Recently, BTC reached a high of $99,588, getting infinitely close to the $100,000 mark, but ultimately failed to break through.

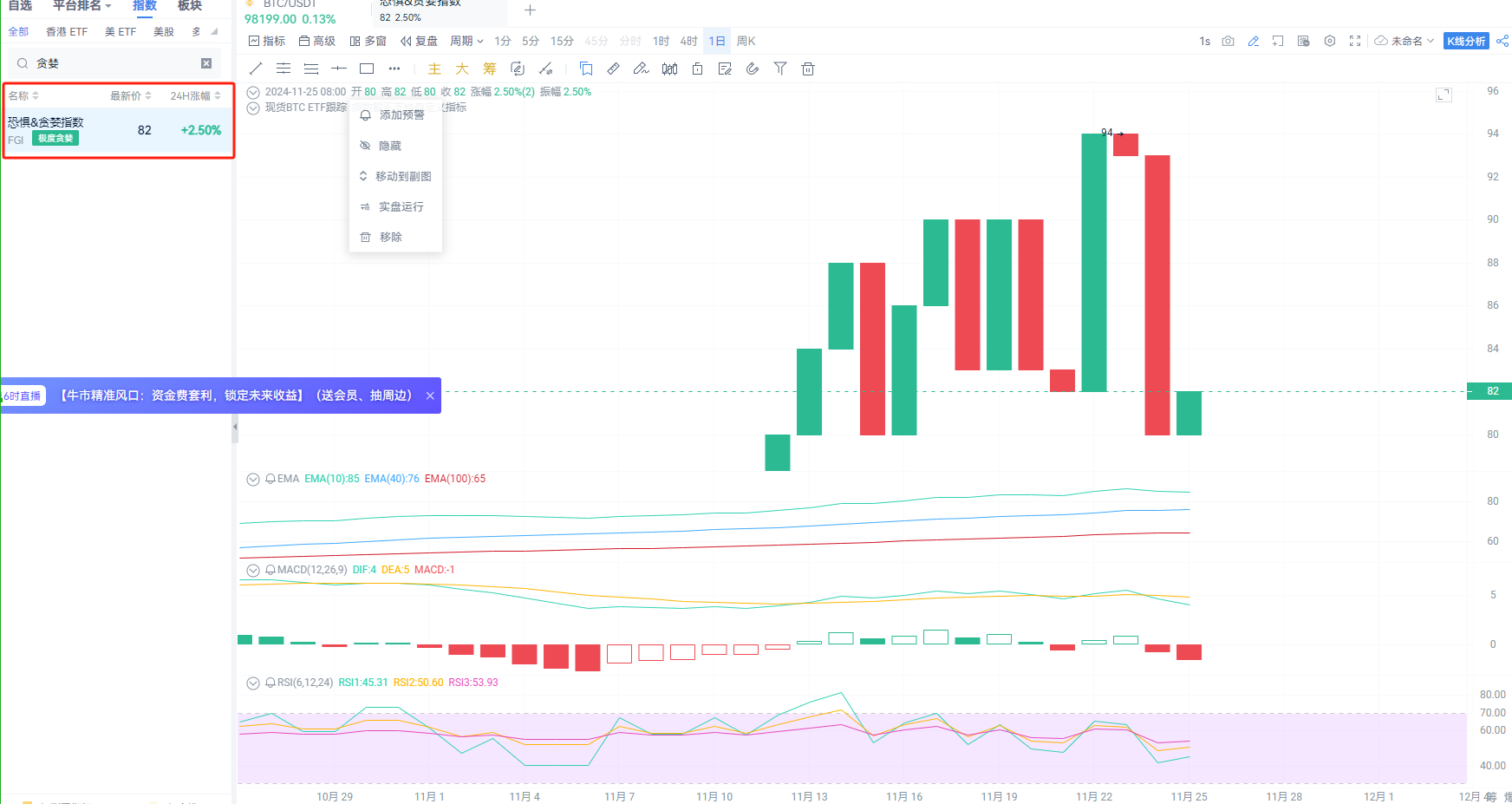

Market data shows that BTC's candlestick chart indicates price fluctuations at high levels, with certain upper and lower shadows, suggesting fierce competition between bulls and bears. The daily chart shows a long bullish candle followed by a series of small bearish and bullish candles, hinting at a consolidation phase. The MACD on the 4-hour cycle is near the zero line, with signs of DIF and DEA convergence, and the momentum bars are shortening, indicating an unclear trend. The RSI fluctuates between 56 and 70, slightly leaning towards the overbought zone but not reaching extreme levels, suggesting that there is still room for upward movement in the market, albeit with caution.

