Original | Odaily Planet Daily (@OdailyChina)

In July this year, the U.S. Securities and Exchange Commission (SEC) officially approved the trading application for the Ethereum spot ETF, making ETH the second cryptocurrency to enter the traditional financial trading market in ETF form, following BTC.

However, four months later, the traditional financial market has not shown the same enthusiasm for ETH as it did for BTC. The main reasons are that ETH's narrative as a tech innovation product is less compelling to the traditional market compared to BTC's "digital gold"; additionally, the continuous selling pressure from Grayscale's ETHE and the SEC's prohibition on staking features for Ethereum spot ETFs have objectively weakened its attractiveness.

For investors in the Ethereum spot ETF, currently holding ETH through the ETF means missing out on staking yields (currently around 3.5%), and they also have to pay an additional management fee of 0.15% to 2.5% to the ETF issuer. While some investors may not mind giving up this yield for convenience and security, there will inevitably be a portion of investors who will seek alternative options or even pause their investment intentions.

With Trump's victory, this situation is now seeing a turnaround. The market expects that the regulatory environment for cryptocurrencies will improve effectively, and the Ethereum spot ETF is also expected to introduce staking features, thereby amplifying the attractiveness of this investment product and boosting ETH's strength.

On November 13, ETF issuer Bitwise announced the acquisition of Ethereum staking service provider Attestant. Bitwise CEO Hunter Horsley stated in an interview that currently one-fifth of Bitwise's clients wish to earn yields through staking, but in a few years, most clients may have this demand.

On November 20, European cryptocurrency ETP issuer 21Shares AG announced the addition of staking features to its Ethereum Core ETP product, renaming it to "Ethereum Core Staking ETP" (ETHC). This product is currently listed on the Swiss Stock Exchange, Germany's Xetra Exchange, and the Amsterdam Euronext.

On November 22, Gary Gensler, the SEC chairman viewed as an opponent of cryptocurrency regulation, announced he would resign on January 20, 2025, further increasing the probability of the Ethereum spot ETF introducing staking features.

Which cryptocurrencies will benefit?

First and foremost, the introduction of staking features in the Ethereum spot ETF will directly benefit ETH — this will directly enhance the investment appeal of the Ethereum spot ETF, which may also be one of the reasons for ETH's relative strength recently.

Additionally, this shift will indirectly benefit the staking sector and the higher-level re-staking sector.

