Written by: Alex Liu, Foresight News

In the early hours of November 26, Beijing time, the Movement Foundation announced the launch of the Movement Network utility token MOVE. Movement is a Layer 2 public chain built on ETH, aimed at bringing the Move language into the Ethereum ecosystem. With the Sui coin price hitting new highs and Aptos making frequent moves, the Move public chain is gradually gaining momentum, and the TGE of Movement seems to have timed it well.

When will the token be released?

The Movement Foundation has not disclosed the specific TGE date, but we can glean some clues from exchange-related information — Bybit Convert will launch MOVE on December 4, the TGE will likely occur before this date, most probably at the end of this month or in the first two days of December.

What about the token economics?

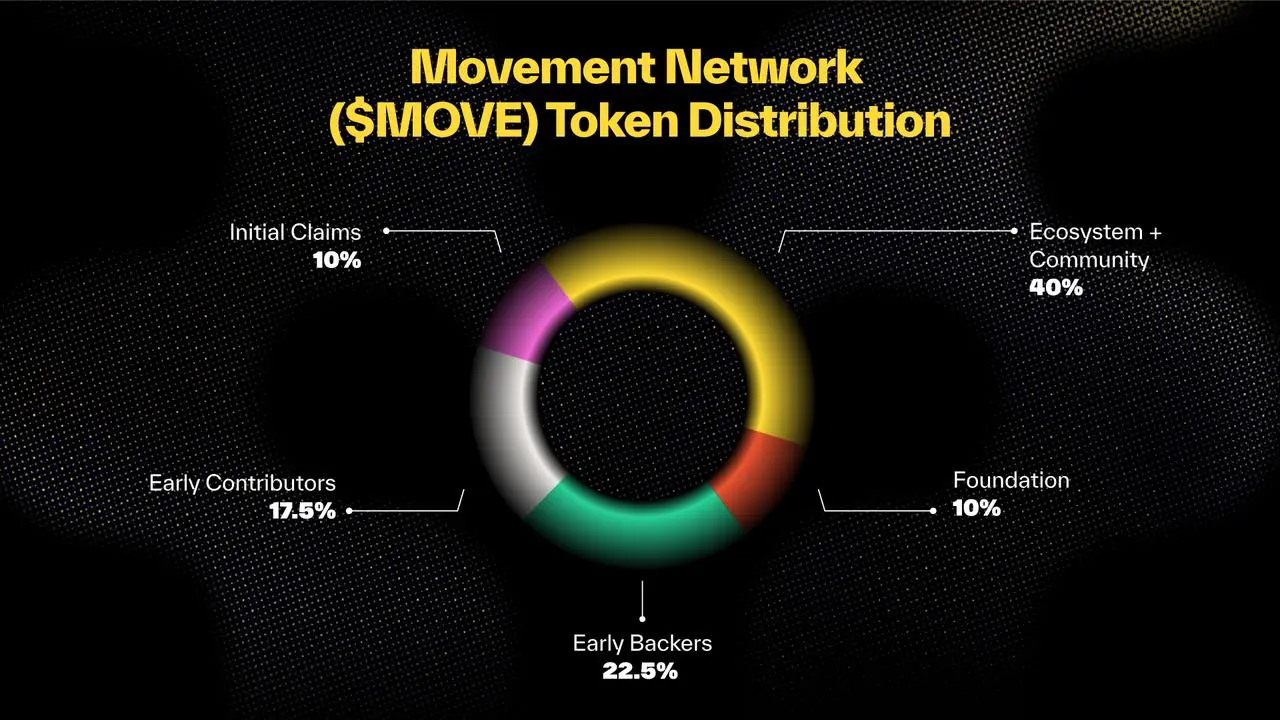

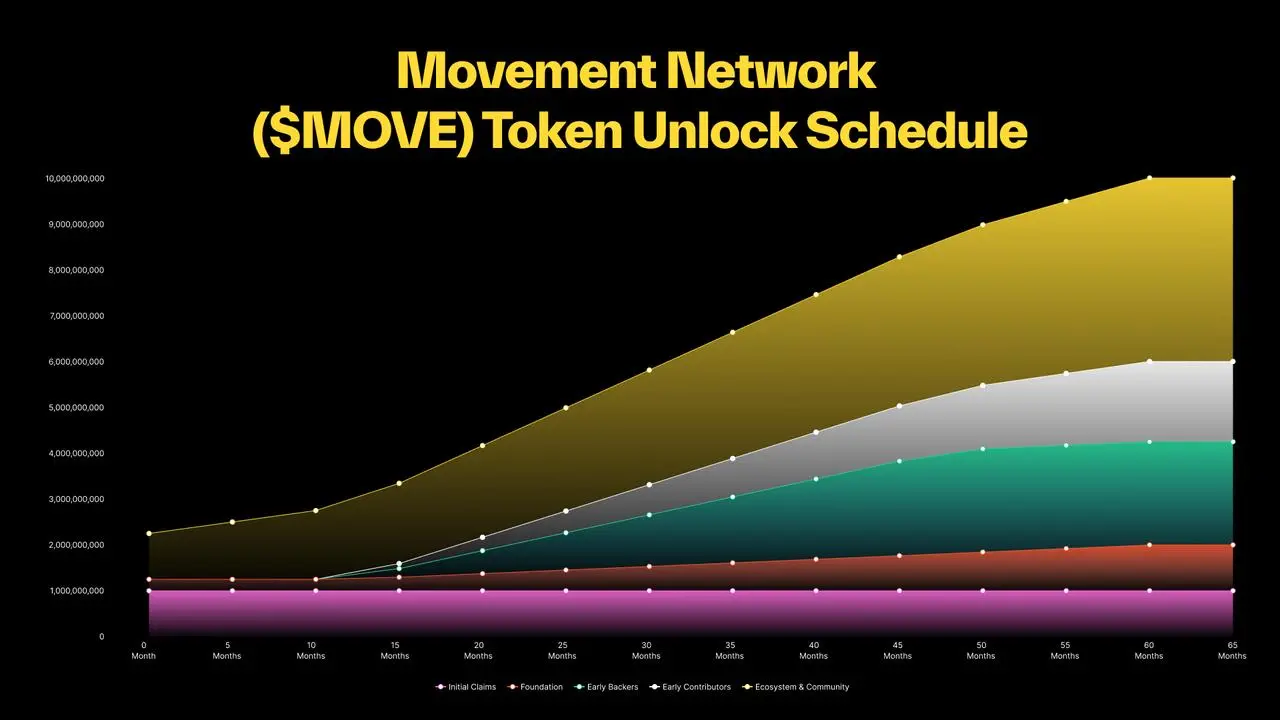

The total supply of MOVE tokens is 10 billion, with an initial circulation of about 22%. A total of 60% will be allocated to the community, including the ecosystem and community (40%), the foundation (10%), and initial airdrop (10%).

Early contributors will receive 17.5%, and early investors will receive 22.5%. The MOVE token will gradually unlock over 60 months and will have its TGE on the Ethereum mainnet. The team and investors will not be able to participate in staking initially. The Movement Foundation stated that once the MOVE token goes live on the mainnet (which is imminent), holders of MOVE will be able to cross-chain to the Movement Network.

The 10% initial airdrop ratio is relatively good compared to recently launched projects, and the 60-month (5-year) lock-up period spans a complete cryptocurrency "4-year cycle." A longer token unlock period can compel the team to adopt a long-term perspective and "BUIDL," rather than becoming complacent after the token launch.

The team and investors will not be able to participate in staking initially, addressing criticisms from TIA regarding "investors selling staking rewards to break even," which is a pragmatic approach.

