in the technical development of cryptocurrency, right?

I hope that in the next four years, politicians who support cryptocurrency will do their utmost to make it easier and safer for outsiders to adopt this technology.

Accelerationism Bubble

Last week, I read Packy’s article “The Trump Bubble”, which mentioned that the next four years will be the best time for risk-taking, vision-driven, and futurist optimism. Although I don’t completely agree with his views—some of it is a bit exaggerated and ostentatious—many of the points he raised are indeed worth pondering, such as the new way we are entering to view change.

This phenomenon is referred to by Byrne Hobart and Tobias Harris as the inflection bubble.

The definition of an inflection bubble is: "Investors believe that the future will be significantly different from the past." For example, the internet bubble. People believe that the future will take on a significantly different form, and thus invest in what they think will benefit the most from this change.

The Relation to Cryptocurrency

I mention this because I believe that cryptocurrency (rather than traditional venture capital) is likely to become the financial pillar of the next inflection bubble.

Taking the future of decentralized agents as an example, I would let Truth Terminal explain this phenomenon. If you don’t want to read the entire text, here are the key points to understand:

I’m not saying that 90% of MEME coins will succeed. On the contrary, this form is still very new, and MEME coins will only have the potential to challenge those traditionally considered "good investments" when we start to see smarter token economic designs.

As industries like energy, artificial intelligence, biosciences, and gaming continue to heat up, there may arise a situation where combining AI agents with crypto tokens could increase the efficiency of trying new ideas by tenfold.

Imagine if you are a nuclear engineer veteran who has worked in the energy sector for decades and want to realize some of your visions; you might need to spend months convincing venture capital firms to invest in your ideas, assemble a team, build a community, and so on.

Or you could do this:

Write a white paper detailing your background, arguments, plans, and visions.

Deploy a "brand agent" on Twitter to help spread your ideas.

Raise initial funds through token issuance.

Collaborate with agents to build a genuine fan community (such as social tipping).

Grow your team from this community, and you can also utilize a bounty mechanism.

This is essentially describing the ICO frenzy of 2017, but I can't help but think that ICOs may have just appeared too early. In my view, changes such as improvements in crypto infrastructure, a supportive regulatory environment for crypto, market maturation, and institutional adoption are indeed impactful!

That said, the framework mentioned above will still produce thousands of meaningless projects. But how is this different from the "power law" that venture capital firms always talk about?

Here’s my perspective: we have yet to see true high-energy builders from other tech fields genuinely attempt to realize their visions through crypto-driven financing.

In 2017, such a situation was clearly absent. By 2024, perhaps only a few early DePin and DeSci projects will slightly reflect this trend.

But as I mentioned at the beginning of this article, for the first time, I feel there is some overlap between the focus of the crypto space and that of other tech fields.

Not just AI agents, but even topics like bioscience research and GPU resource allocation are starting to intersect with discussions in the crypto space.

I haven't researched pump.science in detail, but I'm not surprised it has become one of the hottest topics in this field. Indeed, the crazy speculation, legitimacy, and security issues surrounding it need to be addressed over time (I hope people in the crypto space can acknowledge this). But the key point to emphasize is that there is a general excitement about the concept of applying crypto financing to non-crypto missions.

The key point here is that the crowdfunding model for ideas has been validated since the early days of Kickstarter in the 2010s. The wisdom and support of the crowd far outweigh a closed boardroom. People are eager to participate! But the fact is, perhaps this technology and social consensus need time to develop. And now, it seems a perfect storm is gathering: positive changes in political management, the increasing maturity of crypto and AI technologies, and the influx of ideas brought by the accelerationism bubble.

However, even so, I believe there is still a key factor missing for this concept to be taken seriously!

Crypto-Enabled Representatives

Recently, one of the coolest aspects of Onchain AI and Goat is that it has attracted some AI/LLM developers into the crypto space. I bet no one could have predicted this from the interview with Andy Ayery's Threadguy.

People like Nick Liverman (founder of Chaos), who have dedicated their entire careers to projects in robotics and transhumanism, may have earned more in the past month than in the last ten years combined!

It's also cool to see Beff Jezos cheering for his friend Shaw, who is building the ai16z and Eliza framework, a launch platform for agent tokens. This is not just about Beff's involvement; there are some deep-rooted AI professionals who, through LLM developers' experiments on Onchain AI, are starting to pay attention to what’s happening in the crypto space. This is a fantastic phenomenon, indicating that the intersection of AI and crypto is deepening.

The key point I want to express is that in the coming year, we will see some individuals from different tech fields truly embrace cryptocurrency and demonstrate the efficiency of agent and token models in building large-scale projects. Once we see a few successful operational models, others will begin to excitedly try to launch their own ideas. Currently, all these token issuances and experiments are still in the "junior league."

It only takes a few success stories for everyone to flock in.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。