On November 25th at 16:00, AICoin Research Institute conducted a graphic and text sharing session titled "Precise Opportunities in the Bull Market: Funding Fee Arbitrage, Locking in Future Profits" in the 【AICoin PC Client - Group Chat - Live Broadcast】. Below is a summary of the live broadcast content.

Introduction:

Today, the host continues to share a relatively advanced topic and a high-quality tool: arbitrage.

First, let’s briefly summarize the purpose of arbitrage.

In ancient times, there was a famous saying that encapsulates the essence of arbitrage: "You can't catch a wolf without letting go of the child." Since ancient times, people have been aware of the concept of arbitrage.

In the cryptocurrency space, especially in the current bull market, arbitrage opportunities abound. We can continuously profit from these opportunities, just like catching wolves and eating wolf meat.

The host has an assignment for everyone!

Assignment One:

Check how well the positions selected last time were, do you remember the host's operations from last time?

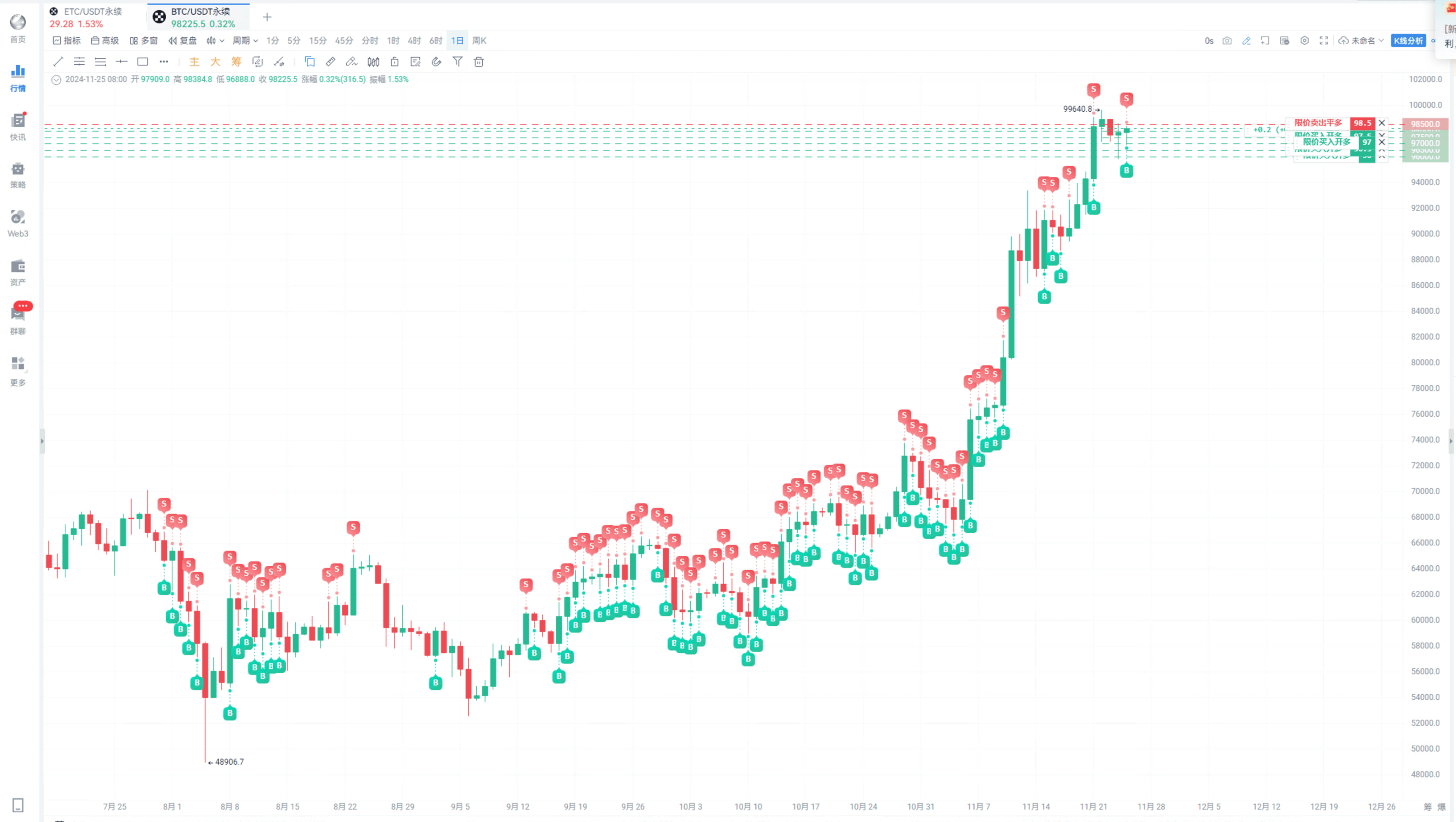

Those who watched the host's 20U War God operations should know that the host consistently recommended opening grids.

This is the record of the host's continuous grid openings.

Currently, it has reached a new oscillation space, where you can buy the dip and make profits when it rises.

A perfect long grid!

The host's current price range is: opening grids between 95,000 and 105,000.

The fish in this grid are all from the host's old high family.

