Bitcoin Bill Passed

Yesterday (November 24), the United States passed a historic bill that officially recognizes Bitcoin as a "store of value" asset. The passage of this bill marks a further consolidation of Bitcoin's status within the traditional financial system.

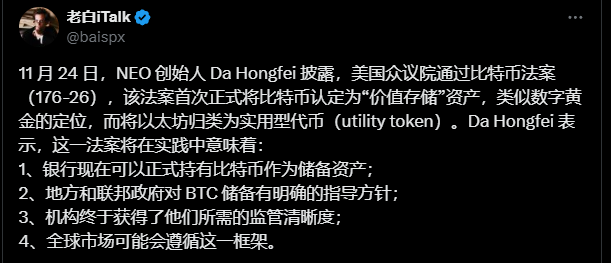

Image source: x

NEO founder Da Hongfei stated that Bitcoin is now officially recognized as a "store of value" asset, similar to digital gold, while ETH is still classified as a utility token. This clear distinction brings significant opportunities, meaning in practice: banks can now officially hold Bitcoin as a reserve asset - local and federal governments have clear guidelines on BTC reserves - institutions finally gain the regulatory clarity they need: global markets may follow this framework.

Support for Bitcoin Reserves Crosses Party Lines

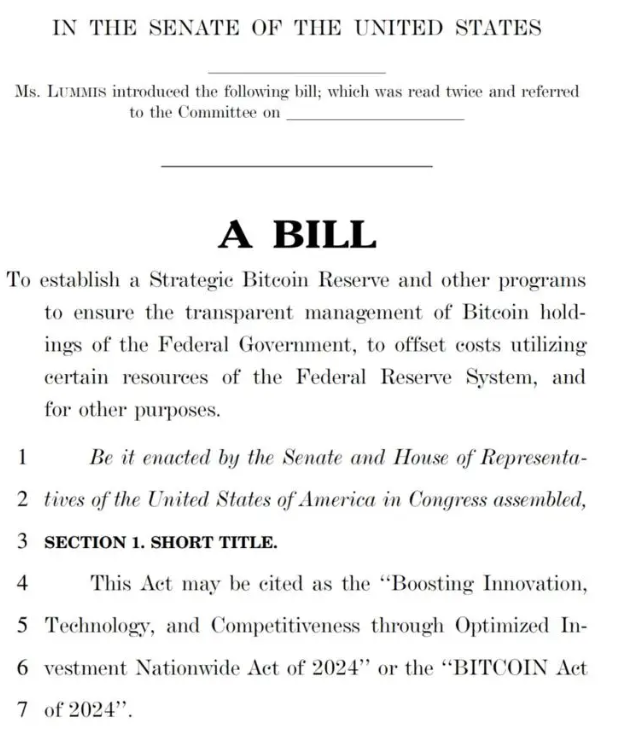

Senator Cynthia Lummis introduced the "U.S. Bitcoin Strategic Reserve Act" as early as July 31, which received bipartisan support. Its core objective is to establish a national Bitcoin reserve by using federal funds to purchase 1 million Bitcoins, enhancing the financial security and international leadership of the United States.

The bill establishes a "Bitcoin Purchase Program," which plans to buy no more than 200,000 Bitcoins per year for five years, totaling 1 million. This measure aims to ensure that the U.S. government holds a significant amount of Bitcoin over the next twenty years, providing the nation with a long-term financial hedge. By incorporating Bitcoin into national asset reserves, the U.S. hopes to combat economic uncertainty and currency instability while solidifying its position as the largest national holder of Bitcoin, owning about 5% of the Bitcoin network.

According to the bill, the Bitcoins purchased by the government will be held for at least 20 years. During this period, these Bitcoins cannot be sold or exchanged unless used to pay off national debt. After the initial holding period, no more than 10% of the reserves can be sold every two years to ensure the long-term stability of the Bitcoin reserves.

Democratic Congressman Ro Khanna also expressed support, stating, "We want to ensure that we can accept Bitcoin as part of the Federal Reserve and as a reserve asset because it has the potential for appreciation and could allow the U.S. to set financial standards."

On November 14, the Pennsylvania House of Representatives proposed legislation that would enable the state to recognize Bitcoin as a reserve asset on its balance sheet, more broadly acknowledging Bitcoin as a means of storing value. Kabbler believes that Bitcoin has experienced significant appreciation over time and can help stabilize the state's funds amid economic changes and inflationary pressures. He argues that this measure will support the state's financial stability and help ensure the long-term economic security of Pennsylvania's retirees and residents.

Former President Trump’s supportive stance on Bitcoin also added weight to the passage of this bill. He stated at a Bitcoin conference, "Bitcoin is not only a technological marvel, but it is also a great achievement of cooperation and human ingenuity."

Risk Warning

Even though Bitcoin is now officially recognized as a "store of value" asset, similar to digital gold, Goldman Sachs' Chief Information Officer for Private Wealth still stated, "We do not recommend investing in cryptocurrencies as an asset class." She believes that cryptocurrencies cannot generate cash flow, dividends, or stable returns, making their valuation difficult and thus hard to recommend as an investment asset class.

Earlier in April, she mentioned that despite other traditional financial institutions like BlackRock and Fidelity increasing their investments in cryptocurrencies, Goldman Sachs' clients are not interested, criticizing the hypocrisy of the cryptocurrency market.

Image source: x

Conclusion

The rise of Bitcoin from a fringe asset to a national strategic reserve highlights its importance in the financial sector today. Although Goldman Sachs' Chief Information Officer for Private Wealth remains cautious about classifying cryptocurrencies as an investment asset class, believing they are difficult to value, the passage of this bill undoubtedly opens new possibilities for Bitcoin's application in the global financial market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。