Many old players and seasoned investors believe that the bull market in 2024 will be vastly different from that of 2021, with a different level of difficulty. The challenges lie in the absence of native narrative creation, the lack of new investors entering the market, the influx of projects with high FDV for harvesting, and the long-awaited mass adoption still not materializing…

However, as Dickens said, "It was the best of times, it was the worst of times." The key to wealth often lies in the riddle itself.

Following Trump's Bull Market

At the moment Bitcoin was approved for an ETF, crypto assets seemingly became a market dominated by the West. Almost all significant positive news and narrative innovations in this round have come from Western capital, whether it be SocialFi, DePIN, or Restaking. In this "most difficult bull market in history," one can simply follow Trump and Western concepts to switch to Easy mode.

Trump's Positive Meme

BTC

After Trump took office, BTC was the frontrunner. With the memory of the 2021 boom still fresh, many old players hope to replicate the previous Alt season, while new players are lost in the fantasy of "going all in on altcoins and lying flat to get rich." However, in this bull market, holding BTC has already outperformed a portfolio full of altcoins.

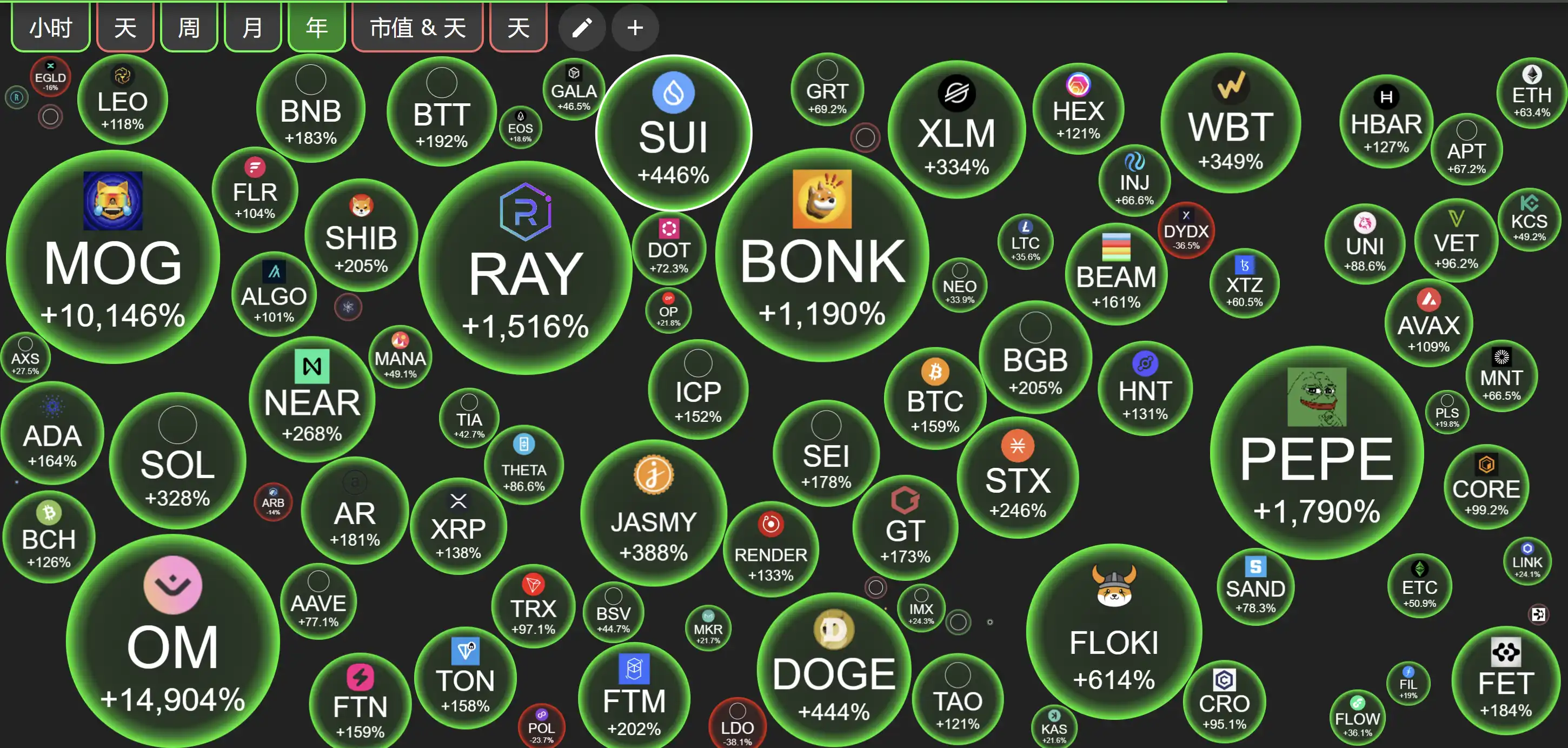

Since the beginning of the year, BTC has surged from 40k to around 98k, achieving a return of over 200%. The only assets that have outperformed BTC during this period are in the meme sector and some mainstream public chain tokens (like SOL and SUI), while most altcoins have not seen significant price changes compared to the beginning of the year.

Before the election, Trump has been publicly promoting BTC. At the Bitcoin 2024 conference held in Nashville, Trump appeared and delivered a nearly one-hour speech, claiming he would "fire the SEC chairman" and "never sell your Bitcoin." He also announced plans to establish a national strategic reserve for Bitcoin and ensure that the U.S. becomes the world's crypto center and a Bitcoin superpower. The various positive policies and commitments regarding Bitcoin after Trump's election are quite rare in the global capital market. With Trump's endorsement, BTC broke through the long-standing resistance at the 70k mark with brute force, achieving a 40% increase in a short period.

In addition to the ETF, the national strategic reserve and Bitcoin superpower narrative have become the biggest stories for BTC.

DOGE

As the original meme coin, Dogecoin has a deep connection with Musk and Trump. In April 2019, Musk tweeted that Dogecoin was his favorite cryptocurrency, calling it "cool." In May 2021, during an episode of Saturday Night Live, Musk referred to himself as the "Dogefather" and called Dogecoin "the people's cryptocurrency." Over time, Musk has become closely associated with Dogecoin, even becoming the public's image representative of it. To date, DOGE has gone through four bull and bear cycles but still firmly holds a spot in the top ten by market cap.