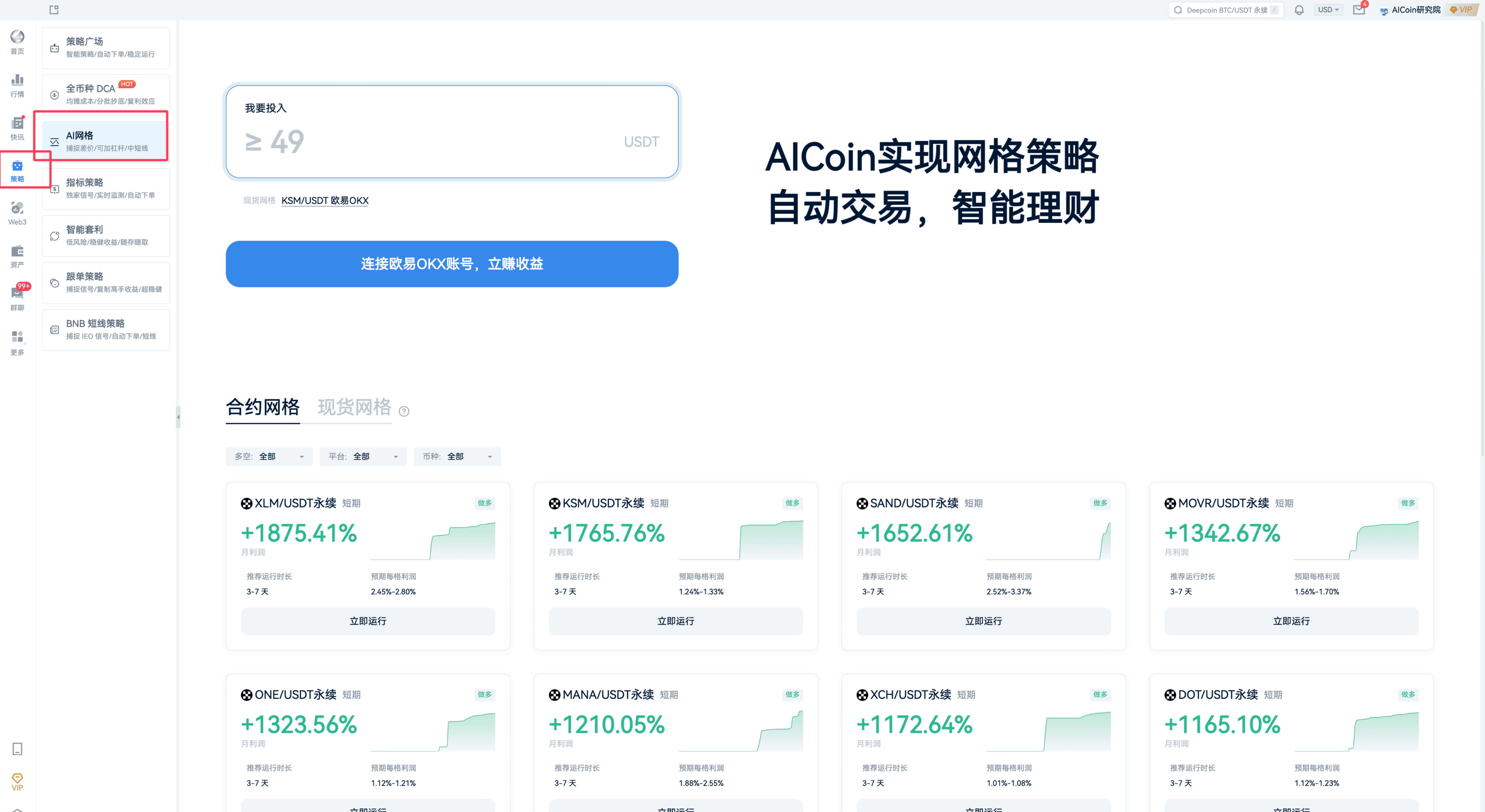

This is the first tool the host recommended last time: AICoin's AI grid tool.

If you believe the trend is still upward, you can try a long grid.

If you believe the trend is oscillating, you can try a neutral grid.

The benefit of grids is that you can enter and exit multiple times, buying and selling automatically.

You can make money while sleeping or playing games. Life is multi-threaded!

Neutral grids are suitable for oscillating markets.

Previously, AICoin conducted a series of grid explorations; you can find some tutorials in the news section.

That concludes Assignment One.

Assignment Two:

The host's second assignment is also for everyone.

20U War God assignment:

On November 21st, the host selected ETC to open a position.

Opened with 20U, let’s take a look back at the point situation.

The host's choice at that time was good.

Although the principal was only 20U, it still yielded good returns!

This method of selecting altcoins has been validated as effective again!

So the host has closed it this time, assignment completed! The host's selection this time was quite good.

Let’s also review Assignment Two.

The operation method still utilizes AICoin's statistical data, focusing on the ranking data on AICoin's homepage.

Find the homepage - Hot Rankings - Position Volume.

Filter for coins with large position volumes, positive position changes, and not too high 24-hour increases.

Then this coin is a quality coin!

It’s actually easy to understand:

● Large position volume: funds are being monitored.

● Positive position changes: indicating that the position funds are continuously growing.

● Not too high an increase: indicating that it is in the early stages of rising.

