In this report, we provide industry practitioners with an overview of the emerging market of fund tokenization, focusing on the potential of this technology in practical applications, the incentives for end investors and financial institutions, potential critical points for promotion, and how fund managers can seize this opportunity.

Written by: Boston Consulting Group (BCG)

Translated by: Yue Xiaoyu

Executive Summary

In the wave of generative AI, the attention on distributed ledger technology (DLT) seems to have waned in recent months. However, in the financial services industry, DLT-based solutions are attracting increasing attention. Through an innovative technology called fund tokenization, many of its advantages have found new applications in asset management, enhancing value creation, increasing transparency, and streamlining transaction processing. When DLT is combined with smart contracts that execute business logic automatically, it is easy to understand why market participants are eager to get involved.

As the application scenarios of DLT continue to expand, banks are accelerating efficiency improvement initiatives across various markets, from cross-border payments to fixed income. However, we refer to fund tokenization as the third revolution in asset management, with the potential to create billions of dollars in value for financial institutions and end investors. By the end of 2024, the assets under management (AUM) of tokenized funds are expected to exceed $2 billion, with one manager raising a significant amount of funds in just a few months and charging above-average fees. This reflects a growing trend in investor demand, particularly from virtual asset holders (such as cryptocurrency foundations). In the coming period, we expect demand to continue to rise, especially with the realization of regulated on-chain currencies (such as regulated stablecoins), tokenized deposits, and central bank digital currency (CBDC) projects.

In this report, we provide industry practitioners with an overview of the emerging market of fund tokenization, focusing on the potential of this technology in practical applications, the incentives for end investors and financial institutions, potential critical points for promotion, and how fund managers can seize this opportunity.

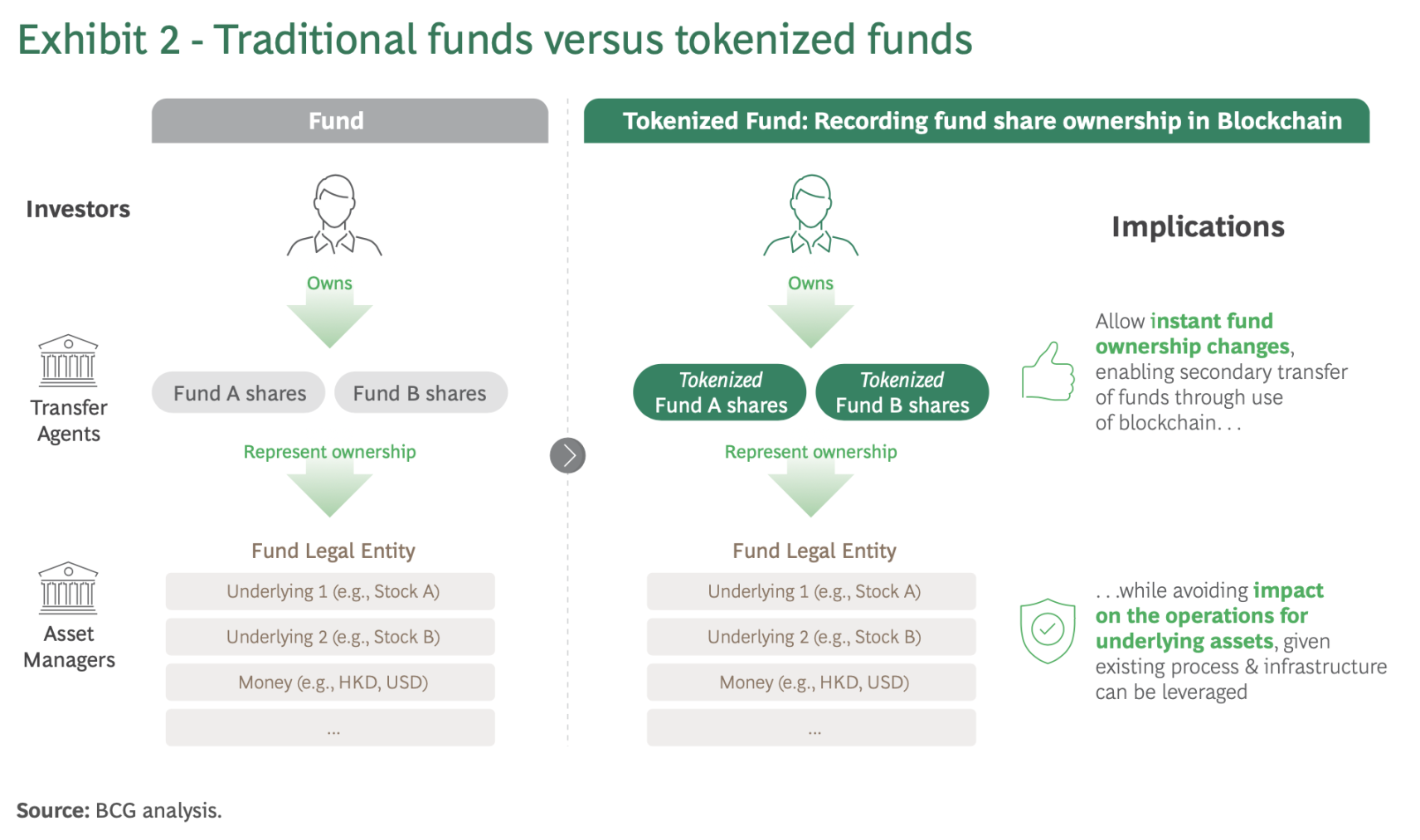

First, a brief introduction: Fund tokenization refers to the use of blockchain-based digital tokens to represent fund ownership, functioning similarly to the current method of transfer agents recording fund shares. Early use cases of tokenization show that some companies manage assets such as real estate through special purpose vehicles (SPVs). Similarly, fund tokenization can be achieved through existing unit trusts or fund company entities, meaning that asset managers should not encounter too much resistance in the operational process.

Once operational, tokenized funds offer numerous advantages to investors, including 24/7 secondary transfers and share fractionalization, lower investment thresholds, and instant collateralization when regulatory frameworks are in place. If all mutual funds globally were to achieve tokenization, we estimate that mutual fund investors could realize an additional approximately $100 billion in investment returns annually, while mature investors could gain up to $400 billion by capturing intraday value fluctuations.

For financial institutions such as asset management companies and wealth management firms, fund tokenization provides opportunities to develop new investor groups, protect existing investor groups, and enhance business products. Indeed, as regulated on-chain currencies (such as stablecoins, tokenized deposits, and central bank digital currencies) become more prevalent, demand for tokenized funds will significantly increase. We estimate that virtual asset holders represent approximately $290 billion in potential tokenized fund demand, and as traditional financial institutions adopt on-chain currencies, this could bring in trillions of dollars in additional demand. Furthermore, innovative fund distribution opportunities will arise through secondary tokenized brokerage and embedded investments. Managers can also leverage smart contracts to optimize distribution models, customize fund portfolios, and create hyper-personalized investment portfolios.

Drawing lessons from the development of exchange-traded funds (ETFs) in the "second revolution" of asset management, the AUM of tokenized funds could reach 1% of the global mutual fund and ETF AUM within just seven years. This means that by 2030, the AUM of tokenized funds could exceed $600 billion. If regulators allow existing mutual funds and ETFs to convert into tokenized funds, the AUM could even reach trillions of dollars.

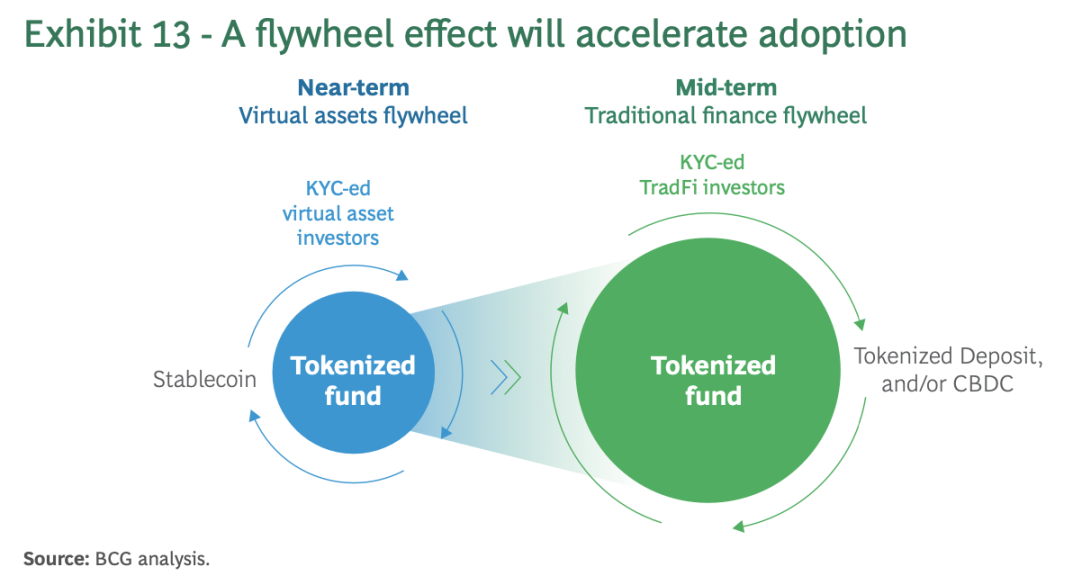

We believe that tokenized funds may reach a tipping point in the next 12 to 18 months, as innovations in on-chain currencies create a flywheel effect driven by early adopters (such as virtual asset holders) using stablecoins. Subsequently, with the launch of tokenized deposits and central bank digital currencies (CBDCs), we may see rapid expansion. Among asset managers, early movers may capture significant market share, occupying priority whitespace and helping them build brand recognition and economies of scale through simple products. In contrast, companies that follow closely may need to innovate in niche areas.

To fully realize the potential of fund tokenization, the industry must first establish a solid foundation, including clear regulatory guidelines, global operational standards, and technological interoperability. On this basis, financial institutions will benefit from six core capabilities: a strategic vision for tokenized funds, a use case roadmap, on-chain compliance, blockchain technology and operational setup, cross-chain interoperability management capabilities, and a center of excellence to coordinate their efforts. Successfully executing these building blocks will open the door to long-term effective adoption and competitive dynamics.

Fund Tokenization

Transformative Blockchain Applications in Financial Services

With successful proof of concepts, the adoption of blockchain technology has become increasingly attractive for financial institutions that have been on a digitalization path. The ability to store immutable data from multiple participants not only builds trust but also significantly enhances efficiency, effectively connecting companies with business opportunities and paving the way for collaborative innovation. Through the process of tokenization, digital ownership representations of real-world assets can be created on the blockchain, making instant delivery versus payment (DVP) easier to execute than ever before.