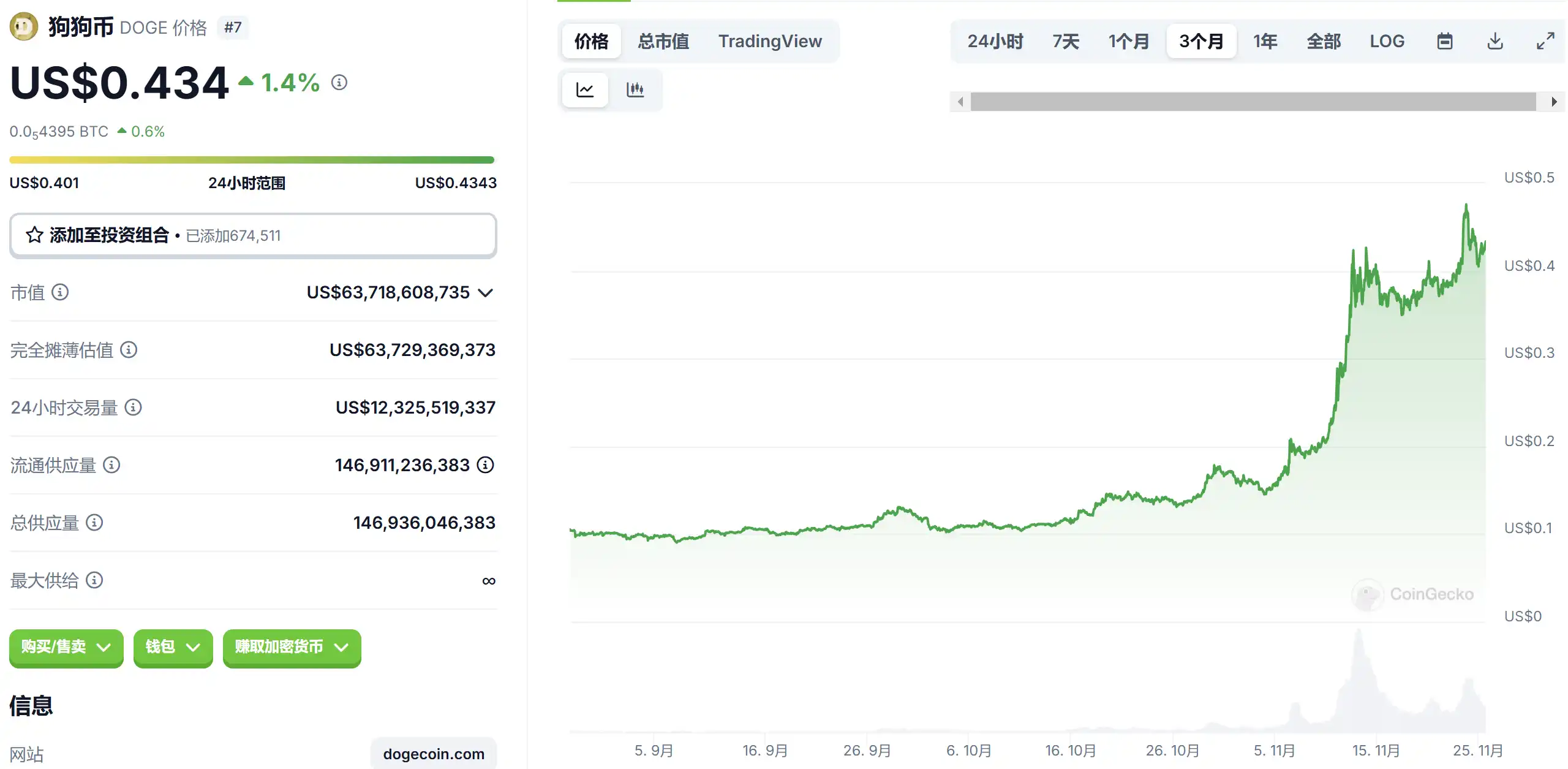

Most people hold the belief that "the market cap is too large to move" and "buy new, not old," and thus do not pay much attention to DOGE. However, once DOGE started, it moved independently, stunning everyone with its "path to rise." It has quadrupled in the past year and doubled in the past month, heading straight for $1.

PEPE

The name Pepe comes from the character Pepe the Frog created by American cartoonist Matt Furie, first appearing in his work "Boy's Club." This character won affection for its cute appearance and comical expressions, gaining some attention on the internet. Pepe the Frog first appeared in a comic in 2005 and later became a widely recognized meme in internet culture. The Pepe coin was launched on Ethereum in April 2023 and began to surge in February this year after nearly a year of consolidation. It has since maintained a market cap fluctuating in the billions.

As a meme that became popular in the West, Pepe went live on Robinhood and Coinbase after a six-month silence. Robinhood, the largest trading platform for U.S. stocks, previously only had DOGE and SHIB as memecoins, and the listing of PEPE indicates the U.S. market's recognition of PEPE. This significant development in the U.S. market led to a 50% surge in PEPE, maintaining a market cap of $6 billion and briefly surpassing the $10 billion mark.

WIF

In late December 2019, images of various logos and graphics added to beanies became popular as profile pictures among esports organizations and celebrities on Twitter. WIF, short for dogwifhat, draws its inspiration from the meme ancestor "DOGE," combined with the viral characteristics of the beanie.

WIF's trajectory is similar to that of PEPE, and it can be considered PEPE's junior. On November 14, when Coinbase listed dogwifhat (WIF), it surged over 30% on the day, nearing its previous high. In addition to already being listed on Coinbase, on November 25, Robinhood also listed WIF, making it the first Solana memecoin to go live on Robinhood.