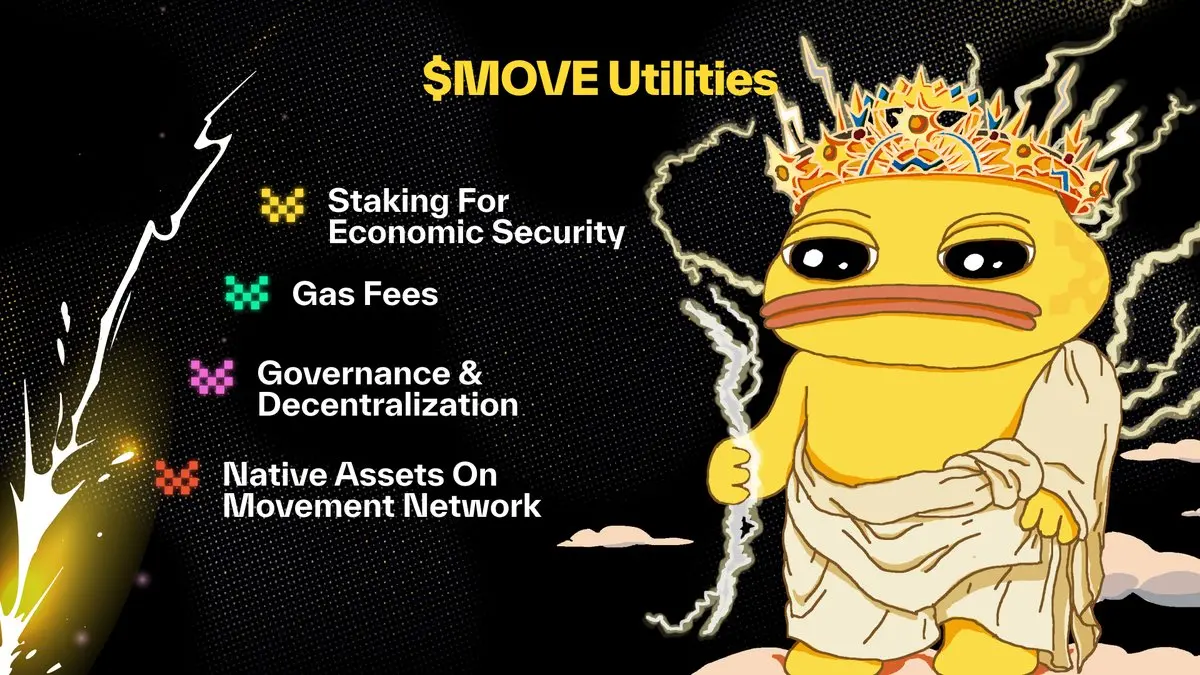

What is the utility of the token?

The MOVE token will serve as the native asset of the Movement Network, participating in staking, gas fees, decentralized governance, and other use cases.

Staking for economic security

Once the Movement public mainnet is launched and staking functionality is enabled, validators on Movement will be able to stake MOVE. As a reward for providing economic security to Movement, active validators will receive MOVE staking rewards.

Gas fees

The gas fees on the Movement Network will be priced and paid in MOVE, with a portion of the fees used to cover transaction settlement costs on Ethereum.

In the future, networks built using Move Stack are also expected to use MOVE to pay gas fees.

Governance and decentralization

MOVE holders will be able to propose governance proposals and vote on them to change certain network parameters.

Native asset of the network

MOVE will become the native asset of the Movement mainnet. Applications built on Movement can use MOVE for:

- Providing liquidity

- Serving as collateral

- Payments

- More

Who will receive the airdrop?

The initial airdrop ratio is 10%, and the main recipients of the airdrop are expected to be testnet participants, cooperative ecosystem projects, etc.