Image source: AICoin

According to AICoin market data, BTC is currently priced at $98,194, above the EMA7, with EMA7 > EMA30 > EMA120, showing a bullish arrangement, and the overall trend remains bullish.

The exchange Material Indicators previously tweeted, "FireCharts shows that there is significant selling pressure on Bitcoin, between $99,300 and $100,000," indicating that sellers are lining up to prevent Bitcoin's price from rising further—this is a common characteristic of Bitcoin near key psychological levels.

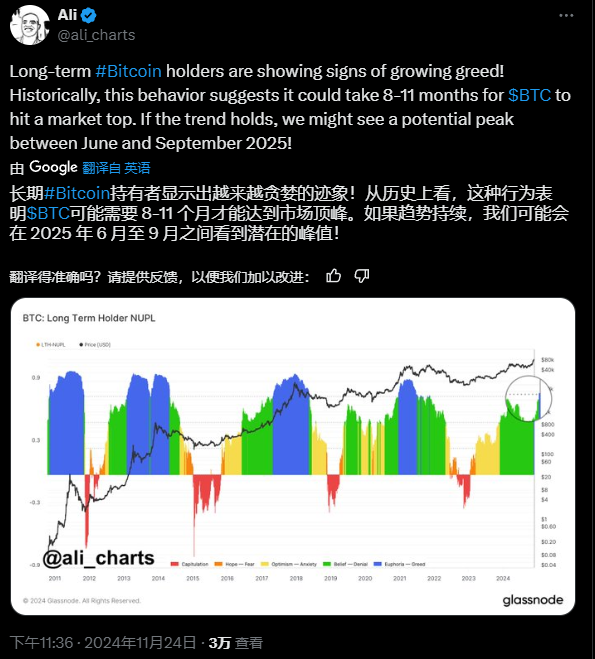

Long-term Holders Remain Greedy

Despite the short-term drop in BTC, investors remain bullish on BTC in the long run. Analyst Ali stated that the current "greed" sentiment among long-term holders is becoming increasingly evident. Historically, this behavior suggests that BTC may need 8-11 months to reach its market peak, potentially seeing a peak between June and September 2025.

Image source: x

Meanwhile, cryptocurrency analyst Willy Woo stated on social media, "It seems there is a large influx of funds into the Bitcoin network." This observation further confirms that investor demand for Bitcoin is increasing.

The accumulation behavior of long-term holders supports the market stability of Bitcoin. In times of high market volatility, long-term holders often help smooth price fluctuations and provide liquidity support. The continued greed of long-term holders generally signals a positive outlook for Bitcoin's future price direction.

Bitcoin veteran Lao Fei tweeted today (November 25) that the BTC pullback is a good time to enter, stating, "The bigger the pullback, the more you earn," reflecting a positive sentiment towards BTC's performance in a bull market.

Image source: x

Georgii Verbitskii, founder of the decentralized finance platform TYMIO, also stated that by the end of 2024 or early 2025, Bitcoin's price could rise to between $100,000 and $120,000. Caleb Franzen, founder of Cubic Analytics, reiterated his prediction that Bitcoin's price could reach $175,000 by 2025 in his latest market analysis.

According to AICoin data, the current greed-fear index remains at an extreme greed level, currently reported at 82, still indicating positive market sentiment.

Image source: AICoin

Market volatility brings short-term price uncertainty but also provides opportunities for investors to enter the market. Each pullback may become a good opportunity for investors to re-enter the market. Especially in a bull market, pullbacks are often necessary adjustments on the way up.

For ordinary investors, holding Bitcoin and increasing positions during price pullbacks may be a wise strategy. Allocating a larger proportion of funds to Bitcoin while keeping a small portion for other high-risk investments can yield more stable returns in the long run.

Conclusion

Although Bitcoin encountered setbacks while attempting to break the $100,000 barrier, its long-term value and market potential should not be underestimated. With stable market sentiment and increased institutional investment, BTC is expected to continue demonstrating its growth potential amid future market fluctuations. Investors should pay attention to short-term market dynamics while also focusing on Bitcoin's long-term development trends to maximize returns in future market opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。