As BTC approaches the $100,000 mark, it seems that every macro observer over the past week has become an expert on MSTR convertible bonds. Cryptocurrency has once again become the focus of news, attracting mainstream attention to the greatest extent since the FTX incident.

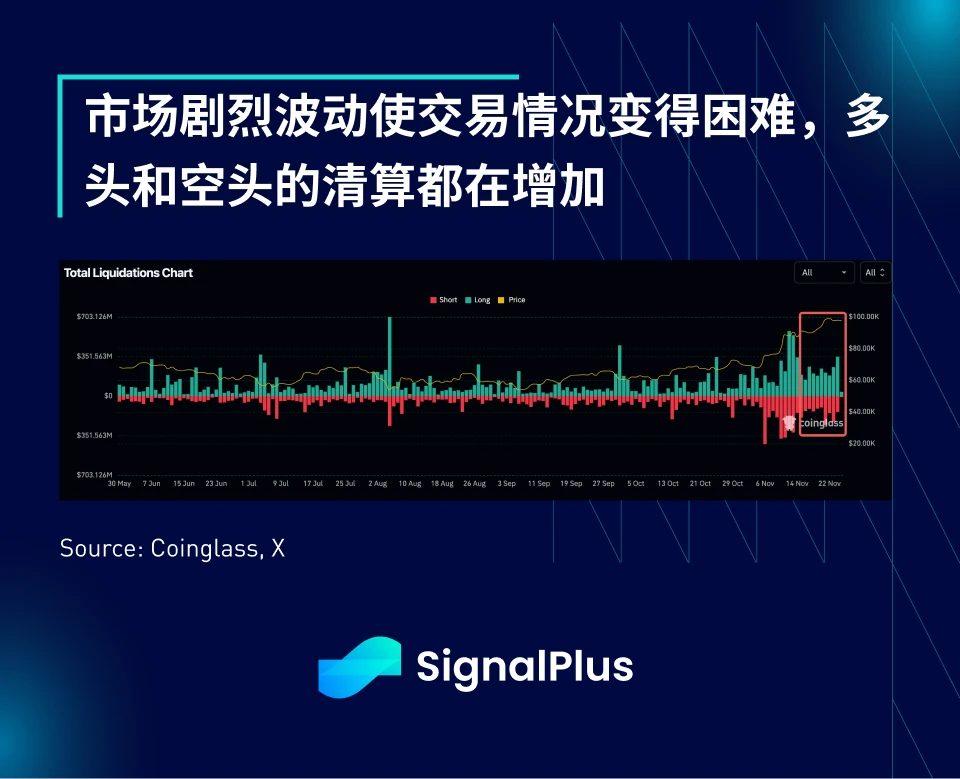

As we have mentioned in the past, the "easy phase" is over. With latecomer investors entering the market with significant leverage, future market volatility will significantly intensify.