At this time, it is the best opportunity for us to take action, letting the main force help us lift the burden.

Some students in the discussion area asked how much of an increase is considered not too high?

High or low is determined by comparison.

Generally speaking, it can be three or four floors high.

For example, if you filter out a batch of coins that meet the criteria,

But you have limited funds and can only choose one or two, then choose the ones with the lowest increase; your chances will be greater!

That concludes Assignment Two.

Now let’s take a look at how to play funding fee arbitrage and lock in future profits! How many opportunities are there!

Everyone still needs to go through a simple overview.

Basic Principles of Arbitrage

First, we need to understand how arbitrage makes money.

The essence of arbitrage is making money through mathematics.

In simple terms, it means guaranteed profit, rigorously earned.

In fact, the cryptocurrency market is a game market where everyone's profits come from other people's losses.

So arbitrage utilizes liquidity and trading rules to earn profits in the middle, making future money through mathematics.

If your funds reach a certain amount, you must know how to arbitrage!

The most basic arbitrage in the cryptocurrency space is actually the current financial products offered by exchanges.

In simple terms: you deposit funds and lend them through the exchange. Then, borrowers use collateral to borrow money from the platform.

At this time, the platform acts as a facilitator, ensuring the safety of funds by liquidating the borrower before they become insolvent. If the borrower can repay, the interest inside is the share for the depositors.

