Master Discusses Hot Topics:

Waking up this morning, I was startled by Bitcoin's drop, which fell a bit more. I opened my phone to see everyone asking: why can't we break through the psychological barrier of $100,000? To be honest, this question is quite philosophical, both simple and complex. It’s just a step away, yet we can’t seem to take it, leaving people feeling anxious.

From trends, data to the information front, I haven’t seen any negative signals recently. On the contrary, Bitcoin's fundamentals seem quite stable. More and more listed companies are starting to allocate Bitcoin as reserve assets, like MSTR (MicroStrategy) which bought 55,000 Bitcoins in one go.

This indicates that the recognition of cryptocurrencies is increasing, but such purchases are often conducted through OTC (over-the-counter) transactions, which have limited direct impact on market prices. So the price isn’t rising, not because of heavy selling pressure in the market, but because the “influence” of these purchases hasn’t quickly translated into market sentiment.

I scanned the news this morning, and the Federal Reserve mentioned a possible interest rate cut in December. The new Treasury Secretary candidate is also suggesting cuts to federal spending, which should be considered positive news for the market.

The background sentiment of the elections hasn’t changed either, and these conditions don’t seem to have any factors unfavorable to Bitcoin's price. So currently, it’s more likely that market sentiment is weak, especially with a decline in FOMO enthusiasm; people are no longer eager to chase prices and are choosing to wait and see.

In fact, for Bitcoin, I believe it’s not a question of “can it reach $100,000,” but rather “when will it happen.” Just be a bit more patient! Perhaps once the spot ETF data comes out, market confidence will return.

For me, it’s like seeing a train full of dreams on the road. It’s slowly climbing uphill; although it’s not fast, you know it will eventually crest the hill and head to farther places.

From last night until now, Bitcoin has encountered strong resistance, dropping to a low of 92,666. Such fluctuations are no longer surprising for Bitcoin, but they still make one’s heart tighten.

Many friends ask: can it stabilize? To be honest, if it can’t stabilize, the altcoin season may really be hopeless. But if it stabilizes, the next one should be Ethereum’s turn to make a move.

The question is, it now depends on how the market makers write their script. If Bitcoin experiences another drop of 10,000 points, and Ethereum follows with a drop of 150 points, those altcoins might drop another 30%. If this situation occurs, the crypto market may have to endure another bloodbath.

Recently, I’ve seen many friends trading contracts, resulting in both long and short positions being liquidated, wiping out their assets completely. I must say, pursuing high returns indeed comes with corresponding costs. This is an iron rule in the crypto world: those who want to win more often lose even worse.

We cannot predict the future—whether it will rise or fall; frankly, these are the realms of “crypto fortune tellers.” As believers in science, we don’t predict; we only prepare.

When the market falls, how to respond? When the market rises, what should we do? Only by planning ahead and taking control can we stand undefeated in this battlefield of temptation and traps in the crypto world.

So while everyone is still predicting “will it rise or fall,” it’s worth asking yourself: if there’s a crash today, is your position stable enough? If there’s a surge tomorrow, can your plan keep up? Whether it’s a storm or a rainbow, the only thing we can do is be prepared to welcome any possible future.

In summary: The crypto world is not a casino; it’s a true test of human nature. If you can’t even control yourself, how can you control the overall situation?