PNUT

PNUT is the most frequently mentioned animal meme by Musk in this cycle, aside from DOGE.

The squirrel image of PNUT comes from a squirrel named "Peanut" adopted by an engineer named Mark seven years ago. Mark often shared videos of his interactions with Peanut on Instagram, gradually gaining hundreds of thousands of followers. However, a nearby resident complained to the New York State Department of Environmental Conservation (DEC) about Peanut, claiming it carried infectious diseases. Strangely, the DEC entered Mark Longo's home without a search warrant and took Peanut away. Mark Longo then launched a petition on social media, which garnered tens of thousands of signatures. Unfortunately, Peanut was ultimately euthanized by the DEC.

After Peanut's euthanasia, Dogecoin condemned the Democrats, and Musk mourned Peanut's death, claiming that Trump's presidency would save Peanut. The animal image represented by Peanut is not just a meme of a social media influencer but has begun to accumulate a "Trump" political buff.

Due to the rapid surge in PNUT's early stages, many retail investors "climbed on the bandwagon," leading to a nine-day consolidation. Today, PNUT has stabilized at a small level and shows signs of a pullback.

In my previous article in the "Bull Market Bottom Fishing" series, I provided a detailed narrative analysis of PNUT (《Why $PNUT is the biggest alpha in this cycle? | Bull Market Bottom Fishing List》), explaining why PNUT has been able to maintain a steady market cap above $1 billion, while most memecoins struggle to break through the $1 billion hard cap.

In addition to these memes, there are also DOGE, which is highly related to Musk (as a new government department established by Musk after Trump's presidency), and Banana (the logo on Musk's rocket). For more information on DOGE, you can refer to my previous article: 《How did the $50 billion Dogecoin help Musk enter the new U.S. government department?》

Trump's Beneficial Enterprises

People often rely on historical experiences from previous bull markets to guide their investments, typically following the "pyramid cup" logic: BTC leads the way, excess funds flow into ETH and other mainstream coins, and then overflow into lower market cap altcoins, leading to an "altcoin season." In this BTC-included "BTC bull market" in the U.S., the market has belatedly realized that there seems to be no altcoin season. "BTC has always led the way, and funds have never overflowed."

However, the altcoin season has not disappeared; it has simply taken on a different form: the funds that overflowed after BTC's rise have flowed into U.S. stocks related to BTC concepts.