Growing Tokenization Under Various Market Conditions

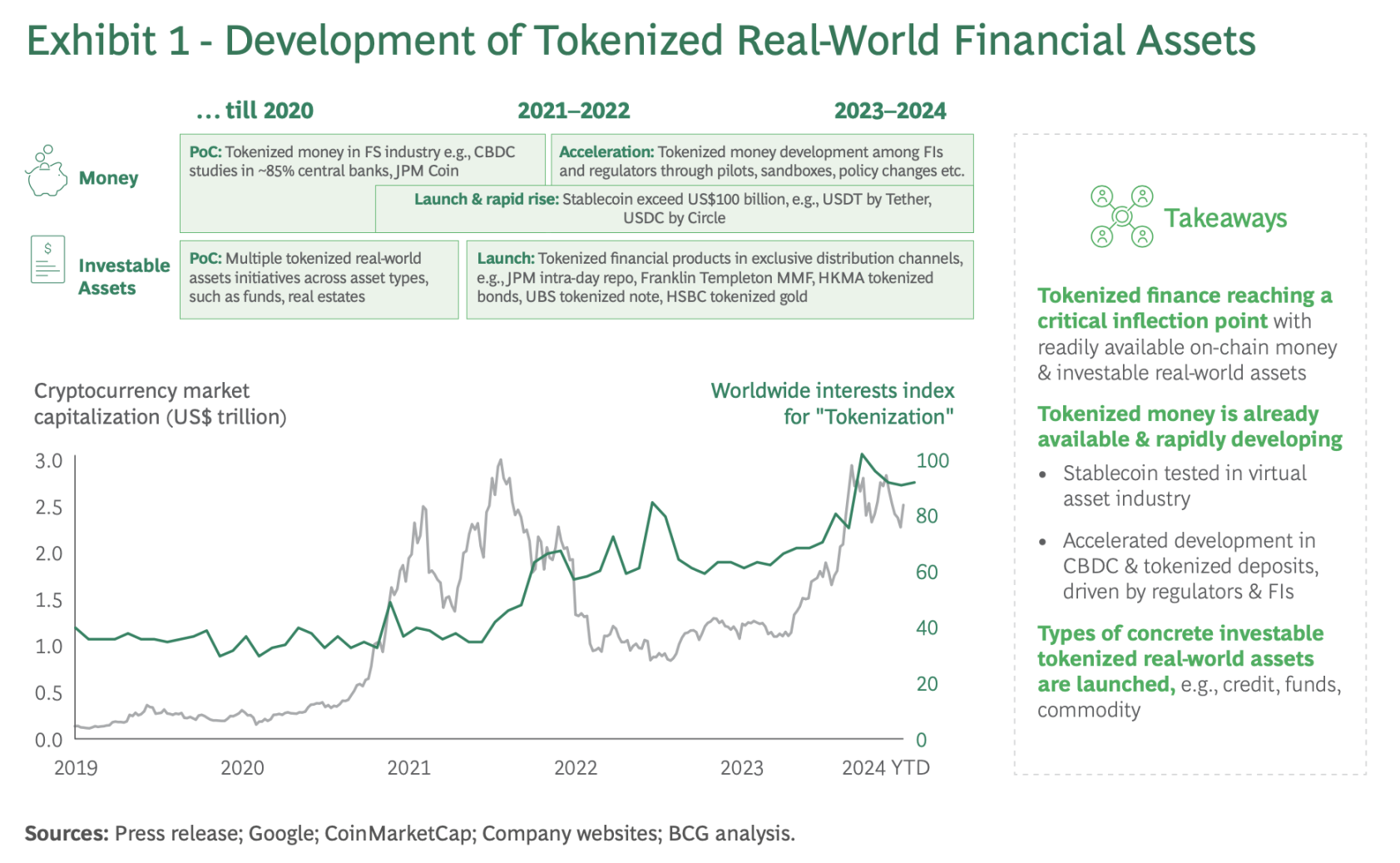

In recent years, interest in tokenization has steadily increased, with production-level specific projects led by financial institutions and supported by regulators being launched over the past five years. As the trading volume of tokenized assets increases and the types of assets diversify, we see the foundation of tokenized finance becoming more solid, and with the widespread availability of on-chain currencies, this field may reach a critical tipping point. (See Figure 1)

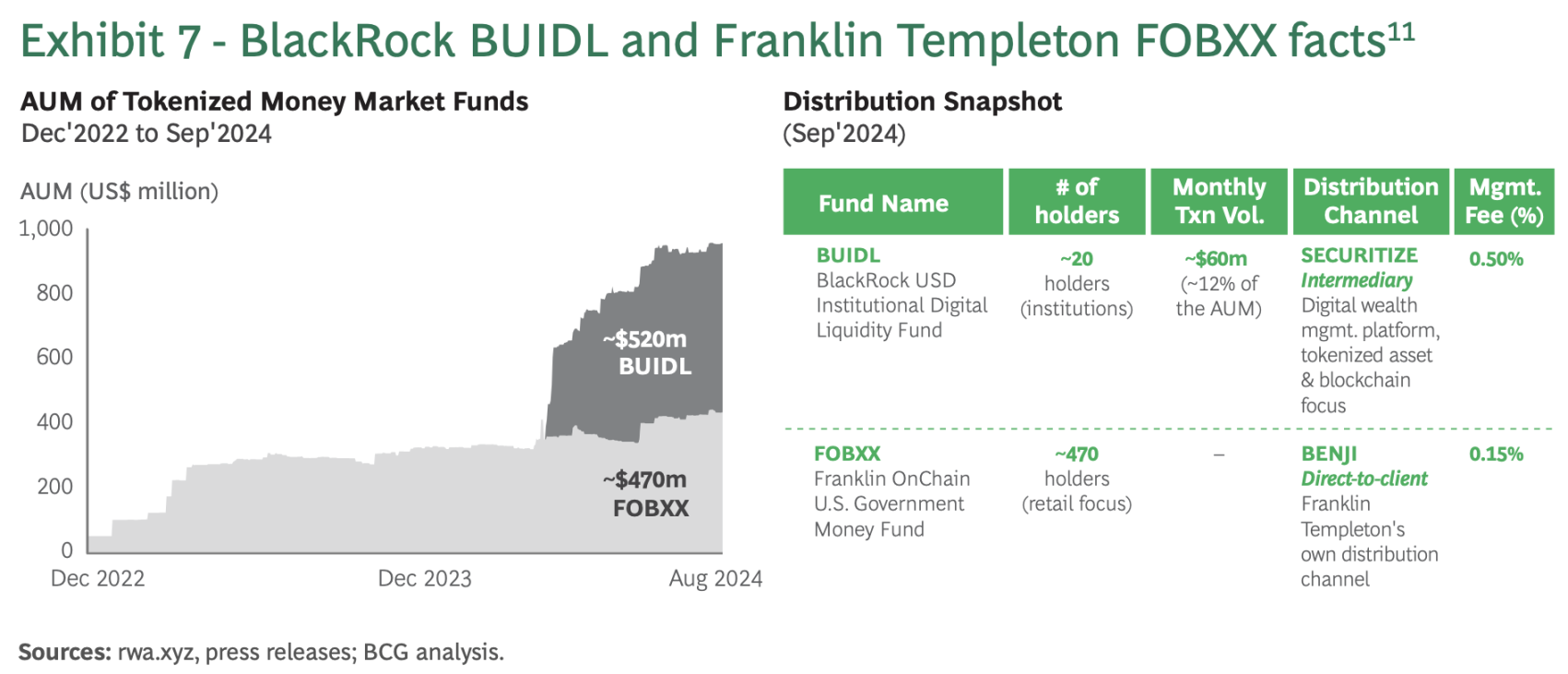

Fund tokenization is not just an innovative attempt by a few asset managers, but an industry-wide movement covering numerous global asset managers. Franklin Templeton launched the first fund registered in the U.S. using blockchain in 2021 (Franklin OnChain U.S. Government Money Fund, FOBXX), while BlackRock launched the BlackRockUSD Institutional Digital Liquidity Fund (BUIDL) in 2024, quickly achieving a market value of over $500 million within months.

Fund Tokenization is Scalable and Impactful

We view it as a two-step transformation process. The first step is to register fund shares on the blockchain to enable instant ownership transfer. The second step is to use tokenized funds to invest in other tokenized assets, such as tokenized bonds. Completing the first step can unlock significant value and pave the way for future scenarios where tokenized funds directly hold tokenized assets.

Tokenization typically involves using special purpose vehicles (SPVs) to hold underlying assets (such as real estate) and issuing tokens that represent shares. This is similar to the current structure and operation of funds. For example, asset managers use unit trusts to hold assets like stocks and bonds, with transfer agents managing investor records. However, unlike other asset types, fund tokenization does not require the use of SPVs. Secondary transfers can be conducted through authorized participants and market makers setting prices, ensuring compliance with regulatory standards. This makes tokenized funds more similar to exchange-traded funds (ETFs). (See Figure 2)

Tokenized Funds Can Compete with Exchange-Traded Funds (ETFs)

