Meme Culture

In the internet age, memes have become an important cultural phenomenon. Memes are presented in the form of images, videos, or text, and spread rapidly through social media platforms in a viral manner. With their humorous, satirical, or inspirational content, memes have successfully resonated and engaged audiences globally. Memes are now a vehicle of modern culture, conveying societal values and collective emotions.

The popularity of memes also reflects the characteristics of information dissemination in the digital age: speed, wide reach, and high engagement.

76% of Influential KOLs Promote Ineffective Memes

The success of many meme tokens relies on the coordinated efforts of the community and support from external signals. For instance, when well-known institutions or individuals endorse a meme token, the market's recognition of its value increases. This value growth is often disconnected from actual utility, more a result of market sentiment and collective belief. However, the latest report indicates that even so, the majority of influential KOLs promote ineffective memes.

According to the latest report from CoinWire, 76% of influential KOLs promote memes that actually have no real investment value. These so-called "ineffective memes" mostly rely on celebrity effects and community hype to maintain their fleeting market popularity.

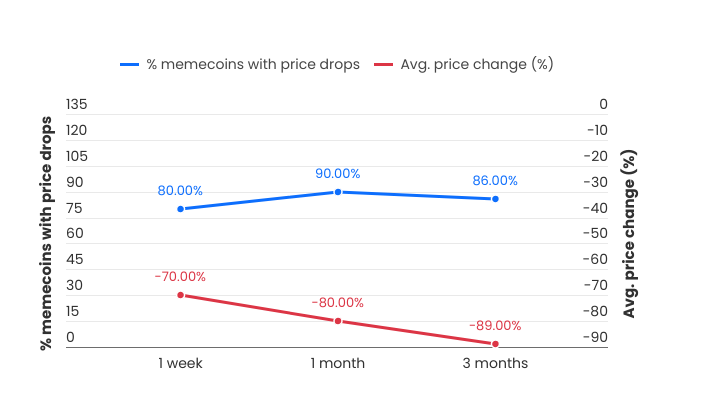

Research shows that one week after being promoted by influencers, 80% of memecoins lost 70% of their value; one month later, 90% of memecoins promoted by influencers dropped by 80%; and three months later, 86% of memecoins promoted by influencers saw their value decrease tenfold.

Image Source: Report

The significant drop in most meme coins over a short period reflects, to some extent, the market's speculative psychology and gaming behavior, especially in the short term, where quick profits are gained through hype, leading to the subsequent depreciation of most memes.

From the perspective of game theory, the market behavior of meme tokens can be seen as a complex collective game. In this game, investors face a choice between short-term profits and long-term value creation. Many investors choose to sell quickly at price peaks to realize profits, a behavior akin to the "prisoner's dilemma" in game theory, where maximizing individual short-term interests often leads to the loss of collective long-term benefits.

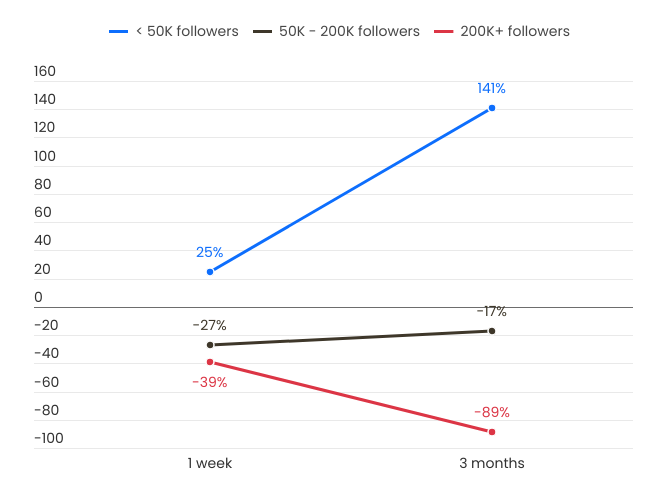

The report also reveals an interesting phenomenon: the more followers a blogger has, the worse the performance of the meme coins they recommend. The report explains, "Less influential individuals may have more genuine promotional practices, while more influential individuals may prioritize economic incentives over the quality of the projects they endorse."

Image Source: Report

What Makes a Good Meme?

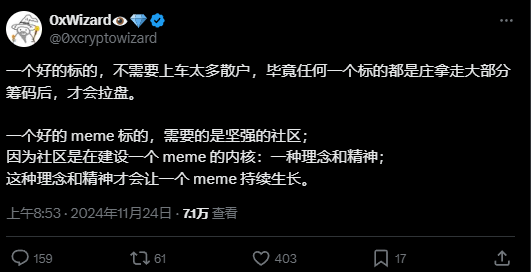

Trader 0xWizard states that a good meme requires a strong community, which is building the core of a meme, a concept and spirit that will allow a meme to continue to grow.

Image Source: x

What Are the Characteristics of a Real Community?

- Shared interests and goals

- Communication and interaction

- Structure and identity recognition

- Knowledge and resource sharing

- Collective recognition

Conclusion

As a modern social phenomenon, meme culture's influence and speed of dissemination cannot be underestimated. In the financial market, meme tokens are often viewed as speculative tools due to their lack of real value. From the perspective of game theory, meme coins represent a game between investors regarding short-term benefits and long-term value. The latest report indicates that 76% of influential individuals promote ineffective tokens, and these promotions align more with the interests of the bloggers rather than their followers. Therefore, investors need to be cautious and avoid making decisions driven solely by social media hype.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。