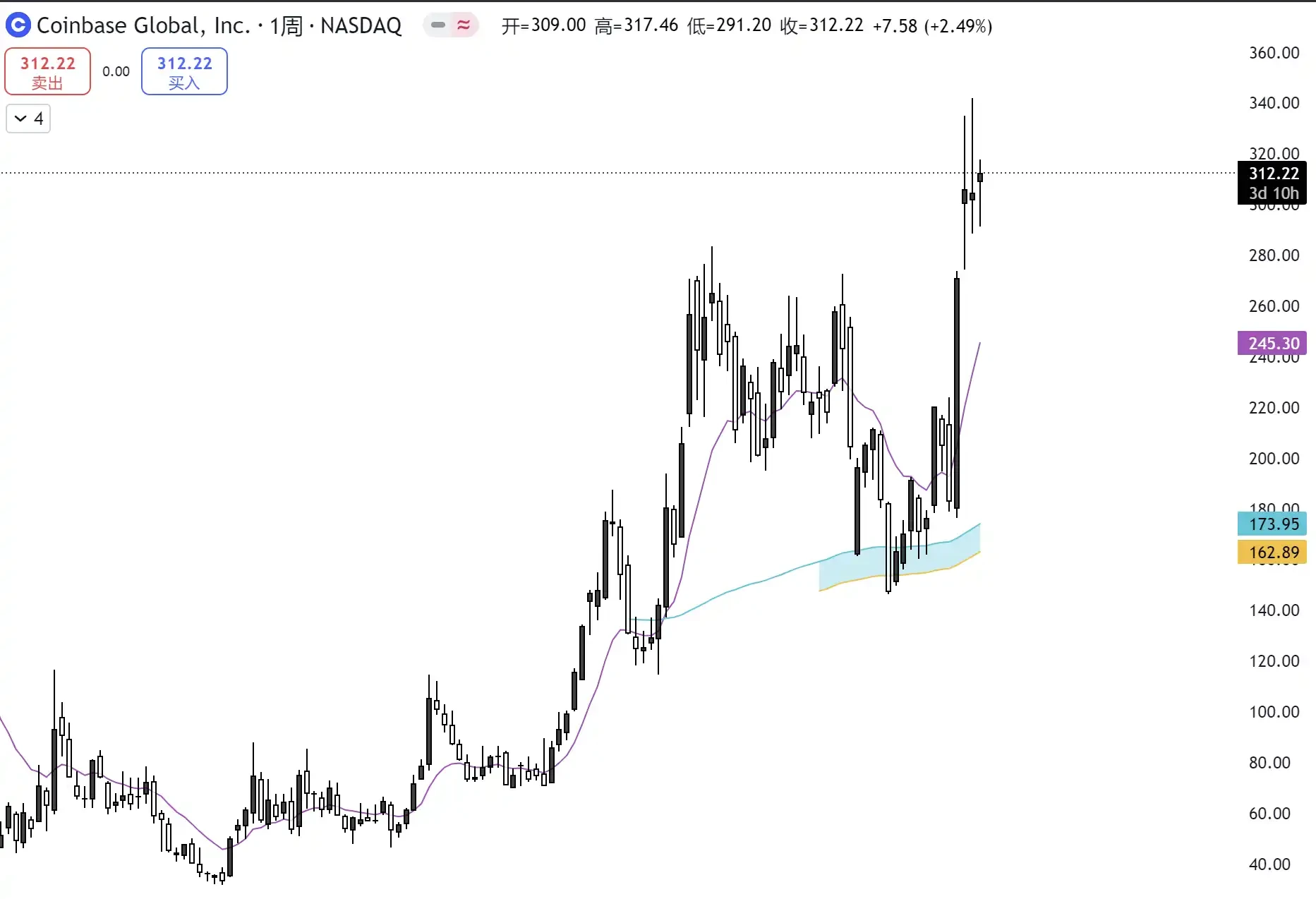

COIN

COIN is the stock of Coinbase, which achieved an extraordinary 800% increase this year. Before the election, Coinbase's stock price continued to rise due to the arrival of the crypto bull market. Although COIN experienced a pullback mid-year, Coinbase's stock price surged by 31% on November 6, 2024, due to the election results, rising from $193.96 to $254.31. Investing in COIN is akin to investing in the beta of "U.S. crypto assets," as any positive news regarding crypto assets is almost always absorbed by COIN's stock price.

In addition to COIN, other U.S. stocks related to crypto also show strong momentum.