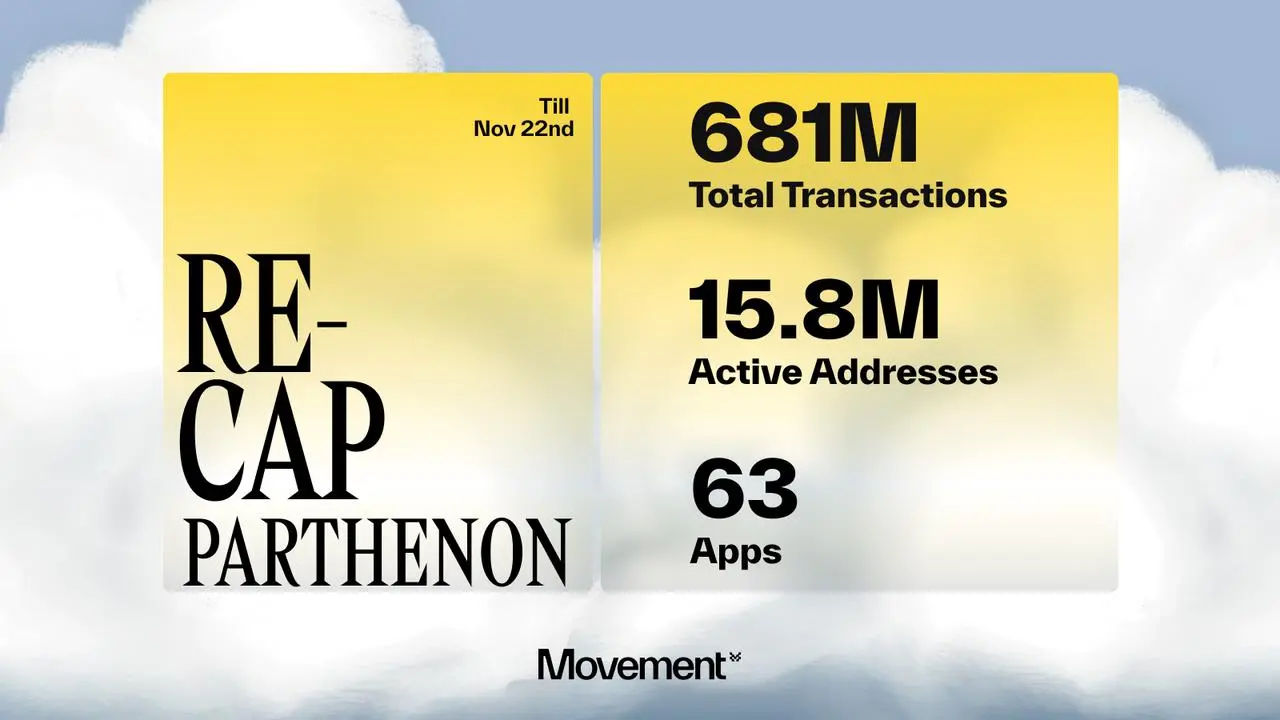

It is worth noting that the number of active addresses on the Movement testnet has exceeded 15.8 million, with a total transaction count of 680 million (an average of over 40 transactions per address). The airdrop benefits for testnet addresses should not be overly expected.

As for the share allocated to cooperative ecosystem projects, the author speculates it will be given to:

- Active DeFi users in the Aptos ecosystem. Movement primarily supports Aptos Move, and most Aptos ecosystem projects are preparing to deploy to Movement.

- POL stakers. Movement will integrate Polygon's AggLayer solution to address liquidity fragmentation issues.

TGE first, then mainnet?

Why will the MOVE token be launched before the Movement public mainnet?

To correctly initiate "post confirmations." Post confirmations are a mechanism that allows Movement to achieve finality in one second (or less).

The implementation of Movement's "post confirmation" mechanism requires pre-established economic security. By using the MOVE token to establish economic security through liquidity deposit contracts before the public mainnet launch, Movement can achieve one-second finality through the "post confirmation" mechanism upon launch.

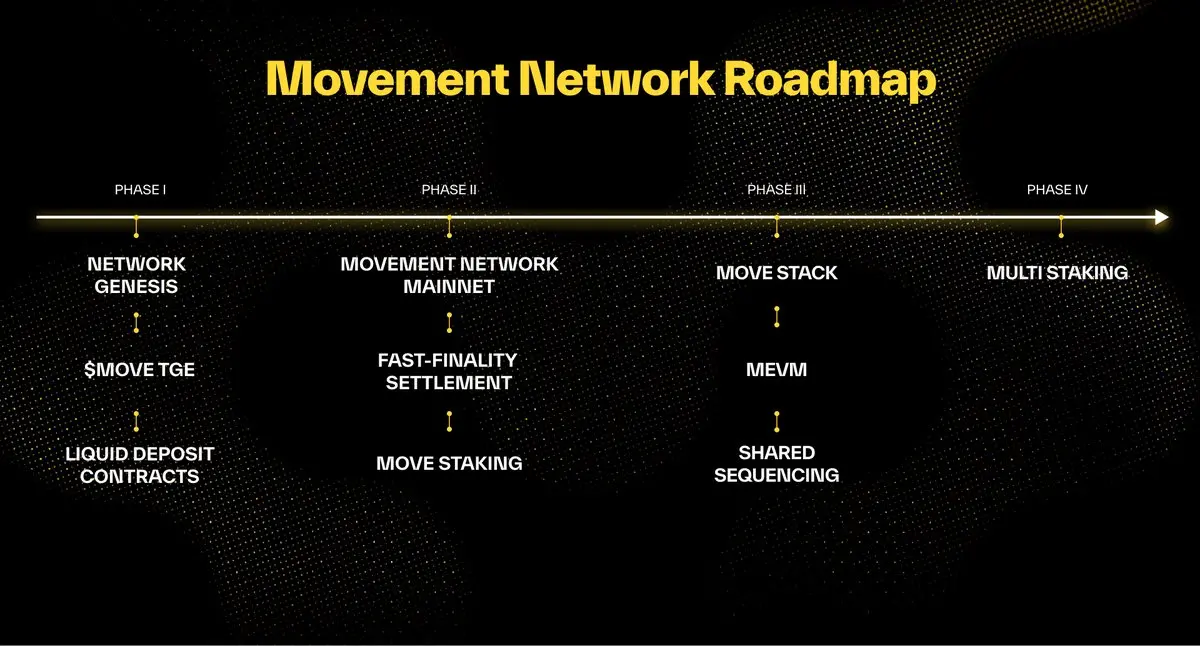

Roadmap

- Phase 1: Network genesis, MOVE token TGE, launch of liquidity deposit contracts

- Phase 2: Launch of the Movement mainnet, achieving rapid finality, MOVE token staking

- Phase 3: MOVE Stack, MEVM, shared sequencer

- Phase 4: Multi-asset staking

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。