Key Points:

The total market capitalization of cryptocurrencies globally is $3.4 trillion, up from $3.1 trillion last week, with a weekly increase of 9.7%.

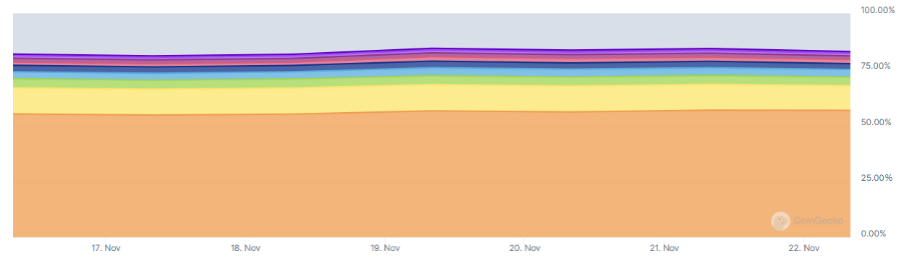

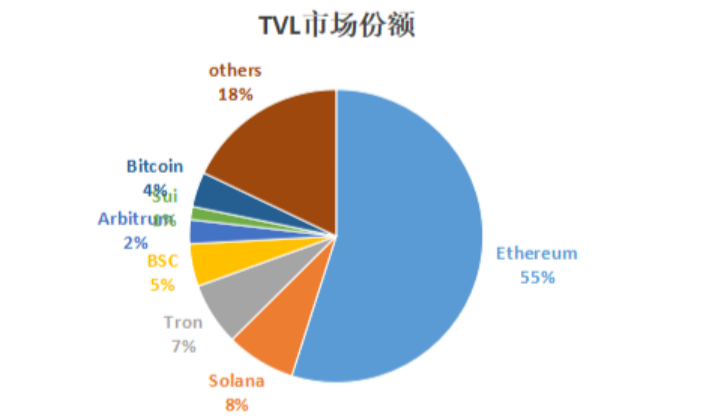

By public chain classification, the top three public chains by TVL are Ethereum with a share of 55%; Solana with a share of 8%; and Tron with a share of 7%.

On-chain data shows that daily trading volume is mainly concentrated on the SOL and ETH chains, while daily active addresses are primarily on the SOL and SUI chains, followed by APT, BNB, and ETH. ETH remains the absolute leader in the DeFi space, with a total locked value of $48 billion, far exceeding other public chains. USDT continues to dominate the stablecoin market, with a market cap of $128.8 billion, accounting for 69.1% of the total stablecoin market cap.

Innovative project highlights: Hadron by Tether: Hadron by Tether is an asset tokenization platform that allows users to easily tokenize stocks, bonds, commodities, funds, and reward points, opening up new opportunities for individuals and businesses to raise funds using tokenized collateral; FlowerAI: FlowerAI represents users' positions as a flower on the platform, with each flower randomly generated based on a hash value, ensuring no two flowers are the same; curved.wtf: Mint NFTs on the Curve launchpad without a whitelist or private allocation, simplifying NFT gameplay.

I. Market Overview

1. Total Cryptocurrency Market Cap/Bitcoin Market Cap Ratio

The total market capitalization of cryptocurrencies globally is $3.4 trillion, up from $3.1 trillion last week, with a weekly increase of 9.7%.

Data Source: cryptorank

As of today, the market cap of Bitcoin (BTC) is $1.93 trillion, accounting for 55.87%. Meanwhile, the market cap of stablecoins is $186.3 billion, accounting for 5.62% of the total cryptocurrency market cap.

Data Source: coingecko

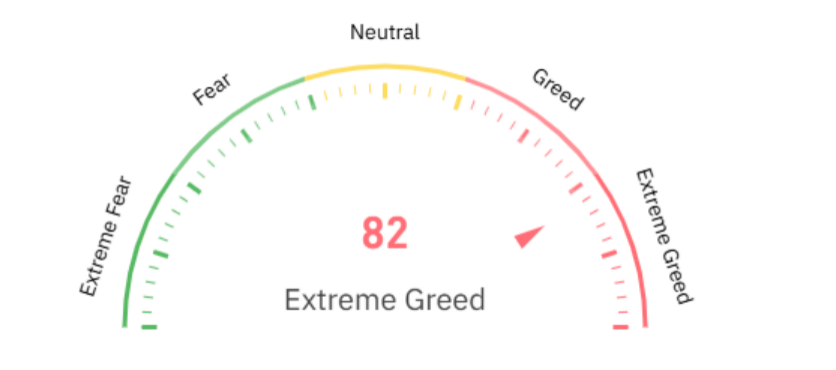

2. Fear Index

The cryptocurrency fear index is at 82, indicating extreme greed.