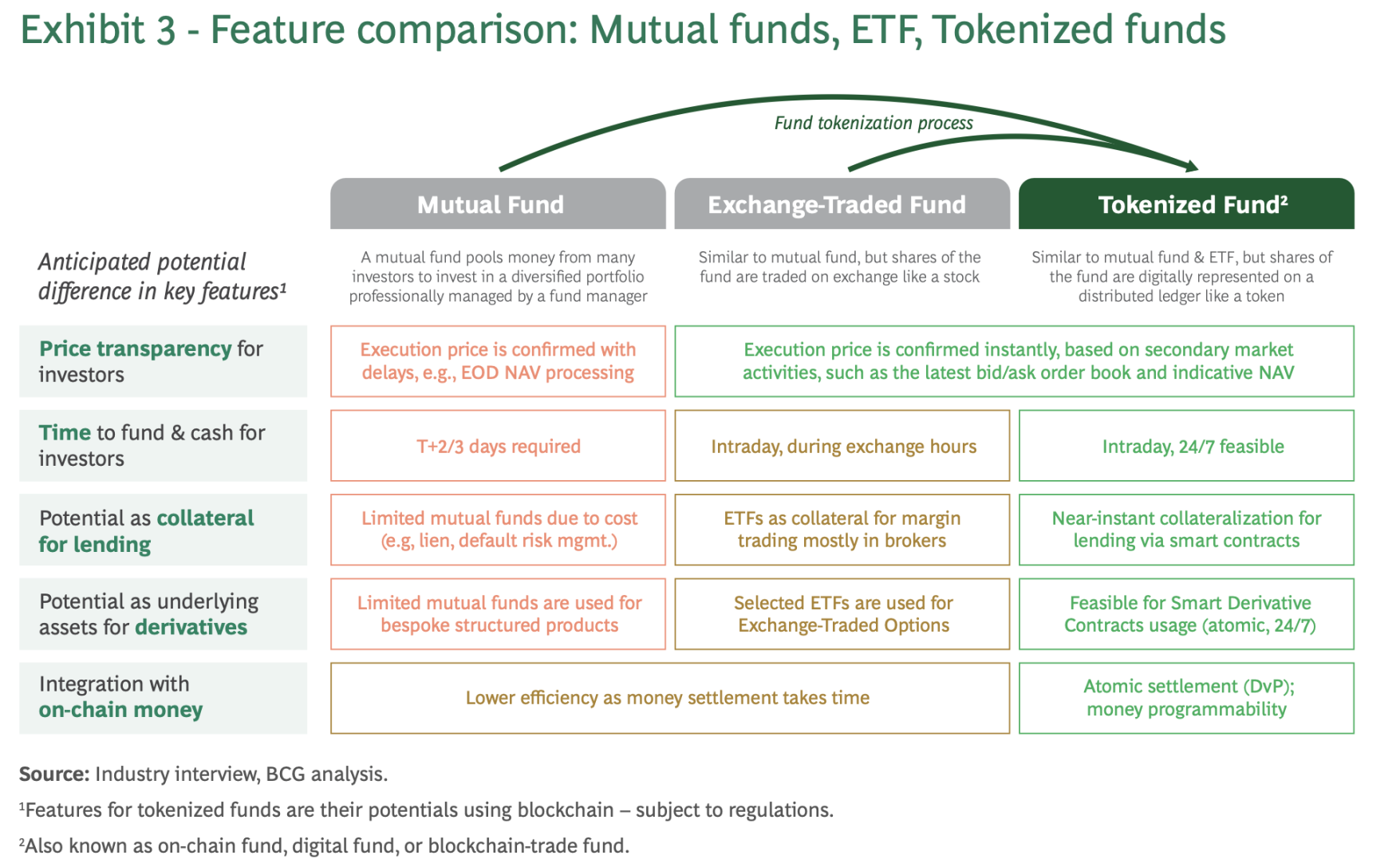

Tokenized funds have the potential to become the third evolution in the asset management industry, following the $58 trillion mutual fund industry established under the Investment Company Act of 1940 and the subsequent revolution sparked by ETFs.

From the perspectives of investors and managers, tokenized funds share many similarities with ETFs. Both offer high price transparency, superior liquidity, and various advantages such as simplified collateral management compared to mutual funds. (See Figure 3)

There are three main approaches to fund tokenization, each with its unique advantages and challenges. The first is to create a digital twin, typically achieved through security token offerings (STOs), similar to a master-slave structure. This approach is quick to implement but involves additional costs for managing dual operations. The second approach is to develop native tokenized fund tools. While execution is relatively straightforward, it requires attracting new investor groups. The final approach is to convert existing funds into tokenized funds, which is scalable but needs to be handled carefully to avoid operational disruptions.

"Through an innovation called fund tokenization, many advantages of distributed ledger technology have found new applications in the asset management field, enhancing value creation, increasing transparency, and streamlining transaction processing."

How Tokenized Funds Create Value for Investors and Financial Institutions

Tokenized funds provide virtual asset investors with the opportunity to access professionally managed products through exposure to real-world assets that can generate stable long-term returns. At the same time, tokenized funds can offer traditional investors advantages such as faster access to returns. Wealth management and asset management companies are expected to benefit from enhanced connections with investors, reduced operational costs, 24/7 investment services, and the creation of new business opportunities.

Fund Investors Can Benefit from Value-Added Services

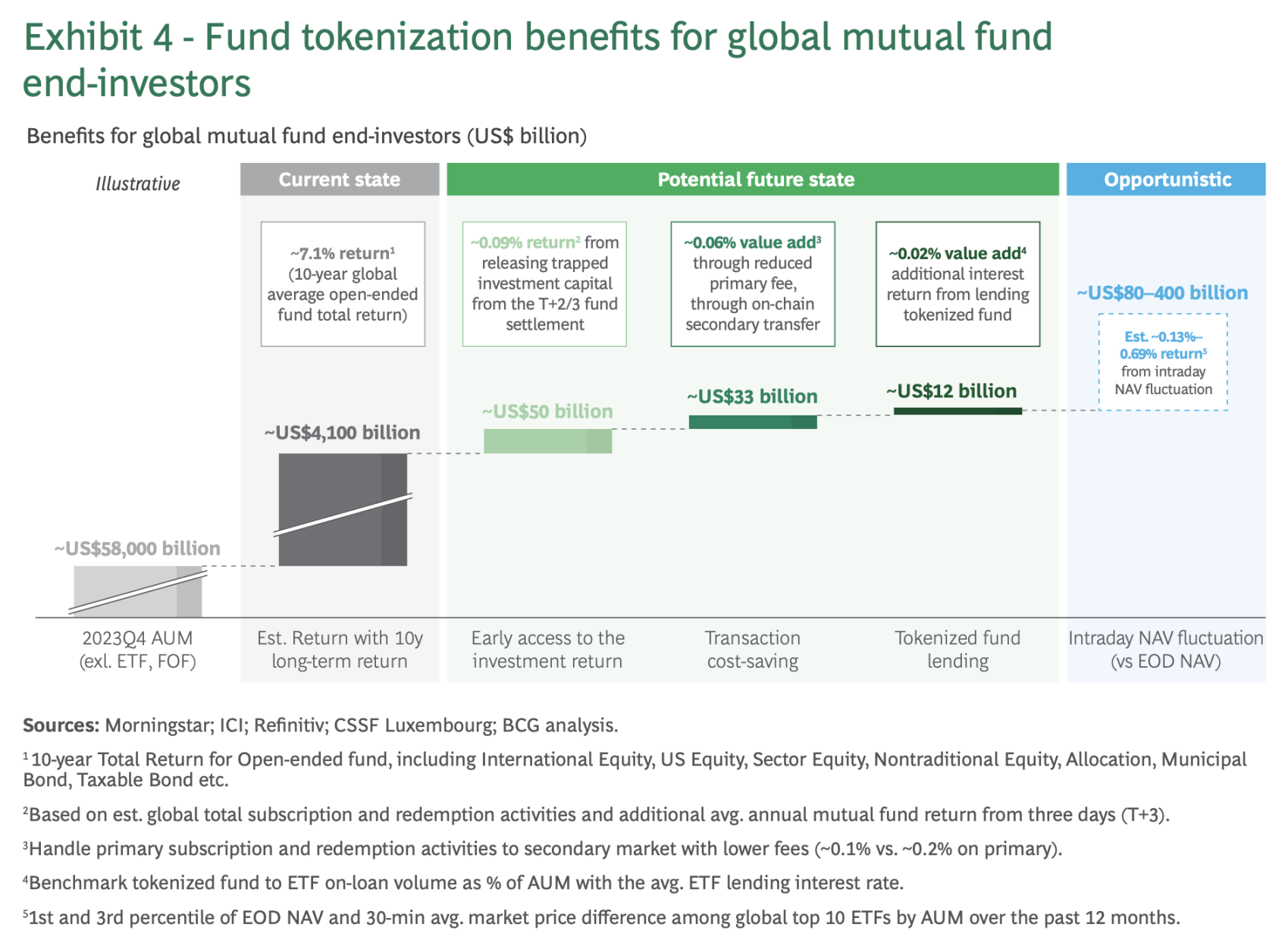

The AUM of mutual funds is approximately $58 trillion, with a 10-year average annual return of 7.1%. However, the current settlement process is inefficient, with T+2/3 settlement cycles locking up funds and presenting operational challenges when providing innovative financial products to end investors.

Our preliminary estimates indicate that by addressing these issues, fund tokenization could provide mutual fund investors with an additional annual return of approximately 17 basis points, roughly equivalent to $100 billion. We specifically see that investors can benefit in four areas. (See Figure 4) First, instant settlement will unlock the productivity of locked capital, potentially adding about $50 billion to investors' portfolios each year. Second, trading costs may approach the average ETF fee of 0.09%. We estimate this could save investors about $33 billion annually, as some mutual fund subscriptions and redemptions can be managed through the secondary market. Third, tokenized mutual funds are easier to lend compared to funds like ETFs, potentially generating about $12 billion in interest income. Finally, tokenized mutual funds allow for intraday trading, enabling mature investors to capture fluctuations in the intraday net asset value (NAV) of the funds, which we believe could create value ranging from $80 billion to $400 billion annually.

