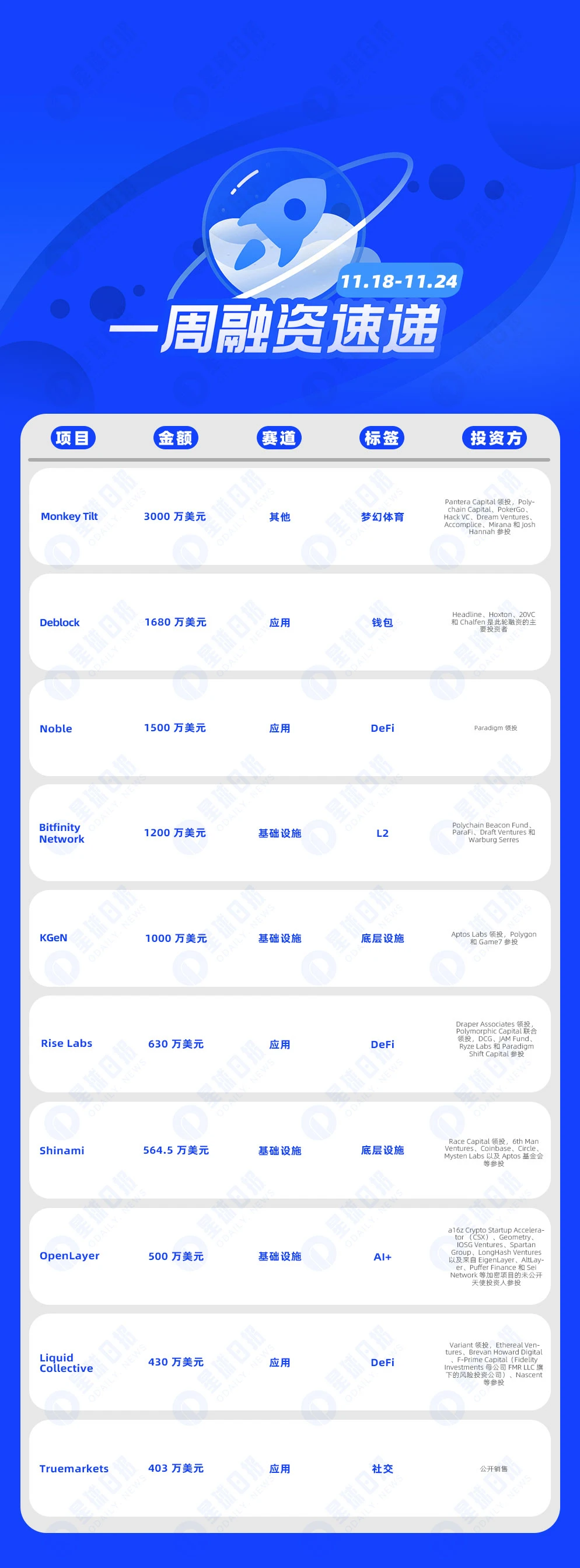

According to incomplete statistics from Odaily Planet Daily, there were a total of 14 blockchain financing events announced from November 18 to November 24, a significant decrease from the previous week's data (24 events). The disclosed total financing amount is approximately $118 million, down from last week's figure ($175 million).

Last week, the project that received the most investment was the crypto fantasy sports platform Monkey Tilt ($30 million); the crypto wallet Deblock followed closely ($16.8 million).

The following are the specific financing events (Note: 1. Sorted by disclosed amount; 2. Excludes fund raising and merger events; 3. * indicates traditional companies involved in blockchain):

On November 20, the crypto fantasy sports platform Monkey Tilt announced the completion of $30 million in Series A financing, which concluded this summer but was only recently disclosed. Pantera Capital led the round, with participation from Polychain Capital, PokerGo, Hack VC, Dream Ventures, Accomplice, Mirana, and Josh Hannah. This latest financing brings the total amount raised to over $50 million.

On November 21, documents submitted to the UK Companies House this month revealed that the crypto wallet Deblock, founded by former Revolut and Ledger executives, has completed an additional £13.3 million (approximately $16.8 million) in seed round financing. Another document from October indicated that Headline, Hoxton, 20VC, and Chalfen were the main investors in this round. Sifted previously reported that this startup quietly raised €12 million last year.

Stablecoin Infrastructure Platform Noble Completes $15 Million Series A Financing, Led by Paradigm

On November 19, stablecoin infrastructure platform Noble announced the completion of $15 million in Series A financing, led by Paradigm, with other investors yet to be disclosed. This new financing brings Noble's total funding to $18.3 million. It is reported that the platform will use the funds from this round to accelerate the adoption of stablecoins by developing new user-facing products and expanding its workforce. Currently, Noble has partnered with stablecoin issuers such as Circle, Ondo Finance, Hashnote Labs, and Monerium, managing assets exceeding $458 million.

On November 19, Bitcoin L2 solution Bitfinity Network announced the completion of $12 million in financing, which includes $7 million from institutional investors such as Polychain Beacon Fund, ParaFi, Draft Ventures, and Warburg Serres, as well as $5 million raised through community OTC token sales. The project will utilize Internet Computer Protocol (ICP) Chain Fusion technology to enable the operation of Bitcoin native assets within Ethereum-compatible ecosystems.

Additionally, Bitfinity Network has launched, with its security enhanced by a "powerful proof-of-stake protocol utilizing Chain-Key technology," which offers stronger security than the traditional multi-signature methods used by most L2s. The ecosystem plans to host dApps such as Sonic, Chapswap, Lendfinity, and Omnity Bridge.