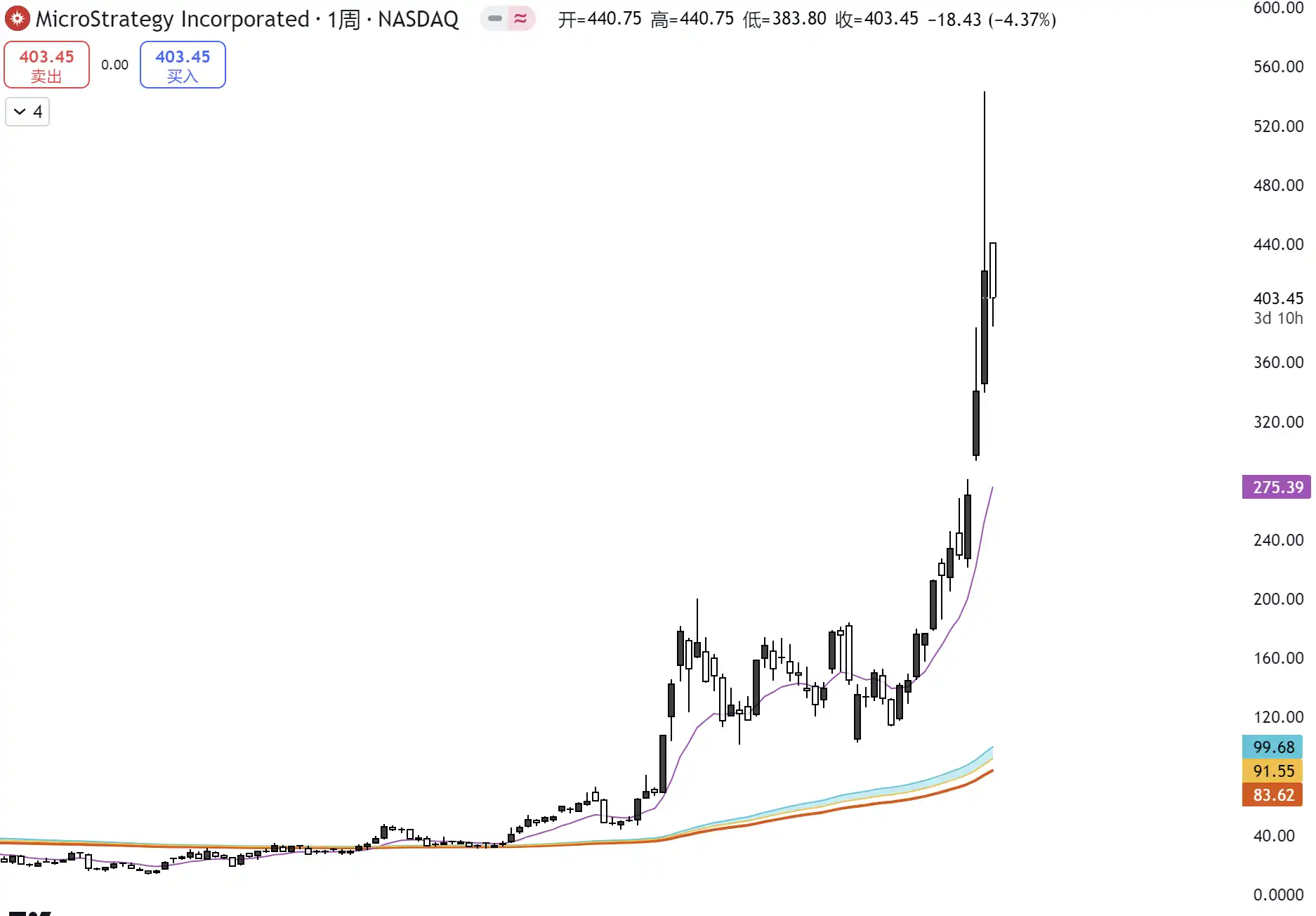

MSTR

MicroStrategy is primarily a business intelligence software company, but in 2020, it adopted a strategy of "issuing bonds to buy Bitcoin." As of now, MicroStrategy holds 1.2% of the total circulating supply of Bitcoin, making it the publicly listed company with the largest Bitcoin holdings in the world. The stock price of MicroStrategy has skyrocketed by 1000% within a year, far exceeding Bitcoin's returns.

MicroStrategy's strategy of issuing bonds to buy Bitcoin has led many to worry that MSTR could be the next LUNA, but in reality, MicroStrategy's safety is much better than that of LUNA. Moreover, its recent repayment period extends to 2027, which is still some time away.

In addition to companies like MicroStrategy that rely on Bitcoin, many "small-cap" firms have begun to emulate MicroStrategy's strategy. For example, fitness equipment company Interactive Strength (TRNR) announced plans to purchase up to $5 million worth of Bitcoin after its board approved cryptocurrency as a treasury reserve asset. Following the announcement, the company's stock price surged over 80%. Similarly, small-cap companies like LQR House (LQR), Cosmos Health (COSM), Nano Labs (NA), Gaxos (GXAI), Solidion Technology (STI), and Genius Group (GNS) also saw brief surges in stock prices after announcing Bitcoin treasury plans in November.