Revenue Growth Incentives for Wealth and Asset Managers

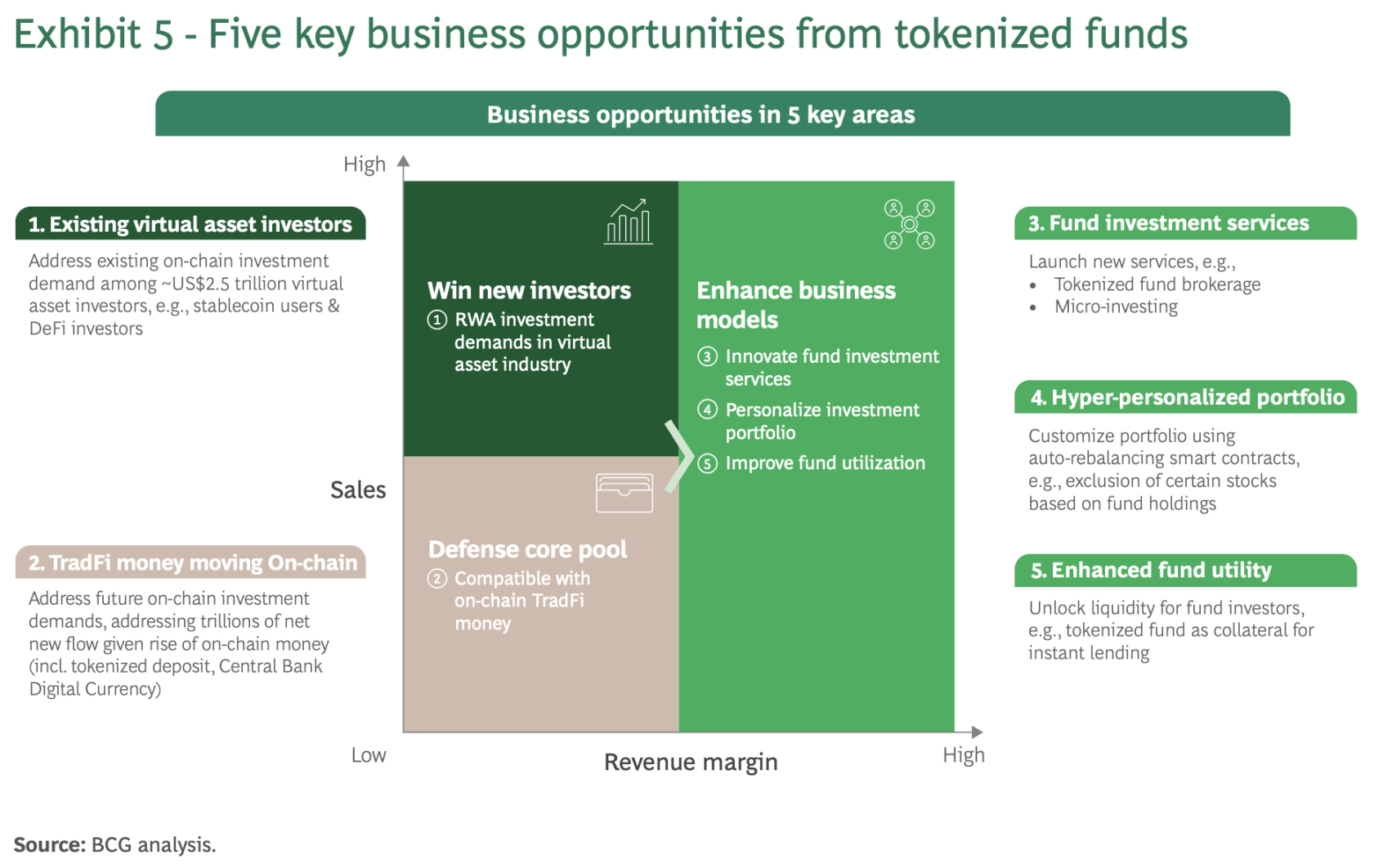

Wealth and asset managers have the opportunity to commercialize tokenized fund services in five key activity areas. (See Figure 5) We believe that both individual and collective proactive engagement will help enhance sales and revenue margins.

Below, we will discuss each of the five business opportunities in more detail:

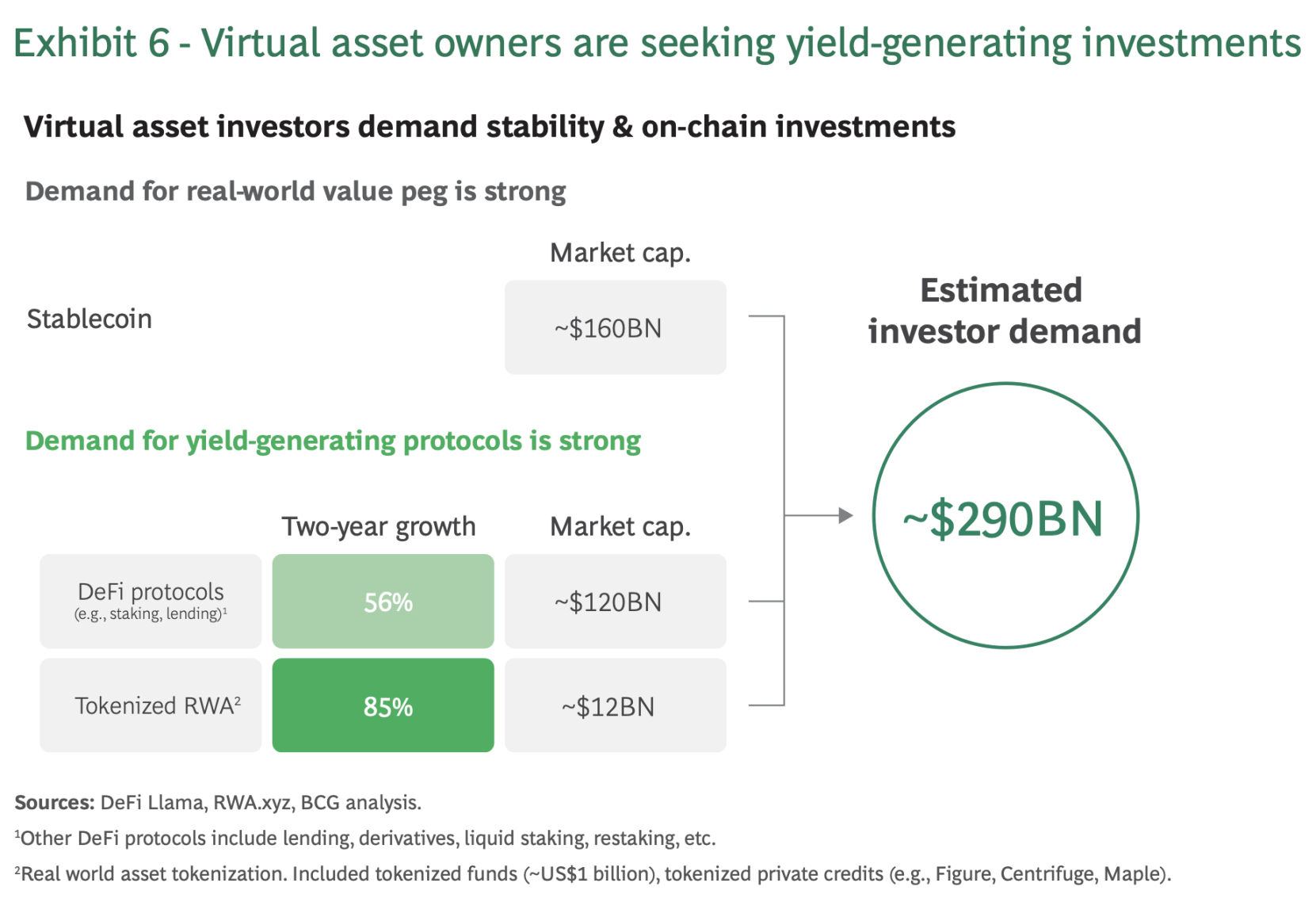

#1: Meeting the $290 billion Existing On-Chain Investment Demand

In the global cryptocurrency market (valued at approximately $2.5 trillion), we estimate there is about $290 billion in demand for tokenized fund investments. (See Figure 6) This area includes holders of stablecoins, real-world asset tokenization (RWA), and decentralized finance (DeFi) protocols, and it is growing rapidly. The scale of DeFi protocols (excluding stablecoins) is larger, with a market capitalization of about $120 billion and an average growth rate of 56% over the past two years. The market capitalization of the real-world asset tokenization (RWA) market has reached approximately $12 billion, with a growth rate of 85% over the past two years.

As on-chain collective investment tools, tokenized funds can effectively meet investment demand, filling the current gap in on-chain products dominated by DeFi protocols. By leveraging the mature investment strategies that asset managers have used to manage trillions of assets over the past decades, these funds offer more robust investment options. Additionally, they provide access to real-world investment opportunities, allowing portfolios to achieve better diversification in response to changing market dynamics. (See Figure 7)

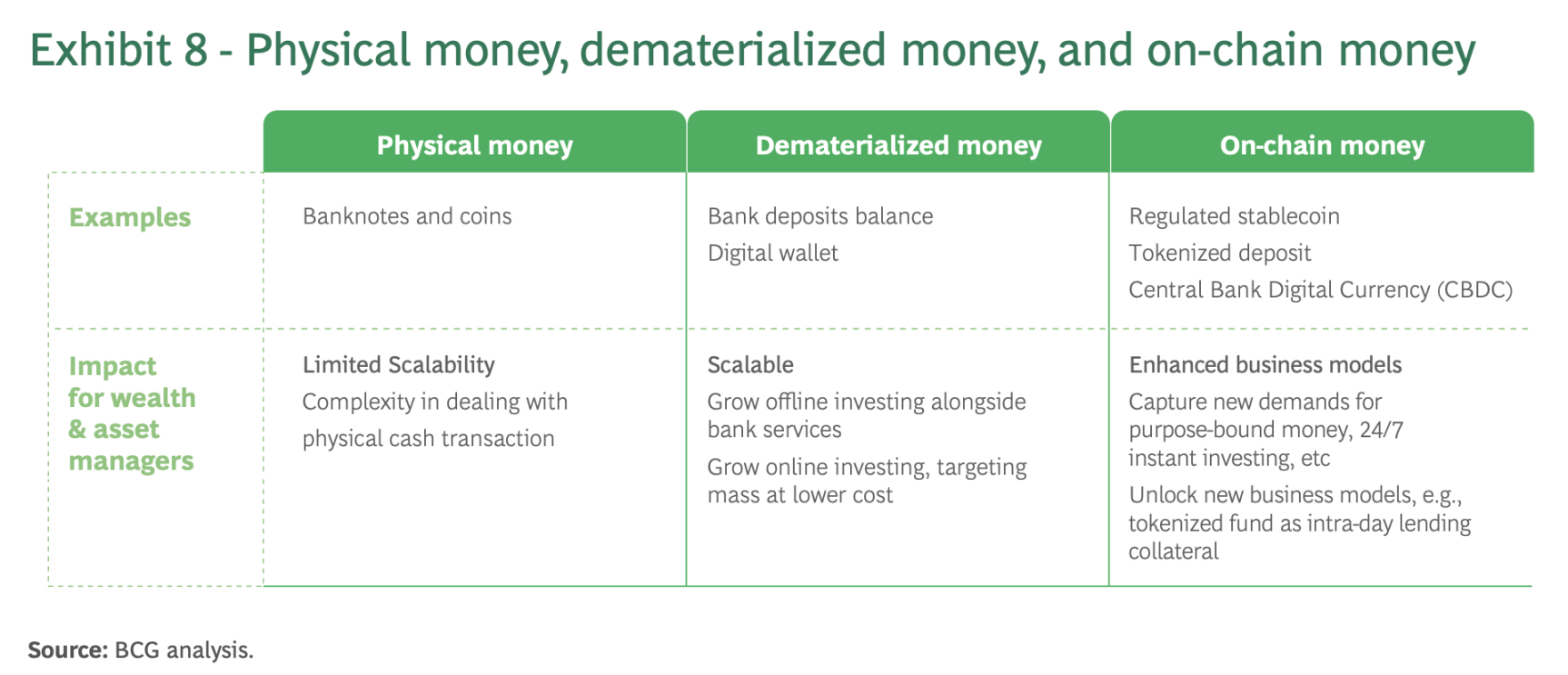

#2: Protecting Existing Investor Groups Against the Rise of Regulated On-Chain Currencies

Funds from traditional finance are being transferred on-chain through rapidly developing regulated on-chain currencies (including regulated stablecoins, tokenized deposits, and central bank digital currencies (CBDCs) driven by regulators and financial institutions). (See Figure 8)

On-chain currencies have two important distinctions from non-physical currencies—programmability and atomic settlement with tokenized assets. Programmability will enable the development of programmable currencies and purpose-specific currencies, allowing users to specify the use of currency across financial institutions and jurisdictions through programming logic. Atomic settlement with tokenized assets will achieve true synchronized delivery versus payment (DvP), meaning that on-chain assets and on-chain currencies can be exchanged synchronously.

