Daily Share

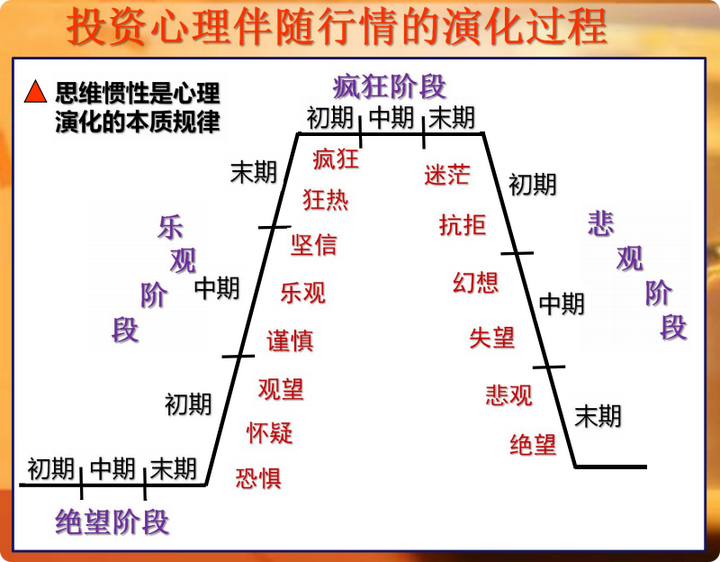

Last night, Bitcoin's 1-hour level retracement hit a low of 95734, which is actually a normal pullback. However, many people panicked at the sight of the drop, thinking a major crash was imminent. In reality, this reflects a clear fear of heights sentiment. From the emotional perspective of the crowd, it is evident that Bitcoin should not drop too much in the short term.

Currently, we are in the second half of the bull market. From the market sentiment perspective, it remains in a cautious and optimistic phase. The caution stems from the fact that Bitcoin has been rising since breaking through 70,000, without any significant pullbacks in between, leading to a widespread fear of a sharp drop that could cause altcoins to plummet by 30-40% in an instant. However, we are also in a phase of widespread altcoin rallies, which keeps some level of optimism. Therefore, at this stage, I personally expect Bitcoin to struggle to drop too much, and even breaking below 90,000 would be quite challenging.

So, if the structure indicates a normal pullback, do not be overly afraid of a crash. In fact, we all know that even if there is a sharp drop for a washout in the short term, it can easily be pulled back. There is no need to overly scare yourself with spot trading.

The only thing you need to consider is your ability to adjust your position. For example, if the price reaches your expected target, consider reducing your position partially, and when a pullback occurs, you can buy back the reduced portion. Alternatively, consider leaving some room for your funds and avoid going all-in, so that if a pullback happens, you still have the opportunity to add to your position and lower your average cost.

BTC

Due to the rapid changes in the market, this article can only make predictions based on the market conditions at the time of publication. Short-term players should pay attention to the latest market changes, which should only be taken as a reference.

1H:

At the 1-hour level, we are currently experiencing a rebound from the 1-hour central three-buy. The target for this 1-hour level rebound is around 102500. We will see if it continues to consolidate into a 1-hour central.

If the trend is particularly strong, it is possible that we will see a 3-central upward movement in the future. If it is not strong, we will consider whether to have a 4-hour pullback. These need to be observed as we go along; do not assume that a slight pullback means a daily downtrend; it is not that easy. Once a one-sided upward trend is established, it is not easy to pull back. Of course, in my opinion, it is essential to continuously monitor when there will be a pullback opportunity. Once there is a pullback signal, I will promptly notify in the article.

15M:

At the 15-minute level, the yellow arrow on the left indicates the internal 15-minute structure of the 1-hour downtrend, which has completed 5 moves down. The blue arrow on the right indicates the expected 1-hour upward structure. Currently, it is uncertain whether the first 15-minute upward move has ended. If it has ended, the pullback should focus on around 97300. Overall, the 1-hour upward movement needs to continue until tomorrow morning, and if it takes longer, it may be pushed back further.

ETH

At the 4-hour level, Ethereum has consolidated in the range of 2360-2730, forming a 4-hour central. It is currently experiencing an upward movement from the 4-hour central departure segment. From the above chart, we can see that this 4-hour departure segment is not diverging, so Ethereum's daily upward movement is not likely to end quickly. It will at least need to undergo a 4-hour pullback and a 4-hour upward movement.

Interjecting with the daily structure, since Ethereum's recent upward movement has brought it back into the previous daily central, it has now formed a substantial reversal. Therefore, the first daily upward move is expected to break through 4000 and reach around 4200. After that, there will be a daily pullback, followed by a third daily upward move that is expected to break the historical high of 4800.

At the 1-hour level, we are currently experiencing a 1-hour central three-buy upward movement, which has already reached above 3500, aligning with our previous prediction that Ethereum's rebound would reach 3500 and 3700. For now, let's see if this 1-hour upward movement can break through 3700. There should be a chance.

Currently, this is just the first 15-minute upward movement within the 1-hour upward trend. In the short term, there should be a 15-minute pullback, focusing on around 3400, followed by a third 15-minute upward movement to see if it can break through 3650.

Trend Direction

Weekly Level: Direction is upward, currently undergoing a new weekly upward movement, with an overall target above 150,000.

Daily Level: Direction is upward, with the daily upward movement expected to reach around 120,000.

4-Hour Level: Direction is upward, focusing on the range of 100,000-110,000.

1-Hour Level: Direction is upward, currently undergoing a 1-hour upward movement, with the initial target at 102500.

15-Minute Level: Direction is upward.

Feel free to follow my public account for discussions and exchanges:

The article is time-sensitive, please pay attention to risks. The views expressed in the article are personal suggestions and for reference only!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。