Last month, Stripe made a major acquisition, purchasing the stablecoin platform Bridge for $1.1 billion, marking the largest acquisition in cryptocurrency history.

Written by: IOSG Ventures

1. What does Stripe's largest acquisition, Bridge, mean for the crypto industry?

Stripe is one of the largest online payment service providers and processors in the world, helping businesses accept online and in-person payments through its developer-friendly API. In 2023 alone, Stripe processed over $1 trillion in transaction volume, with adoption rates second only to ApplePay.

Last month, Stripe made a major acquisition, purchasing the stablecoin platform Bridge for $1.1 billion, marking the largest acquisition in cryptocurrency history.

Recent cryptocurrency merger and acquisition activities, such as Robinhood's $200 million acquisition of Bitstamp, reflect the growing demand from tech/finance giants to engage with 2B and 2C cryptocurrency businesses that prioritize compliance and have established user bases. Bridge is no exception.

You may have noticed that the adoption of stablecoins has surged globally. According to a16z's report, the trading volume of stablecoins reached $8.5 trillion in Q2 2024, more than double Visa's $3.9 trillion during the same period.

Stripe sees potential in stablecoins as the perfect medium for achieving a smooth and efficient asset conversion process. Although Bridge generates only $10 million to $15 million in revenue annually, Stripe paid nearly 100 times the premium to acquire the company. This highlights that Stripe's motivation is not only related to Bridge's current revenue but also to the compliance, partnerships, and technology that Bridge can bring to the Stripe ecosystem.