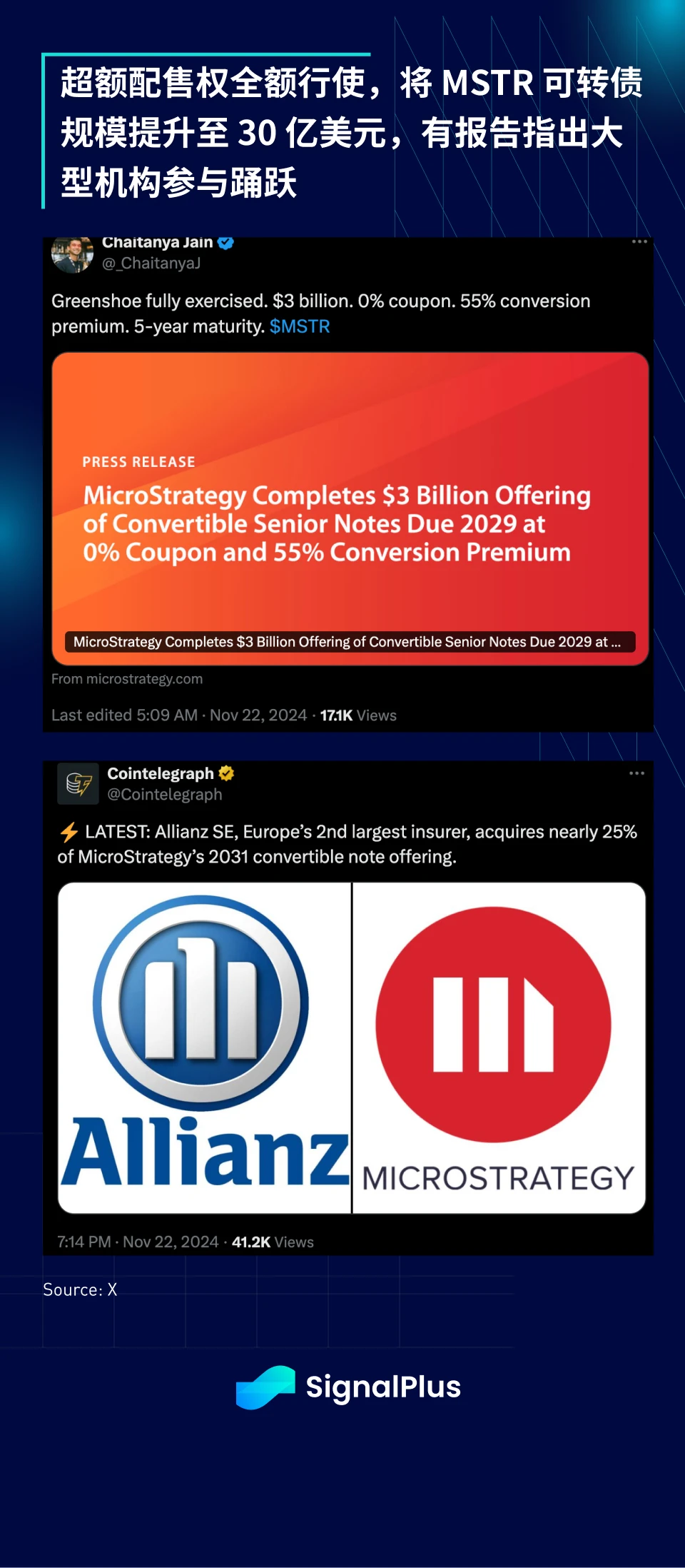

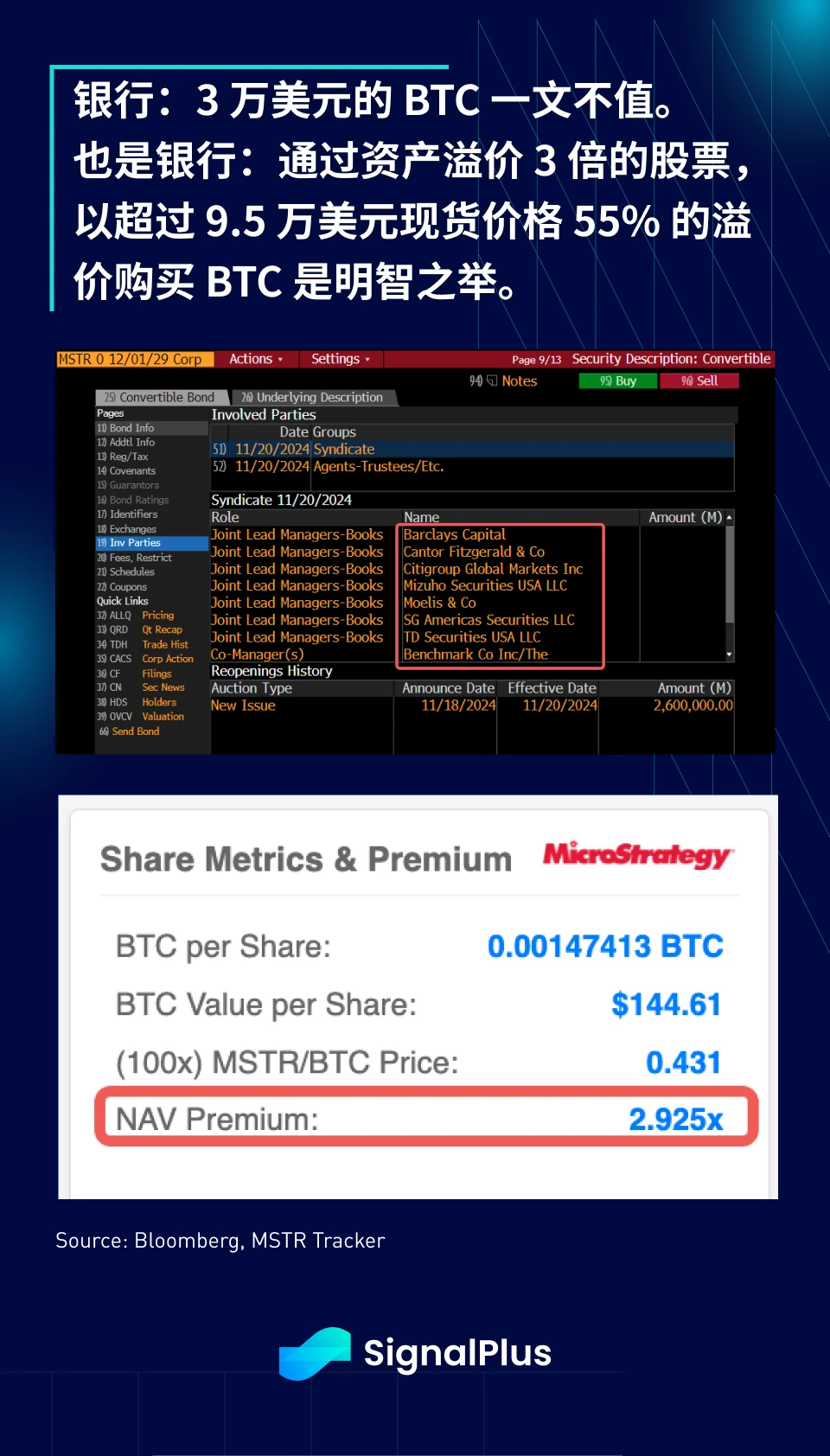

Microstrategy successfully exercised its $400 million overallotment option on its original $2.6 billion convertible bond (0% coupon, 55% premium), raising the final size to $3 billion. According to Cointelegraph, Allianz Insurance was one of the main participants in this transaction, and the convertible bonds maturing in 2029 closed above $104 on the first trading day.

The irony of Wall Street's involvement is evident. For years, they have criticized cryptocurrencies for being high-risk and lacking fundamental value, yet now these banks are scrambling to dominate this transaction. In fact, when BTC was between $6,000 and $60,000, these banks claimed BTC was worthless, and now these underwriters are suggesting that it is "quite reasonable" for investors to pay a 55% premium based on a $95k price through an indirect