Data Source: coinglass

3. ETF Data

According to Sosovalue data, the cumulative inflow of the U.S. Bitcoin spot ETF since its launch has reached $30.84 billion; the cumulative inflow of the U.S. Ethereum spot ETF since its launch has reached $1.06 billion. This week, the cumulative inflow of the U.S. Bitcoin spot ETF is $3.38 billion; the cumulative outflow of the U.S. Ethereum spot ETF this week is $71.6 million.

Data Source: CoinW Research Institute, sosovalue

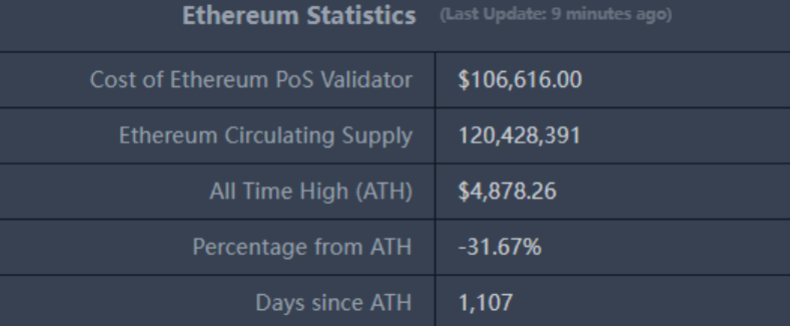

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Currently at $3,342, with a historical high of $4,878.

ETHBTC: Currently at 0.034237, with a historical high of 0.1238, down approximately 72%.

Data Source: ratiogang

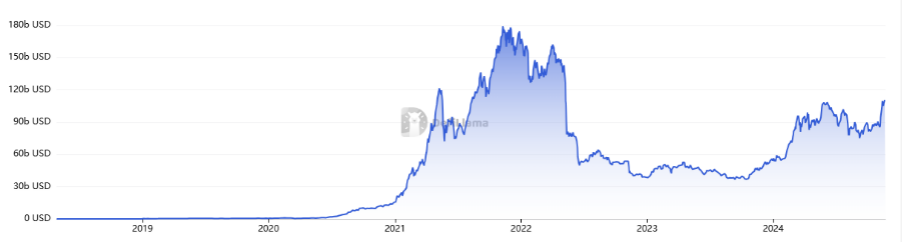

5. Decentralized Finance (DeFi)

According to DeFiLlama data, the TVL of all DeFi projects this year has remained in the range of $60 billion to $100 billion, with overall fluctuations being minimal.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 55%; Solana with a share of 8%; and Tron with a share of 7%.

Data Source: CoinW Research Institute, defillama

Data as of November 25, 2024

6. On-chain Data

This section analyzes the relevant data of major public chains ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, transaction fees, and total locked value (TVL).

Data Source: CoinW Research Institute, defillama, Nansen

Data as of November 25, 2024

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees reflect the frequency and cost of network usage, serving as core indicators of public chain activity and user experience. In terms of daily trading volume, SOL stands out, likely influenced by low GAS fees and the current concentration of meme coins on SOL PVP. Solana has become the preferred choice for meme players due to its low fees and high trading volume.

● Daily Active Addresses: Daily active addresses are an important indicator of network user activity, reflecting the ecological participation and user stickiness of public chains. In terms of daily trading volume, SOL ranks first with over 5 million active addresses; followed by SUI with over 1.57 million active addresses, which is related to the current market trend of meme coins, with active players mainly concentrated on the SOL and SUI chains, followed by APT, BNB, and ETH.

● Total Locked Value (TVL): Reflects the liquidity of funds and is typically used to measure the maturity of DeFi and the level of user trust in the platform. In terms of TVL, ETH remains the absolute leader in the DeFi space, with a total locked value of $48 billion, far exceeding other public chains.