Decentralized Gamer Network KGeN Completes $10 Million Financing, Led by Aptos Labs

On November 21, decentralized gamer network KGeN (Kratos Gamer Network) announced the completion of $10 million in ecosystem round financing, led by Aptos Labs, with participation from Polygon and Game7. To date, the total financing has reached $30 million, and it is reported that its gamer network primarily operates in India, Brazil, Nigeria, Southeast Asia, and the Middle East and North Africa.

On November 21, hybrid payment platform Rise Labs announced the completion of $6.3 million in Series A financing, led by Draper Associates, with Polymorphic Capital co-leading, and participation from DCG, JAM Fund, Ryze Labs, and Paradigm Shift Capital.

Rise Labs primarily develops hybrid payment infrastructure that integrates fiat currencies, stablecoins, and cryptocurrencies. Currently, Rise has over 150 clients and more than 100,000 contractors. Its client base includes traditional businesses, Web3 companies, as well as DAOs, protocols, and platforms.

On November 21, Move ecosystem developer platform Shinami announced the completion of $5.645 million in seed round financing, led by Race Capital, with participation from 6th Man Ventures, Coinbase, Circle, Mysten Labs, and the Aptos Foundation.

Shinami aims to become the "Consensys" of the Move ecosystem, providing developers with a one-stop tool platform to simplify application building on Move blockchains such as Aptos, Sui, and Movement.

Additionally, Shinami has joined the Move Collective.

On November 20, crypto AI startup OpenLayer, co-founded by three former Robinhood employees, completed $5 million in seed round financing, with participation from a16z Crypto Startup Accelerator (CSX), Geometry, IOSG Ventures, Spartan Group, LongHash Ventures, and undisclosed angel investors from crypto projects such as EigenLayer, AltLayer, Puffer Finance, and Sei Network.

OpenLayer acts as an AI data layer, allowing users to contribute and verify data through a Chrome extension and earn points. According to its website, application developers can access this user data with user consent, thereby protecting privacy. Use cases include training AI models, user targeting, and enhancing functionalities.

Additionally, OpenLayer plans to launch its own token in the future. Currently, there are 7 people working at OpenLayer in the U.S., with plans to hire two more engineers.

Staking Protocol Developer Alluvial Completes $4.3 Million Strategic Financing, Led by Variant

On November 19, according to official news, Alluvial, the developer of the institutional-grade liquid staking protocol Liquid Collective, completed $4.3 million in a new round of strategic financing, led by Variant, with participation from Ethereal Ventures, Brevan Howard Digital, F-Prime Capital (the venture capital arm of Fidelity Investments' parent company FMR LLC), Nascent, among others, bringing its total financing to $22.5 million.

The new funds aim to facilitate product development and expansion to meet the growing demand from ETFs and global institutions.

Previously, in July last year, Alluvial completed $12 million in Series A financing, co-led by Ethereal Ventures and Variant.

On November 19, the market-based news and entertainment platform Truemarkets raised over $4 million through a public NFT sale, generating $4.03 million by selling 15,071 NFTs, with a minting fee of 0.08 ETH (approximately $250) per NFT. Ethereum co-founder Vitalik Buterin purchased 400 of these NFTs, spending a total of 32 ETH (about $107,000).

Truemarkets allows users to bet on real-world events. Truemarkets has two types of NFTs: Oracle Patron NFT and Truth Seeker NFT. NFT holders are eligible to claim the upcoming asset TRUE tokens during the platform's token generation event.

DeFi Liquidity Solution System Barter Completes $3 Million Seed Round Financing, Led by Maven11

On November 19, the decentralized finance liquidity solution system Barter announced the completion of $3 million in seed round financing, led by Maven11, with participation from Lattice, Anagram, Heartcore, DCG, and Daedalus Angels. Founded in 2023, Barter primarily engages in on-chain trade matching and settlement. The company intends to use the funds to expand its team, accelerate research, and continue developing DeFi tools AppChain that connect liquidity and order flow.

Solana On-Chain DeFi Project Exponent Completes $2.1 Million Financing, Led by RockawayX

On November 22, according to official news, the Solana on-chain DeFi project Exponent announced the completion of $2.1 million in financing, led by RockawayX, with participation from Solana Ventures, Cherry Ventures, Mechanism Capital, Robot Ventures, and others.

On November 19, according to official news, the decentralized AI cloud service Heurist recently announced the completion of $2 million in financing, with participation from Amber Group, Contango Digital, Manifold Trading, Selini Capital, X Ventures, Sharding Capital, Blue7 Capital, Mozaik Capital, Zephyrus Capital, Origin Capital, Steroids Capital, DCF God, and others.

Heurist is addressing critical AI infrastructure challenges based on a ZK stack, making it as accessible as the internet:

- True serverless deployment;

- Elastic resource scaling;

- Community-owned computing network.

On November 20, according to official news, Gabby World announced the completion of $2 million in financing at a valuation of $20 million, with investors including SevenX Ventures, OnePiece Labs, Everest Ventures Group, Huofeng Capital, Zonff Partners, and 13 other institutions, as well as 8 angel investors including former partners from Republic, Hashed, and Gam3Girl Ventures.

Gabby World is a community co-created AIGC Dungeons & Dragons game, and it aims to explore a new paradigm for issuing VC tokens through a "fair release" token economy, achieving a meme-like ultra-low market cap issuance. The GABBY token was issued at the end of October on Solana's DEX with a market cap of $10,000, successfully validating the on-demand release and buyback destruction advocated by the "fair release" token economic model over the past few weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。