This is the first layer of the arbitrage model, recommending OK and Binance's financial products, such as Yubi Treasure, and some options financial products. Its invention mainly aims to prevent the contract price from deviating too much from the spot price, allowing the contract and spot prices to converge and bind.

The second layer of arbitrage: funding fee arbitrage.

Think about it, why do people still mortgage to borrow coins when the interest rates on exchanges are so high? What are the borrowers doing?

In fact, a large part of it is the demand from arbitrage users.

In many cases, when you see annualized returns of 20%, 40%, or 60% on exchange financial products like Yubi Treasure, there are people borrowing.

Why? Because many arbitrage opportunities yield higher returns than this, leading to a demand for borrowing.

Additionally, many people hold BTC or ETH, which are difficult to generate returns, yet they want to hold coins for appreciation.

At this time, they will also mortgage BTC or ETH to obtain USDT funds to open arbitrage positions.

The topic has strayed too far; the above illustrates that many people are playing in this arbitrage market, and there are many opportunities.

The reason so many people take the risk of borrowing coins from exchange financial products at extremely high interest rates is that arbitrage is about making money through mathematics.

It can lock in future profits, allowing you to calculate whether this loan is worth it.

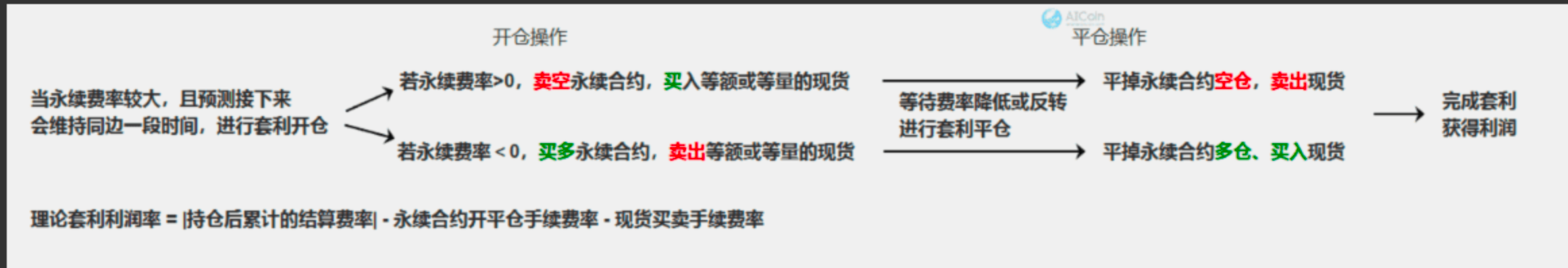

So, what is funding fee arbitrage?

In spot trading, we need to have coins before selling.

If the current price is high and you think the chance of a drop is greater,

How do you operate when you want to sell?

You can borrow the spot from the exchange, sell it, and then buy it back after the price drops to repay; this is the spot leverage trading model.

I’ve digressed; let’s continue explaining funding fee arbitrage.

In fact, the funding fee is a cost of perpetual contract trading rules.

Its invention mainly aims to prevent the contract price from deviating too much from the spot price, allowing the contract and spot prices to converge and bind.

For example:

If the contract price is particularly high, far exceeding the spot price, the party going long must pay the funding fee to the party going short. This creates a positive funding fee arbitrage opportunity, which is the focus of our research today.

If the contract price is particularly low, far below the spot price, the party going short must pay the funding fee to the party going long. This creates a reverse funding fee arbitrage opportunity, which involves borrowing coins for leveraged arbitrage, carrying more risk than the positive arbitrage mentioned above, typically played by professionals in bear markets. We can discuss this further later.