equity instrument to buy BTC. We will not delve into how MSTR has become a convex financing tool for TradFi investors, but we must acknowledge that these mainstream "gatekeepers" (including regulators) are bringing mainstream investors into this market through this incredible structure, and it all seems reasonable and legitimate because it is done through "regulated securities." Isn't that a typical traditional finance trick?

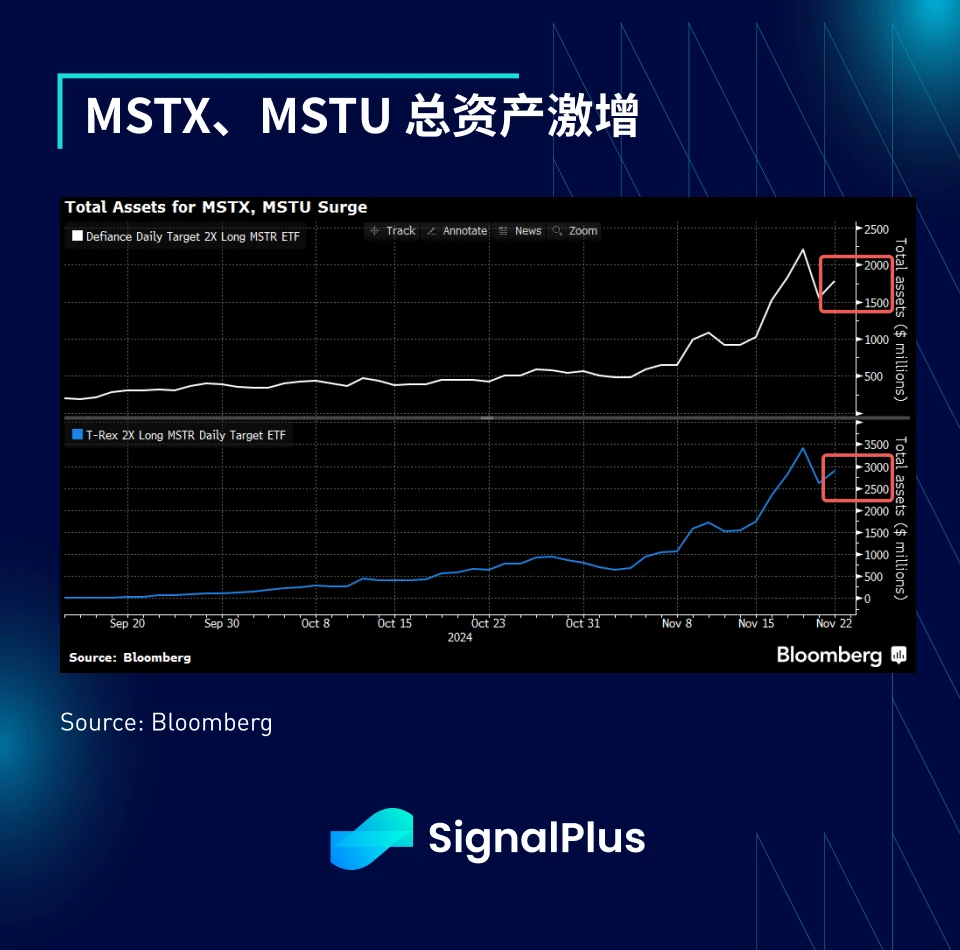

Mainstream institutions naturally will not miss such an opportunity and quickly launched Microstrategy's leveraged ETFs (MSTX, MSTU), providing retail investors with more "suboptimal" ways to leverage trade BTC spot. According to Bloomberg, the high demand for these leveraged ETFs has put pressure on the main brokers responsible for securities lending, with related assets under management surging to nearly $5 billion in the past week.