As regulated on-chain currencies are gradually adopted, net fund inflows will be affected in a chain reaction. If only 10% of investable funds are on-chain, the demand for tokenized funds will also reach billions of dollars.

#3: Enhancing Fund Distribution Through Instant 24/7 and Fractional Transfers

Once mutual funds are tokenized, investors can transfer their mutual fund shares to other investors. BlackRock's BUIDL and Franklin Templeton's FOBXX have already allowed secondary transfers within their managed distribution channels.

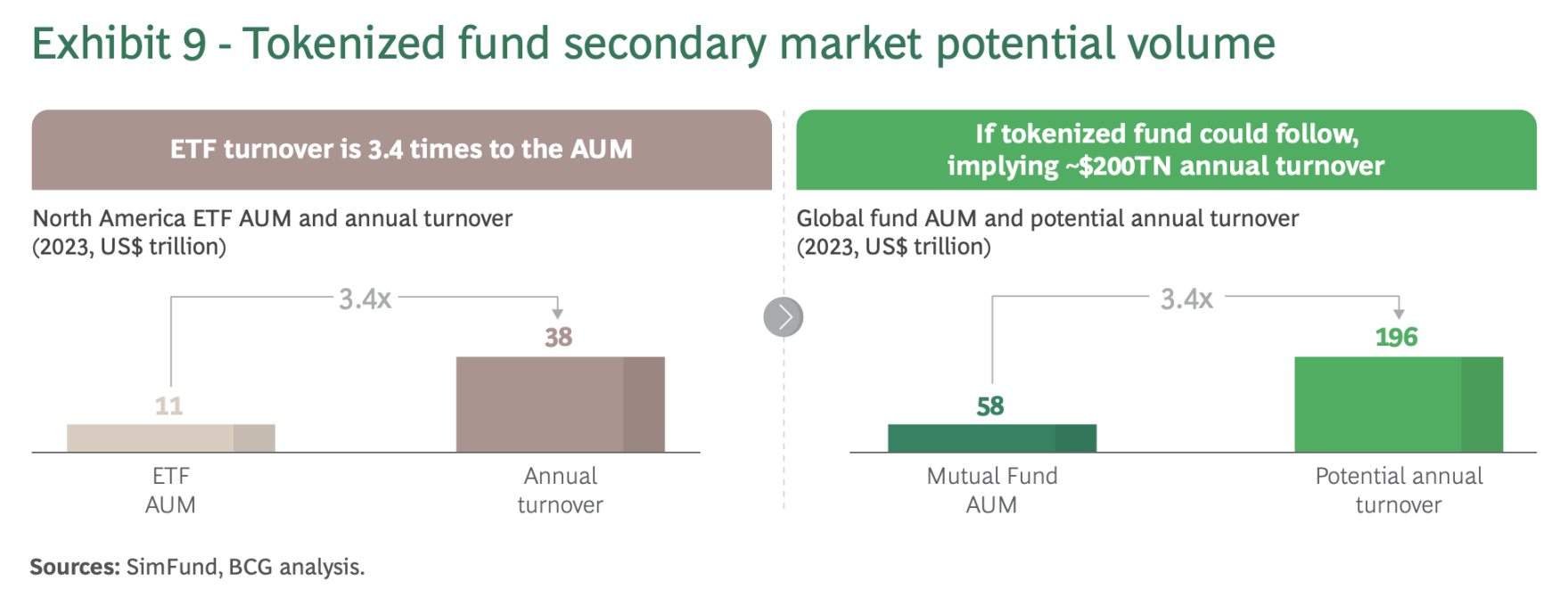

If the secondary market for tokenized mutual funds can develop like ETFs, the turnover ratio based on North American ETFs (340%) could lead to an annual trading turnover of approximately $200 trillion. (See Figure 9) Even if the market only realizes 10% of its potential, it is foreseeable that wealth management companies will be able to service about $20 trillion in trading turnover.

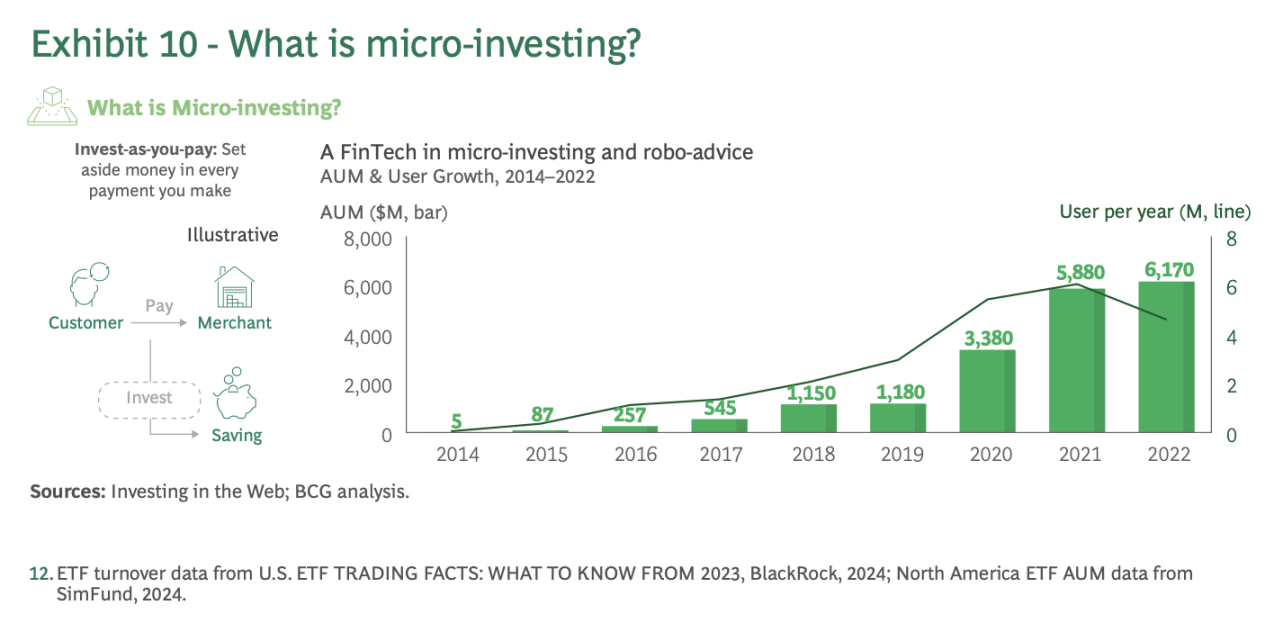

Tokenized funds can also enable innovative fund distribution methods (or investment methods for investors), utilizing fractionalization and instant 24/7 execution, significantly lowering investment thresholds. For example, micro-investing is a rapidly growing area for fintech companies. (See Figure 10) To catch up, wealth management companies can leverage tokenized funds to enhance their products. If wealth management companies can improve the customer experience, they have the potential to attract younger investors and help them develop investment habits early on.

#4: Providing Hyper-Personalized Portfolio Management Through Smart Contracts

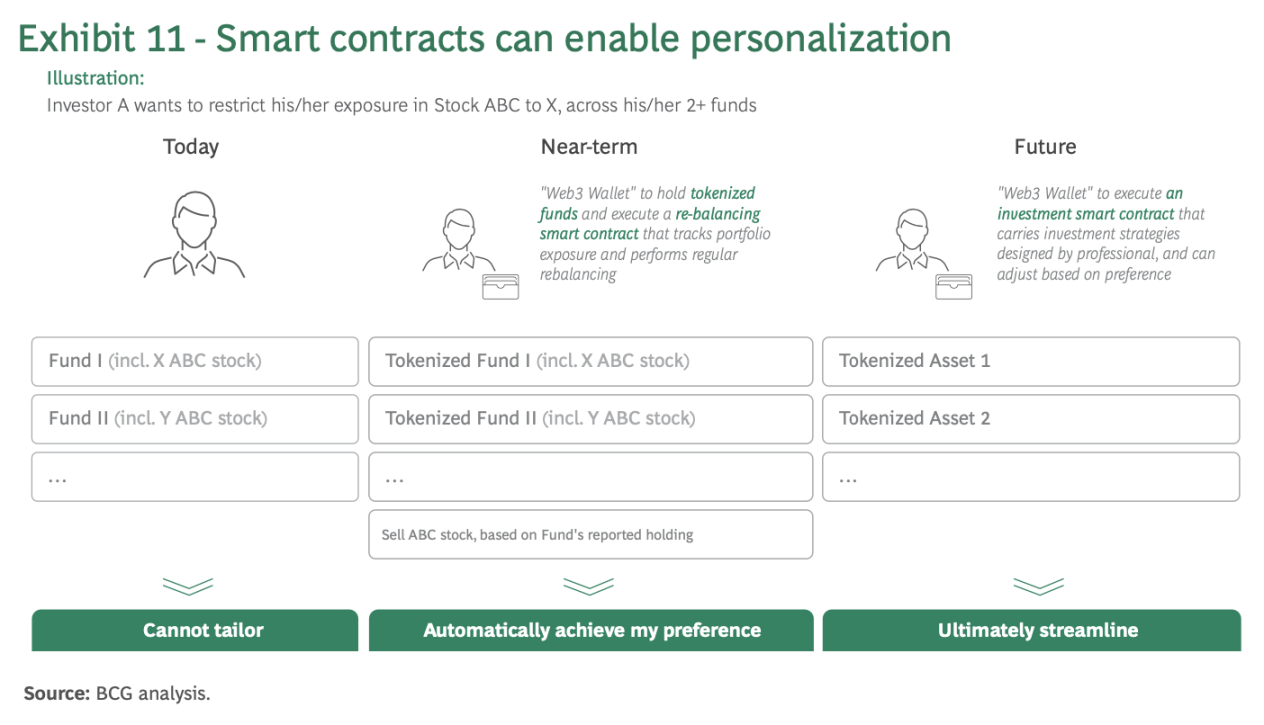

Hyper-personalized portfolios can significantly enhance customer experience and retention rates. While the level of personalization is limited in the mass market, it is increasingly seen as a must-have option among high-net-worth investors.