Western Concept Public Chains

In addition to cryptocurrencies closely related to Trump, the election of this Bitcoin president is a significant boon for all crypto projects rooted in the West. Not only will the regulation of crypto assets in the U.S. loosen, but it will also facilitate the inflow of traditional financial capital into crypto assets. Among the cryptocurrencies listed on Coinbase, the first ones that traditional U.S. brokers can access, besides BTC and ETH, include ADA, BCH, DOT, and XRP. Similarly, when the floodgates open, the water will only flow to the larger basins.

SOL

As one of the high-performance public chains that challenged Ethereum in the last cycle, Solana seems to have "partially" replaced Ethereum's position in the crypto ecosystem this time around. In the previous cycle, Solana thrived alongside FTX, but after FTX's collapse, Solana became a target of widespread FUD, dropping to a low of just $11. Since September 2023, Solana has entered a trending market. Over the course of a year, Solana has become the true meme public chain in the entire crypto space, characterized by high performance and low GAS fees, successfully breaking through $200 and once again challenging previous highs.

XRP

At the beginning of this cycle, XRP was mired in legal disputes with the SEC and regulatory challenges. In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, accusing it of conducting an unregistered securities offering by selling XRP. The SEC argued that XRP met the criteria for a security and therefore needed to be registered and comply with federal securities laws. Due to the SEC's lawsuit and the regulatory uncertainty surrounding XRP's classification, several cryptocurrency exchanges, including Coinbase, delisted XRP. On August 7, 2023, the court issued a final ruling requiring Ripple to pay a civil penalty of $125.0351 million and prohibited the company from further violating the Securities Act.

Ripple's CEO claimed on FOX News that an XRP ETF would be launched in 2025.

However, after Trump took office, XRP not only cleared the shadows of past regulatory issues but also saw multiple institutions rushing to apply for an XRP ETF.

In early October, Bitwise and Canary Capital submitted applications for an XRP ETF to the SEC. On November 2, 21Shares submitted an application for the "21Shares Core XRP TRUST" ETF to the SEC, joining the ranks of those seeking approval for an XRP ETF. On November 25, WisdomTree Funds submitted a fund registration application named "WisdomTree XRP Fund" in Delaware and prepared to file an S-1 registration with the SEC.

Although the SEC has not yet approved any ETF, once Trump officially takes office, crypto asset ETFs may be approved in bulk.