(Friendly reminder: Do not purchase leveraged ETFs except for short-term trading. Leveraged ETFs are mathematically designed to gradually lose value over time; please Google their daily return calculation for more details.)

Main brokers - units within banks that collaborate with clients on securities lending and other businesses - have reached their limit on the swap exposure they are willing to provide for the T-Rex 2X Long MSTR Daily Target ETF (code MSTU), a fund that has been established for about a month. According to certain indicators, this fund was the most volatile ETF ever launched on Wall Street. -- Bloomberg

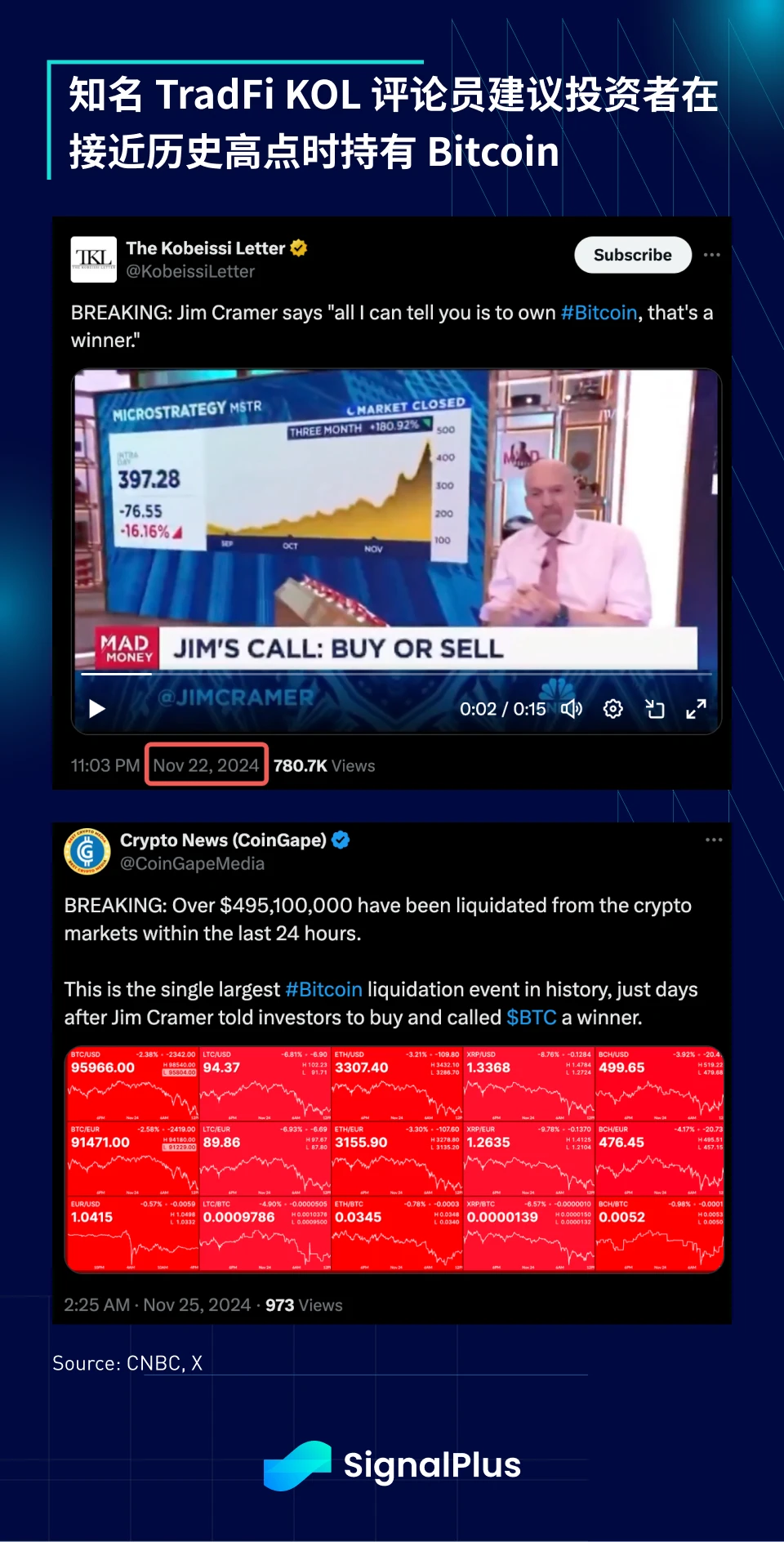

Mainstream enthusiasm has further fueled the recent market bubble, with well-known television commentators suddenly reversing their stance to support cryptocurrencies, leading to a significant increase in leverage at current market levels and causing actual volatility to rise sharply. Reports indicate that nearly $500 billion in long positions were liquidated in the past few days due to the price's failure to break through again, potentially marking the largest wave of liquidations in history.