With the help of smart contracts and tokenized funds, personalized services can be offered to all investors. For example, investors can track their disclosed holdings in tokenized funds in real-time and use rebalancing smart contracts to periodically execute long or short positions to achieve optimal risk exposure.

At the same time, for financial institutions, personalized services can open up a range of revenue sources and lay the foundation for better meeting investor needs. (See Figure 11)

#5: Increasing Asset Utility and Releasing Liquidity Through More Efficient Risk Management

Loans collateralized by mutual funds are mature financial products in multiple markets, especially in high-interest-rate markets. However, due to operational complexities and a collateral cycle of three to five business days, borrowing against funds has become relatively complicated. Through tokenized funds, this process can be simplified, reducing the collateral time to less than a day. Additionally, loan terms can be pre-programmed, allowing lenders to reduce credit risk and offer more tailored financing rates.

"In the next 12 to 18 months, we will approach a critical tipping point, and wealth and asset managers must act swiftly to seize the opportunity. While early movers have achieved some success, establishing regulatory guidelines, global standards, and technical support will be key to building a frictionless, globally interconnected industry."

Opportunities for Adoption and More Active Industry Participation in the Next 12 to 18 Months

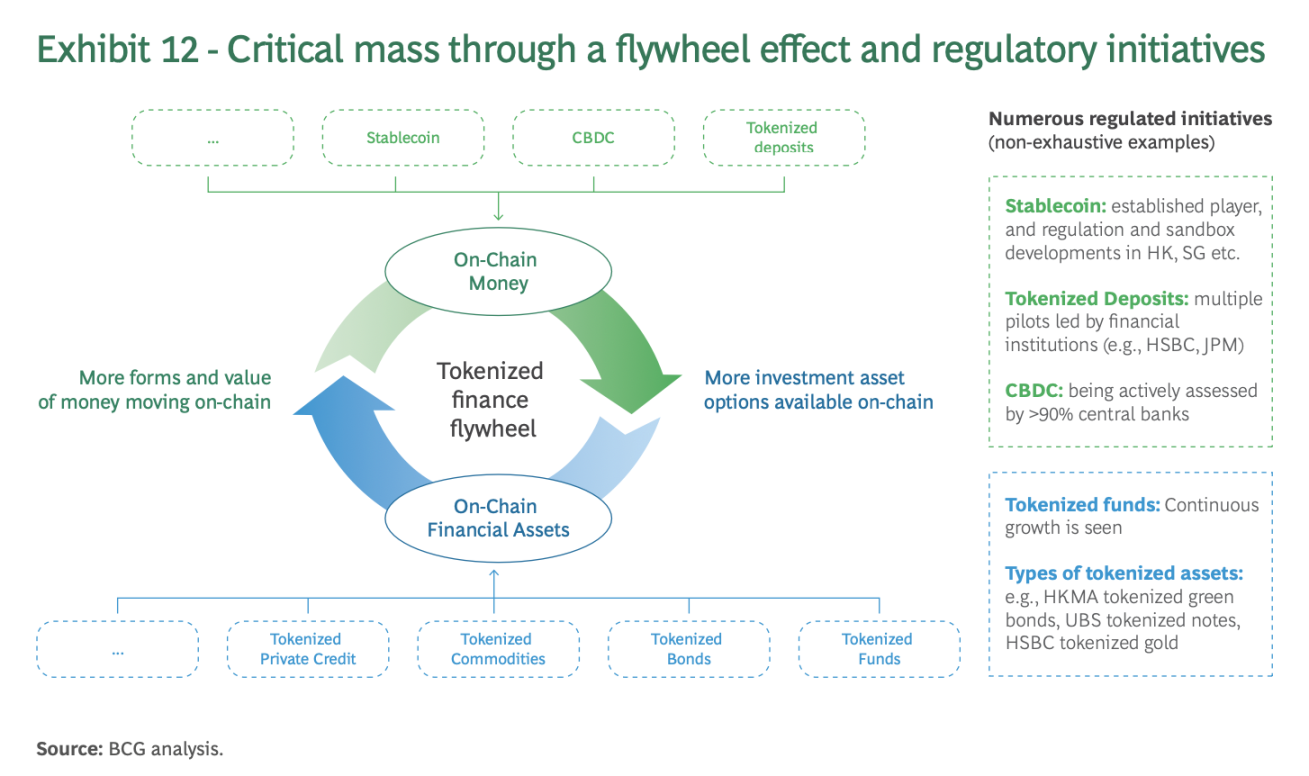

Against the backdrop of rapid regulatory developments in on-chain currencies and assets, the financial services industry is approaching a critical moment. The growth flywheel effect of tokenized funds indicates tremendous potential and drives development through various adoption pathways. Furthermore, the entire tokenized finance ecosystem is advancing rapidly, and effective coordination can lower adoption costs.

The Tipping Point for Tokenized Finance May Be Reached in the Next 12 to 18 Months

We anticipate that in the next 12 to 18 months, as regulated on-chain currencies (such as regulated stablecoins, tokenized deposits, and central bank digital currencies (CBDCs)) gradually establish themselves in key international financial centers, momentum in some markets will accelerate. For example, in Hong Kong, several regulatory initiatives are underway, including a stablecoin sandbox, the e-HKD+ project, and the Ensemble project. Meanwhile, developments in markets such as Singapore, Japan, Taiwan, the UK, and the Middle East are also progressing, bringing the future of finance closer than ever. (See Figure 12)

The Growth Flywheel of Tokenized Funds is Triggered

We estimate that the existing investment demand for tokenized funds from virtual asset holders is about $290 billion, and as traditional financial institutions (TradFi) increase their adoption of on-chain currencies, this will bring in trillions of dollars in demand. The increasing adoption of stablecoins and the rising demand from virtual asset holders (such as cryptocurrency foundations) will drive the flywheel effect in the short term. (See Figure 13)

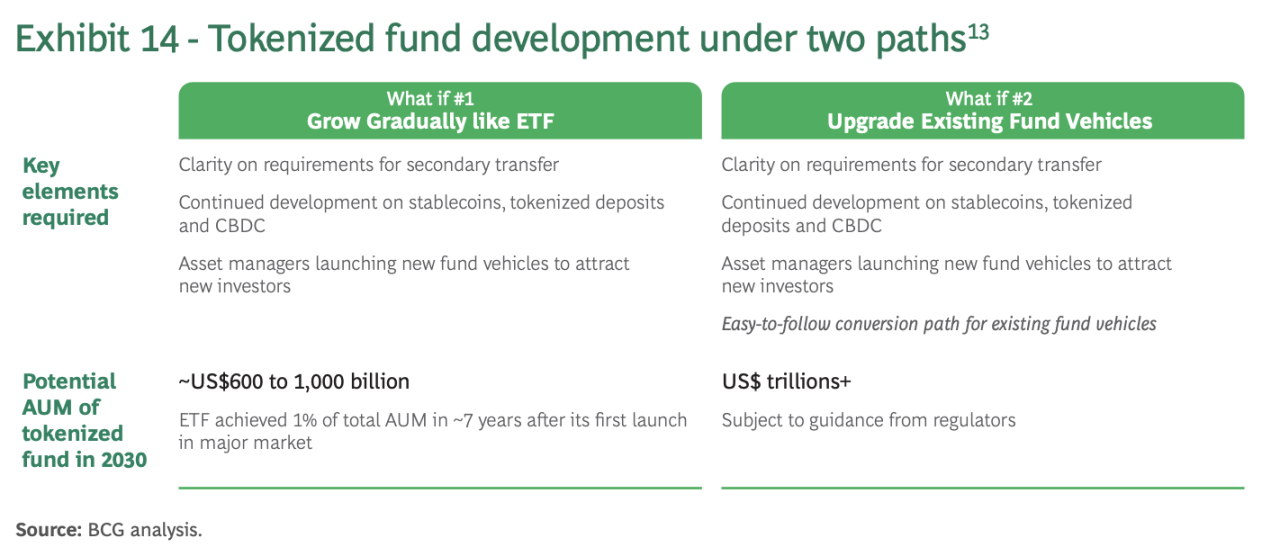

With characteristics similar to ETFs, tokenized funds may lead the next revolution in global investment. Since the launch of the first ETF in 1993, exchange-traded funds (ETFs) reached about 1% of total fund assets under management (AUM) within seven years. With characteristics comparable to ETFs, tokenized funds could also reach 1% of total AUM by 2030, meaning AUM would exceed $600 billion. If a clear and low-friction conversion path (i.e., tokenization) is provided for existing mutual funds and ETFs, the scale of tokenized funds could be even higher.

We see two potential growth paths. First, managers can launch new tools to enter new investor groups. At the same time, regulators and private sector participants can explore pathways to upgrade existing tools. (See Figure 14)

Financial Institutions Need to Collaborate to Drive a Frictionless Third Industry Revolution

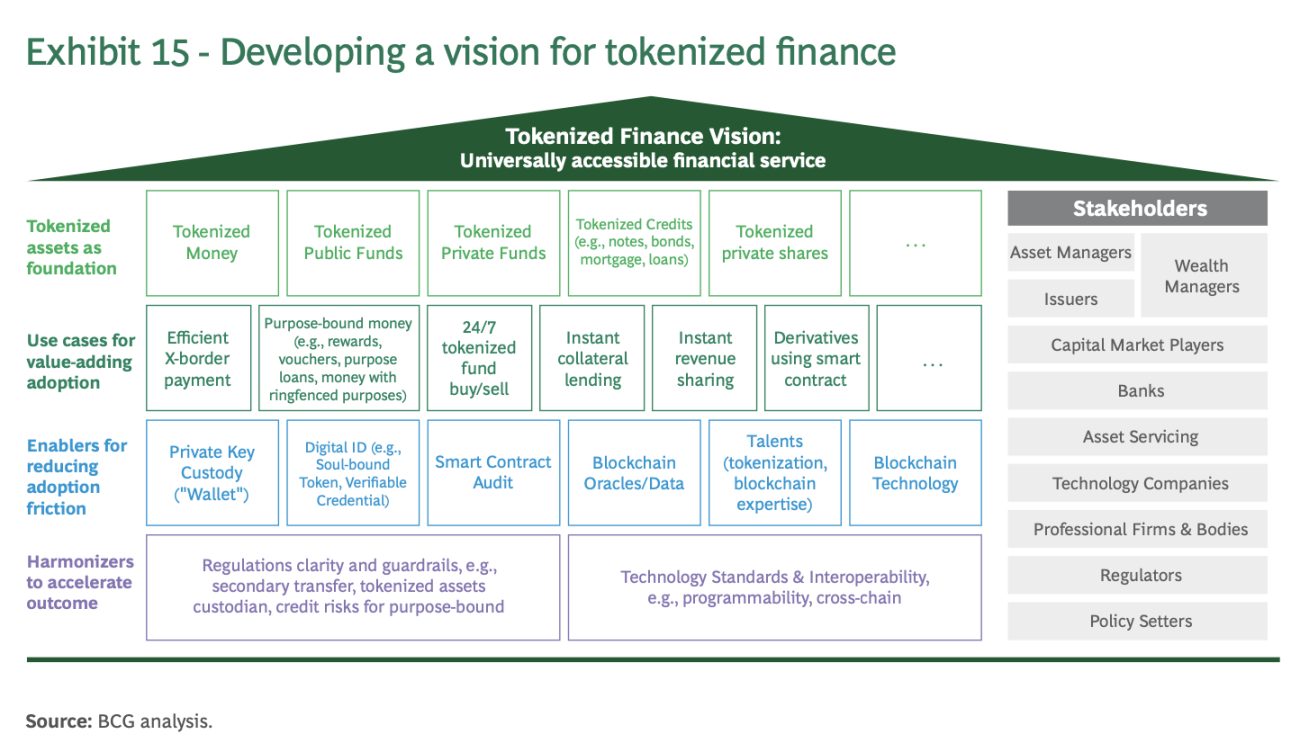

The successful development of fund tokenization will be based on the coordination of the ecosystem, one important element of which is to define a clear vision for universally accessible financial services, covering foundational capabilities, application scenarios, drivers to reduce transitional friction, and coordinators to accelerate positive outcomes. (See Figure 15) The current moment is similar to the early development of ETFs, where stakeholders need to develop their products, adapt technologies and operations, and identify ecosystem partners such as market makers.