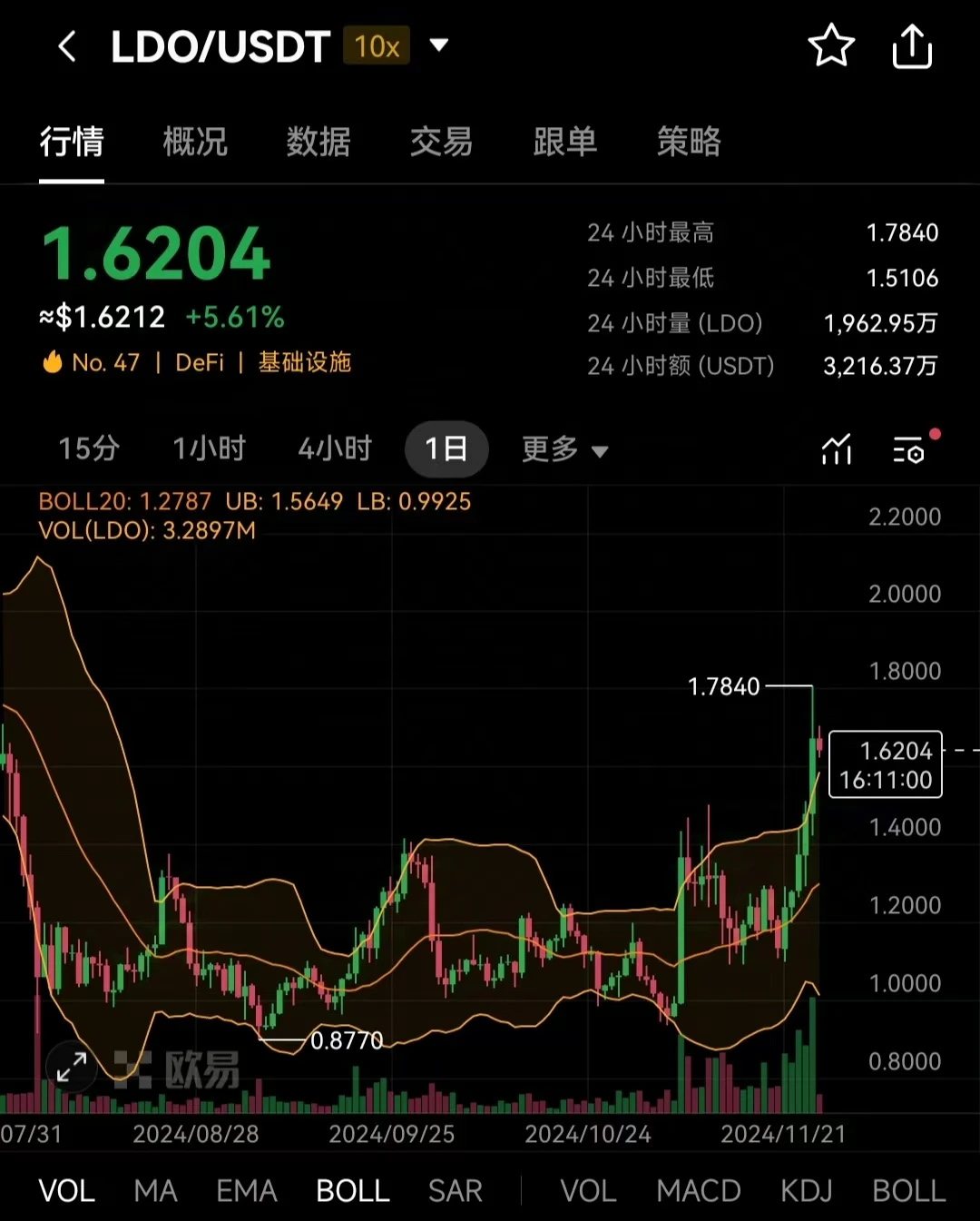

In the staking sector, Lido (LDO), Rocket Pool (RPL), Ankr (ANKR), and Frax (FXS) have recently emerged from a long consolidation period and are showing signs of recovery.

LDO and RPL deserve special mention. In June of this year, the SEC sued Lido and Rocket Pool, claiming that the stETH and rETH issued by the two platforms constituted securities, which caused a short-term plunge in LDO and RPL. It is expected that with Gensler's departure, this lawsuit will be resolved in a more amicable manner.

In the re-staking sector, EigenLayer (EIGEN) has rebounded strongly after awkwardly hitting a historical low last week, temporarily holding the critical position of 3 dollars despite a significant pullback in BTC. As a cornerstone protocol in the sector, the subsequent performance of EIGEN is expected to significantly influence the future performance of ecosystem projects like ether.fi (ETHFI), Renzo (REZ), and Puffer (PUFFER).

In addition to these cryptocurrencies, other companies providing staking services will also attract more business from the opportunity presented by the Ethereum spot ETF introducing staking features, such as Coinbase (COIN), which is already listed on the U.S. stock market. As a major custodian for both Bitcoin spot ETFs and Ethereum spot ETFs, Coinbase also issues a liquid derivative token cbETH. Although there is currently no concrete news, it can be expected that some ETF service providers will prefer to continue using Coinbase's services.

Limited Business Connections, Emotion-Driven Dominance

Looking at the recent market performance, ETH, the staking sector's LDO and RPL, and the re-staking sector's EIGEN and ETHFI have all achieved relatively good rebounds.

However, even if the Ethereum spot ETF is confirmed to introduce staking features, it may still be difficult for this business to flow towards native liquid staking tokens (LST) or liquid re-staking tokens (LRT) like stETH, rETH, or eETH in the cryptocurrency world. ETF issuers may either acquire staking service providers like Bitwise or, as mentioned earlier, directly choose reputable platforms like Coinbase.

Therefore, ultimately, the rapid rebound in the staking and re-staking sectors in the short term is still primarily driven by market sentiment, and there may be few actual business opportunities… But then again, the most precious thing in a bull market is sentiment, which is not a bad thing for the long-dormant Ethereum ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。