Author: 0xWeilan

The information, opinions, and judgments regarding the market, projects, cryptocurrencies, etc., mentioned in this report are for reference only and do not constitute any investment advice.

Market Summary

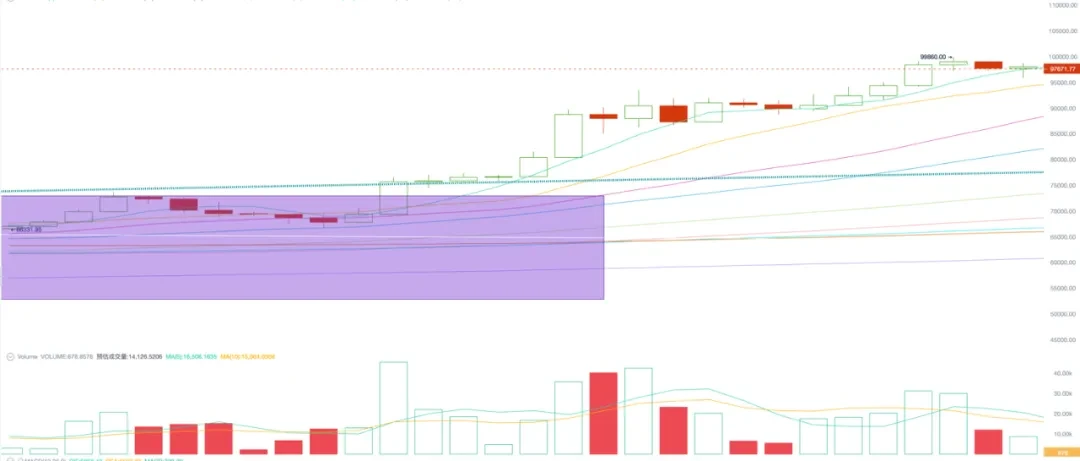

After several days of consolidation last week, BTC regained its upward momentum this week, recording six days of gains over seven trading days, ultimately achieving a weekly increase of 9.06%.

This week, BTC opened at $89,877.11 and closed at $98,028.18, with effective volume expansion, marking four consecutive weeks of increases. On November 22, it reached a historical high of $99,860, just a step away from the psychological $100,000 mark.

Expectations for the U.S. crypto-friendly policies and ongoing capital inflows provided dual support in terms of sentiment and funds for BTC's exuberant rise.

Federal Reserve and Economic Data

The market believes that Trump's administration will boost the dollar, while the Federal Reserve's statements have also reinforced expectations of a reduction in interest rate cuts next year, leading to a three-week consecutive rise in the dollar index, peaking at 108 and ultimately closing at 107.503. Under the strong dollar expectations and the overall healthy assessment of the U.S. economy, capital continues to flow into the U.S., stabilizing and rebounding the three major U.S. stock indices that had adjusted last week.

In terms of U.S. Treasury bonds, both the 2-year and 10-year yields remain above 4.3%. Meanwhile, global economic uncertainties and geopolitical conflicts have led to a resurgence in gold prices, which have risen for five consecutive trading days.

Previously, we judged that BTC would move independently of the Nasdaq, and this seems to be becoming a reality. This week, BTC rose by 9.06%, far exceeding the Nasdaq's 1.73%. Statistics show that the correlation between Bitcoin and the Nasdaq on a 30-day rolling basis has dropped to 0.46, the lowest level in five years.

There is a profound change in the scrutiny of crypto assets in society globally, especially in the U.S. Whether it is the continuous inflow of BTC Spot ETFs or the unexpected progress of the "U.S. Bitcoin Strategic Reserve Act," these developments not only provide expected attraction for the market but also ensure sustained capital inflows.

Stablecoins and BTC Spot ETF

Both major channels are experiencing explosive inflows.

This week, inflows into BTC Spot ETFs surpassed the previous two weeks' scale of over $1.6 billion, reaching $3.333 billion, setting a record for the largest single-week inflow since their launch. Funds continue to flow in, and BTC-related stocks in the U.S. market, such as MicroStrategy, are also experiencing significant gains.

The stablecoin channel saw inflows of $6.721 billion this week, marking the highest value since the start of this cycle. The continuous capital inflow not only drives BTC rapidly towards the $100,000 mark but also began to flow into altcoins in the latter half of the week, with various competitive coins at low levels recording significant increases.

Although there is still about a week left, the inflow of funds in November has reached $10.054 billion, making it the highest month of this cycle. After the second half of the bull market has started, with rising asset prices and the diffusion of wealth effects, it is highly likely that capital will continue to flow in.

In addition to these two major channels, according to announcements, MicroStrategy made a $4.6 billion purchase of BTC the week before last. This shocking scale also explains the short-term massive increase and fierce selling, yet why BTC prices have not seen adjustments.

Selling Pressure

In November, BTC's increase peaked at nearly 42%, with both long and short positions showing substantial unrealized profits. As the $100,000 price level approaches, selling has continued this week following last week. Over the week, over 240,000 BTC flowed into exchanges, with more than $700 million in profits locked in on just one day, the 21st.

However, the overall profit from short positions still exceeds 30%, indicating that short-term selling is likely to continue.

The good news is that over 40,000 BTC flowed out of exchanges throughout the week. More and more BTC is entering the hands of medium- to long-term investors.

All technical indicators are in the overbought territory, yet enthusiasm and capital are exceptionally strong. We anticipate that an adjustment will occur, but it is difficult to determine when and how long it will last; the best strategy remains to hold long, as it is far from the time to exit.

Cycle Indicators

The EMC BTC Cycle Metrics indicator is at 0.875, indicating that the market is in an upward phase, showing vigorous upward momentum.

EMC Labs was established in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies, aiming to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。