Global Collaboration is Crucial for Ensuring Consistent Standards

Standards are essential, and the tokenized fund ecosystem will require globally recognized standards to ensure legitimacy and interoperability between different infrastructures and regions. Standards will also facilitate collaboration across the entire value chain. Priority themes include:

Clarity in Tokenized Fund Regulation to promote smooth development, including anti-money laundering (AML)/counter-terrorism financing (CFT), know your customer (KYC), security/custody guidelines for digital assets, operational requirements for tokenized funds, and secondary transfers.

Unified Tokenization Operating Standards to ensure interoperability, including ensuring digital asset data standards for inter-company operations and processes for handling on-chain/off-chain records.

Technical Interoperability to promote innovation, including interoperability between databases/chains and cost-effective, risk-managed adoption on public chains. Global protocols are crucial for achieving cross-chain and cross-border interoperability and composability.

Key to Global Collaboration

Clarity in Tokenized Fund Regulation

Reusing Existing Fund Tools: What kind of setup is needed to allow tokenized funds to reuse existing fund structures? Funds could be directly converted into tokenized forms without the need to create new structures, reducing costs and adoption impacts.

Allowing Secondary Transfers: What protective measures should be in place to safeguard investor interests? Solutions may include KYC-compliant wallets, management of buy-sell spreads, and qualification requirements for tokenized fund brokers.

Operational Qualifications for Tokenized Funds: What are the requirements for operating tokenized funds, covering fund management, asset custody, transfer agency, and fund managers? What tokenized currencies should be accepted (e.g., stablecoins issued by licensed institutions to manage issuer risk)?

Universal Tokenization Operating Standards

Global Tokenized Fund Passport: How should tokenized funds be designed to support cross-jurisdictional distribution, including leveraging existing mutual recognition arrangements?

Common Control Measures Adhered to by All Parties: What common protocols should be in place to implement automated controls? Possible control levels could be defined by specific regulatory bodies, asset managers, distributors, and projects.

Operation of Tokenized Underlying Assets: If managers decide to manage tokenized underlying assets through tokenized funds and smart contracts, what kind of setup should be in place?

Technical Interoperability

Blockchain Interoperability: What common cross-chain interfaces should be established to ensure that functionalities embedded in funds through smart contracts (such as secondary transfer controls, collateral management) remain effective in a multi-chain environment?

Risk-Based Security Standards: What data management and cybersecurity principles should be in place to protect the privacy and security of tokenized funds?

Blueprint for a New Capability Ecosystem

Financial institutions in the wealth and asset management value chain are facing a critical moment, where some institutions will thrive in the new era of tokenized funds, while others may be left behind. Technology will play a key role in driving tokenization, but rapid upgrades will be needed in the early development stages. For example, there are currently over 1,000 independent chains, and the number is rapidly increasing.

Cost-Effective Path Forward: Modular Technology Stack

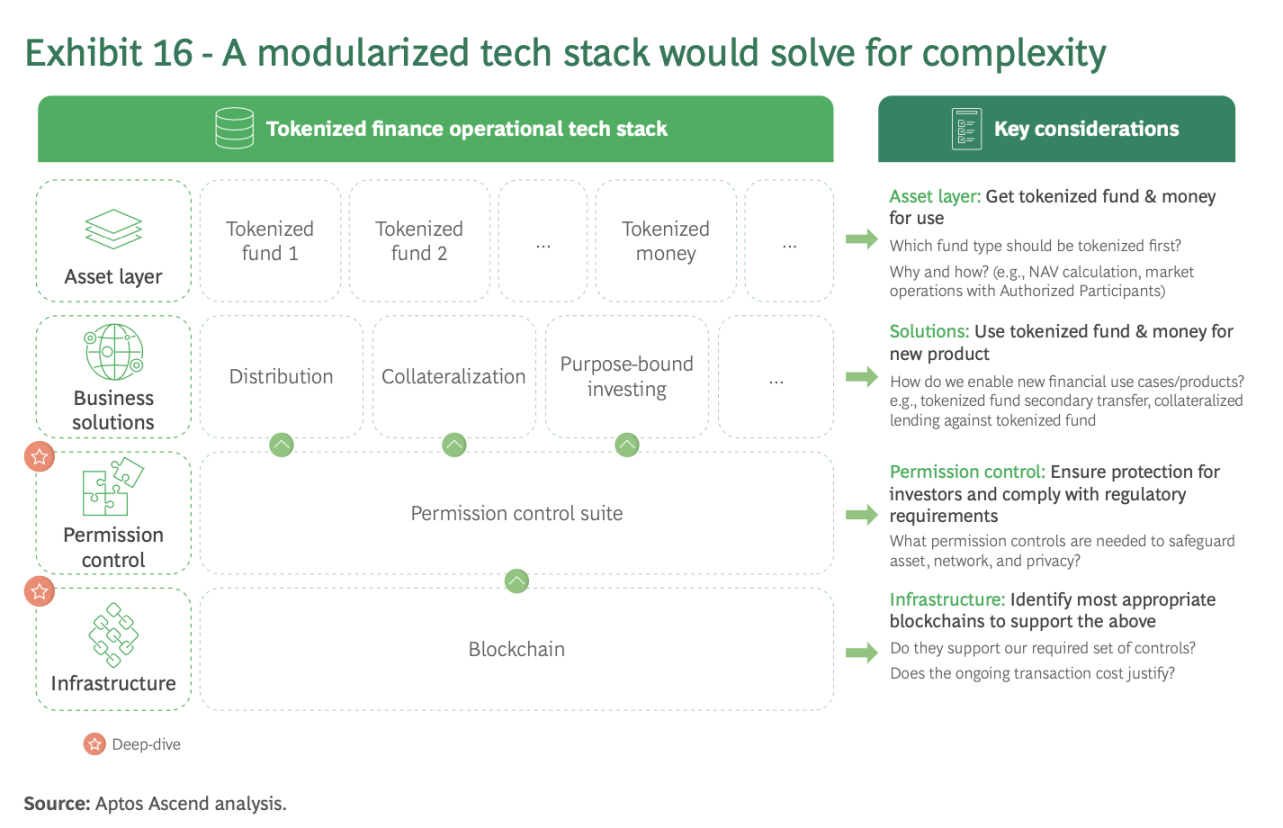

Given the variables such as different forms of tokenized assets, business solutions, and permission controls, developing solutions for everyday applications may face challenges. Based on this complexity, financial institutions can benefit from designing a modular technology stack composed of four fundamental layers: asset layer for managing types of tokenized assets; solution layer for business needs; permission control layer to meet various compliance requirements; and infrastructure layer to ensure security and scalability. (See Figure 16)

Below, we delve into two key considerations that reflect the need to balance compliance and commercial cost factors:

In-Depth Exploration #1: Permission Control for Compliance Needs

One of the key tasks of any tokenized fund initiative is to address risks related to data privacy and other regulatory requirements (such as cybersecurity). Here are some key issues we often see in industry discussions.

Specific Issues

Security and Encryption

How resilient is the blockchain's security model in addressing network threats (including hacking, fraud, and unauthorized access)? Can we ensure that tokens/assets on the blockchain can only be transferred to authorized parties (e.g., through KYC-compliant wallets)?

Can we design it to allow only vetted participants to validate transactions?

What is the process for making changes or updates to the blockchain? Are there security measures in place to prevent malicious behavior from network participants?

Data Privacy and Confidentiality

How does the blockchain ensure data privacy at the asset, transaction, and wallet levels, for example, by using strong encryption methods to protect sensitive financial data and transactions?

Does the platform support advanced encryption technologies (such as zero-knowledge proofs, multi-signatures) to ensure data integrity and confidentiality?

Disaster Recovery and Continuity

Is there a clear continuity plan that meets institutional uptime and operational resilience requirements, including during blockchain functionality upgrades?

How does the platform recover from network failures without compromising data integrity or transaction records?