2. What is Bridge?

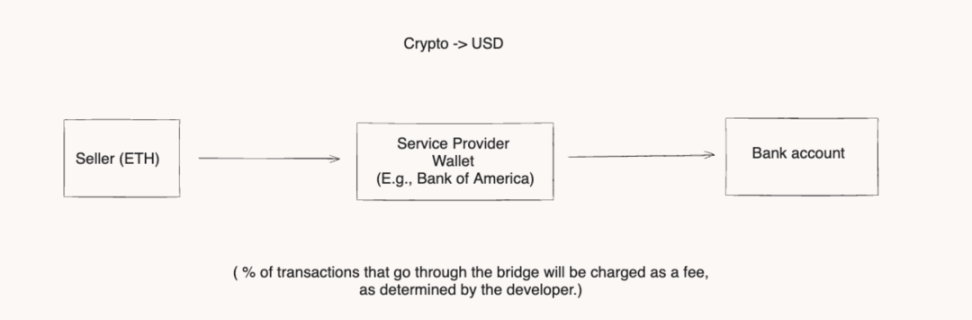

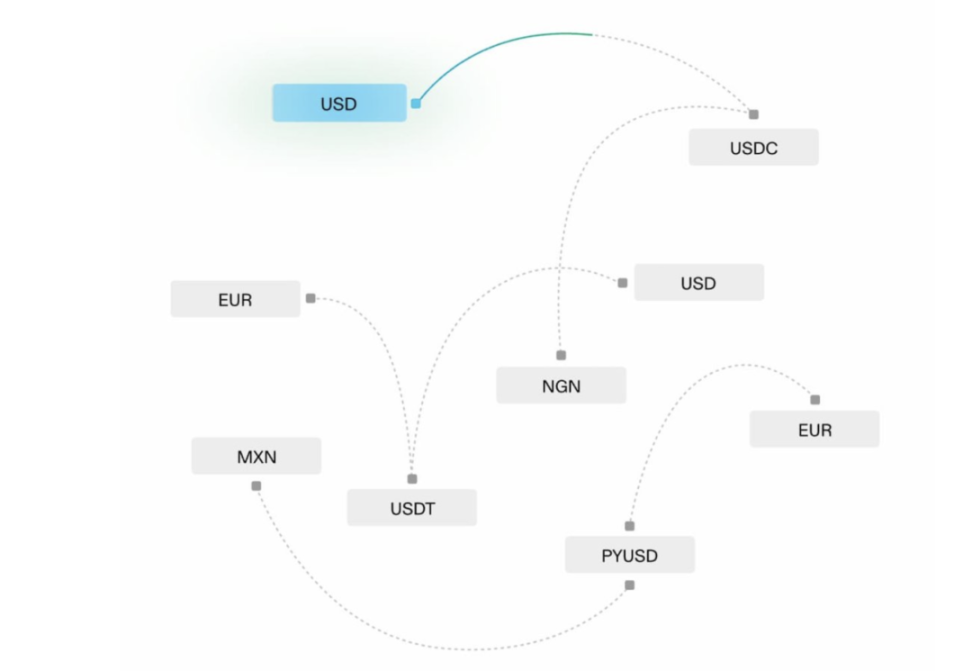

Bridge is a stablecoin platform that allows businesses or users to transfer tokenized dollars using blockchain technology. Users can wire/ACH transfer to whitelisted banks, purchase cryptocurrencies with fiat currency, or sell cryptocurrencies for fiat by sending assets to designated wallets. It also offers custodial wallets to help businesses accept, store, or transfer stablecoins through a simple set of APIs.

In the background, Bridge handles KYC, regulatory compliance, and more, enabling businesses to easily integrate and start accepting cryptocurrencies as a payment method. Currently, Bridge supports USD/EUR as fiat currency payments and accepts five stablecoins across nine different chains.

Regarding the team, Bridge founders Zach Abrams and Sean Yu previously worked at Coinbase, serving as the head of consumer products and senior developers, respectively. Before the acquisition, Bridge raised a total of $58 million from various venture capital firms, with approximately $40 million coming from Sequoia Capital. This indicates that investors were confident in the product even before the acquisition.

2.1 Advantages and Moat of Bridge:

Bridge is not the first product to address the issue of cross-border transaction services. In fact, Ripple (XRP) has been providing cross-border transfer and payment services for the past three years, but it relies on its own currency as a medium, which exposes users to currency downside risks. However, in an era where regulated stablecoins like USDC offer greater protection and flexibility, such solutions have become outdated. Bridge addresses this issue in a more efficient and compliant manner.

2.2 Compliance and Collaboration

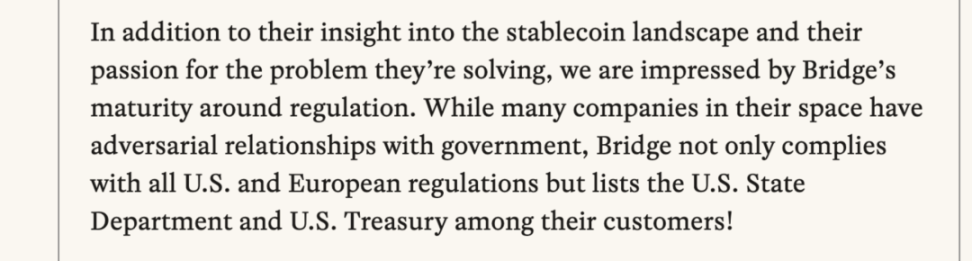

Bridge's advantage lies in its compliance and partnerships. First, according to Sequoia's report, Bridge complies with all U.S. and European financial regulations and anti-money laundering laws, holds remittance licenses in 22 states, and collaborates with the U.S. State Department and Treasury for asset transfers. Before integrating with Bridge, businesses need to provide ownership and incorporation documents to prove their credibility. For more details, please refer to the following documents: As pointed out by SY Lee, founder of Story Protocol, content businesses often lack network effects, forcing them to rely on large content production and marketing budgets to survive. This overwhelming negotiating power makes it difficult for smaller IPs to be profitable, often leading to their failure before launch. Even large IP studios hesitate to develop new IPs, choosing instead to focus on expanding existing IPs.

The credibility and reputation that Bridge gains from compliance will significantly improve and expand its business channels, as evidenced by their recent collaboration with SpaceX, where Bridge will be used for stablecoin management in its global financial operations (source: Ledger).