As we have always warned, the cryptocurrency market will be very volatile in the short term. BTC technical indicators show severe overbought conditions, and the public is experiencing FOMO regarding this asset class. If the BTC price can successfully break through the psychological barrier of $100,000, there may be an opportunity for further price increases to the $120,000 to $130,000 range, but we are not optimistic about the prospect of a steady price increase, as the asset market is overall in an overbought state. Selling put options as an income or target buy strategy may still be attractive in the short term (DYOR: not investment advice).

Speaking of options, following Nasdaq's launch of IBIT ETF options, CBOE will introduce the industry's first cash-settled options. We still expect the options market to become an important growth catalyst for the industry after 2025, and SignalPlus will provide comprehensive support for your options journey!

Lutnick (Trump's new Secretary of Commerce) and his company Cantor's recent initiatives in the cryptocurrency space should have a positive impact on the long-term structural development of the ecosystem. According to recently disclosed information, the company is not only the custodian of Tether but also invested $600 million to acquire a 5% stake in Tether (with a company valuation of $12 billion). The company will also launch (off-chain) Bitcoin financing services, offering fiat loans to customers with BTC as collateral, further reinforcing Bitcoin's role as a balance sheet asset in the mainstream ecosystem.

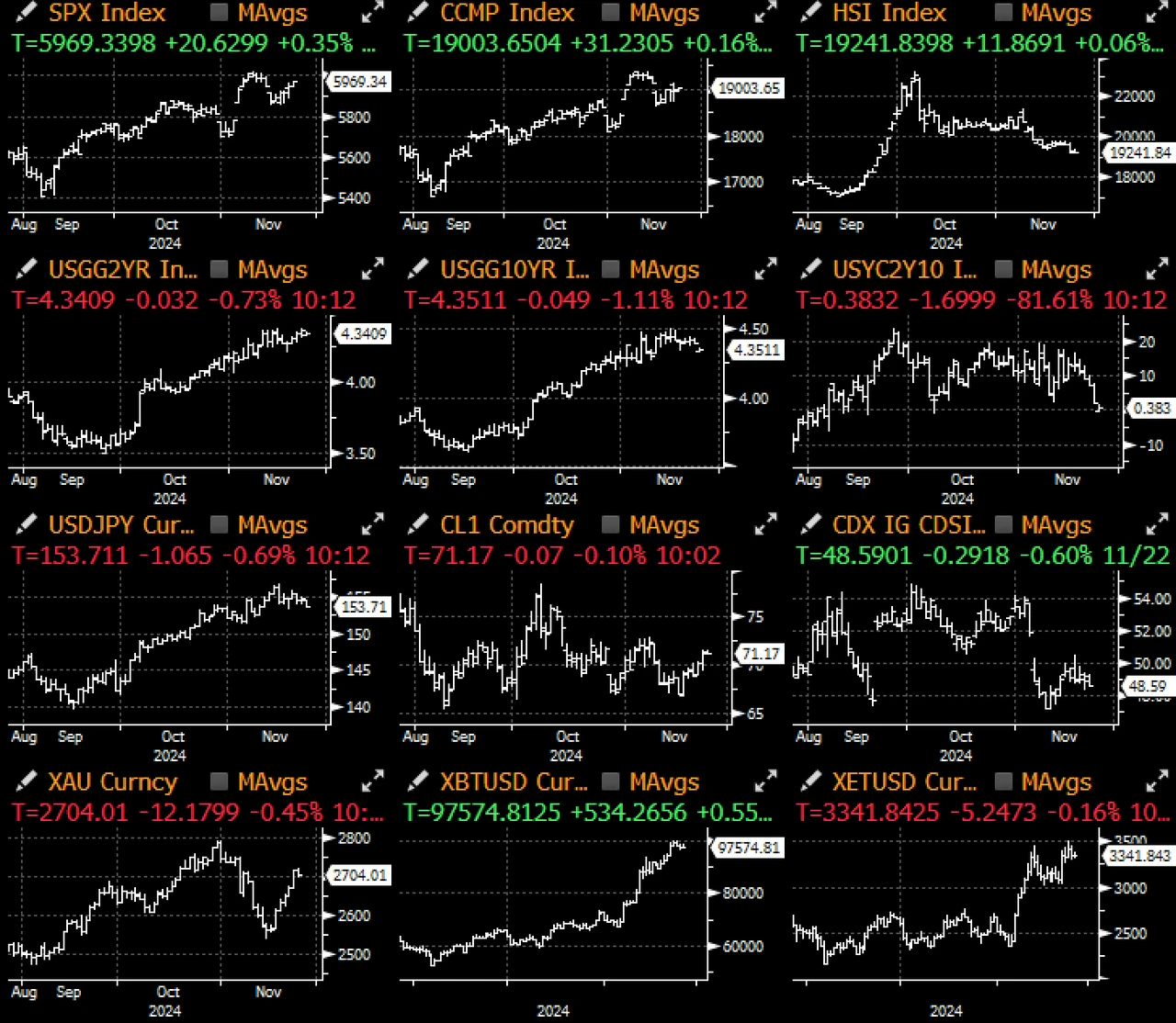

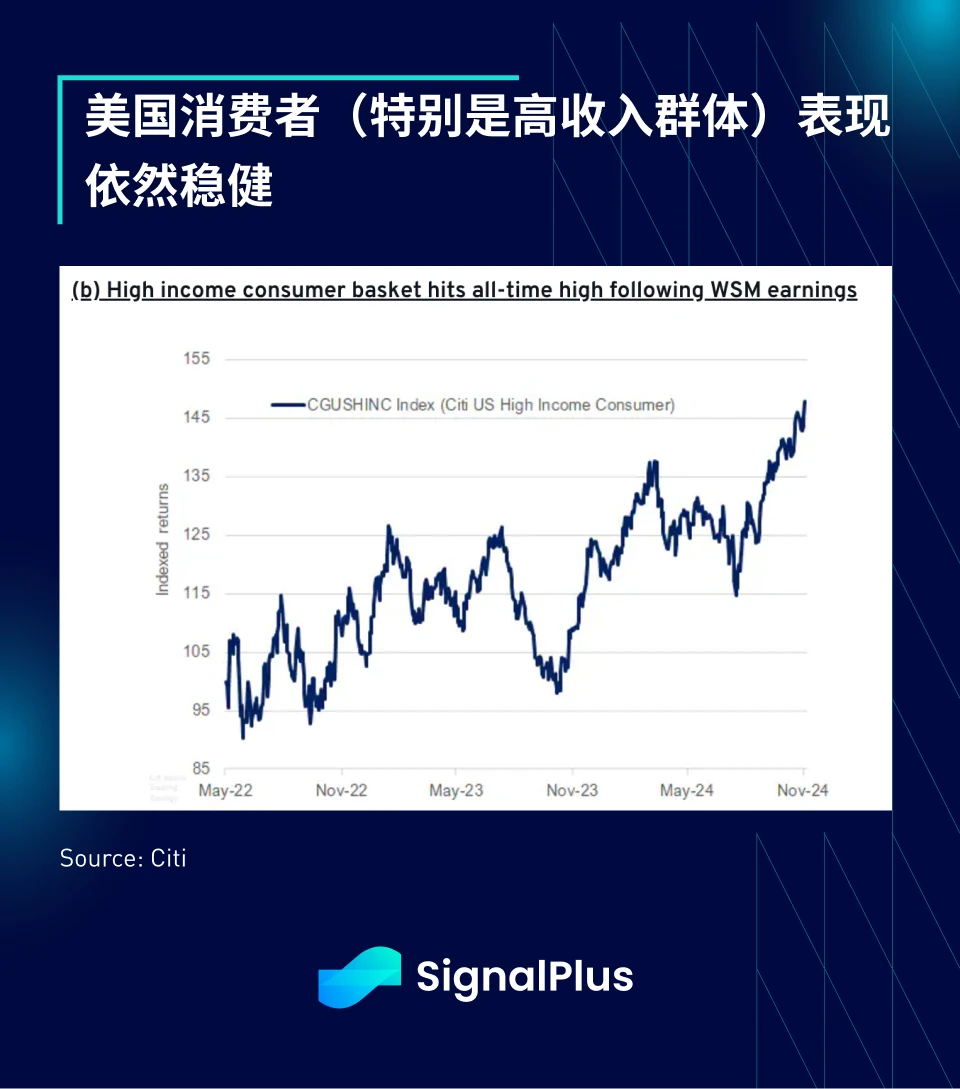

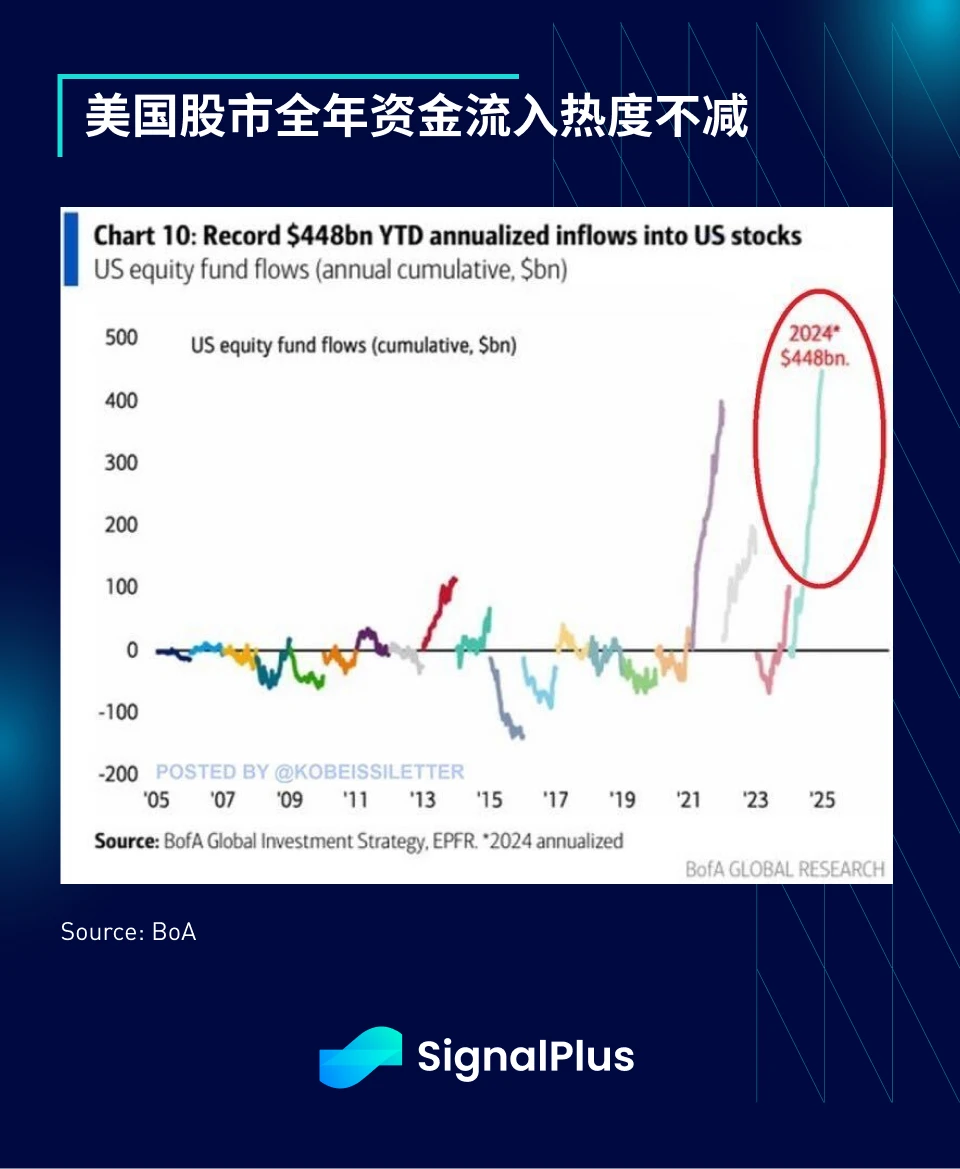

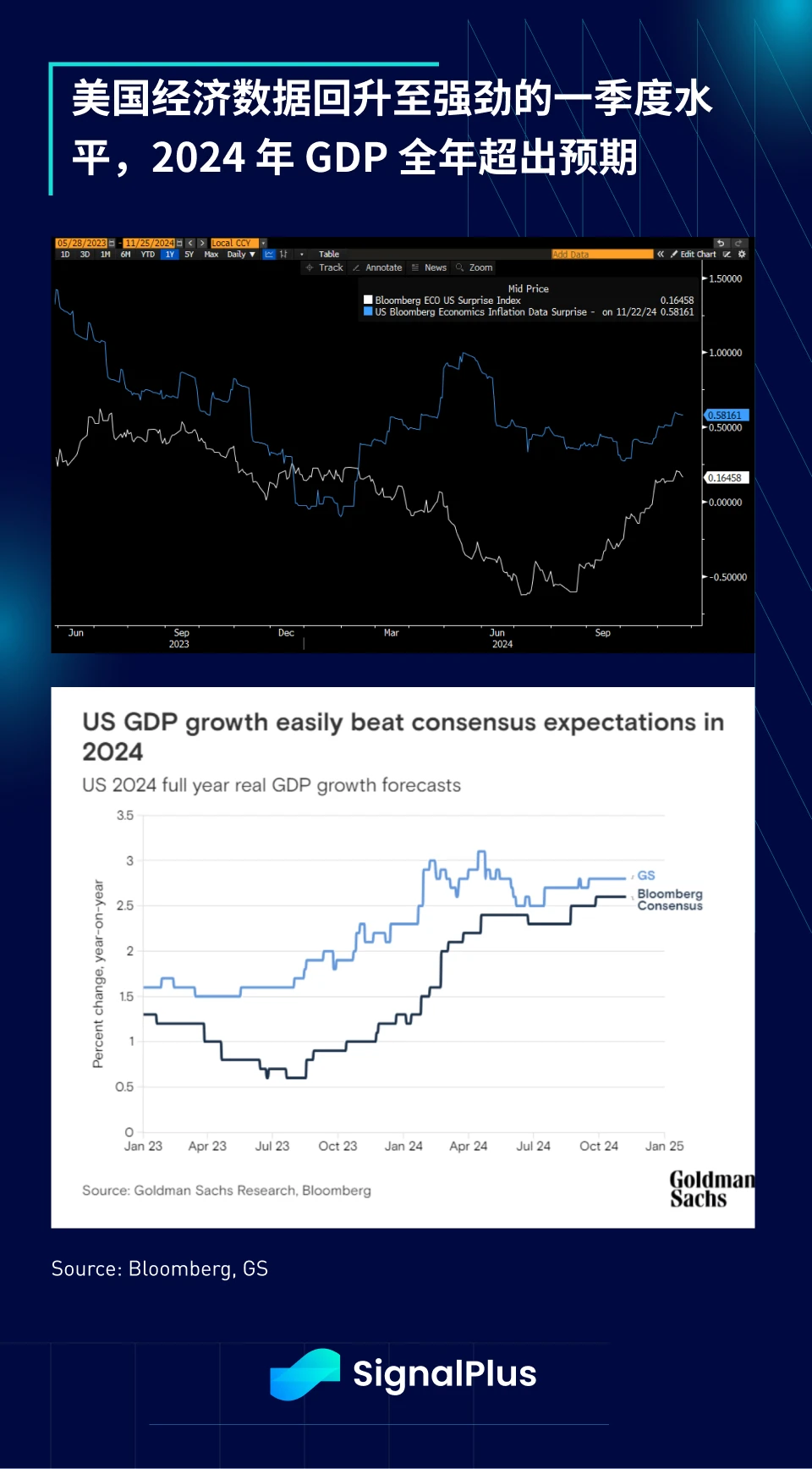

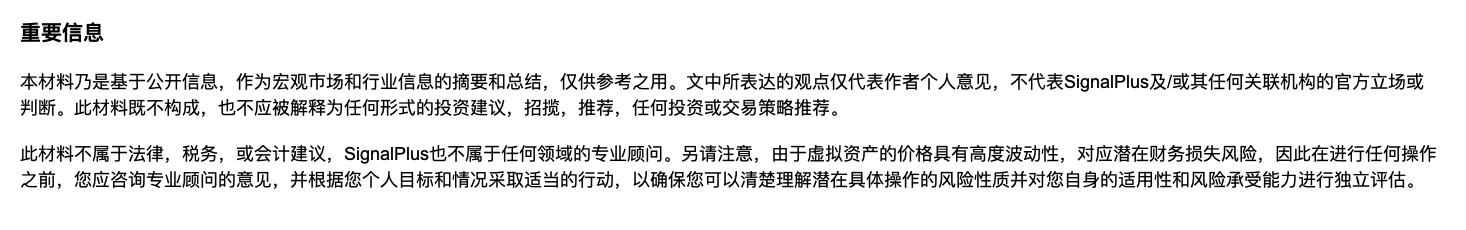

Back to TradFi, last Wednesday Nvidia's earnings report exceeded expectations, and the high-income consumer index reached a new high, reflecting the strong purchasing power of the American (high-income) group. The stock market rebounded strongly from earlier pullbacks. The economic surprise index rose to a strong first-quarter level, while inflation data has not yet broken upward, keeping the possibility of a Federal Reserve rate cut (December possibility = 56%) alive, and the soft landing scenario remains solid. Additionally, Bank of America reported that over $448 billion has flowed into the U.S. stock market this year, breaking the record set in 2021 and reaching unprecedented levels.

The U.S. market will welcome the Thanksgiving holiday on Thursday, and trading activity this week may be very light. Hopefully, this will also give us time to catch our breath as we approach the final month of the year.

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。