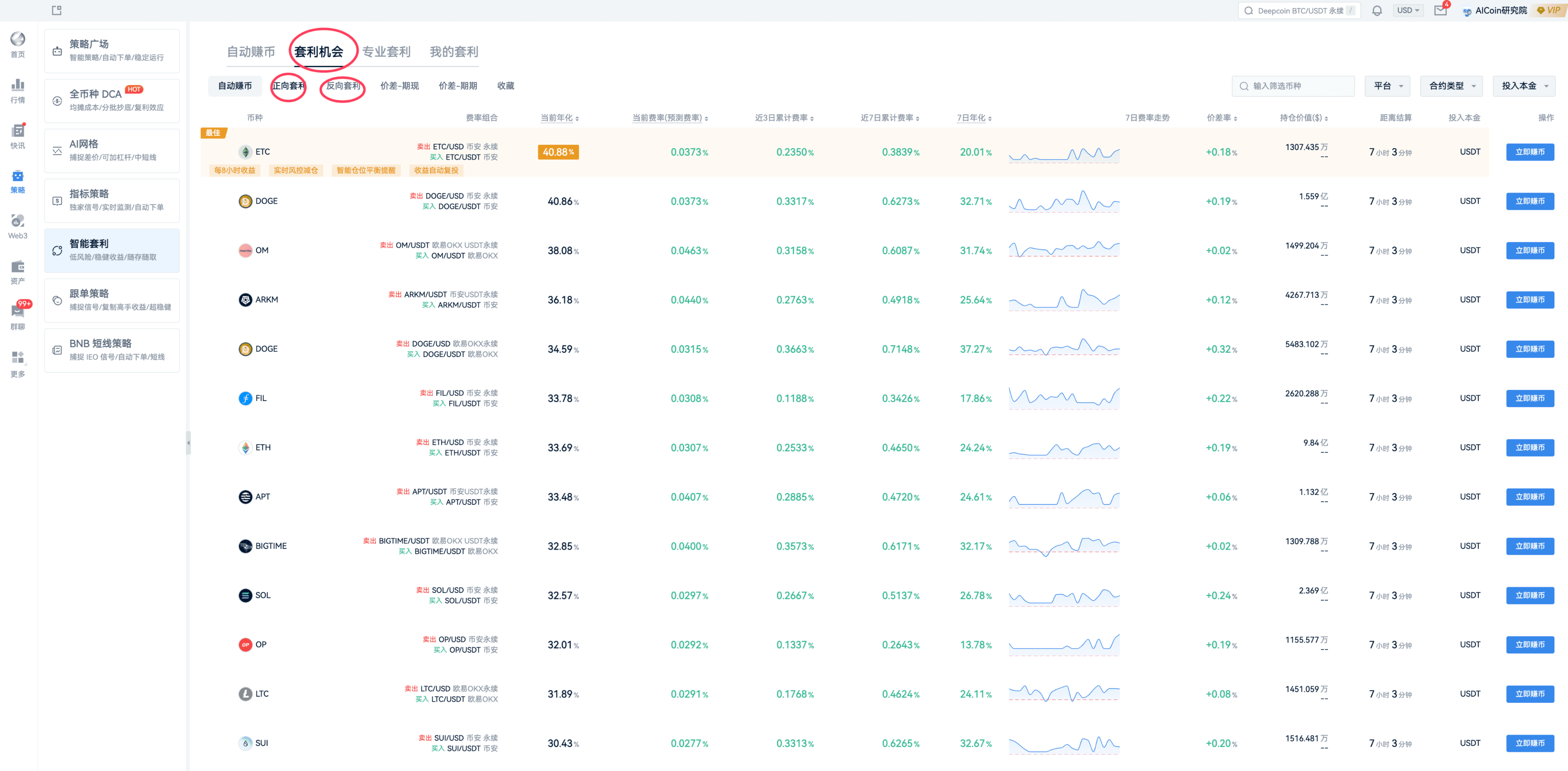

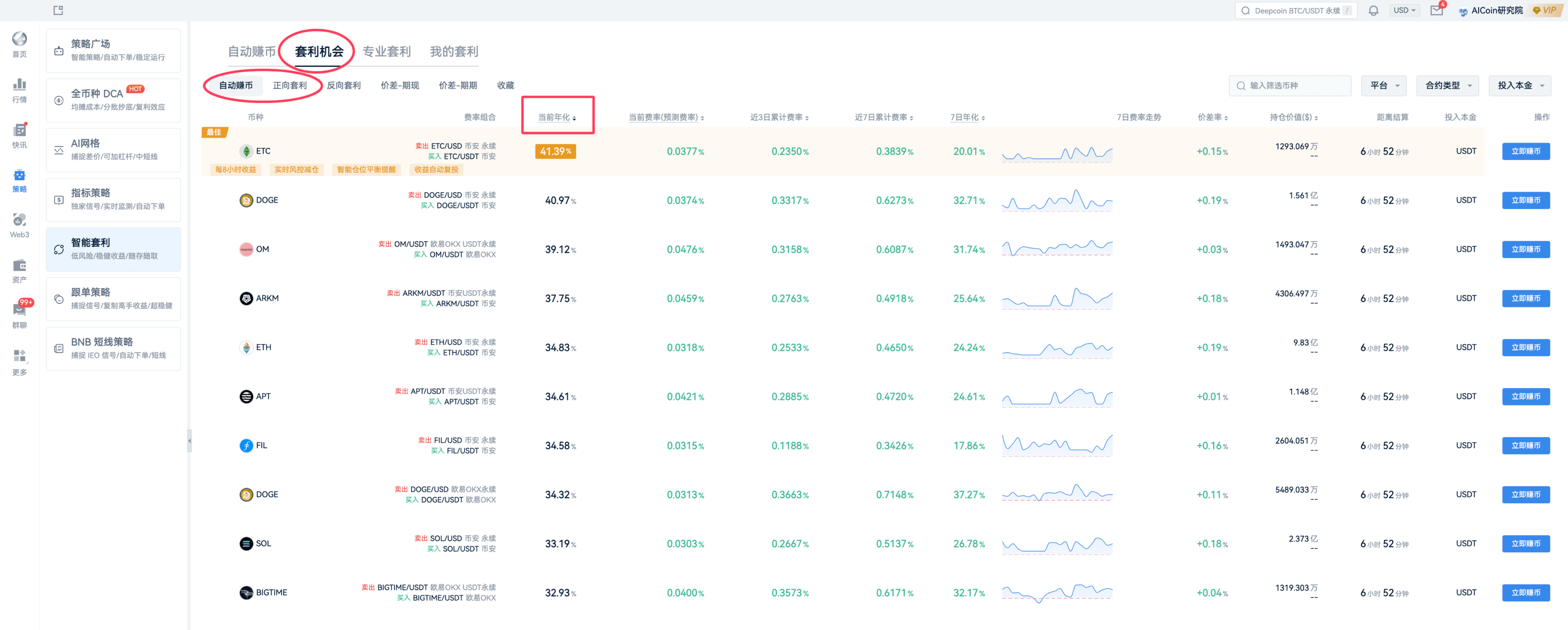

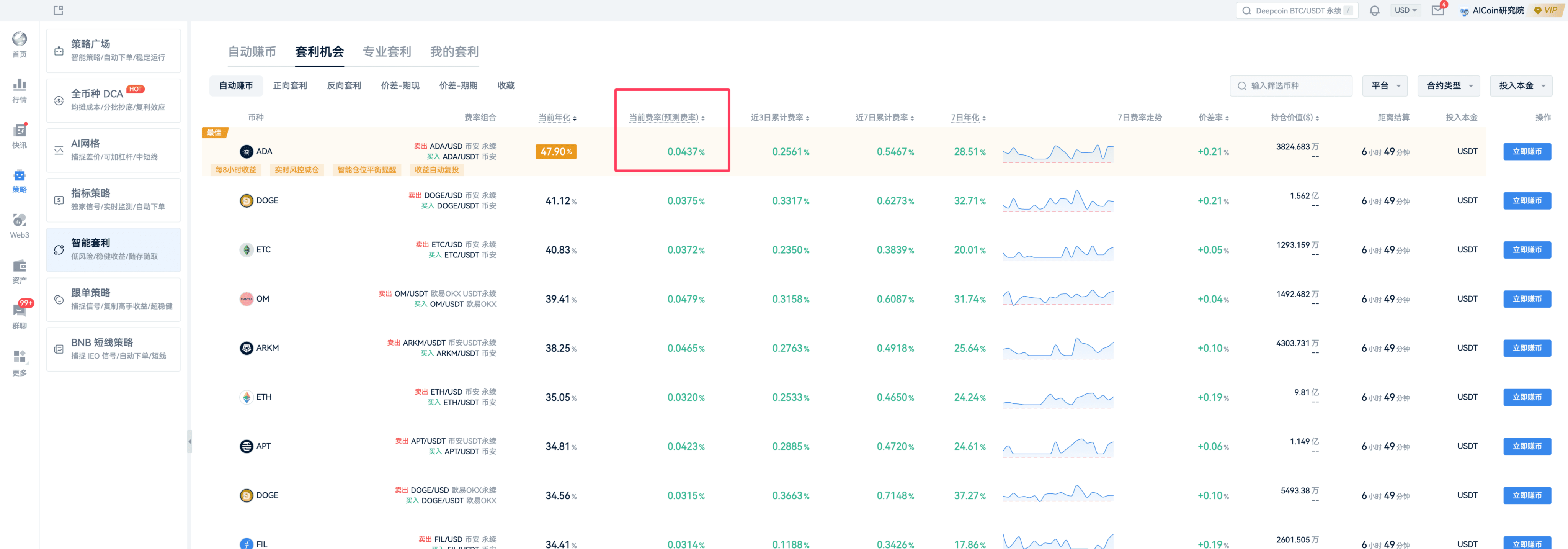

Let’s take a look at AICoin's client, which also distinguishes between positive and negative arbitrage.

Here, AICoin has thoughtfully categorized automatic coin-earning modes for everyone.

This mode is very suitable for beginners.

Once you invest, you don’t need to worry about it.

What you need to do is find suitable coins and invest funds.

Does anyone still have questions about the principles of arbitrage? If not, I’ve organized a process for everyone here.

You can save this image, which outlines the complete arbitrage process and how to earn money through arbitrage.

It can be said that understanding this is truly understanding trading!

Let’s do a simple example:

If you open a short position of 1 BTC in a perpetual contract, you need to buy 1 BTC in the spot market.

