Tether Minting

Tether's recent minting activities have had a positive impact on Bitcoin prices. According to statistics, Tether minted 3 billion USDT on the Ethereum and Tron networks on November 24, and in the past three days, Tether has minted 5 billion USDT, injecting 2.83 billion USDT into the cryptocurrency market. Since November 6, the total net minting amount has reached 13 billion USDT. This significant increase mainly occurred on the Ethereum and Tron networks.

Market observations indicate that when Tether engages in large-scale minting, it is usually accompanied by a rise in Bitcoin prices. This is because Tether's minting increases the available liquidity in the market, allowing investors to more easily convert USD to cryptocurrency, thereby boosting market demand and prices. Additionally, the inflow of stablecoins provides more trading opportunities in the market, further invigorating market transactions.

Howard Lutnick, Chairman and CEO of the global leading financial services company Cantor Fitzgerald, is working to strengthen ties between his company and USDT stablecoin issuer Tether Holdings Ltd. Reports suggest that Cantor Fitzgerald is seeking Tether's support for a multi-billion dollar loan program that would allow clients to borrow USD using Bitcoin as collateral. The initial funding is set at 2 billion USD, with expectations to expand to hundreds of billions. Tether has already collaborated with Cantor Fitzgerald through its custody services.

Howard Lutnick was nominated as the U.S. Secretary of Commerce after Trump's election, indicating that this collaboration provides a solid backing for the stablecoin market and demonstrates potential support from U.S. high-level officials for the cryptocurrency market, which also brings more favorable policies to the Bitcoin market.

BTC Spot ETF Achieves Net Inflows for Five Consecutive Days

In addition to Tether's large-scale minting in recent days, the continuous large inflows into ETFs also support the next upward movement of BTC prices. According to AICoin data, Bitcoin spot ETFs achieved net inflows for five consecutive days last week, accumulating over 3.3 billion USD in inflows. On the latest trading day (November 22), there was a single-day net inflow of 490 million USD, still reflecting strong investor confidence in the Bitcoin market.

Among them, the Bitcoin spot ETF with the highest net inflow last week was the BlackRock ETF IBIT, with a weekly net inflow of 2.05 billion USD, bringing its historical total net inflow to 31.33 billion USD. The second was the Fidelity ETF FBTC, with a weekly net inflow of 773 million USD, and a historical total net inflow of 115.4 billion USD.

Image Source: AICoin

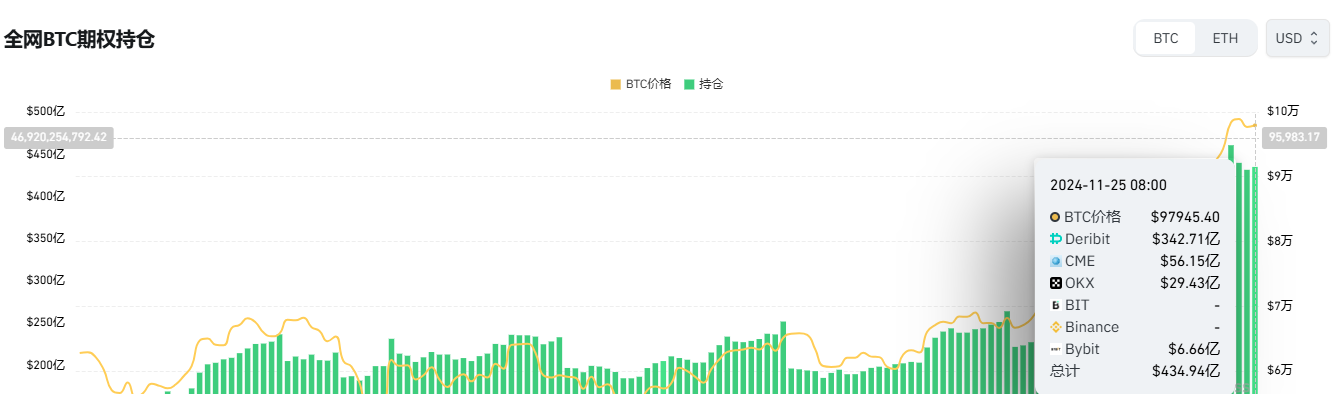

Bullish Sentiment in the Options Market

On-chain analyst Ali pointed out that long-term BTC holders are showing increasingly greedy signs, which typically indicates strong bullish sentiment in the market and may suggest that Bitcoin could reach new price peaks in the next 8 to 11 months.

The high number of open options contracts for BTC also supports this view, as the significant increase in open contracts on major exchanges indicates rising demand for Bitcoin from institutional investors. Today's open options contracts reached 43.4 billion USD, with call options accounting for as much as 63.61%, reflecting optimistic expectations for Bitcoin's price movements in the future.

Image Source: Internet

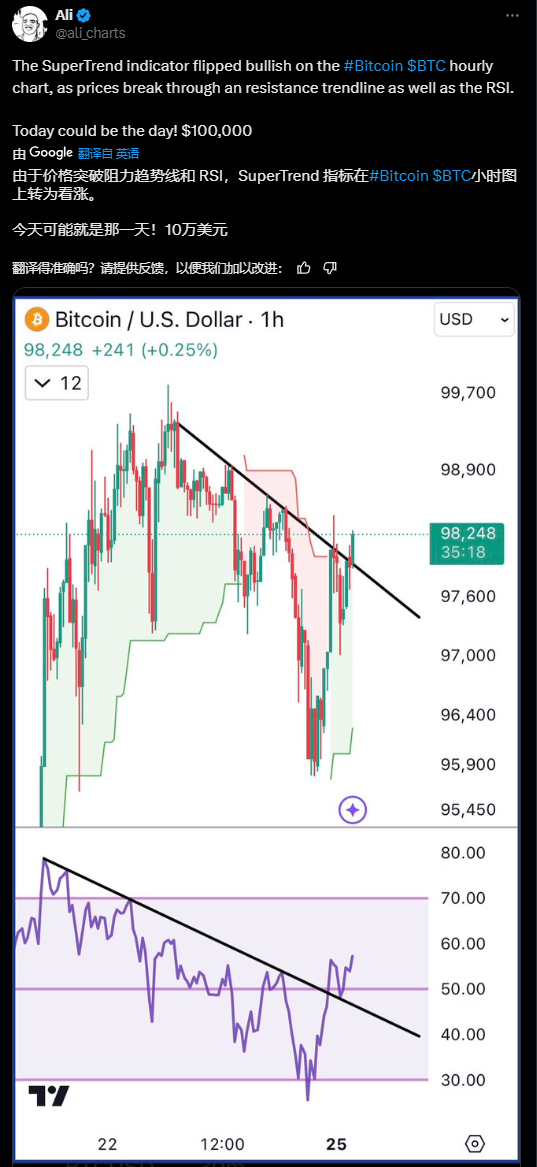

Earlier today (November 25), Ali tweeted that the current technical indicators for BTC have turned bullish, suggesting a potential breakthrough of the 100,000 USD mark is imminent.

Image Source: x

Conclusion

Tether's minting activities, potential policy benefits from the Trump administration, and bullish sentiment in the Bitcoin options market continue to drive the prosperity of the Bitcoin bull market. There is still a significant possibility that Bitcoin will maintain an upward trend in the near future. Investors should closely monitor market dynamics to seize more investment opportunities in this opportunity-filled market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。