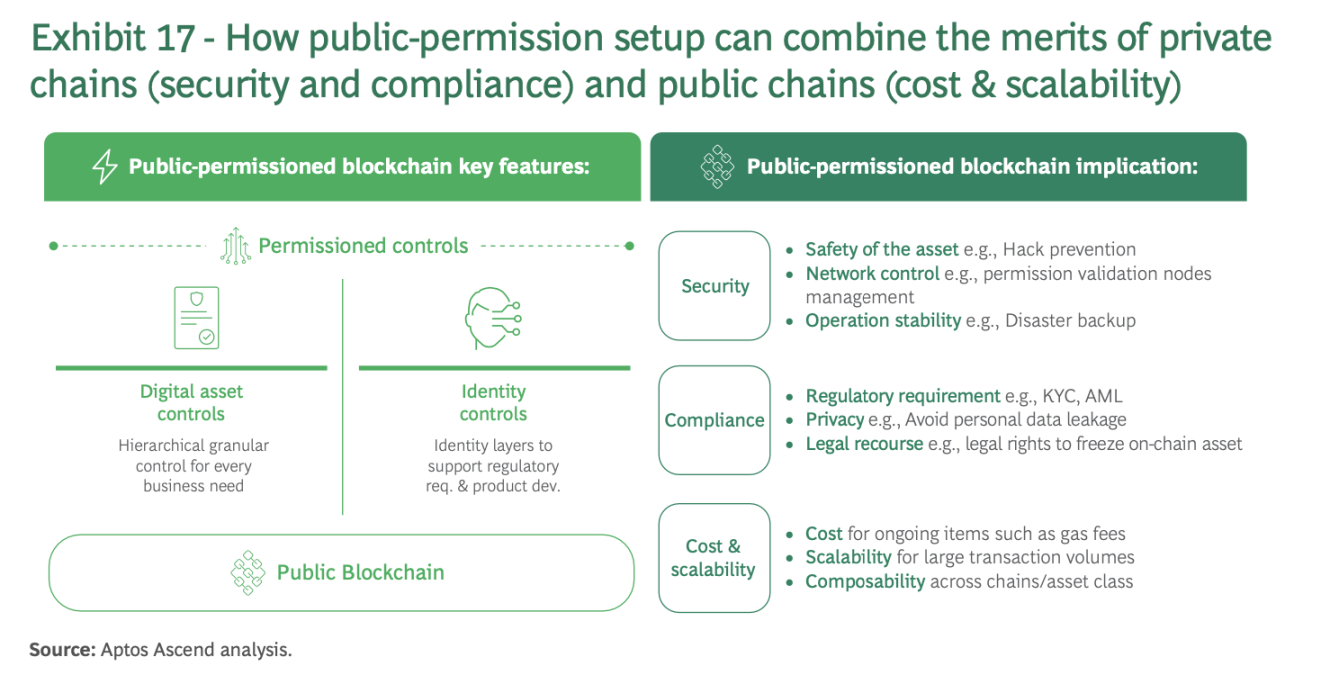

Many financial institutions have explored private or consortium-led blockchains to achieve the above compliance goals but found their development costs to be high. While public blockchains are known for their cost-effectiveness, some believe they lack sufficient permission controls, creating a clear barrier to adoption. However, it is worth noting that the evolving "permissioned" setups within public blockchains have provided financial institutions with a way to significantly reduce costs while maintaining control. (See Figure 17)

In recent years, many financial institutions have utilized Ethereum (a public blockchain) for tokenization attempts— for example, BlackRock launched BUIDL on Ethereum in May 2024. ABN AMRO used a public blockchain for bond tokenization, while UBS launched Hong Kong's first tokenized warrants on a public blockchain. Other institutions, including JPMorgan and Franklin Templeton, have also taken steps to launch fund tokenization and digital assets on platforms like Avalanche. Aptos Labs (co-author of this report) has also been involved in supporting various tokenized asset initiatives, including the launch of Brevan Howard's master fund, Hamilton Lane's senior credit opportunities fund, BlackRock's ICS money market fund, and Franklin Templeton's on-chain money market fund on the Aptos network in September 2024.

In-Depth Exploration #2: Scalability of Blockchain

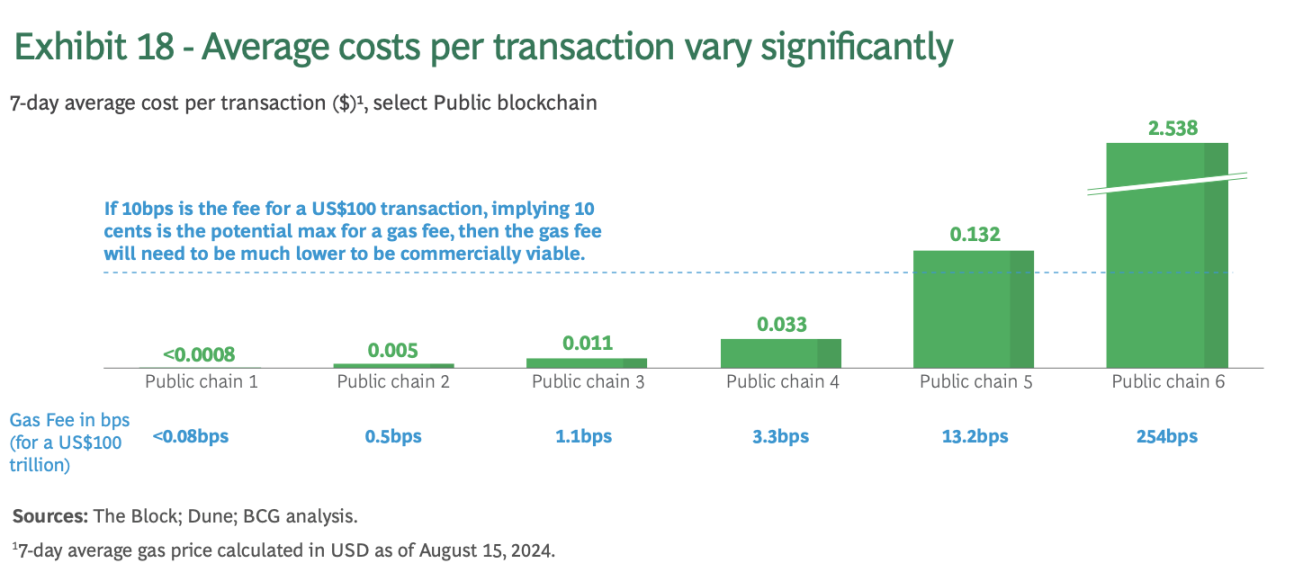

For investors, subscription and redemption fees may be as low as about 10 basis points, leaving little room for increased transaction costs. Gas fees refer to the costs required to execute transactions or smart contracts on public blockchains, ranging from less than $0.001 to as high as $2 per transaction, depending on the blockchain. (See Figure 18)

Secondary transfers of a single fund may involve multiple transactions, for example, when market participants execute smart contracts to verify specific use conditions of funds, adding extra steps. To maintain economic efficiency, total transaction costs (including all on-chain transaction gas fees) must be significantly below $0.10 per transaction.

Need for Swift Action

With the growth of tokenized currencies, the financial services industry is on the brink of a tokenization transformation. We believe that tokenized funds will be a significant driver of tokenized underlying assets.

In our baseline scenario, tokenized funds could provide terminal investors with approximately $100 billion in investment returns and $400 billion in underlying asset opportunities, while financial institutions can create value in multiple operational aspects. In various scenarios, the assets under management of tokenized funds could reach trillions of dollars by 2030.

In the next 12 to 18 months, as we approach a critical tipping point, wealth and asset managers must act swiftly to seize the opportunity. While early entrants have achieved some success, establishing regulatory guidelines, global standards, and technical support will be key to building a frictionless, globally interconnected industry.

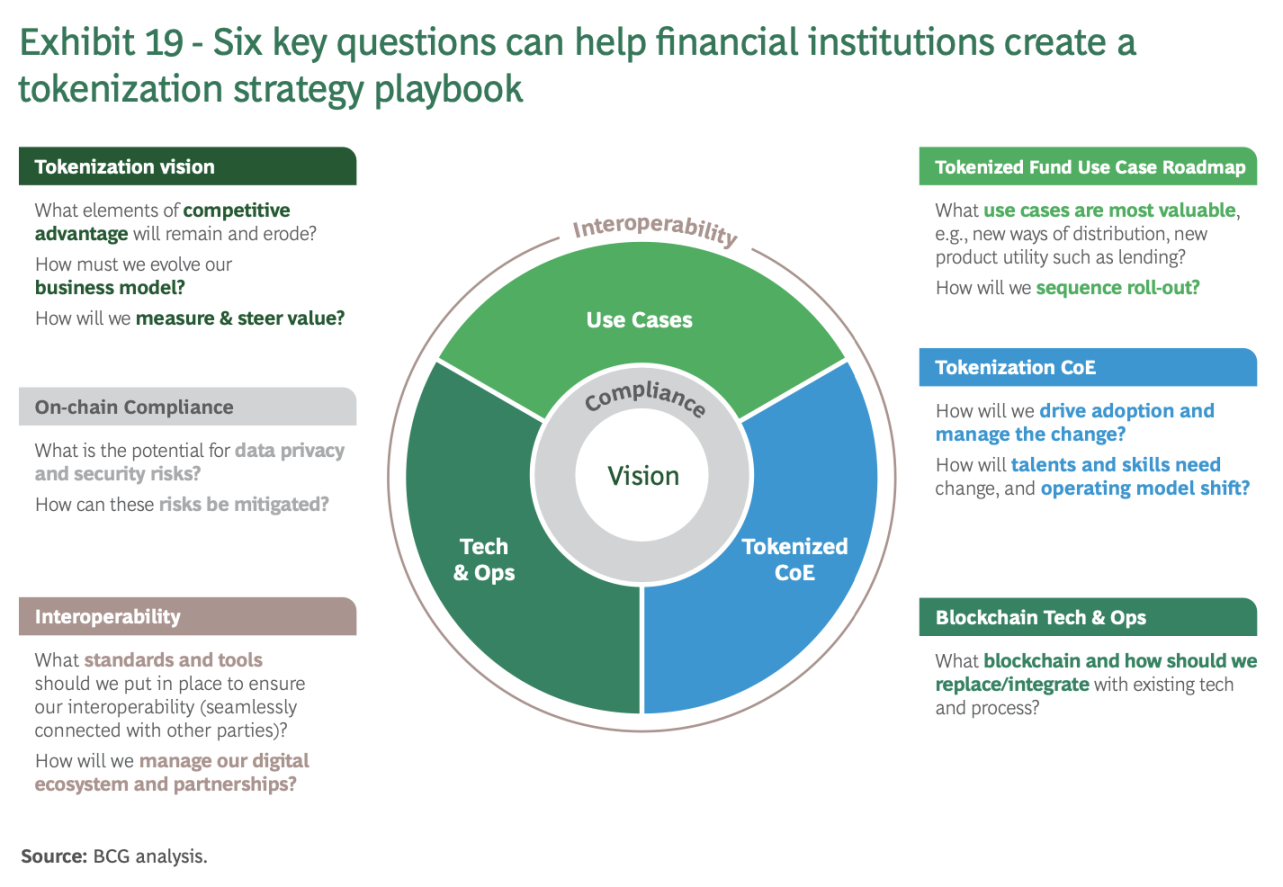

As a first step, companies need to understand how to leverage permission features and comply with security and data privacy requirements. Looking ahead, the doors to cost efficiency and significant competitive advantages are wide open for them. Finally, we propose six key questions to help decision-makers formulate strategies and prepare to take a leadership role in the upcoming transformation. (See Figure 19) Through vision, compliance, interoperability, application scenario roadmaps, centers of excellence (CoE), and foundational technology and operational capabilities, financial institutions can transform an emerging growth area into a financial powerhouse that meets modern demands.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。