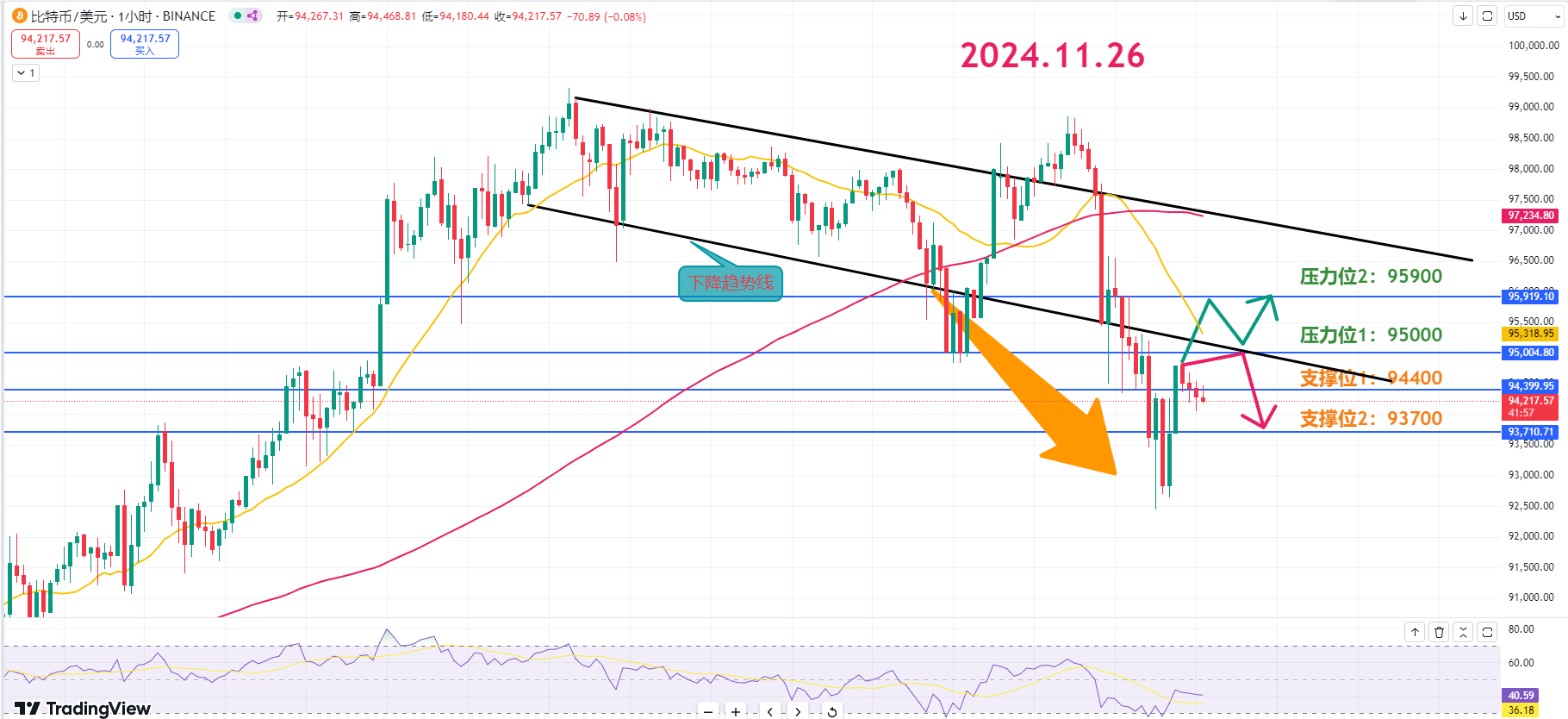

Master Looks at Trends:

Today, Bitcoin has a high probability of price adjustment in the short term, with a greater likelihood of downward movement. Without support from large buyers like MicroStrategy, maintaining the price will become more difficult.

Additionally, the Nasdaq is closed this week; if trading volume decreases, some price defenses may be breached, so strict risk management is necessary when trading this week.

Resistance Levels Reference:

First Resistance Level: 95,000

Second Resistance Level: 95,900

Support Levels Reference:

First Support Level: 94,400

Second Support Level: 93,700

Today's Suggestions:

Since we are currently in an oversold area rebounding, this can be seen as a technical rebound range. If the price breaks through 95K again, the possibility of a short-term rebound can be maintained, but the overall trend is downward, so it’s advisable to take profit in the profit zone and then shift to an adjustment strategy.

The second support at 93,700 is also a favorable entry price for very short-term trades. If the price ultimately closes above the previous low, it can be considered a relatively safe support. If the price breaks below the previous low, the downward risk will increase, so this support line will serve as a key reference.

If a large bullish candle rebounds during the day, while the previous adjustment bearish candle shows a slight decline, it can be seen as a reasonable adjustment. Consider entering after judging the trading volume.

11.26 Master’s Band Trading Setup:

Long Entry Reference: Enter around 91,800 with a light position; if it retraces to 89,200, go long directly; if it breaks below 89,200, exit; target 93,700-94,400-95,000 (do not trade if the position is not reached).

Short Entry Reference: Enter lightly at 95,500-95,900; target: 94,400-93,700.

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。