"The quality of decision-making depends on the information you have and your ability to process that information."

—— Ray Dalio, Founder of Bridgewater Associates - "Principles"

The price of Bitcoin has experienced significant volatility, undergoing its largest adjustment since the rise following the U.S. elections, with a single-day drop of 10.37%. In the past 24 hours, the liquidation amount in the crypto market reached $338 million, with over 129,000 people liquidated. The popularity of Meme projects, which have been hot for several consecutive days, has also declined.

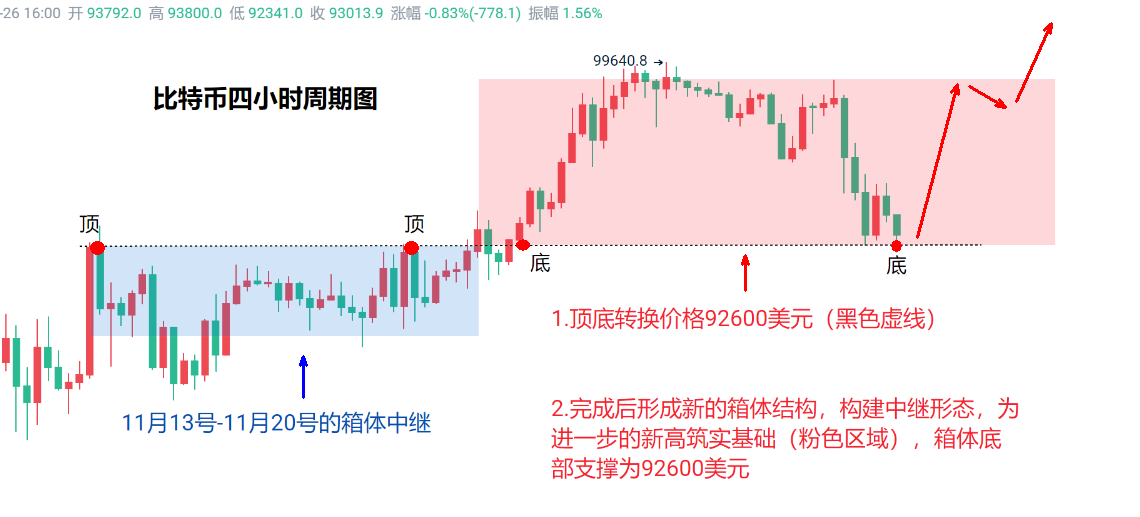

It is worth celebrating that we published an article last Friday indicating that Bitcoin's psychological price level of $100,000 was under pressure. Similarly, in yesterday's article titled "Trader Sean: Bitcoin Faces Adjustment Risks This Week!", we predicted a bearish outlook for Bitcoin at $98,600, with profits reaching thousands of dollars. As of the publication, Bitcoin has fallen to $92,400, touching the support level of the four-hour cycle platform, completing a top-bottom conversion pattern.

The current round of Bitcoin's correction does not require much interpretation. As emphasized in yesterday's article, a price drop of 5%-15% in a bull market is healthy, allowing for pattern repair and the liquidation of long positions. On the macro front, the "new cabinet" formed by the newly elected President Trump holds a friendly stance towards the crypto market. The latest news indicates that he has chosen cryptocurrency hedge fund manager Bessenet as Treasury Secretary, meaning the U.S. is one step closer to achieving a national strategic reserve of Bitcoin. The Chicago Board Options Exchange has also announced the launch of the first cash-settled index options related to Bitcoin's spot price on December 2 (next Monday). Such news is undoubtedly a booster for Bitcoin's prospects.

On a cyclical level, the price has retraced to touch the BOLL upper band support. As shown in the chart: the four-hour cycle retraced to the top-bottom conversion price of $92,600 and stabilized, overall moving steadily upward in a box structure. The top-bottom conversion pattern has been completed, indicating the end of this round of adjustment. The strategy is to buy on dips at $92,600, and once a continuation pattern is established, Bitcoin's next step will reach new highs, heading straight for $110,000.

The above is just my personal logic and viewpoint. Feel free to communicate and discuss. Creating is not easy; please indicate the source if reprinted. Thank you for following the WeChat public account: Trader Sean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。