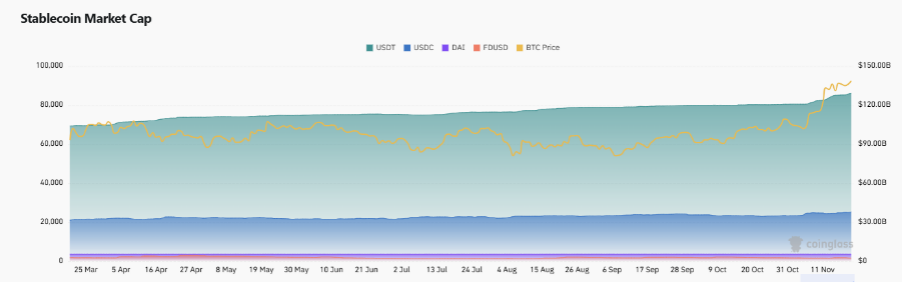

7. Stablecoin Market Cap and Issuance

In terms of market cap share, USDT remains stable. Coinglass data shows that as of November 25, the total market cap of stablecoins is $186.3 billion. Among them, USDT has a market cap of $128.8 billion, accounting for 69.1% of the total stablecoin market cap; followed by USDC with a market cap of $38.7 billion, accounting for 30%; and DAI with a market cap of $5.3 billion, accounting for 2.8%.

Data Source: CoinW Research Institute, Coinglass

Data as of November 25, 2024

Bitcoin continues to hit new highs, having surpassed $98,000 as of the time of writing. According to Lookonchain monitoring, on November 21, Tether issued an additional 2 billion USDT, and since November 8, Tether has issued a total of 9 billion USDT. The continuous issuance of USDT may also be one of the conditions for the bull market to start.

Data Source: Lookonchain, ARKHAM

II. This Week's Hot Money Trends

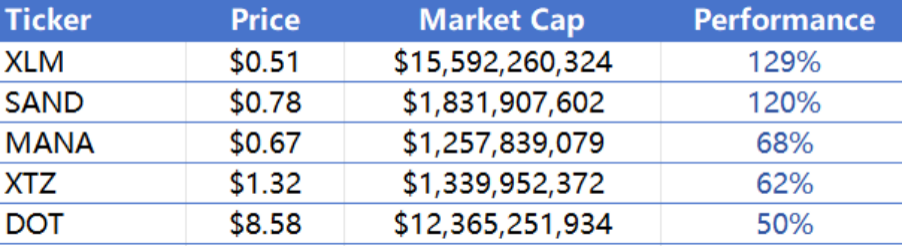

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, Coingecko

Data as of November 25, 2024

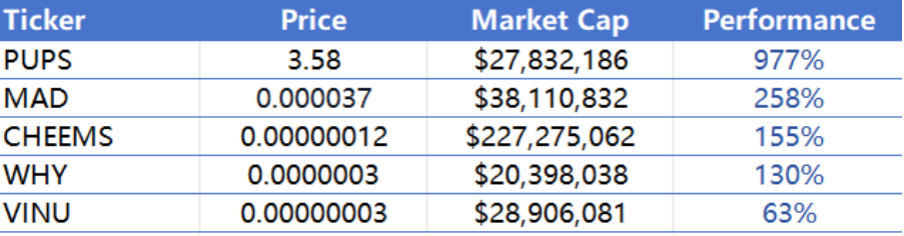

The top five meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of November 25, 2024

2. New Project Insights

● Hadron by Tether: Tether announced the launch of the asset tokenization platform Hadron by Tether, an innovative project in the RWA track. Hadron by Tether is an asset tokenization platform that allows users to easily tokenize stocks, bonds, commodities, funds, and reward points, opening up new opportunities for individuals and businesses to raise funds using tokenized collateral.

● FlowerAI: FlowerAI represents users' positions as a flower on the platform, with each flower randomly generated based on a hash value, ensuring no two flowers are the same. Additionally, @FloweyQuant will look for smart money movements and other data on-chain to allow AI to trade autonomously. An interesting project in the automatic trading AI agent category.

curved.wtf: Mint NFTs on the Curve launchpad without a whitelist or private allocation, simplifying NFT gameplay.

III. Industry News

1. Major Industry Events This Week

● Magic Eden released the ME token economic model on November 18.

● Sui ecosystem game studio Ambrus Studio's game E4C, the Final Salvation token E4C, will have its IDO on November 19.