In addition to compliance, Bridge allows businesses to customize and issue stablecoins using Bridge's orchestration API, with the underlying dollars invested in U.S. Treasury bonds for a 5% yield or kept idle. This provides businesses and even CBDCs the possibility to create and customize their tokenized dollars for various use cases while remaining compliant, with all reserves held in cash and Treasury bills within Bridge.

2.3 Use Cases of Bridge:

2.4 In Today's Payment Solutions:

The global demand for electronic payment solutions is rising, with the electronic payment industry expected to grow at a rate of 9.9% annually, reaching a market size of $90 billion.

Today's digital payment solutions, especially in the U.S., charge transaction fees of up to 1.5-3.5% (Visa charges 1.5-3.5%, Stripe charges 3.4%, with a European cap of ~0.3%, and global payments like PayPal capped at ~2%).

Bridge's transaction fees are expected to be much lower, as they primarily consist of blockchain transaction fees and developer or issuer fees.

In October, Stripe launched a feature called "Pay with Stablecoins" in its customer checkout product, charging a 1.5% transaction fee. While it has not been confirmed whether this feature was co-created with Bridge or if the fee was designed by Stripe, it indicates that Bridge has the potential to provide a more cost-effective alternative for digital payments.

Additionally, data breaches have long been a problem in the traditional electronic payment industry. The tamper-proof nature and security of smart contracts can effectively address these issues. Beyond cost savings, Bridge also unlocks access to $180 billion in stablecoin liquidity within the blockchain ecosystem, allowing Stripe to extend its influence into the cryptocurrency market.

- In Unbanked Regions:

Bridge can provide solutions for businesses in underserved areas, allowing them to store dollars or euros in custodial wallets, thereby establishing better systems for transferring, paying, or investing tokenized dollars based on their needs.

Furthermore, financial institutions can begin offering more complex structured products, accepting stablecoins as deposits, creating more business opportunities for them to leverage on-chain funds.

Since these transactions occur on the blockchain, the selected chains can also benefit from the associated transaction fees. Therefore, Bridge can enhance on-chain transaction activity and potentially increase the earnings of validators and stakers.

- In DeFi:

Businesses can also participate in DeFi for additional yields. For example, they can borrow or lend tokenized dollars on platforms like Aave to earn interest or leverage cryptocurrency investments for potential gains.

Alternatively, users can provide liquidity for stablecoin pairs on Uniswap V2/V3 to earn transaction fees. While DeFi investments come with significant risks, they offer opportunities to maximize the capital efficiency of idle assets.

Given the dominance of USDC and USDT in the market, I believe that the integration of Bridge can further solidify their roles in the evolving cryptocurrency space.

3. Market Outlook

- Until recently, the use cases for cryptocurrencies were largely hindered by their adoption as payment solutions. However, Stripe's acquisition of Bridge has the potential to change this trend, making cryptocurrency payments as seamless and indistinguishable from traditional fiat currency transactions, and could become a pillar of future PayFi.

- The largest merger and acquisition in cryptocurrency history highlights that stablecoins and the regulated payment industry have achieved a significant product-market fit and undeniable utility. Value transfer remains the most compelling use case for cryptocurrencies, with regulated stablecoins becoming the primary medium for payments.

4. Key Takeaways

- Bridge is a stablecoin platform that enables businesses and users to transfer, store, and pay with tokenized dollars using blockchain technology. Bridge manages all compliance and regulatory issues in the background.

- Bridge's advantages lie in its compliance and established partnerships. It adheres to all U.S. and European financial regulations and anti-money laundering laws, collaborating with reputable partners such as the U.S. State Department and Treasury.

- Regions that cannot directly access the financial system can greatly benefit from Bridge due to the economic security provided by the dollar.

- Businesses can now participate in DeFi and maximize the capital efficiency of idle assets. Bridge serves as a link to inject more capital into stablecoins, which is expected to boost the overall DeFi economy.

- Compared to today's electronic payment solutions, lower fees, faster settlements, and data security are some of the main advantages of blockchain. Bridge has the potential to replace or serve as a better alternative to current payment systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。