UNI

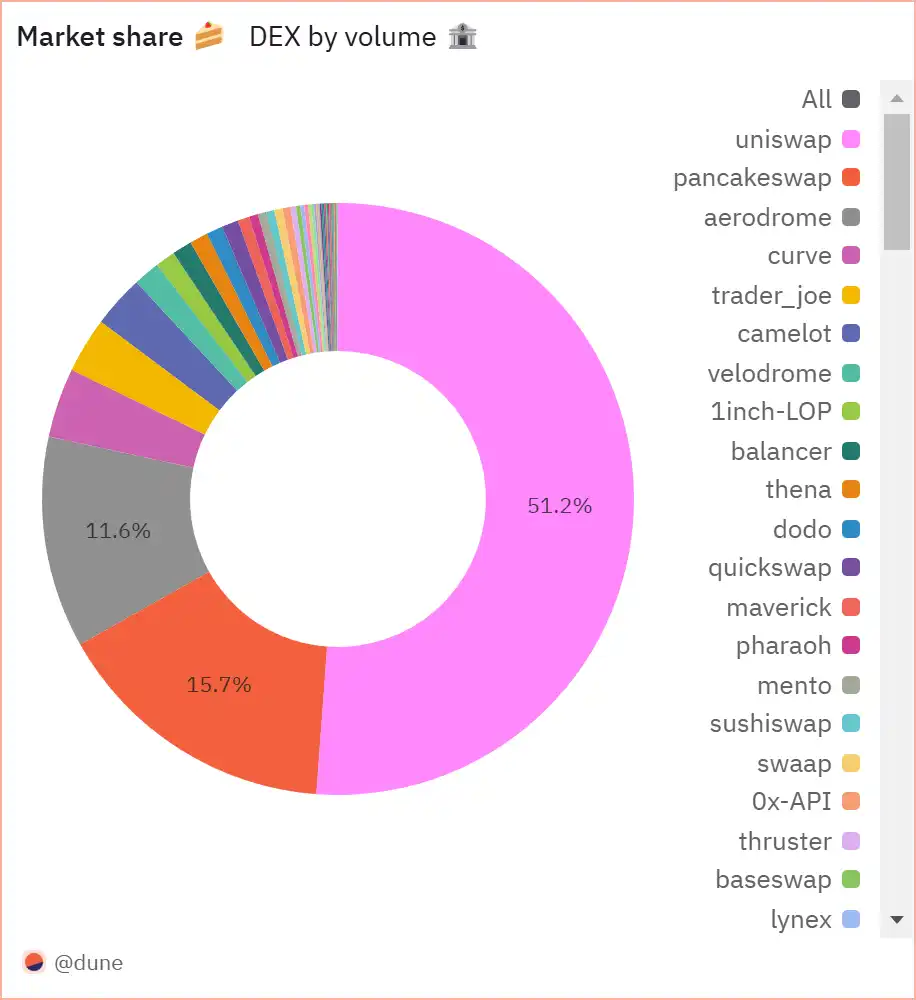

Uniswap, as the flagship application of crypto, has become many people's "first stop on-chain." To this day, it remains the highest-grossing DApp. It accounts for 50% of the trading volume among all DEXs and has consistently held the top position in the DEX space. However, UNI is not in most people's portfolios, primarily due to the belief that "a market cap of $7 billion is too large, with no profit effect" and "UNI is a worthless token with no practical use."

Uniswap's potential extends beyond being the leading DEX. In October of this year, Uniswap announced the launch of Unichain, designed specifically for DeFi (《Unichain launched in a hurry, what projects can be rushed?》), while the biggest benefits of the UNI token have yet to be realized. As the largest DEX in crypto, the SEC has been keen to impose regulations. On April 10 of this year, the SEC issued a warning to Uniswap, planning to take enforcement action against the company. The core controversy lies in whether the UNI token, if it aims to empower and distribute Uniswap's transaction fees to token holders, would conflict with the Securities Act. If Trump takes office, UNI will be free from regulatory constraints, and its "dividend" nature could elevate UNI to new heights.

BASE

Base is a Layer 2 solution backed by Coinbase. Although it has not yet issued a token, Base's fundamentals far exceed those of other L2s. Not only is the trading experience smoother than the mainnet, but many native narratives have also emerged on Base, such as a variety of SocialFi projects. In the meme sector, Base is also making strides, starting to capture the "AI meme" market from Solana. Whether it's VIRTUAL, which supports the mass issuance of AI agents, or Pump.fun CLANKER on Base, the wave of AI has quietly begun to rise on Base. I previously summarized the targets of the Base AI ecosystem in the article 《What speculative targets are brewing a hundredfold opportunity in the Base ecosystem?》. Among them, Clanker has already surpassed a market cap of $100 million, breaking many people's preconceived notions about the asset ceiling on the Base chain.

Similarly, there are also "old projects" like DOT and ADA, which have large market caps and are considered too early.

Summary

In research and analysis, many people often fall into the psychological trap of "I am the only one in the world," seeking alpha that only a few people pay attention to.

From a young age, we hear too much noise around us: in traditional education, teachers often give more attention to students who can solve problems with new methods; in martial arts novels, the highly skilled monk sweeping the floor often has his own "unique secret." Influenced by such social habits, when entering the market, one may also be affected by this "I am the only one in the world" prisoner’s dilemma.

Most ordinary traders look down on cryptocurrencies in the top 100 by market cap, or even the top 10, and typically search for small-cap coins worth tens of millions in search of "get-rich opportunities." Instead of expending so much energy tracking various sectors for alpha, it may be more cost-effective to study "Trump" as an alpha.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。