● The MemeFi token for the Telegram gaming ecosystem will launch on November 22.

● Fuel depositors must migrate their assets to Fuel Ignition by November 23; points for missing the first phase of asset migration will be forfeited.

● FTX's restructuring plan is expected to take effect in early January 2025.

● The Magic Eden token ME will have its TGE on December 10.

2. Major Events Happening Next Week

● WalletConnect's WCT claiming and staking will go live on November 26;

● Starknet's STRK staking will launch on the mainnet on November 26.

● Floki's PlayToEarn MMORPG game Valhalla will launch its mainnet on November 28, and Valhalla will collaborate with the KICK F1 Sim Racing Team to become the official gaming partner for the 2025 F1 simulation racing season.

● Sources in Washington are rumored to suggest that Gary is likely to announce his departure after Thanksgiving (November 28), before the inauguration of Trump in early January.

3. Important Financing Events from Last Week

● Noble, Series A, raised $15M, with investors including Paradigm and Polychain leading the round, and Wintermute, CMCC Global, and Circle Ventures participating. Noble is an application chain built specifically for issuing native assets in the Cosmos and IBC ecosystems, helping issuers manage their tokens: burning, minting, blacklisting, and other functions. (November 19)

● KOKODI, seed round, raised $1.1M, with investors including Avalanche, Tenzor Capital, Merit Circle, Kangaroo Capital, and DCI Capital. KOKODI is a cross-chain, multi-platform MMO game. (November 18)

● Luluchain raised $5M, led by DG Capital, with participation from Smo Capital, LD Block, Unionblock VC, and Blockin.venture. Luluchain belongs to the EWA track and aims to transform human emotions into quantifiable, tradable digital assets through AI, creating a new value chain for a decentralized world. (November 19)

● Shinami raised $564M, with investors including Race Capital, Aptos, 6th Man Ventures, Sui, Circle, and Coinbase. Shinami is building an infrastructure developer platform for Sui, with products designed to help teams build applications faster with better user experiences and lower costs, including node services and in-app wallets. (November 21)

IV. Research Reports from This Week

1. Magic Eden In-Depth Research Report

Magic Eden is a multi-chain NFT trading market created by a team with Chinese backgrounds, established on the Solana chain in 2021 and quickly expanding to support Ethereum (ETH), Polygon, BASE, and Bitcoin (BTC) ecosystems. Despite the downturn in the NFT market, Magic Eden has successfully captured a major market share on the Solana chain through rapid product iteration and rich feature design. The platform's core features include an NFT trading market, multi-chain support, project incubator (Launchpad), staking and yield rewards, aggregated markets, data analysis and rankings, wallet integration, community governance (DAO), and API integration. Additionally, Magic Eden offers user time-limited discounts, rarity scoring systems, on-chain identity verification, membership passes, batch trading, and custom package features. Through these value-added services and detailed data support, Magic Eden has lowered the usage threshold for new users, optimized the trading experience, and enhanced user stickiness on the platform.

Magic Eden's main revenue sources include transaction fees and service fees from Launchpad projects. Although it has not issued a token, the platform has launched a points system, allowing users to accumulate points through platform activities for future airdrops. By the end of 2024, the platform will also launch a test token $TestME, aimed at testing the issuance process for the future official token $ME. In the context of an overall sluggish NFT market, Magic Eden remains competitive, with its growth potential primarily stemming from support for the BTC ecosystem, which is still a blue ocean market. If NFTs on the BTC chain become popular, Magic Eden is expected to welcome broader development space in the future, further consolidating its leading position in the multi-chain NFT trading market.

Original link: https://www.odaily.news/post/5199912

2. Going Crazy, Can DeSci Transform Traditional Research?

● The DeSci concept did not emerge recently; Binance Labs announced its first investment in BIO Protocol, and CZ and Vitalik attended Binance's DeSci Day event, reigniting market interest in DeSci.

● The DeSci track currently has a low market cap and is one of the key tracks attracting top VCs. In addition to Binance Labs starting to lay out in the healthcare sector, a16z has also begun to invest in the DeSci field.

● Projects in the DeSci track are still in the early exploratory stage, with focus areas including the BIO ecosystem and related memes.

Original link: https://www.odaily.news/post/5199955

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。