If the BTC price rises, it will show as a loss in your position, while the spot is profitable;

If the BTC price falls, it will show as a profit in your position, while the spot is at a loss.

From the price calculation formula, you have achieved a break-even point, no longer worrying about the price fluctuations, and can safely collect the perpetual fee rate.

Professional content may be a bit dry, but if you truly want to earn clear money, you still need to delve into the principles.

You should know that price fluctuations are funded; they won’t explode.

So how to seize arbitrage opportunities!

Here’s a secret for funding fee arbitrage!!!

Step One: Filter by annualized returns!

Step Two: Pay attention to position value. The position needs to be greater than 10 million USD.

Step Three: The current rate (predicted rate) should be above 0.03% (expected to recover expenses within 2 days), of course, the higher the better.

Step Four: The price difference rate should be above 0.05%; the higher it is, the more floating profit there is when opening a position.

Currently, ADA and DOGE, etc., are very suitable for opening arbitrage positions.

If they meet all the conditions mentioned above, you can check them out yourself.

It’s a money-making market!

That concludes today’s live broadcast!!!

Thank you all for your attention, and stay tuned to our live broadcast room.

In the bull market, let’s explore the market together and find trading opportunities! Use AICoin well to earn a free life.

Recommended Reading

The 50th Day of the 20U War God: A New Journey with AI Grids

Crazy Bull! Teaching You How to Find Golden Entry Opportunities from Corrections

For more valuable live broadcast content, please follow AICoin's "AICoin - Leading Data Market, Intelligent Tool Platform" section, and feel free to download AICoin - Leading Data Market, Intelligent Tool Platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。